Podcast: Play in new window

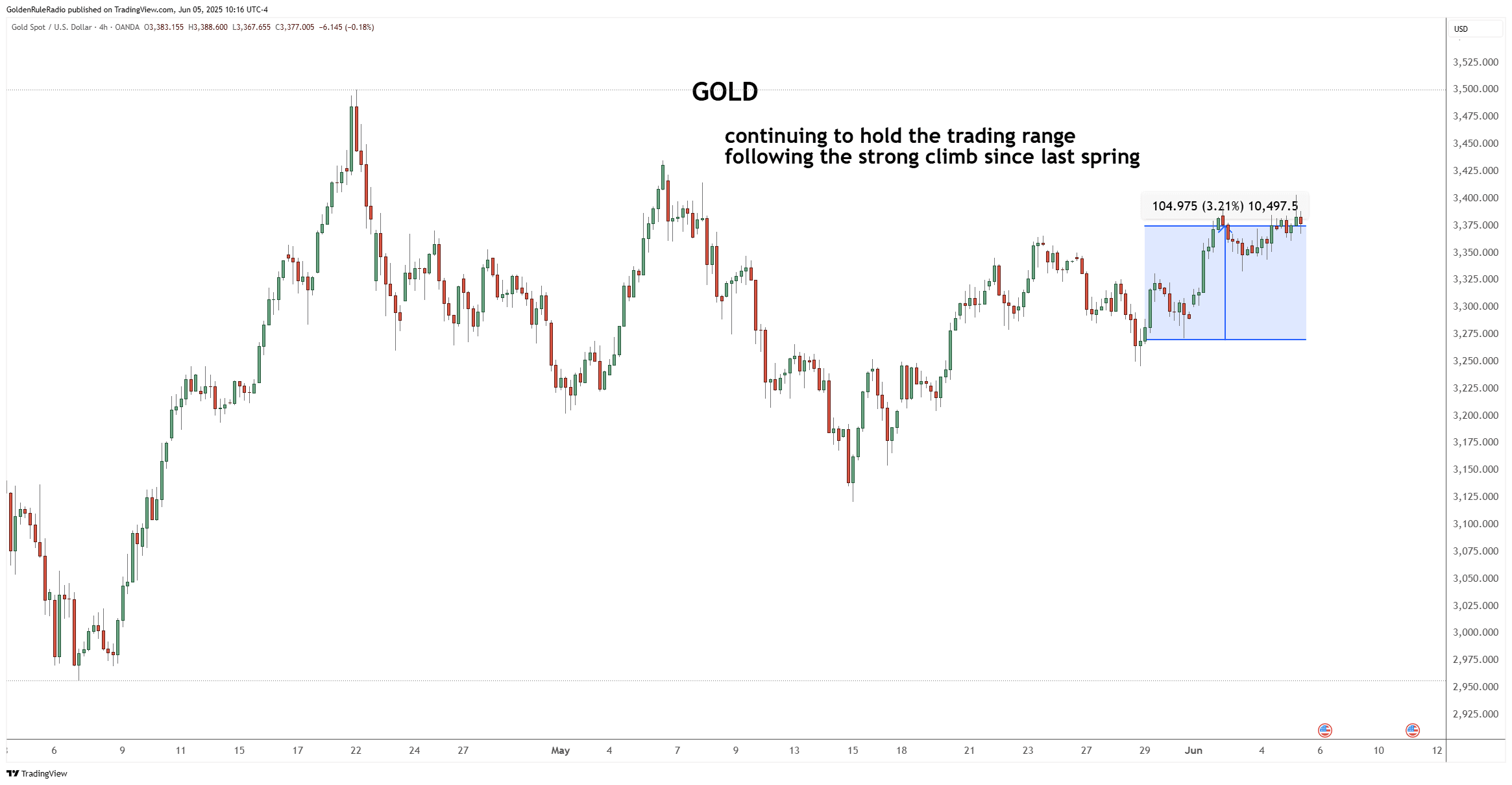

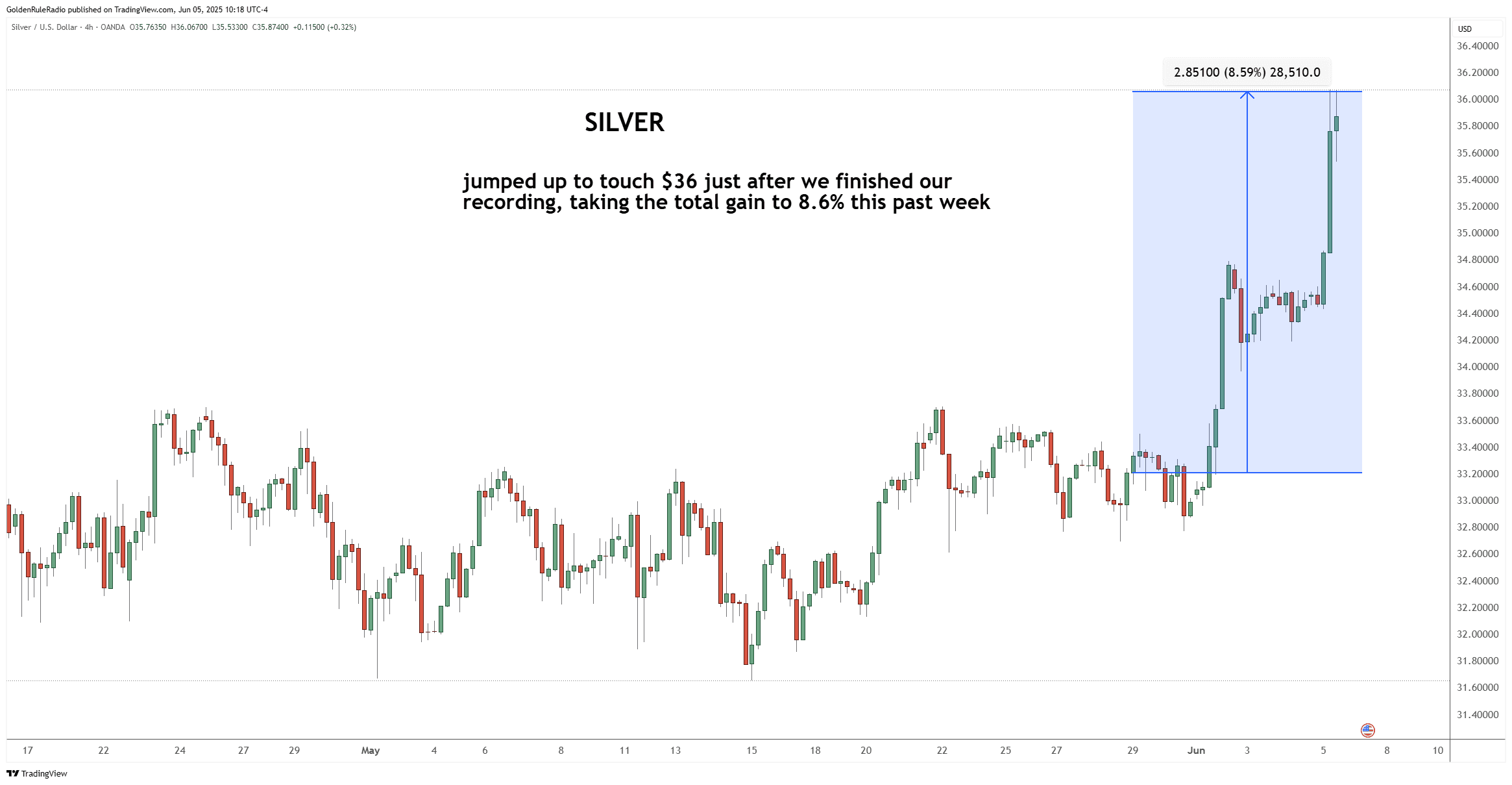

Gold’s rally continues, up over 3% from last week, and silver is not to be outdone, rising almost 4%. We are seeing signs in the S&P and Dow of reaching potential tops following May’s gains. Demand for gold remains globally, with soaring debt, government spending, and geopolitical tensions showcasing the safe haven found in gold.

