Podcast: Play in new window

Markets remain in flux this week, with many sudden movements and short-term charts giving little insight. Silver, platinum, palladium, and copper all see steep declines compared to gold’s continued strong performance.

This week, we focus on the broader scope this week and investigate more long-term planning for your investment portfolio. Let’s take a look at where prices stand as of April 9:

The price of gold is down about 1.5%, but that’s after a steep decline of 6.5% intraweek. Gold is looking strong right now on a strong rebound.

The price of silver is down 10.75% to $30.80. However, it is rebounding from its intraweek low of 17% down from its peak.

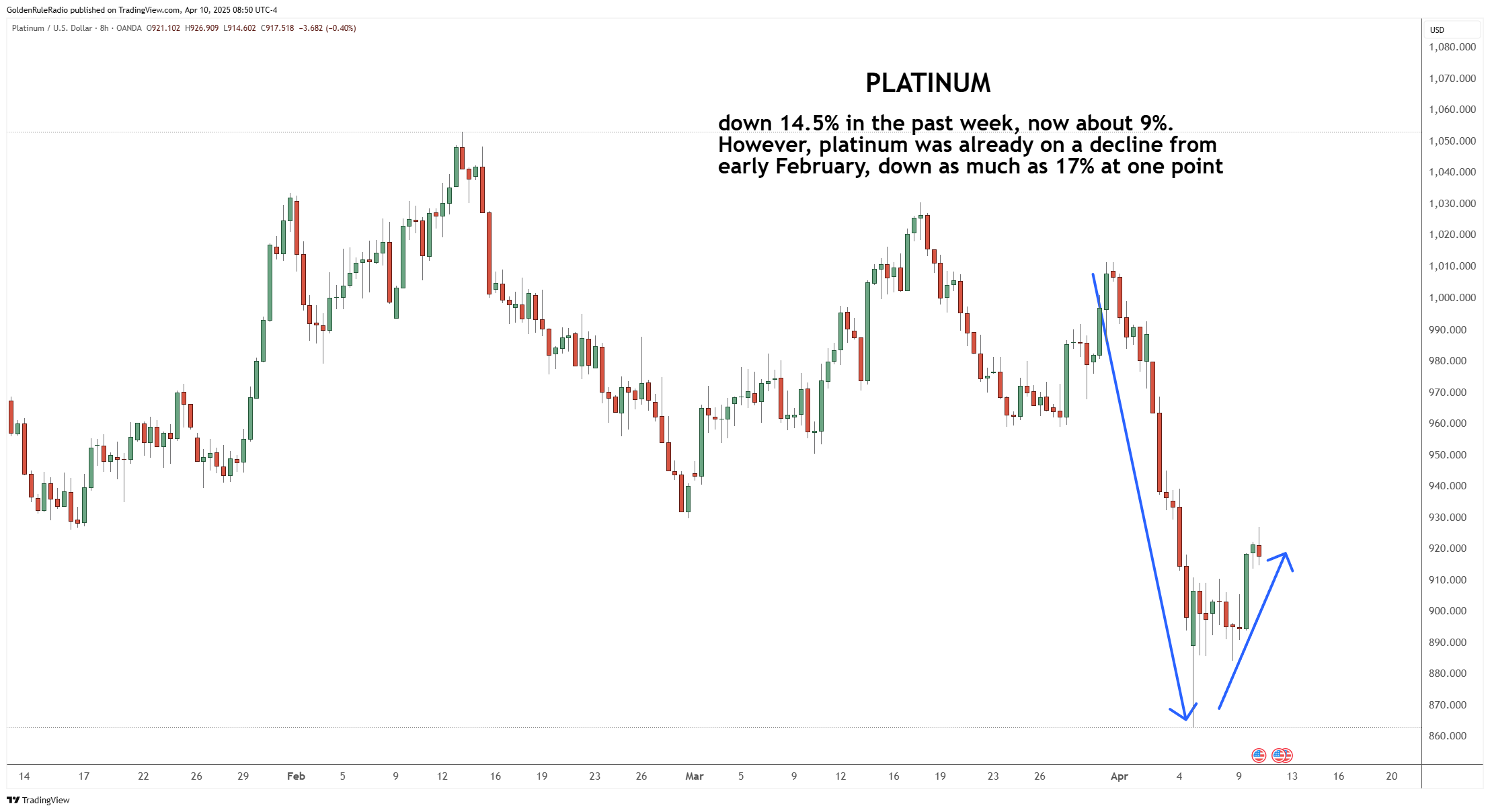

The price of platinum is down 9% to $916 as of recording, but this is after plunging 14.5% since our last recording. Platinum was already on a decline from early February, down as much as 17% at one point.

The price of palladium is down 9.5% to $905. It was down about 13% at one point.

The price of copper is down 16%, sitting at $4.40. While it’s off its previous high, copper was down 23% at one point.

