Podcast: Play in new window

This week on Golden Rule Radio, the team breaks down the latest moves in the precious metals markets following the Fed’s Jackson Hole meeting. Gold hit $3,400, silver is rising alongside it, and rate cut expectations are shaking both the dollar and equities. We also dive into the Fed’s dual mandate struggles, inflation concerns, the potential creation of a U.S. sovereign wealth fund, and what all of this means for gold, silver, platinum, palladium, and mining stocks.

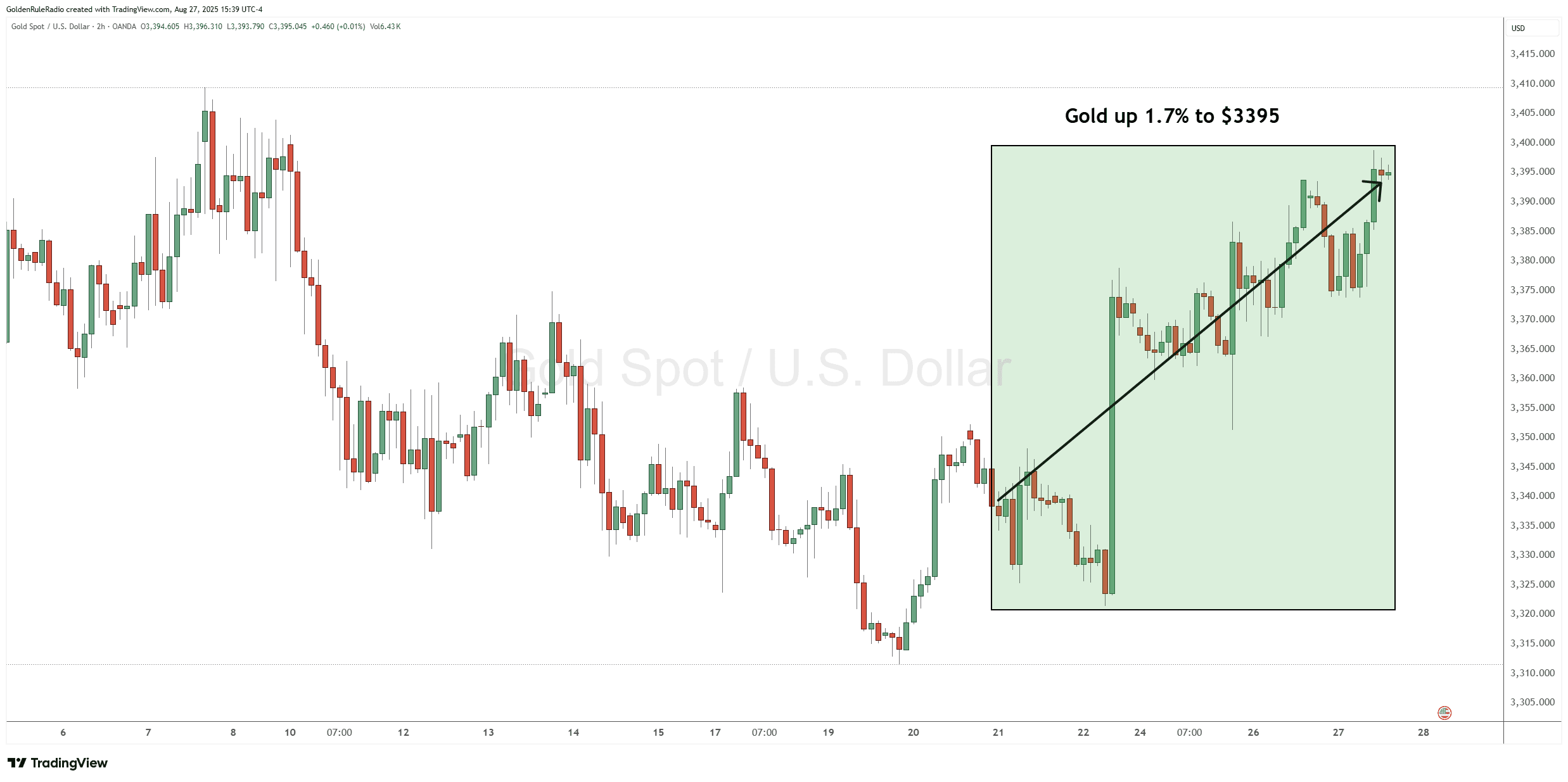

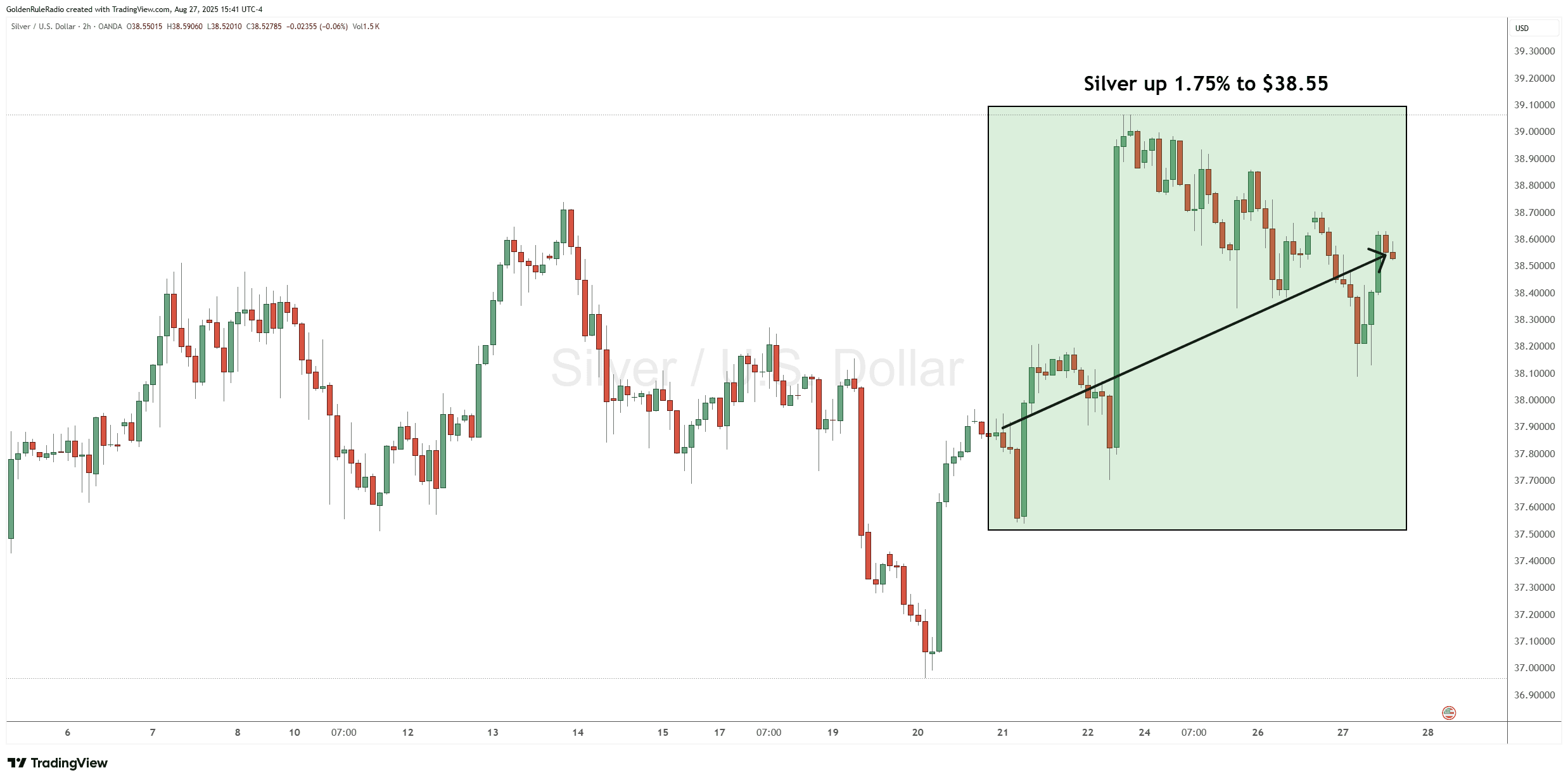

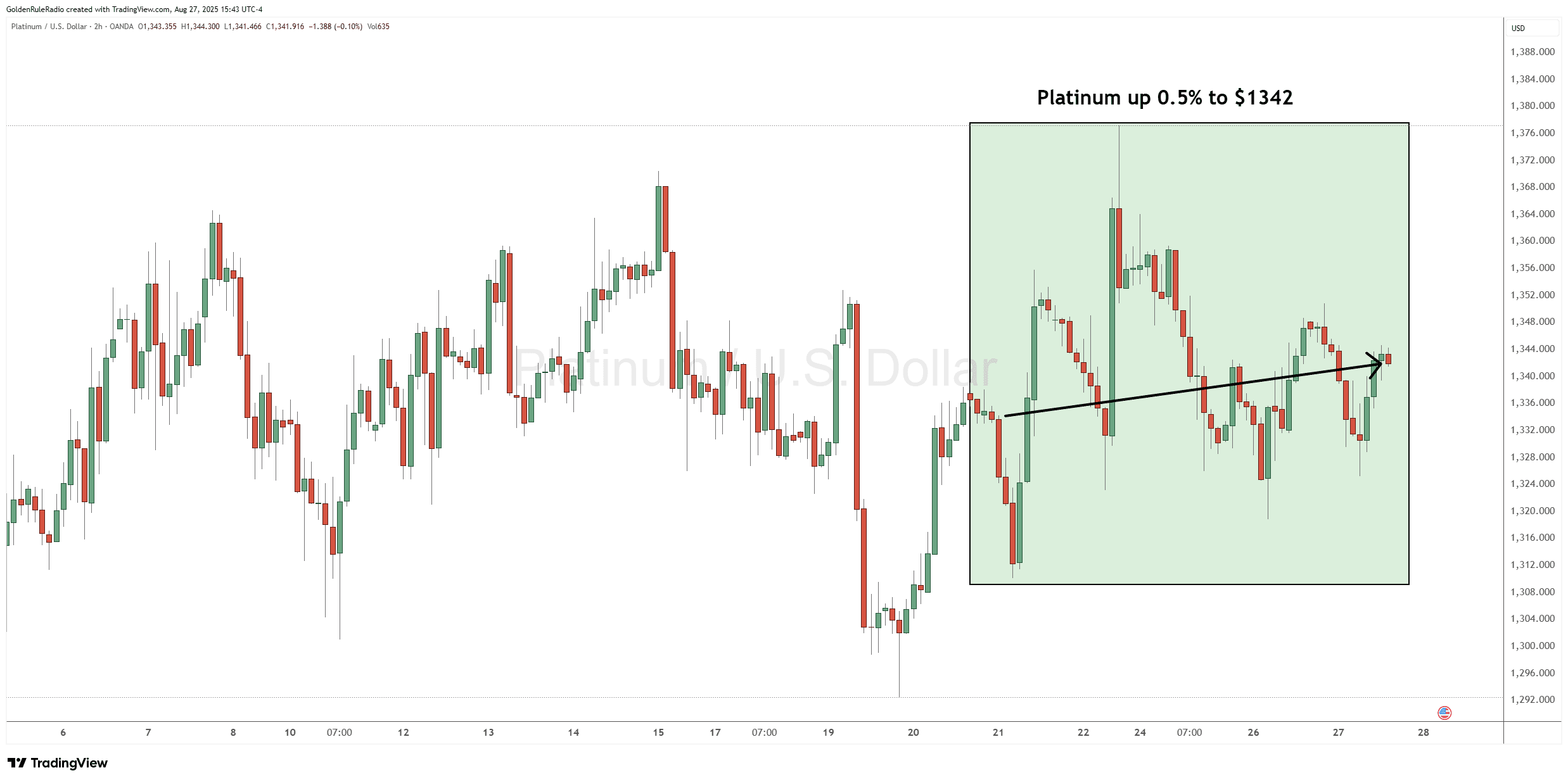

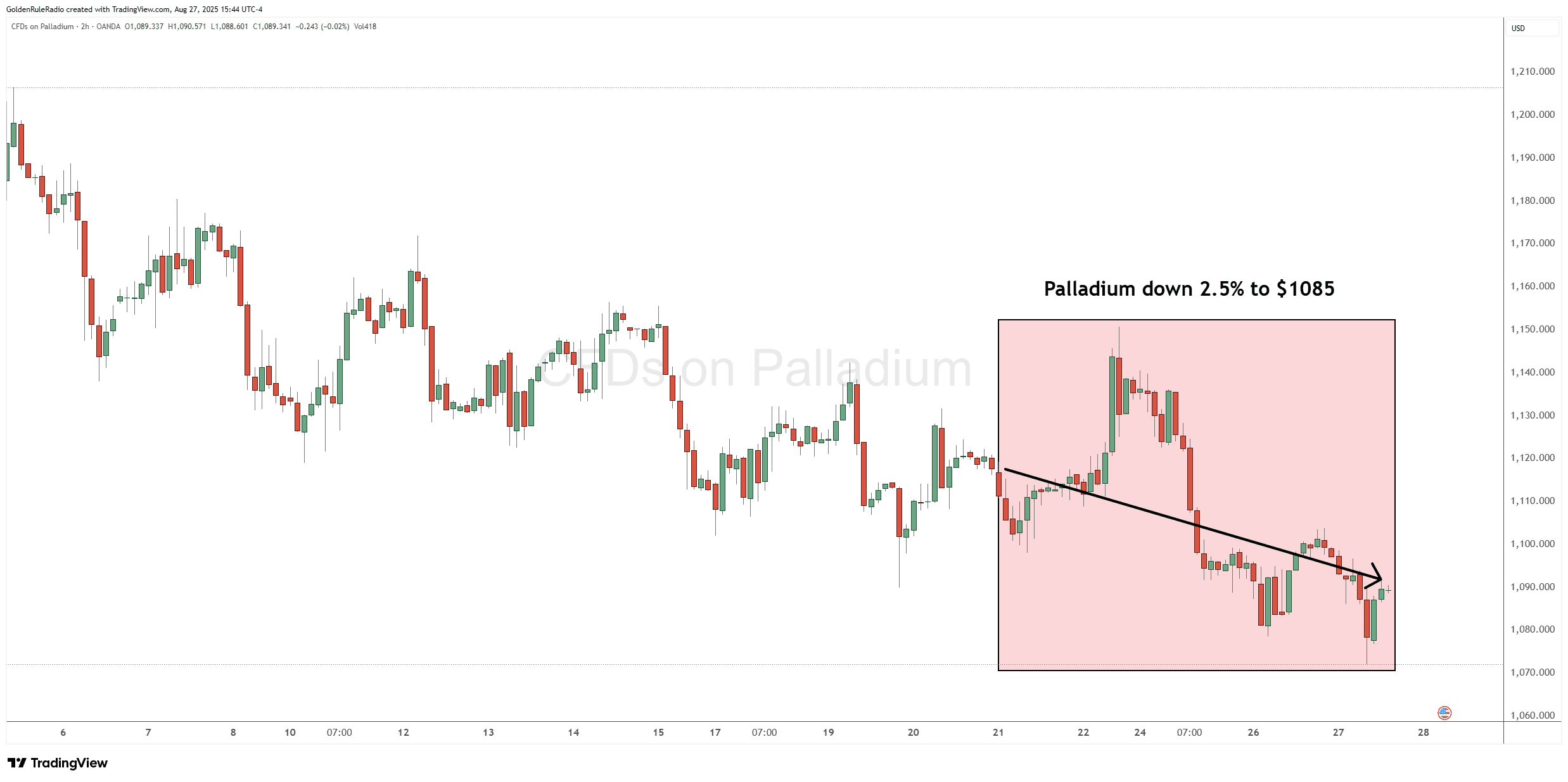

Let’s take a look at where prices stood as of Wednesday, August 27:

The price of gold was up 1.75% to $3,397 as of recording. Since publishing, gold surpassed the $3,400 level.

Silver was up 1.75% to $38.55.

Platinum was up 0.5%, sitting at around $1,342 — a sideways move after its big push this past spring.

Palladium remained bearish, down 2.5% and sitting at $1,085.

