Podcast: Play in new window

While gold reaches a new record and silver surges past its trading range, government policy continues to reshape the investment terrain. Let’s take a look at where prices stand as of Wednesday, September 3:

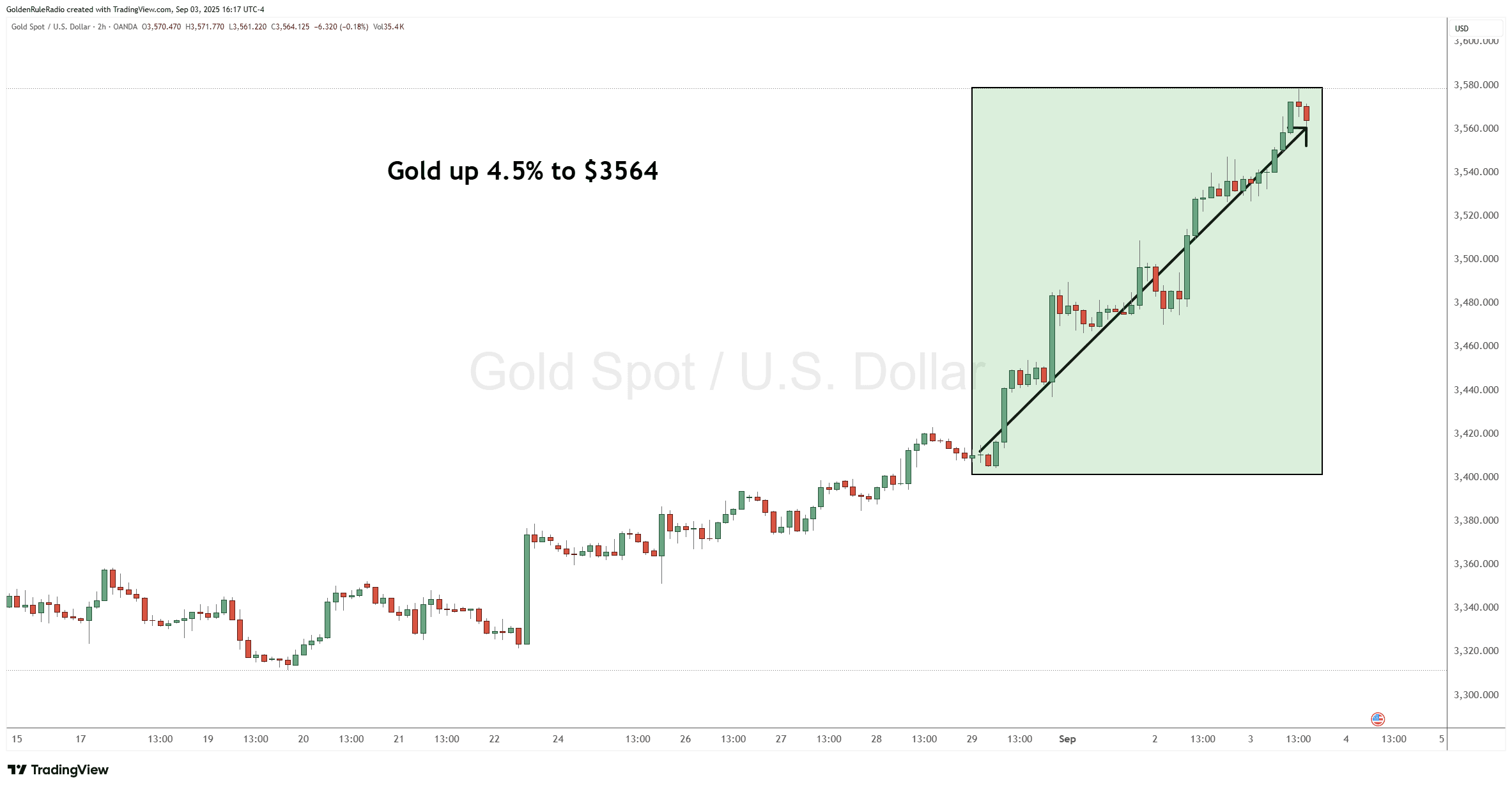

The price of gold is up 4.5% at $3,564, reaching a new record high.