Let’s take a look at where prices stand as of recording Wednesday, June 4:

The price of gold is up 3.5% from our last recording, to $3,378 an ounce.

The price of silver is up 3.8% from our recording last week, sitting at $34.50 an ounce. A couple other

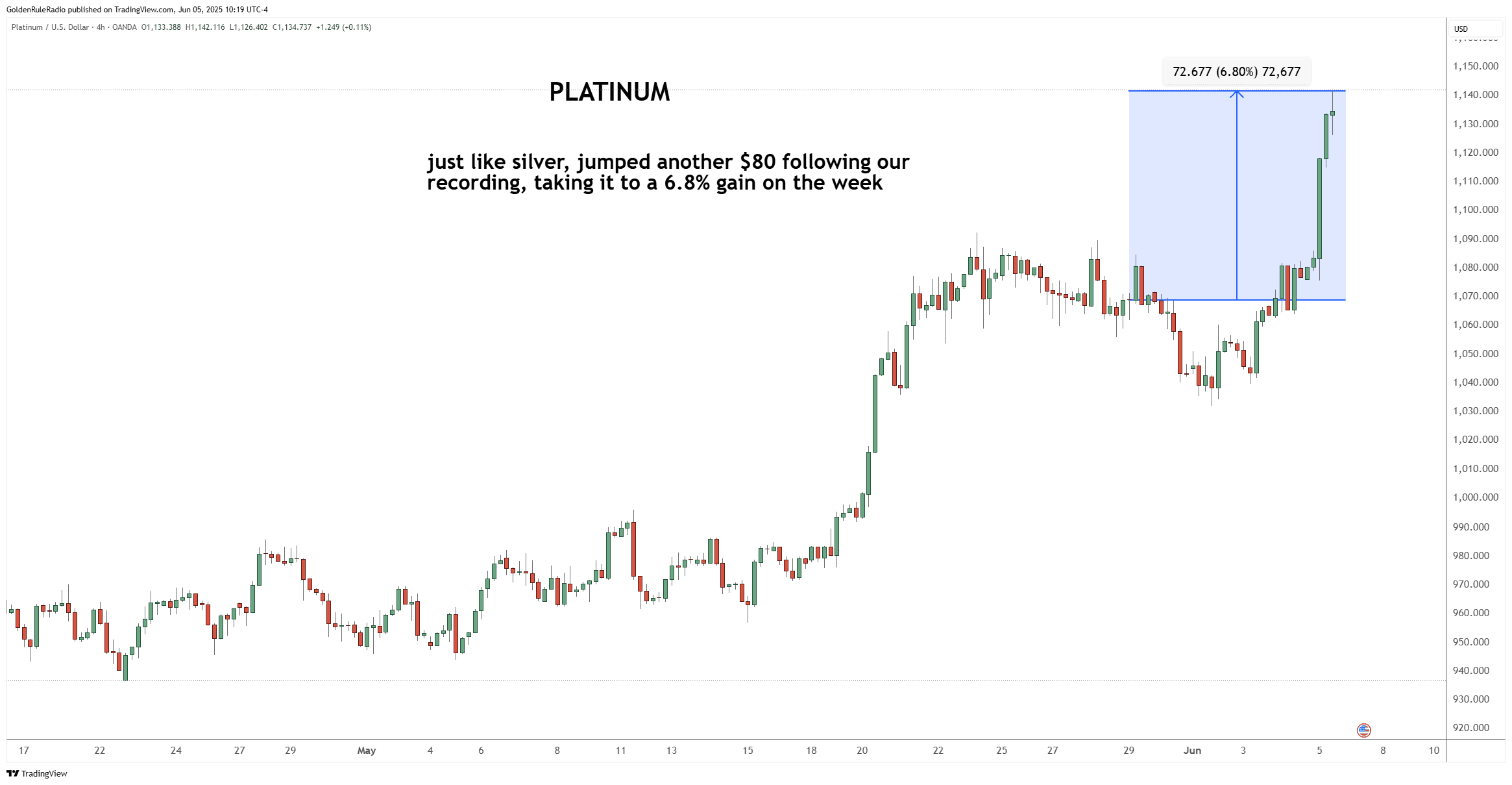

Platinum up about 1% on the week, sitting at about $1,080, but it did have a pretty big range, moving up and down as much as 5%.