Looking over at the paper markets…

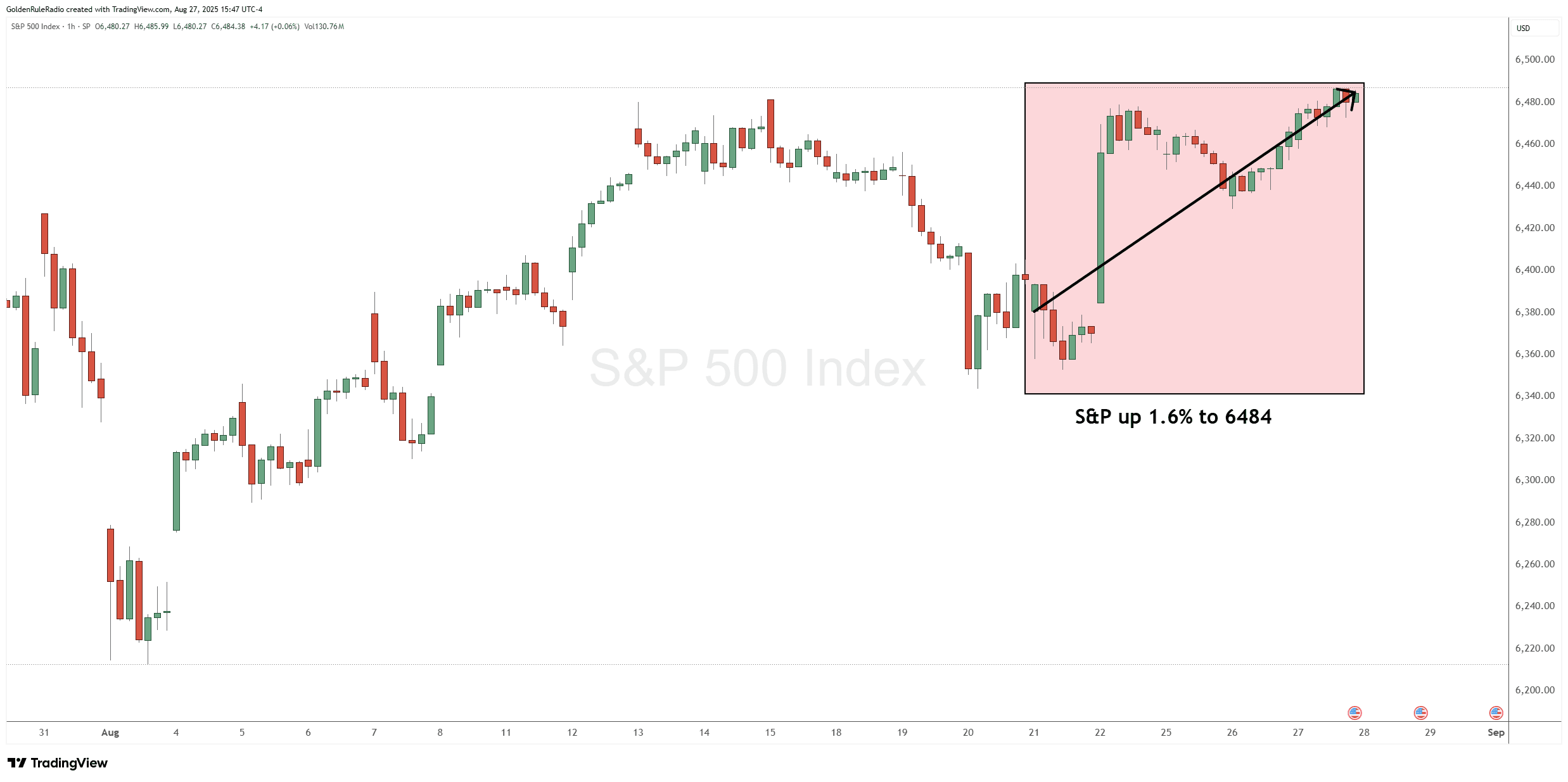

The S&P 500 was up about 1.6% on the week. The index reached another slightly higher high than the previous highs following Friday’s news from Jackson Hole.