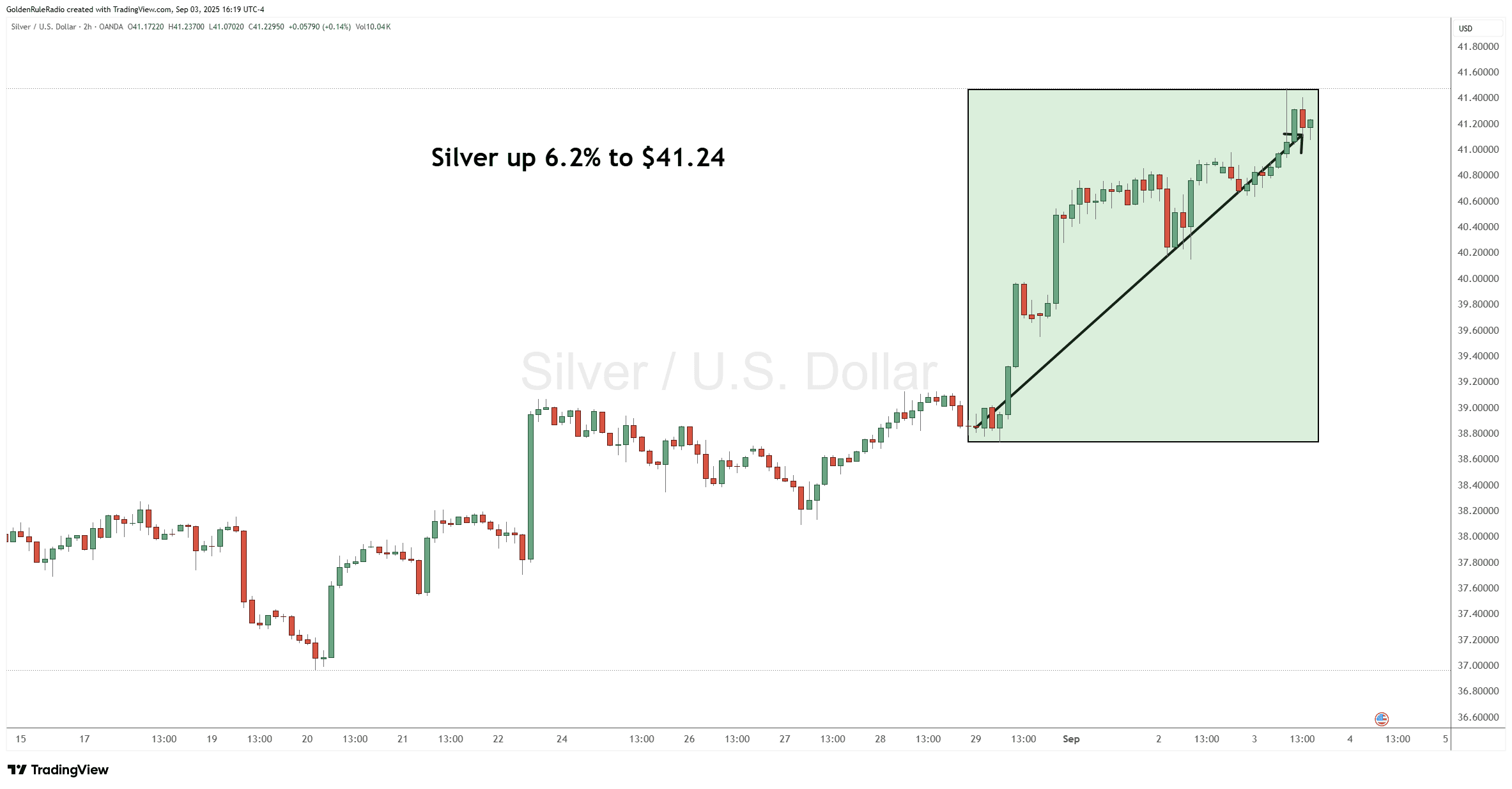

The price of silver is up 6.2% to $41.24 from a week earlier, a strong week for the white metal.