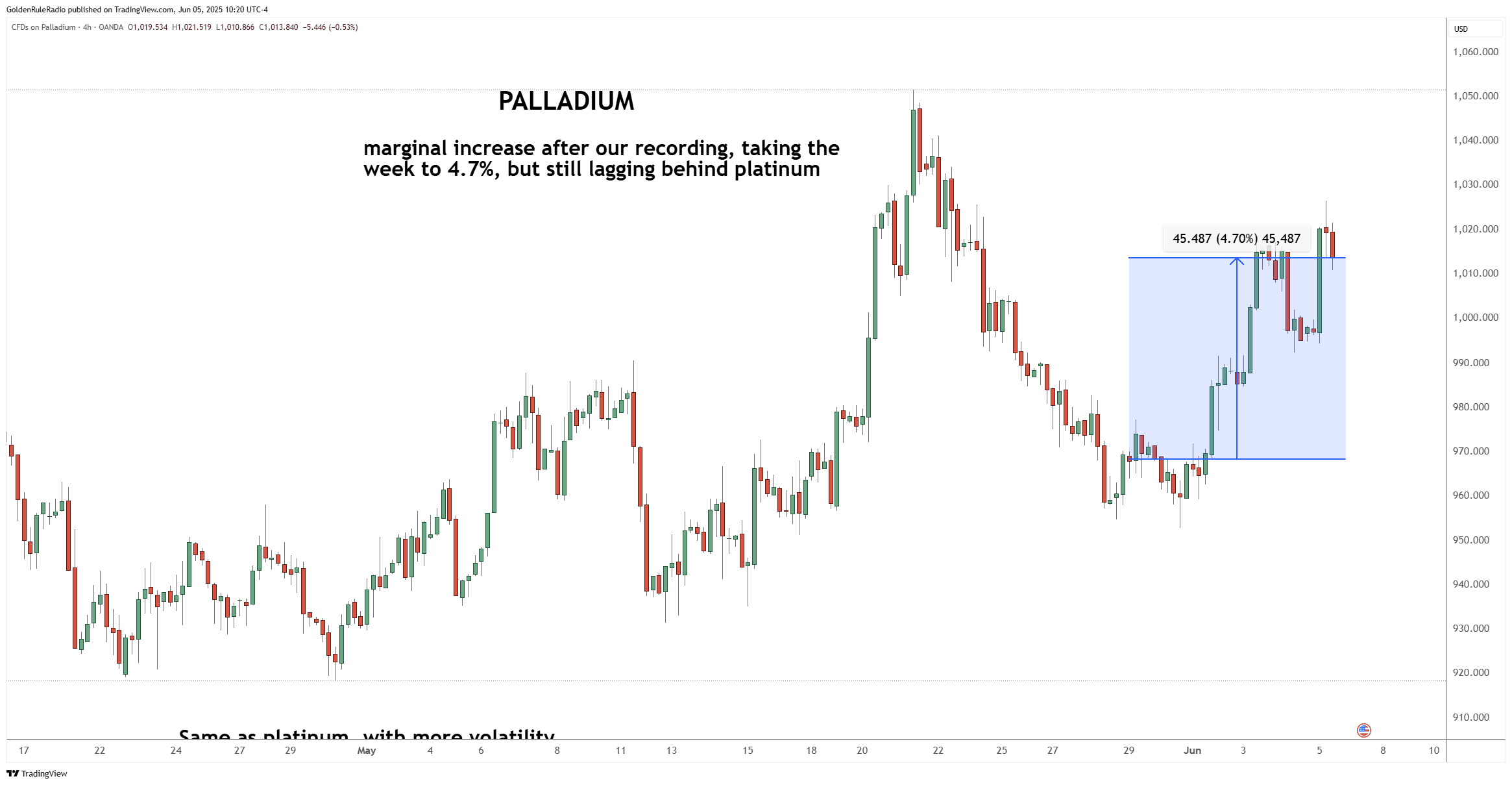

Palladium up about 3%, currently sitting at $997 per ounce.