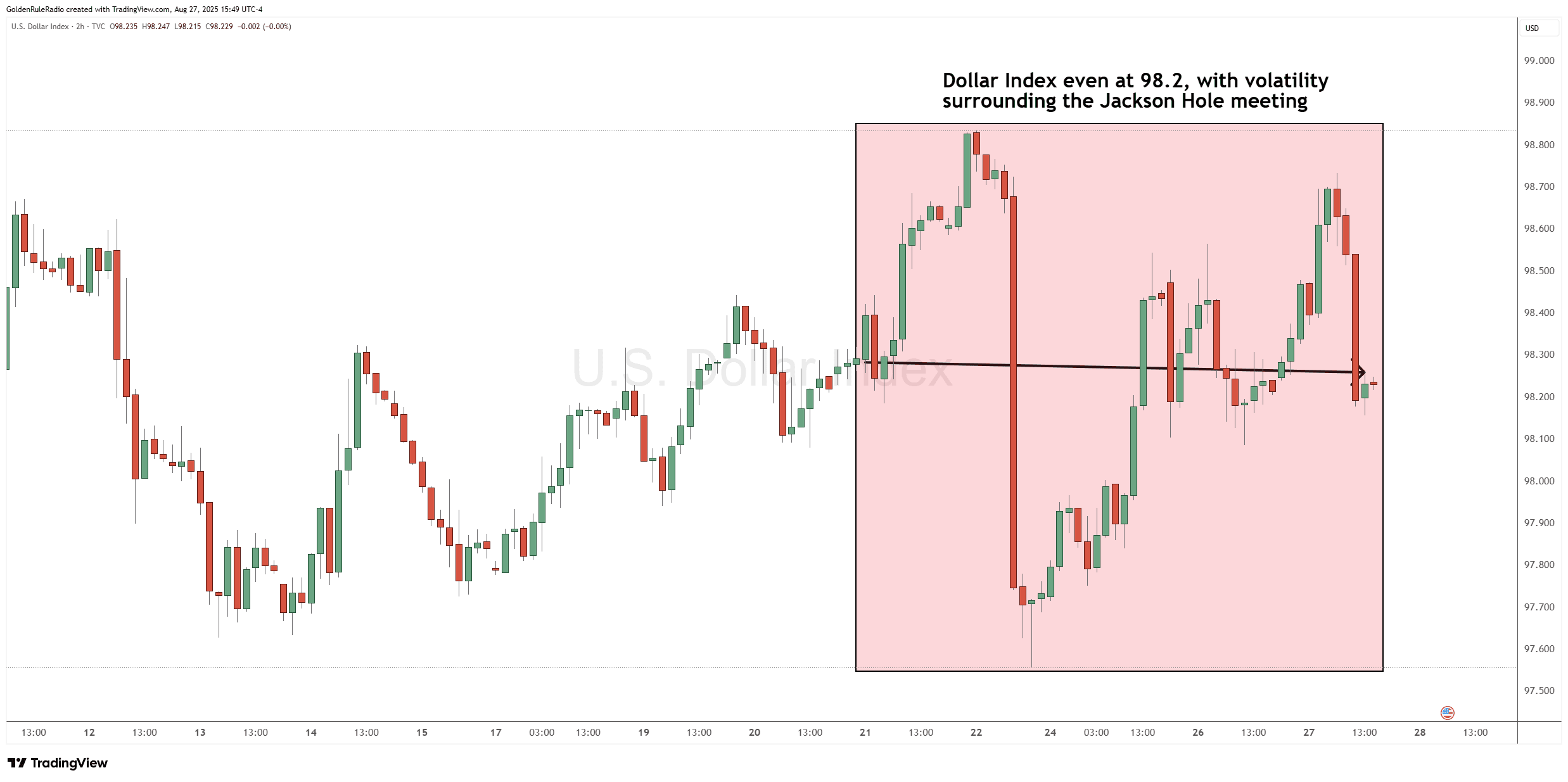

The US dollar index was flat at 98.2. That’s after a lot of volatility over Friday and Monday as we saw a big decline in a bounce back in the dollar.

The Rate Cut Debate: Inflation vs. Labor Market

Much of the recent volatility traces back to the market’s fixation on a possible September rate cut—despite inflation running above the Fed’s 2% target and projected to top 3.3% by year’s end.

The labor market’s surprise weakness has become the central driver: major payroll revisions erased nearly half a million jobs in May and June alone. This jobs report weakness appears to override classic inflation concerns, prompting speculation that policy decisions are increasingly dictated by political and employment considerations, rather than purely economic data.

Notably, history warns of the risks: the last time the Fed cut rates into rising inflation was the 1970s, which led to runaway inflation and the eventual need for aggressive monetary tightening.

Monetizing National Assets: The Sovereign Wealth Fund Plan

Beyond monetary policy, new government proposals to create a US Sovereign Wealth Fund represent a profound shift in fiscal strategy. The plan would bring federal land, mineral rights, oilfields, and other resources onto a state balance sheet, generating income both via traditional royalties and streamlined exploitation of national assets.

Proponents argue this could help curb the federal debt and provide a new source of passive income, but there are pressing concerns. Chief among them is the potential for government overreach, the risk of further wealth concentration, and the environmental consequences. This model—already used in countries like Saudi Arabia and Norway—could greatly change how US assets are managed and who ultimately benefits.

Real Assets Remain Essential

With asset prices uniformly buoyed by a weakening dollar and easy money, the imperative for investors is clear: holding tangible, real assets is more important than ever.

Historically, equity markets have risen an average of nearly 14% in the year following a rate cut near an all-time high. But gold’s performance often outpaces even these gains, thanks to its unique role as a hedge against monetary debasement. Recent trends among gold miners, especially the more volatile junior miners, further highlight the advantages of focusing on physical gold holdings over mining equities—particularly as broad market corrections remain a risk.

Safeguarding Wealth in a Shifting World

No matter how inventive or dramatic the latest policy moves may be—whether monetary stimulus or the monetization of public assets—the fundamental principle holds: to preserve purchasing power and wealth in a world of persistent inflation and central bank intervention, owning hard assets like physical gold is essential. As the global economic order shifts and experiments with new fiscal strategies unfold, maintaining control over tangible value becomes the ultimate insurance.

Get in Touch

What should your next move be in your precious metals portfolio? Your trusted McAlvany advisor can help you determine the best strategy for adding ounces of gold and protecting your wealth. They are happy to speak with you on a no obligation, complimentary consultation at 800-525-9556.