Podcast: Play in new window

In this week’s Golden Rule Radio, we unpack gold’s recent correction and explain why it might be healthy for the long-term trend. We look at what’s driving the dollar’s bounce, how CPI surprised markets, and why central banks — not retail investors — are still the biggest force behind gold’s rise.

Plus: silver’s price action, key technical levels, and what policy shifts could mean for precious metals next. Let’s take a look at where prices stand as of Wednesday, May 14:

The price of gold is down about 5%, from our recording last week at $3,170. This is coming off a significant high, scraping $3,500 a couple of weeks ago.

The price of silver is flat at around $32. Over the past month, it has been up and down about 3%, but it is still looking pretty healthy.

Platinum is about even on the week at around $970. But it is trending upwards.

Palladium is down about 2% on the week, at around $950.

Moving over to the paper markets…

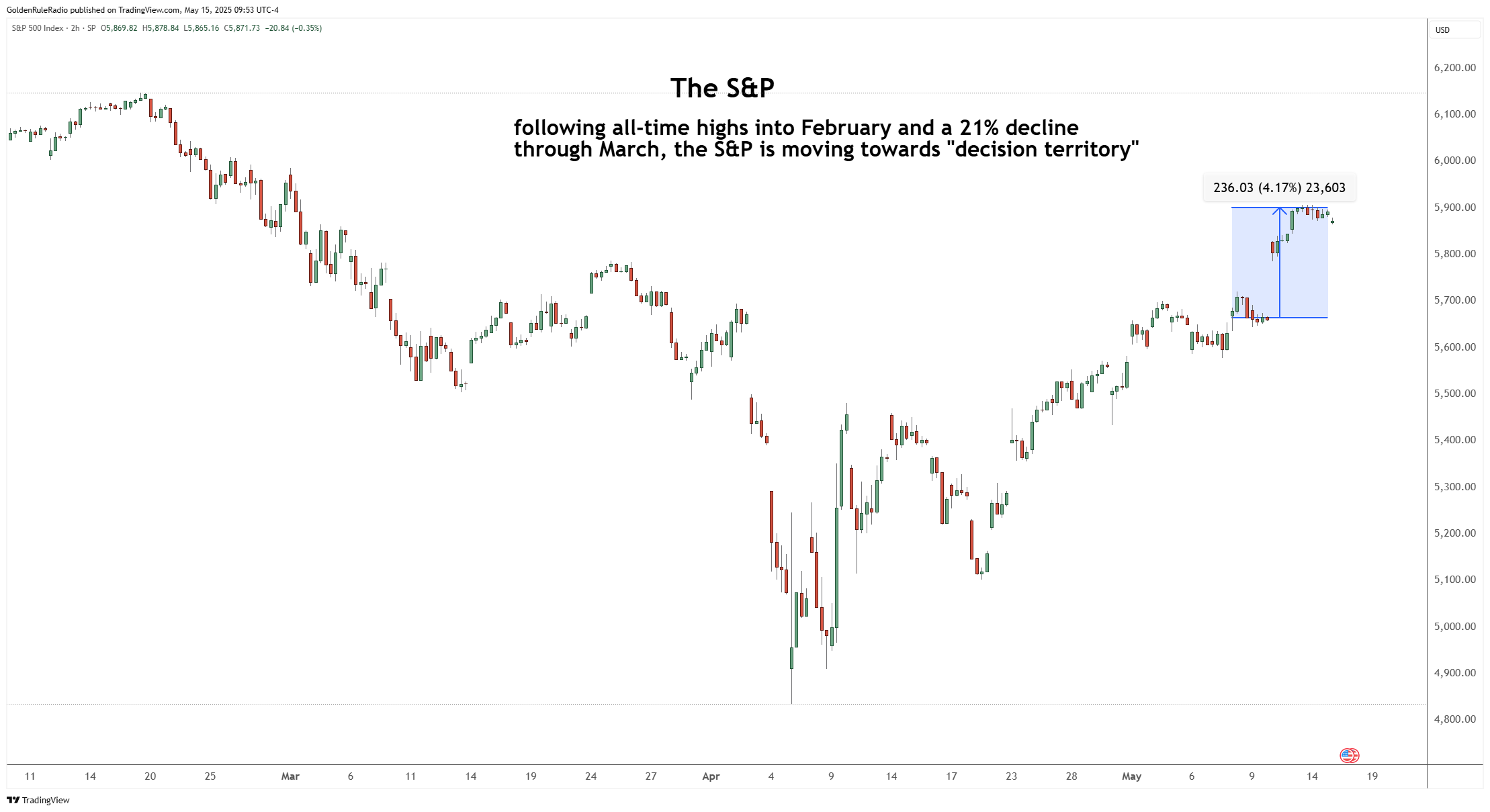

And the S&P 500 is up about 4% from a week earlier, sitting at just under 5,900.

The dollar index is up 0.5% on the week, currently sitting at 101.5. That below 100 number we saw back in April breaks a three-year floor in the dollar index.

Economic Tight Rope Walk

If you go back to the Dollar Index at a Crossroads show from two weeks ago, there was a great image of the inverse correlation between the dollar and the gold price. Is there an expectation of a continued rally?

President Trump wants a weaker dollar along with lower inflation. But they’re also trying to improve our exporting and employment numbers without driving inflation significantly higher. So it’s an economic tight rope walk.

Part of the reason why the price of gold has come down and the dollar index has increased is because of a lack of a rate cut. The Federal Reserve took the “wait and see” stance on rates, indicating that it’s not likely to cut rates in their next session either.

The broader market uncertainty has been driven by tariffs. And now, we have another pause. Trump has declared a 90-day halt on some sectors for those tariffs in regards to negotiations with China. And that news was huge for markets this week.

There’s more good news this week…

Gold’s Short-Term Correction

Gold is now down about 7% since the most recent high, and about 9% since its all time high back in April. As we see it, this correction is a healthy one.

If you look back in the short term, gold has been stairstepping up from around 2,650 in January to 3,500. Now the price is sitting at its first major short-term correction, sitting right at or just below 3,200.

Now, if you look at the longer term chart of this entire move, you’re finally seeing our first longer term Fibonacci correction, the 3 1 8, which is exactly what it sounds like, 6 1 8. That’s about 61% retracement, three steps forward, two steps back, the 3 8 2, that’s about a third. So gold has taken three steps forward in the long term and we have finally taken a real step back.

CPI Shows Slowing Inflation

April’s headline and core (ex-food and energy) Consumer Price Index (CPI) came in at 0.2% month-over-month. That was slightly below the expected 0.3% increase expected by the markets. The year-over-year inflation reached its lowest levels since early 2021. This suggests a potential easing of inflation.

While there’s been an overall sentiment of “the sky is falling,” that has not happened yet. In fact, the CPI has actually come in better and lower than expected — another reason you should expect gold to pull back.

Protect Your Wealth

On the McAlvany Weekly Commentary podcast this week, David McAlvany mentioned that this might just be the eye of the hurricane. Because in April, there was the first one-month Fed surplus since 2001, and the CPI report was better than expected. But if real reforms are coming, there will likely be more need to build your shelter from the storm.

If you have not listened to the Weekly Commentary to add to your precious metals education, we encourage you to do so.

We’re Here to Help

Beyond the Golden Rule Radio, Weekly Commentary, and other news, the team at McAlvany is available to help you uncover your precious metals investing strategy.

The team has decades of experience investing in gold and other precious metals, and they can help you find the best strategy to meet your unique needs. They are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556.