Podcast: Play in new window

Precious metals make a strong showing this week with gold back above the $2900 level. The US dollar continues its downwards trend, dropping 3% over the last week. Let’s take a look at where prices stand as of our recording on March 12:

The price of gold is up about 0.5% at $2,936. It did have a couple percent movement down and then back up in between recordings.

The price of silver is up about 4% over the last week, sitting at $33.22

Platinum up about 2.5%, sitting at $990, and just inching towards that thousand dollars mark again.

Palladium is up about 3% at $946, showing a little strength in its own right as well.

Meanwhile in the paper markets…

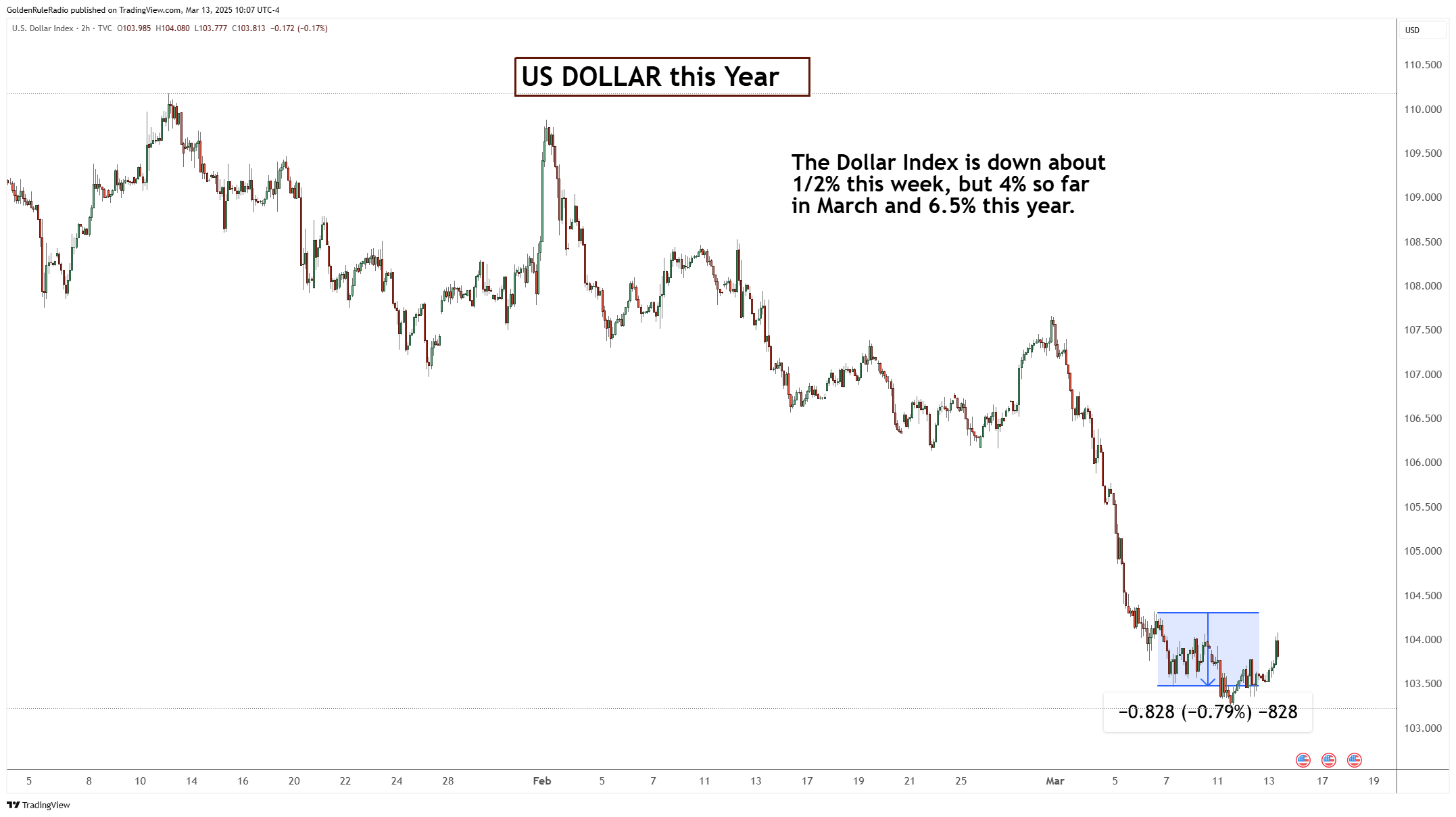

The US dollar is down another 3% over the last week to $103.05. So the dollar remains in free fall now for the last couple of weeks, and it looks like it’s a dragon.