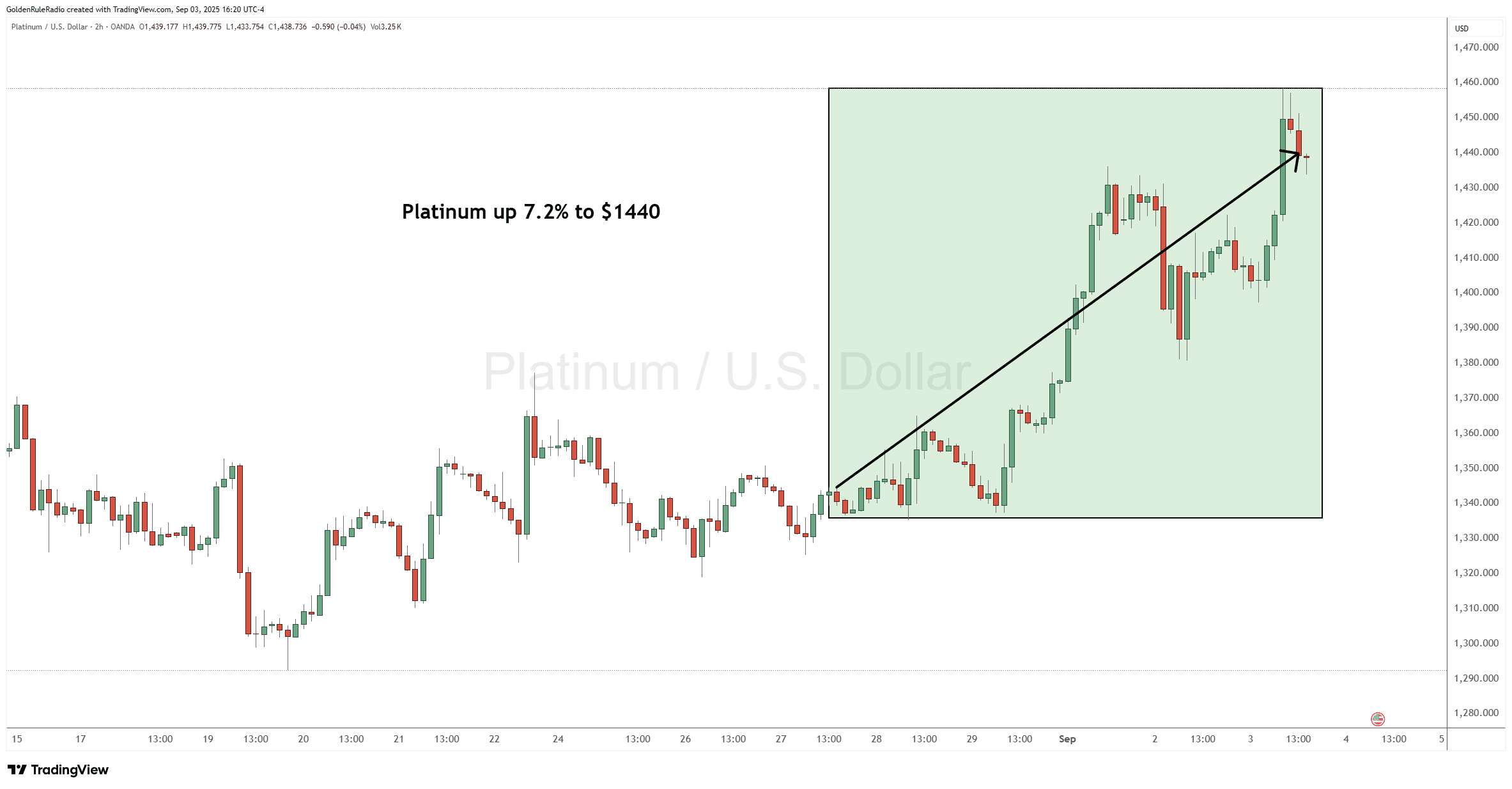

Platinum is up 0.2% to $1,440, working its way back up toward its previous all-time high.