Now taking a quick snapshot at the paper markets…

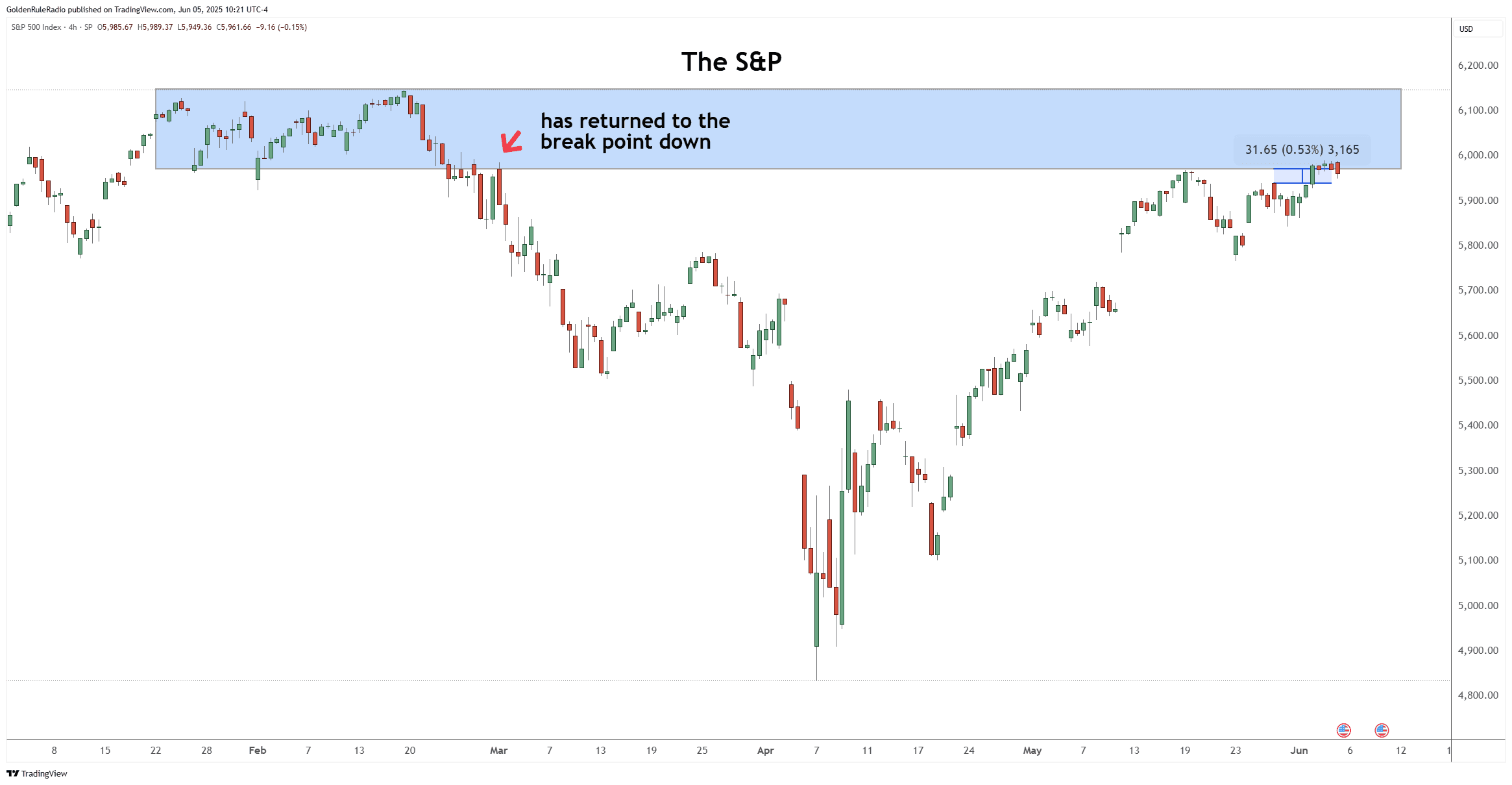

The S&P 500 is up about 0.5%, currently sitting at 5,970 and right at the bottom of the very key trading range.