Moving over to looking at the paper markets…

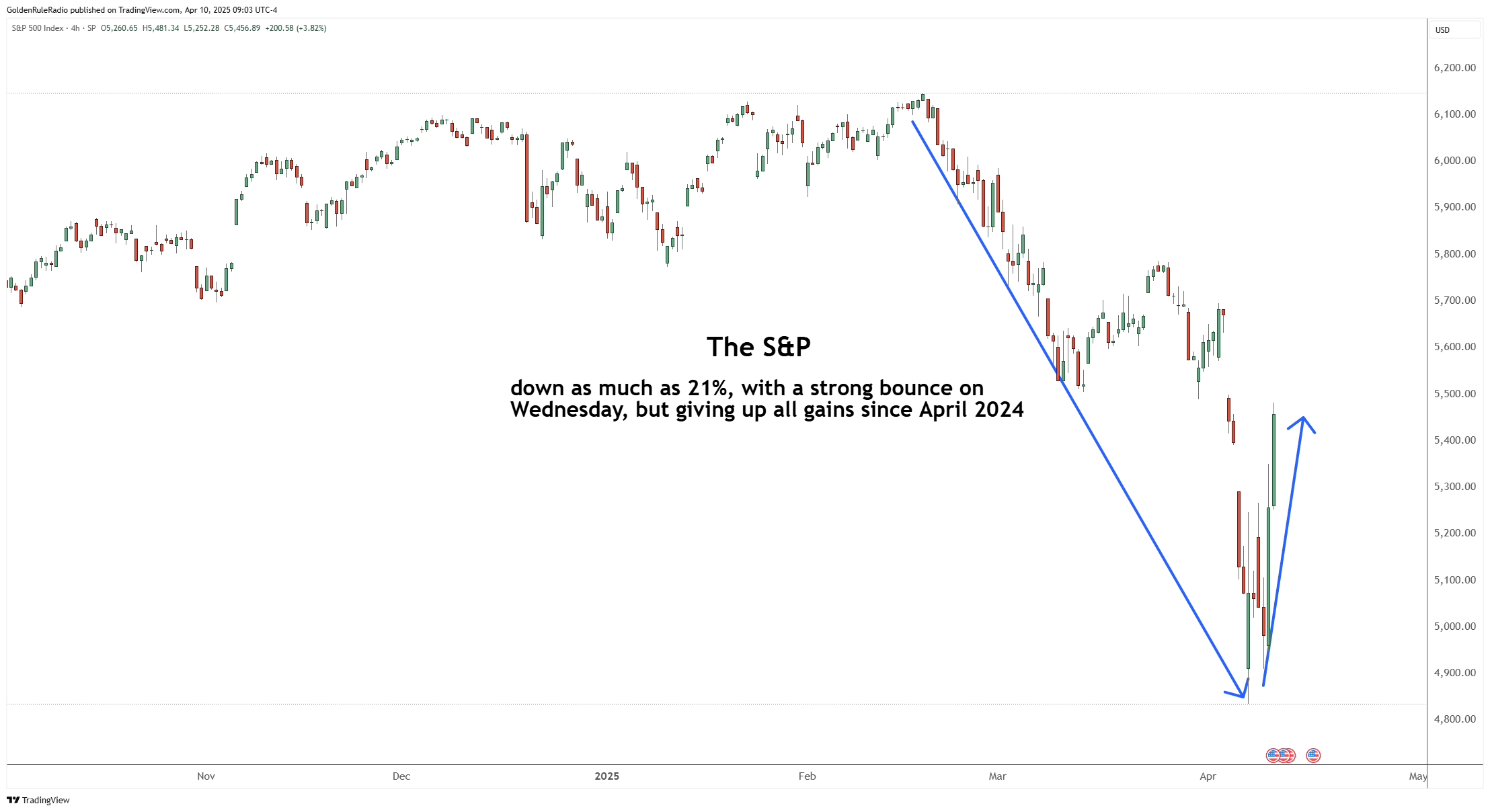

The S&P 500 is down about 11%, sitting at 5,336 off of its February all-time high. However, it was down 21% at one point.

