Podcast: Play in new window

Precious metals markets remain relatively flat this week, while gold takes a minor step back down following its recent climb. Copper is the star of the show this week, reaching a new all-time high and seeing a 10% increase over the last 10 days. The S&P and USD make a small rebound, following weeks of poor performance. Let’s take a look at where prices stand as of our recording on March 26:

The price of gold is down 1% to $3015 from a week earlier.

The price of silver is flat from our recording last week to $33.75.

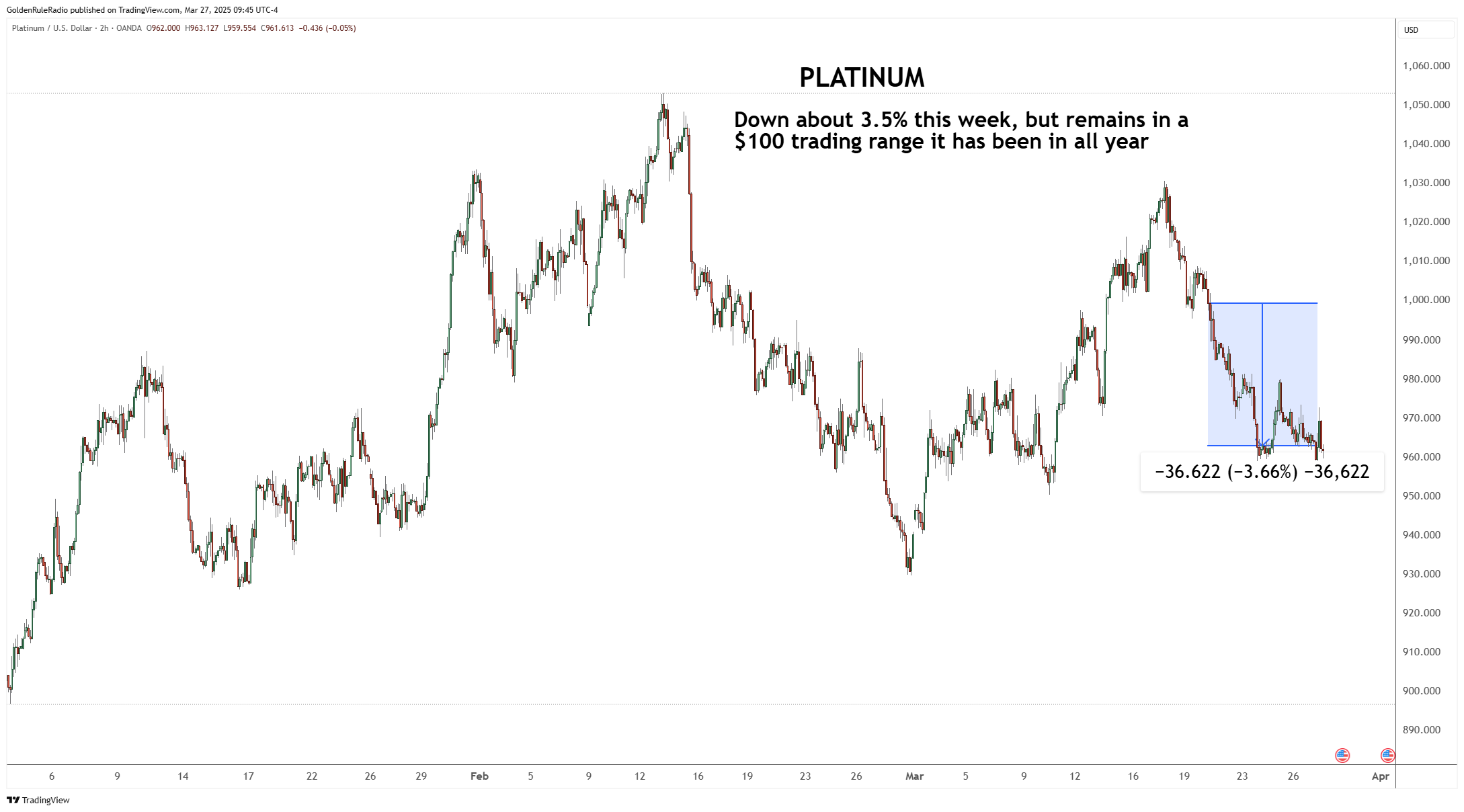

Platinum is down 3.5% to $965 an ounce. It has taken the biggest decline over the week.

Palladium is up slightly, around 1% to $964 per ounce.

Looking over at the paper markets, which are bouncing up slightly from a recent correction…

The S&P 500 bounced up 1.2% to 5,666, a small bounce up after a recent 11% decline.

The dollar index also bounced up 1% to $104.05.

Dr. Copper Reaches New High

The price of copper reached a new highest price ever, pushing above $5.32 early Wednesday. It had a 10% rise within the last week. Looking at its longer-term performance, copper has been in a rising, compressing channel since 2020. It had a slightly higher high in May 2024, and it reached its new high this week.

As we’ve said before, the shiny metal is commonly called Dr. Copper because it tends to lead other industrial resources — as well as precious metals, to some extent. When copper becomes more expensive, it tends to indicate that inflation is on the rise.

Some of copper’s rise could certainly be due to this massive tariff discussion, as well as its effect on consumer confidence.

Consumer Confidence Declines

Following years of a government stimulated economy, markets are now entering a detox period. Treasury Secretary Bessette has said that we need to expect a detox period, and since the election, there has been the beginning of belt tightening.

This has also led to the lowest consumer confidence score seen since January 2021. The most recent report showed consumer confidence dropping to 92.9 from 100 in February. Market expectations were that consumer confidence would drop to 94.

And while the markets may be headed into more belt tightening and recession, smart investors know to look at where the big money is betting — and right now, that’s in real, physical gold.

Add Gold to Your Portfolio

Working with an expert in precious metals will help you find the best buying opportunities for adding more gold to your portfolio. If you haven’t had a complimentary meeting with an advisor at McAlvany Precious Metals to talk through your financial objectives, now is a great time to start.

Our advisors have decades of experience investing in gold and other precious metals, and they can help you find the best strategy to meet your unique needs. They are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556.