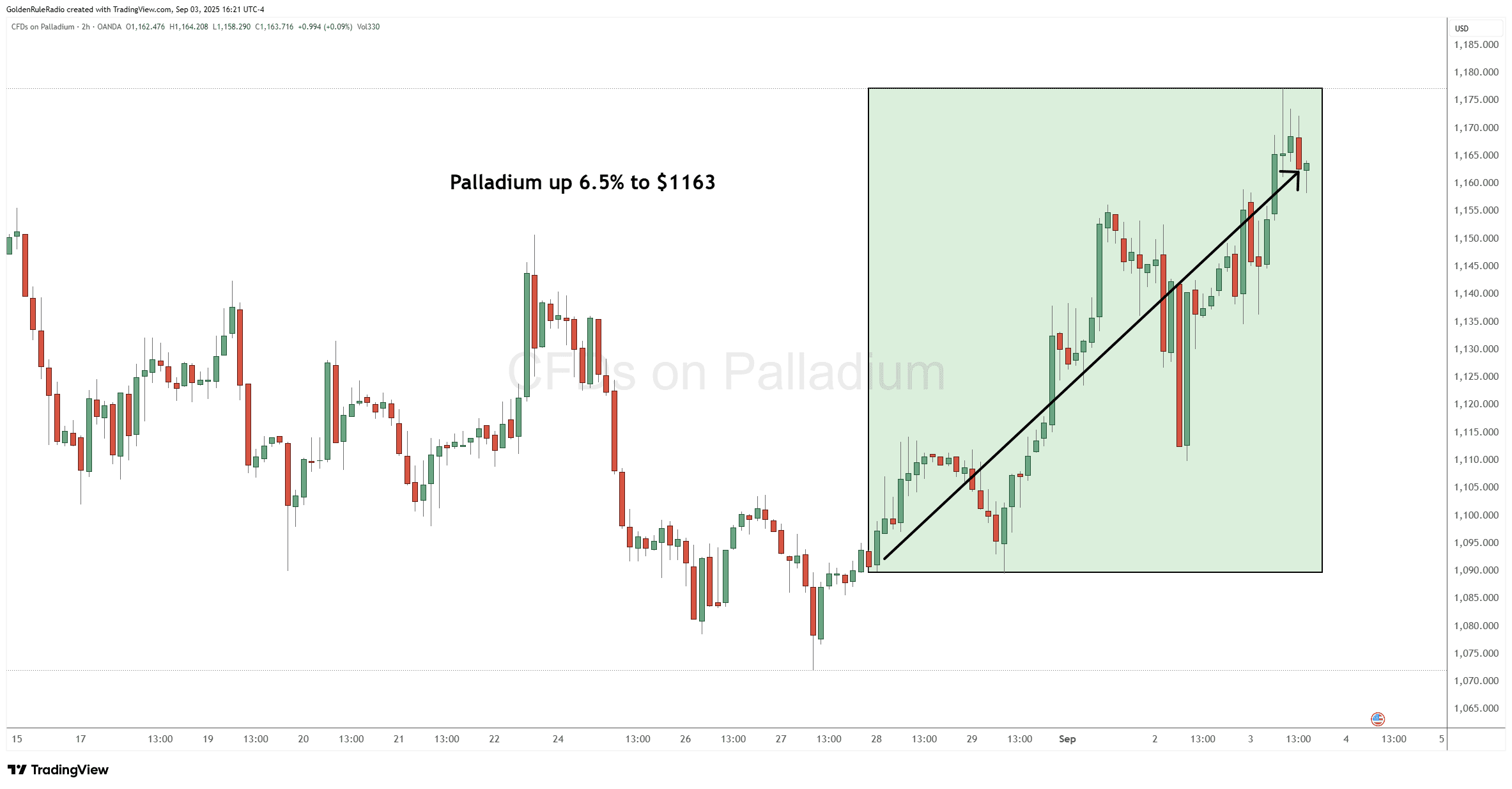

Palladium is up slightly at $1,163 from a week earlier.