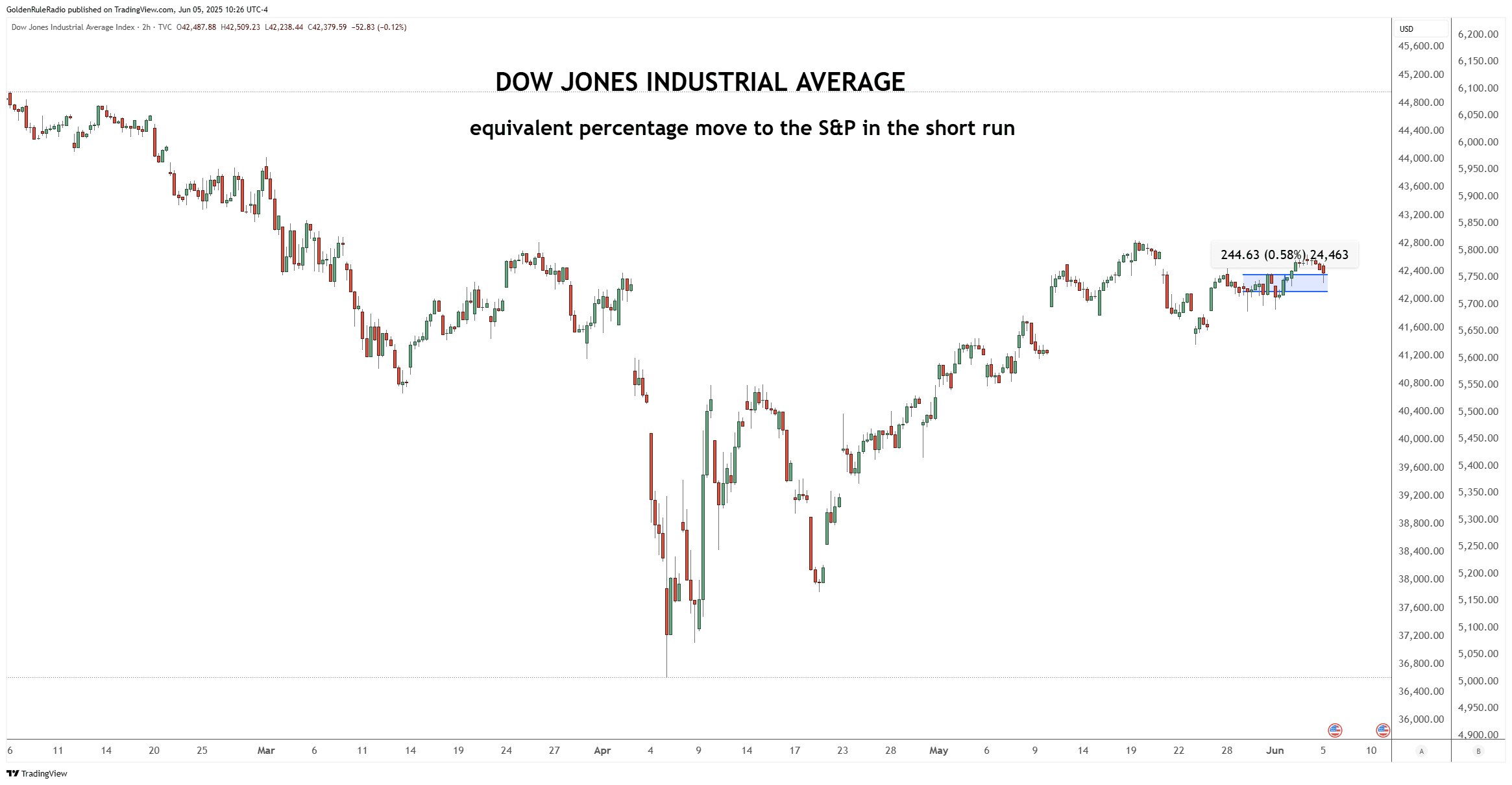

The DJIA is up about 0.5% sitting at about 42,400.

