Podcast: Play in new window

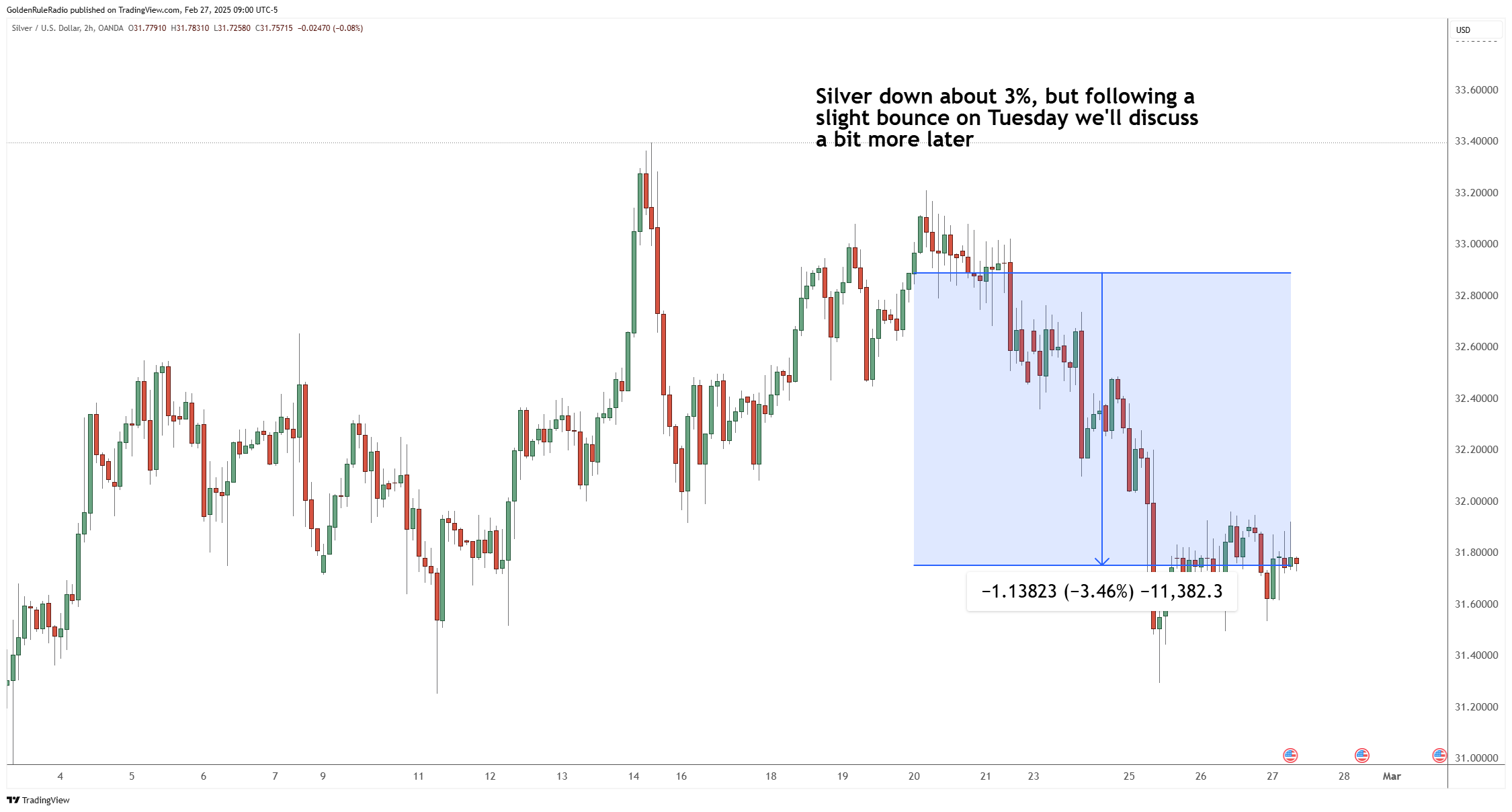

Gold was down slightly week over week. Silver dropped 3% over the past week, while platinum was flat and palladium dropped over 7%. Bitcoin took a massive hit following a major hack.

Let’s take a look at where prices stand as of our recording on February 26:

The price of gold is down 0.6% at $2,918 from a week earlier.

The price of silver is down 3% sitting firmly at $31.80, still looking pretty strong after a big move up.

Platinum is down 1.8% at $966.

Palladium is down 7.25% in the last week to $921.

Looking over at the broader markets…

The S&P 500 is down about 3% to 5,950 from a week earlier.

The US dollar is at $106.50, declining about 0.4% from a week earlier.

Bitcoin is down 13% in the last week, after some North Korean hackers got into one of the crypto exchanges.

Bullish Gold

As we discussed before the election, we expected the price of gold to dip if a Republican president came into office. And as predicted, gold did decline once Trump sealed his victory. The difference is that gold’s dip was pretty insignificant if you compare it to other presidential elections. In Trump’s previous 2016 victory, gold bottomed out around 12-13% lower in February and March. For this election, gold only fell about 7% and it hit the bottom in December.

Looking at the short-term move, gold was around $2590 in mid-December 2024. Now that we’re at the end of February, the price of gold has jumped up all the way to a high of $2,955. That’s an almost 50% rise over the last 12 months.

Could there be a buying opportunity in the near future? With gold on this meteoric rise, there is still a chance that it will have a Fibonacci correction level — which would mean a potential $100 decline. But these buying opportunities have become more rare recently with the bullishness in the gold market.

Silver Buy Opportunity

Silver has been strong over the last several months, with a strong stair-step pattern up when you look at its price chart.

Looking at the short term, silver has already taken about a 50% retracement in price. You’re Silver’s bull market started around the end of December where the price was around $29.16. It has since run up to $33.40 taking a little interim step back down.

Silver is still extremely undervalued, and investing in it while the price is down opens future opportunities for ratio trades. Especially when it comes to stacking ounce of gold over time, silver can create that opportunity with a smaller investment in silver ounces that can eventually be exchange for gold ounces.

Seize Opportunity

Still waiting on the sidelines for the right time to buy precious metals? The best time to buy metals was 20 years ago — but the second best time is today.

Your McAlvany Advisor can help you determine your best strategy for adding ounces of gold and other precious metals to your portfolio. With decades of experience as investors themselves, they are happy to speak with you about your personal investment goals and get you started the right way. Just give the team a call at (800) 525-9556 to get a complimentary portfolio review.