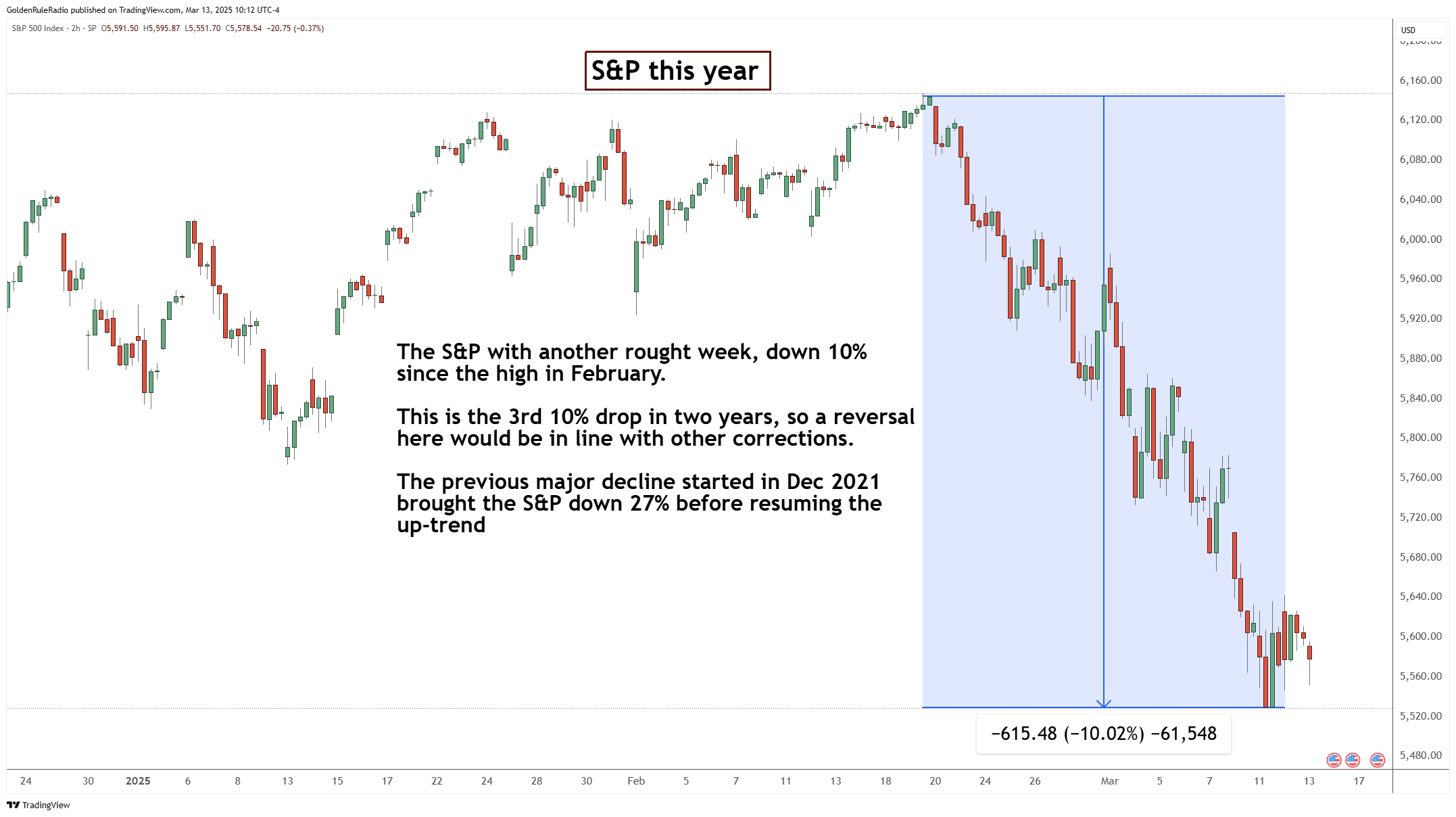

The S&P 500 is down 7% to 5,577, now down over 10%.

The Dow Industrials is down 4.5% to 41,960, and from top to bottom down about 9%.