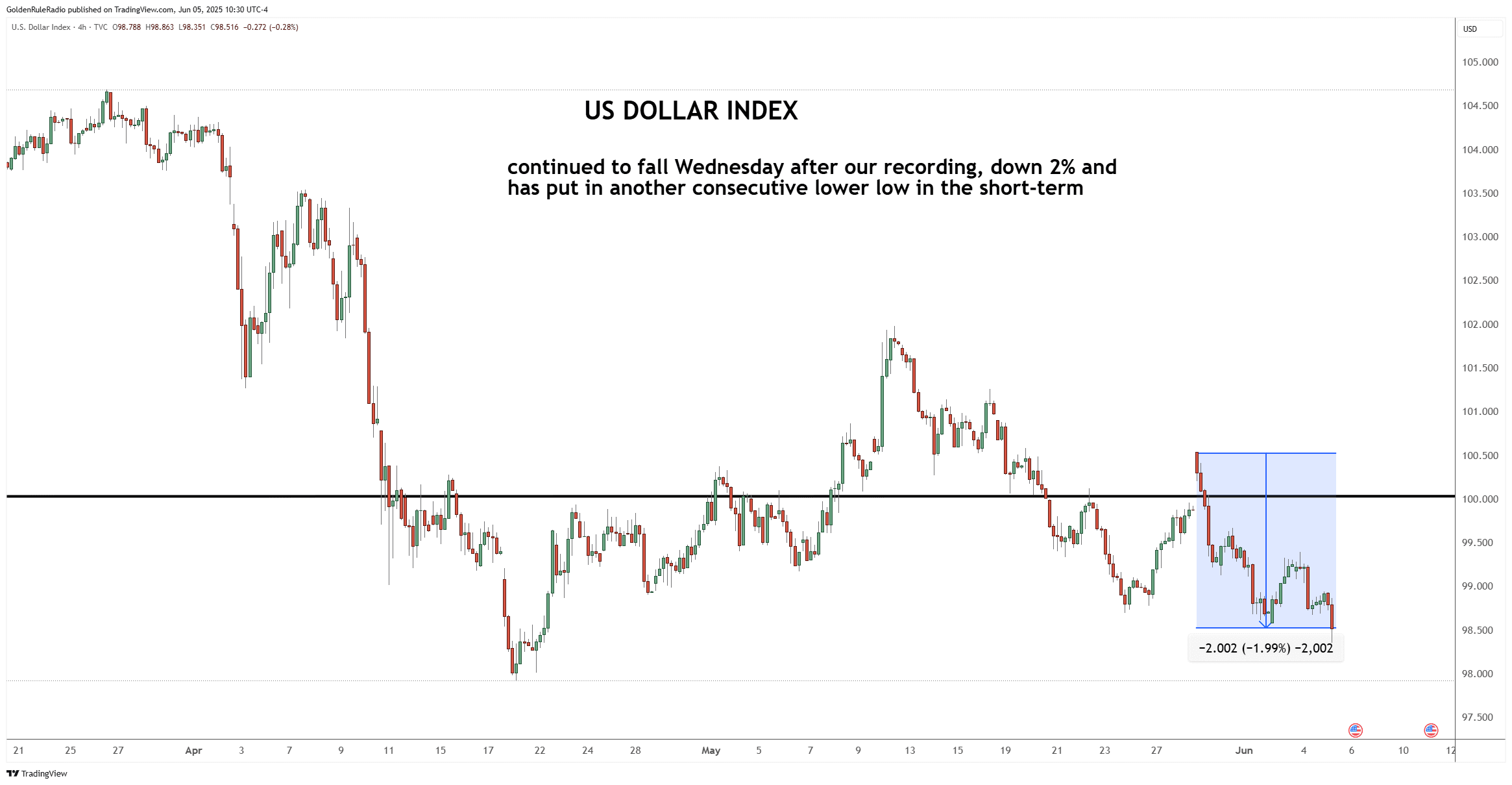

The US dollar index is down about 1.5% over the last week, sitting at 98.8.

Geopolitical Tensions Fuel Demand

It’s no secret that global tensions have a direct impact on precious metals, and this week was a textbook example. Nearly all of the week’s gains in gold and silver happened on June 2, right after news broke of a dramatic drone attack targeting Russian bombers in the ongoing Russia-Ukraine conflict. The hosts pointed out that these bombers are deliberately parked in visible locations for satellite surveillance, a legacy of arms treaties, but the real concern is: who passed along the targeting information to Ukraine? Was it just Ukraine, or did Western allies or even NATO play a role?

This uncertainty is exactly what keeps investors flocking to gold and silver.

Geopolitical “saber-rattling” is not limited to Eastern Europe. Ongoing instability in the Middle East also continues to support a risk premium in precious metals. Historically, gold and silver have acted as safe havens during periods of international conflict, and current events are reinforcing that role.

Global Debt: Losing Faith in the System.

Underlying the recent rally in precious metals is a broader and more structural issue: ballooning global debt. Total worldwide debt now exceeds $324 trillion, or roughly 335% of global GDP—a figure that continues to rise as governments, particularly the US, pursue aggressive deficit spending. The US is poised to raise its debt ceiling by another $4 trillion, with the Congressional Budget Office estimating that the new legislation could add over $5 trillion to the national debt, which already stands at $37 trillion.