Looking over at the paper markets…

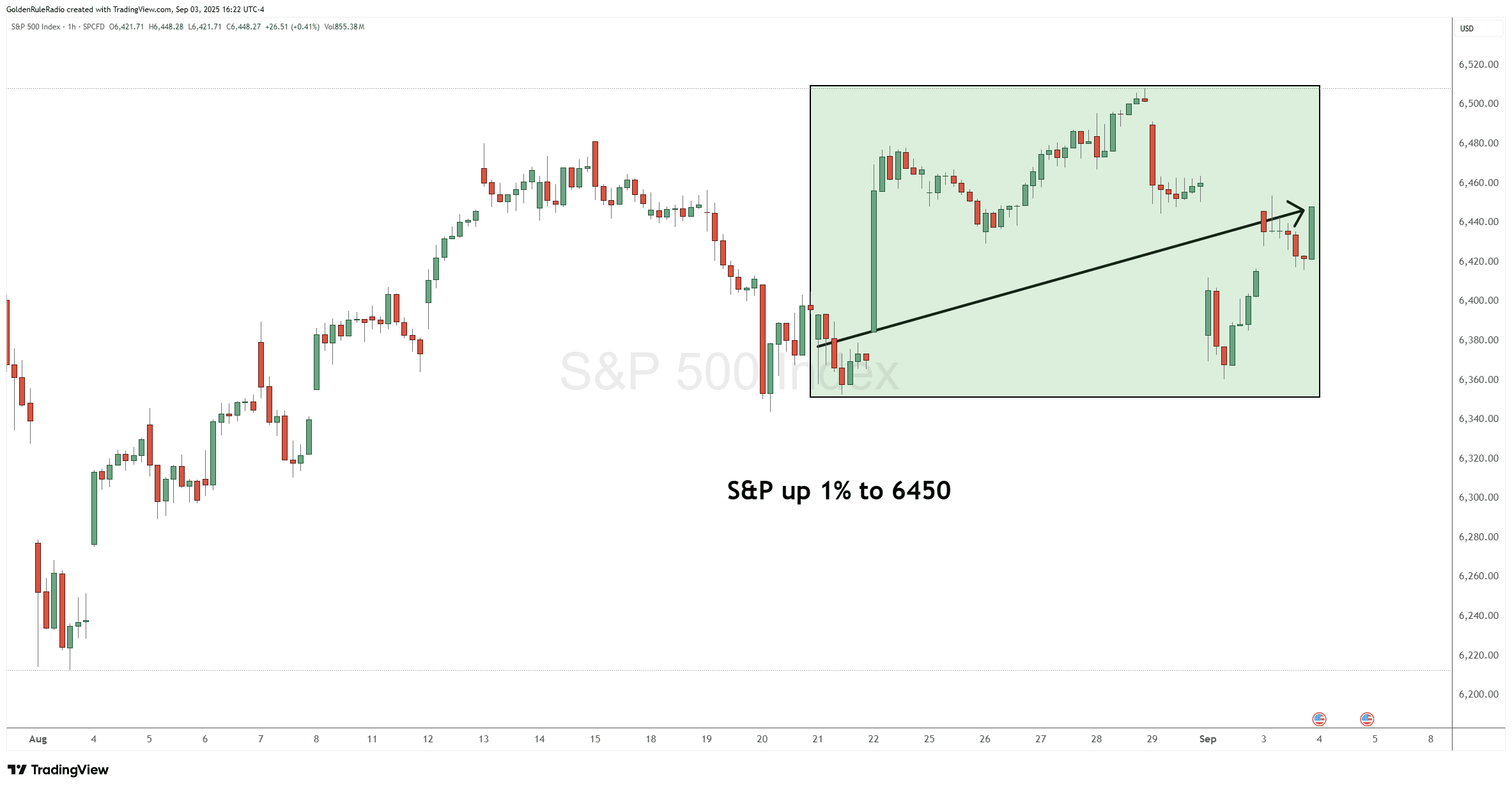

The S&P 500 is up about 1% sitting at 6,450 as of this recording.

