The middle class is under immense financial and societal pressure, and many of the poor would already be underwater if not for government stimulus payments. The collateral damage is immeasurable. Lives torn apart, possessions lost, hopes dashed, plans for the future canceled, families destroyed. It’s not a pretty picture, but it’s right there in the history books for those brave enough to read. Today, you can read it in the newspaper. The battle will not be short or easy. Most such crucial battles are not. So for some good advice on how to make it through, let’s take a lesson from more conventional aspects of our lives.

In the morning, you get up, drink your coffee, and head to work (or whatever other activities define your day). You face rush hour, rude drivers, car troubles, bad bosses, lazy coworkers, setbacks, and much more. Still, you hope to win. You hope to do your work, collect your pay, feed your family, go on vacation, and slowly (or not-so-slowly) get ahead. It’s much harder than it used to be, but that’s still the hope. But with all that innate optimism, we still buy insurance—car insurance, health insurance, life insurance, and other kinds as well. Why? Because we don’t control life. We try to, and we sometimes stay on the bull for the full eight seconds, but, despite our best efforts, sometimes it doesn’t work out that way.

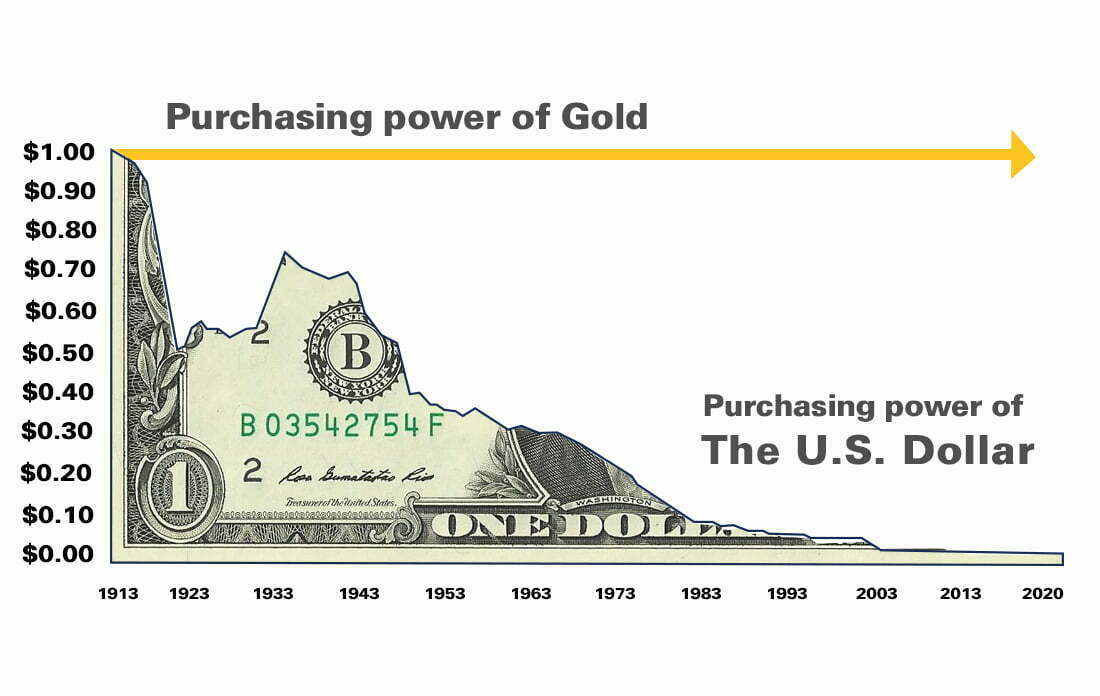

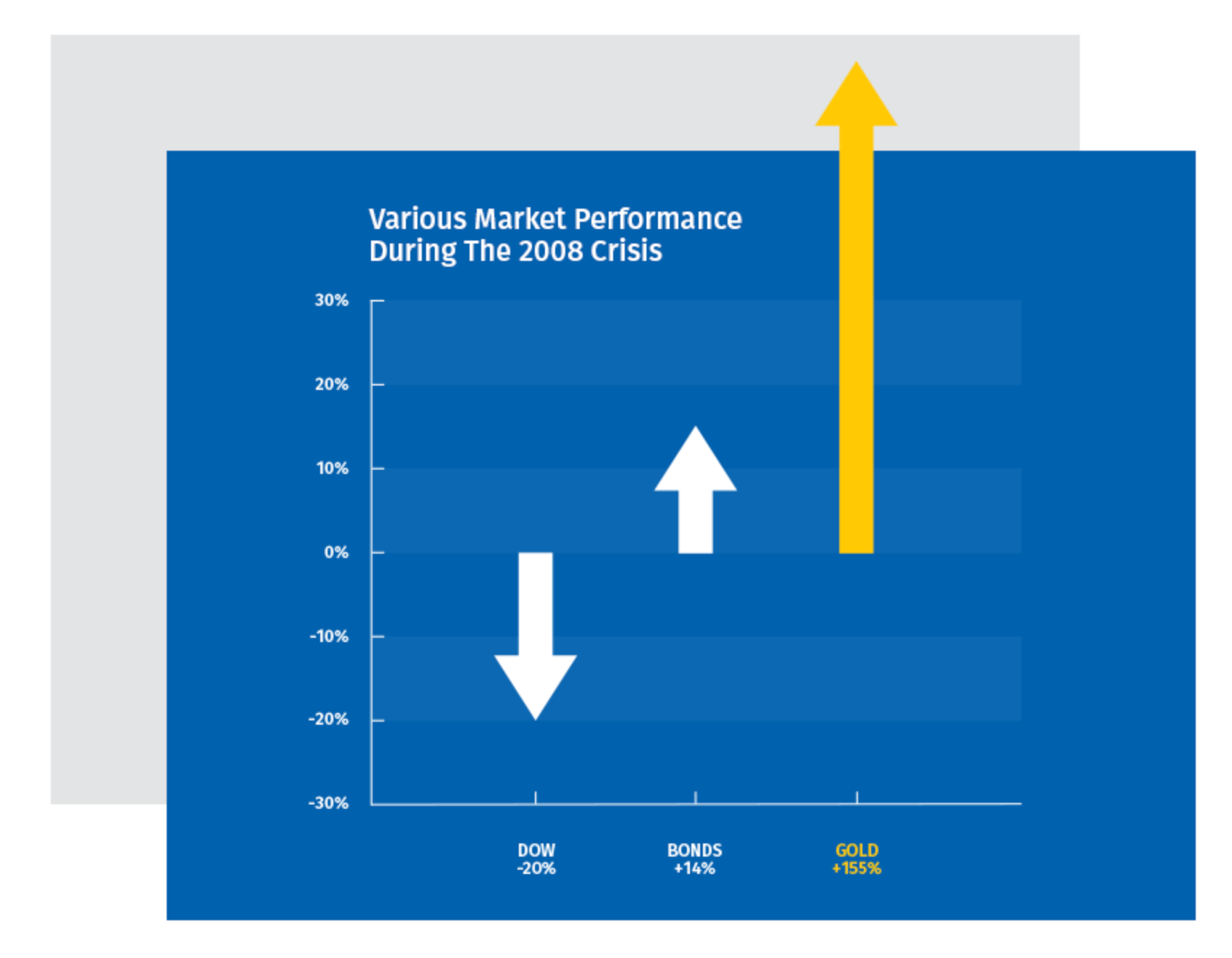

Well, the same thing applies to our finances and investing. There are currently many investments that are giving much higher rates of return than we’ve experienced for a long time. Given the poor rates of return from savings accounts, government bonds, and other things we used in years past to steadily grow a nest egg, these current investments are often a matter of enough or not enough, and possibly even life and death. Likely, you’re invested in some of them. Well and good. But you likely also know that risk and reward go together. And this is a very high-risk market. You might be hedging your investments, but are you insuring them? Those are two very different concepts. One balances performance over the rough patches and the other steps in when everything goes to pieces. One is a fallback position, the other is the cavalry.

If you’re a wealthy investor, gold can insure your portfolio against collapse during adverse macro events. If you’re a productive member of the middle class, gold might be the only thing that keeps you solvent in a crisis. And if recent events have knocked you down toward the bottom of the socioeconomic scale, gold might be the only thing that helps you survive.

Each situation is different, and insurance levels should always be driven by both means and need. For help determining what’s right for you, you can fill out a Market Readiness Worksheet:

Oops! We could not locate your form.

To learn more about how you can insure the things you value, call ICA at 1-800-525-9556. Talk to a professional there, explain your goals, and make up your own mind at your own pace. But also keep in mind that crises and emergencies tend to happen on their own timetables, not ours.