Why does this matter for gold? Because people aren’t buying gold out of fear or greed — but because they’re losing faith in the system. Gold’s role as a hedge against currency depreciation is underscored by the fact that the US dollar has lost about 75% of its purchasing power in the last decade, with gold prices doubling over the same period.

Both retail and institutional investors are watching governments inflate away savings and rack up deficits with no end in sight. The result: gold is doing exactly what it’s supposed to do—protect purchasing power.

The Great Shift: From Treasurys to Gold

Perhaps the most important—and underreported—trend is the move by big players out of US Treasuries and into gold. And it’s not just retail investors; sovereign nations, central banks, and major financial institutions like JP Morgan and Goldman Sachs are all boosting their gold holdings.

A key driver is Section 899 of the new US bill, which essentially discourages foreign entities from holding US assets, including Treasuries. The goal is to weaken the dollar and make US manufacturing more competitive, but the side effect is clear: if foreigners are pushed out of Treasuries, they need a new reserve asset, and gold fits the bill.

The bond market, once considered the ultimate safe haven, is now seen as the biggest systemic risk. The takeaway: gold is increasingly viewed as the only real protection against a potential bond market crisis. As confidence in government debt erodes, the world is moving out of Treasuries and into gold at an accelerating pace.

Protect Your Wealth Today

How many ounces of gold will provide the inflation protection you need to preserve your wealth? The McAlvany advisor team is here to help guide you. With decades of experience in precious metals investing, they are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556