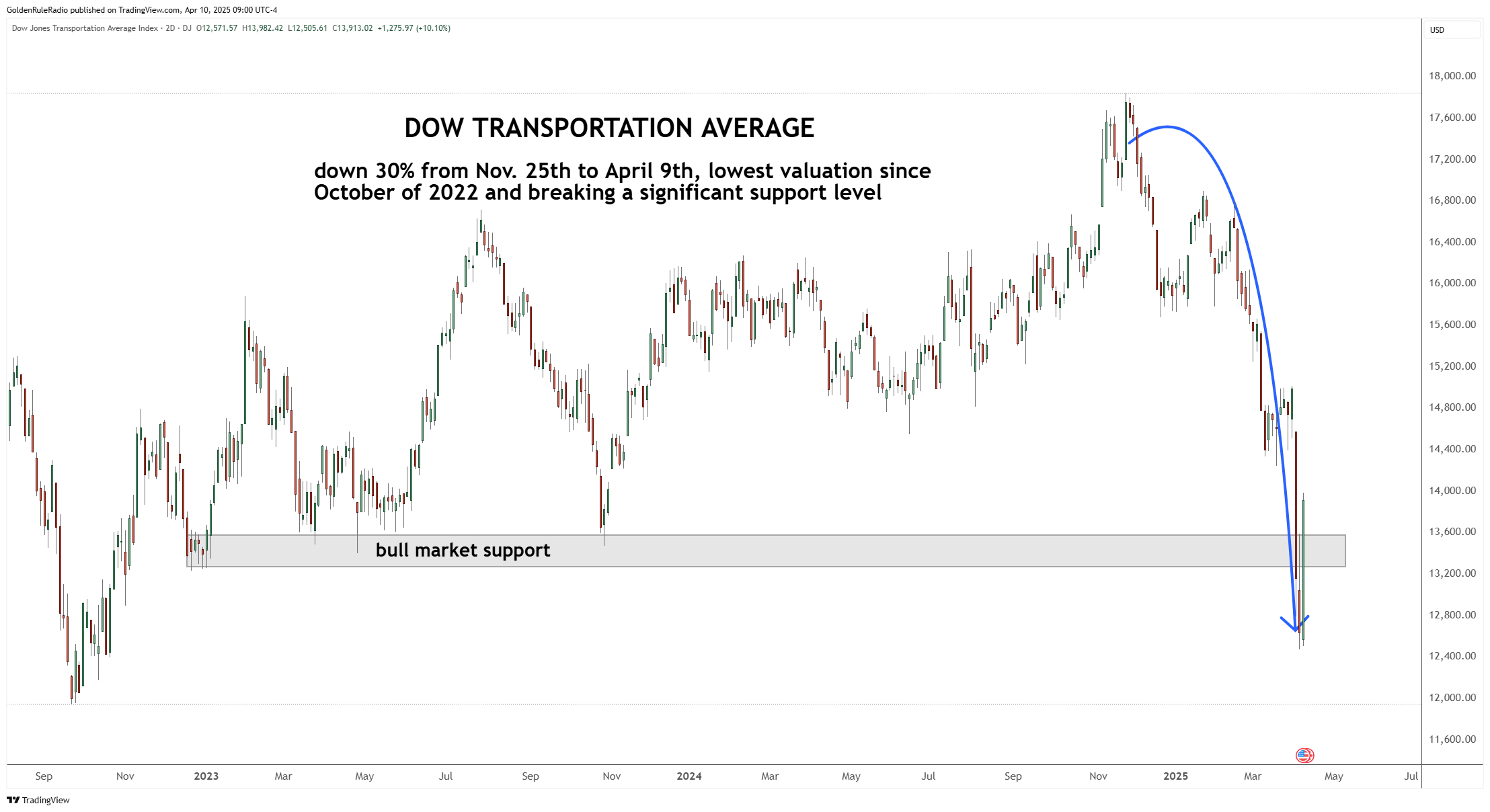

Dow Transportation Average is down 30% from Nov 25 to April 9, lowest valuation since October 2022 and breaking below a significant support level.

Debt Watch

If you look at the big picture, the market gyration seems to be the main event. But to quote our colleague and portfolio manager at McAlvany Wealth Management, Doug Nolan, “The stocks are just the side show. The main event you need to watch is the 10-year Treasury market.”

Indeed, the US will need to refinance $9.2 trillion worth of Treasuries between now and June 2025 — just a few months away. While there’s hope for increased revenue from tariffs, refinancing the sheer volume of paper entering the market will be quite the challenge.

So if you think the markets have been volatile, this is just the beginning of more of the same (and potentially worse) to come.

The 10-year Treasury yield, which had been rising as the interest rates had been rising for the last couple of years, took a dip for the first couple months of 2025. This year, it declined almost 19%, from 4.8 to about 3.9. President Trump has been begging the Federal Reserve to consider lowering interest rates again, but we’re not necessarily seeing that.

But over the last few days, the 10 year Treasury yield has jumped about 11.5%, back up to around 4.3% And with significant rollover coming, it’s very likely we’re going to see those treasury yields continue to climb. Liquidity may become an issue here.

Protection from Volatility

While all of the industrial metals across the boards seem to be declining, gold is holding pretty steady, like it typically does in an emergency. Now is a critical time to reanalyze your investment plans and to take advantage of current market moves.

We’re Here to Help

McAlvany’s team of advisors have decades of experience investing in gold and other precious metals, and they can help you find the best strategy to meet your unique needs. They are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556.