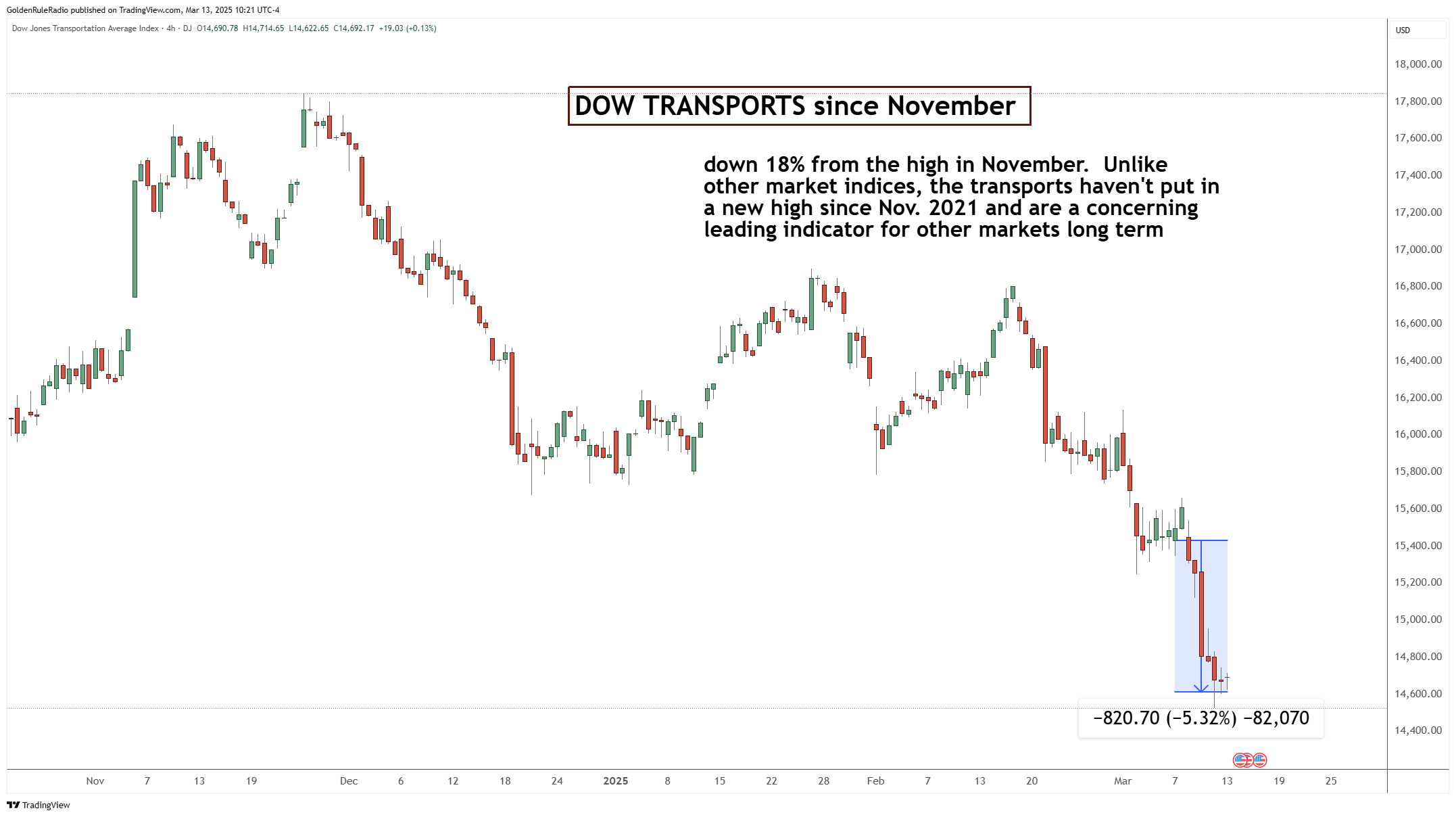

The Dow Transportation Index is down 5.3% to around 14,600, and it has declined 18% since reaching a high in November 2024.

The NASDAQ was down 3% at 19,590 for the week, and down about 14% off highs in February.

Market Flight to Safety

We have been speaking for several weeks about factors in the broader markets that affect the prices of precious metals — like optimism, GDP, and the rate of inflation.

In order for us to see a significant change in precious metals prices, you’d have to see a significant change in one of those categories. With the tariff and trade wars, we’ve seen a lot of movement.

Reviewing the research coming out of Hedgeye Risk Management and their Growth, Inflation, Policy (GIP) Quad System, it seems the US is moving into quadrant four — which is growth slowing and inflation slowing.

What’s unusual is that when you have a sell off occurring in the equities market or in the crypto market, money typically goes into the US dollar. However, there’s a double whammy of the dollar falling precipitously as well as the equities market falling.

So where is the money going? It’s fleeing into safety and going into metals.

The Gold Rush Begins

Trump has also called for an audit of all the gold stored in Fort Knox. But even if all 8,100 tons of gold are stored there, that doesn’t even equal $900 billion — which is valued at about 1.3% of all of the money in circulation and the national debt.

Smart investors who start stacking gold ounces now will be getting in ahead of the massive gold rush about to happen.

The Tangible Opportunity

The new US administration is slashing the government budget and finding money quickly in anticipation of what’s to come financially. The US owes $36 trillion, and it will have to refinance $27 trillion when it comes due in the next four years. That is an erupting volcano of treasury paper into a market without enough buyers.

The US has to find a way to move that money into something else. That’s why Trump has also been talking about establishing a Sovereign Wealth Fund, which could include gold, timber, oil and gas, pipelines and other tangible assets.

Everything that the government is considering putting into a Sovereign Wealth Fund is exactly what we’ve been offering through our hard asset portfolios at McAlvany Wealth Management.

Add Gold Ounces Today

If you haven’t connected with a McAlvany Advisor yet, now is a great time to discover how gold can support your investment strategy. Call us at (800) 525-9556 for a complimentary portfolio review. One of our trusted advisors will help you discover your personal strategy for adding gold ounces to reach your goals.