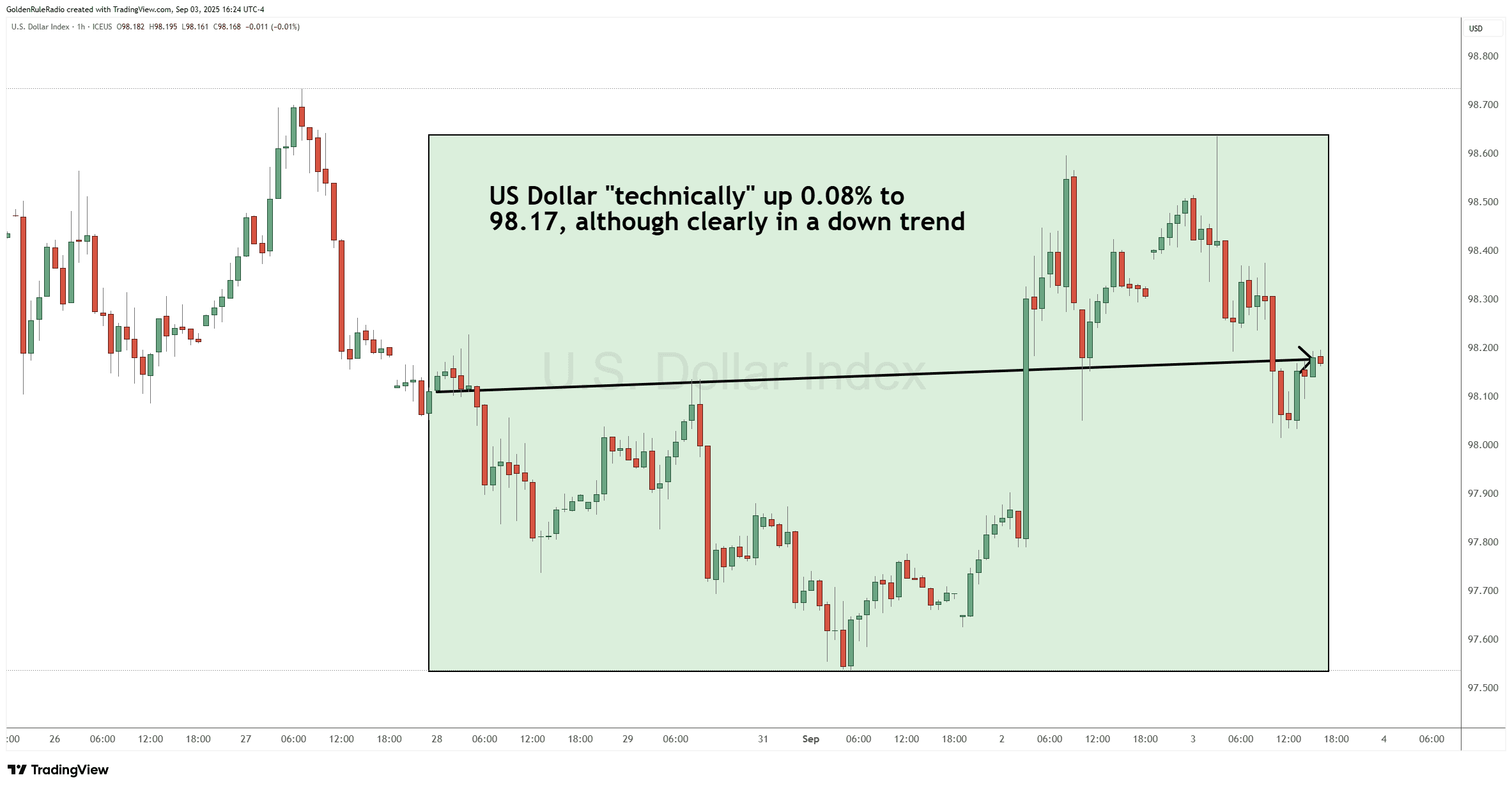

The US Dollar Index is nearly flat, up just 0.08% from a week prior.

Gold and Silver Breakout

In a compelling move for technical traders and long-term holders alike, gold broke out of its several-month chart pennant this week, climbing 4.5% to new highs around $3,564. Silver also rallied 6.2%, pushing above $41—a sign of renewed momentum and sustained buying interest.

These breakouts are not isolated events but reflect a sustained shift in sentiment after months of consolidation, suggesting that both metals could have considerably more room to run as the market heads into the fall.

Institutional and Sovereign Demand Accelerates

Strong price action is matched by robust demand for precious metals from large-scale buyers worldwide. Foreign governments, most notably India, China, and Saudi Arabia, are selling US Treasuries and ramping up their gold holdings at a rapid pace.

Within the same time frame, institutional money is pouring in, with over $1.5 billion moving into the largest gold-backed ETF (GLD) in just one day. We haven’t seen a flow like this since before last year’s major selloff. This broad-based shift from paper assets to hard assets highlights growing global skepticism about US debt and emphasizes gold’s enduring appeal as a reserve and hedge.

US Government Steps More Deeply Into Private Markets

Another dominant theme in recent weeks: the US government’s more active role as an investor and business partner. The government made headlines by taking nearly a 10% stake in Intel and investing directly into strategic companies like MP Materials and US Steel.

Beyond equity stakes, officials are discussing ways to monetize national assets—offering royalty-backed permits for domestic mineral extraction and considering a sovereign wealth fund to channel foreign capital directly into US businesses and infrastructure. These interventions reflect a dramatic shift in federal economic policy, with wide-ranging consequences for both the broader markets and those investing in precious metals as protective assets.

Flight to Safety Intensifies

Investor sentiment seems to be shifting decisively toward safety and certainty. Increasing public debt, aggressive governmental intervention, and ongoing policy uncertainty have triggered a pronounced move toward hard assets, especially gold.

Large institutional and sovereign investors are upping their gold allocations. And while international investors have been snapping up physical gold, many US investors still remain on the sidelines.

Investors waiting on substantial price pullbacks could be left behind in what may become a fast-moving market. As history has shown, the desire for safety during periods of uncertainty can drive substantial and even irrational rallies in safe-haven assets.

Gold’s Global Bull Market Context

It’s important to remember that gold’s recent move to new all-time highs in US dollar terms actually follows similar records already hit in currencies such as the Japanese yen, Chinese yuan, and Indian rupee. This underscores the point that gold’s current strength is not just a dollar-denominated trend but a global phenomenon. As currency and debt issues mount worldwide, gold’s appeal as an international store of value continues to grow.

We’re Here to Help

To discuss how these changes might impact your own portfolio, or for more insights on the latest market moves, contact the McAlvany Precious Metals team. Our expert precious metals advisors are happy to speak with you about your goals on a no-obligation, complimentary consultation. Reach out to us at 800-525-9556.