Podcast: Play in new window

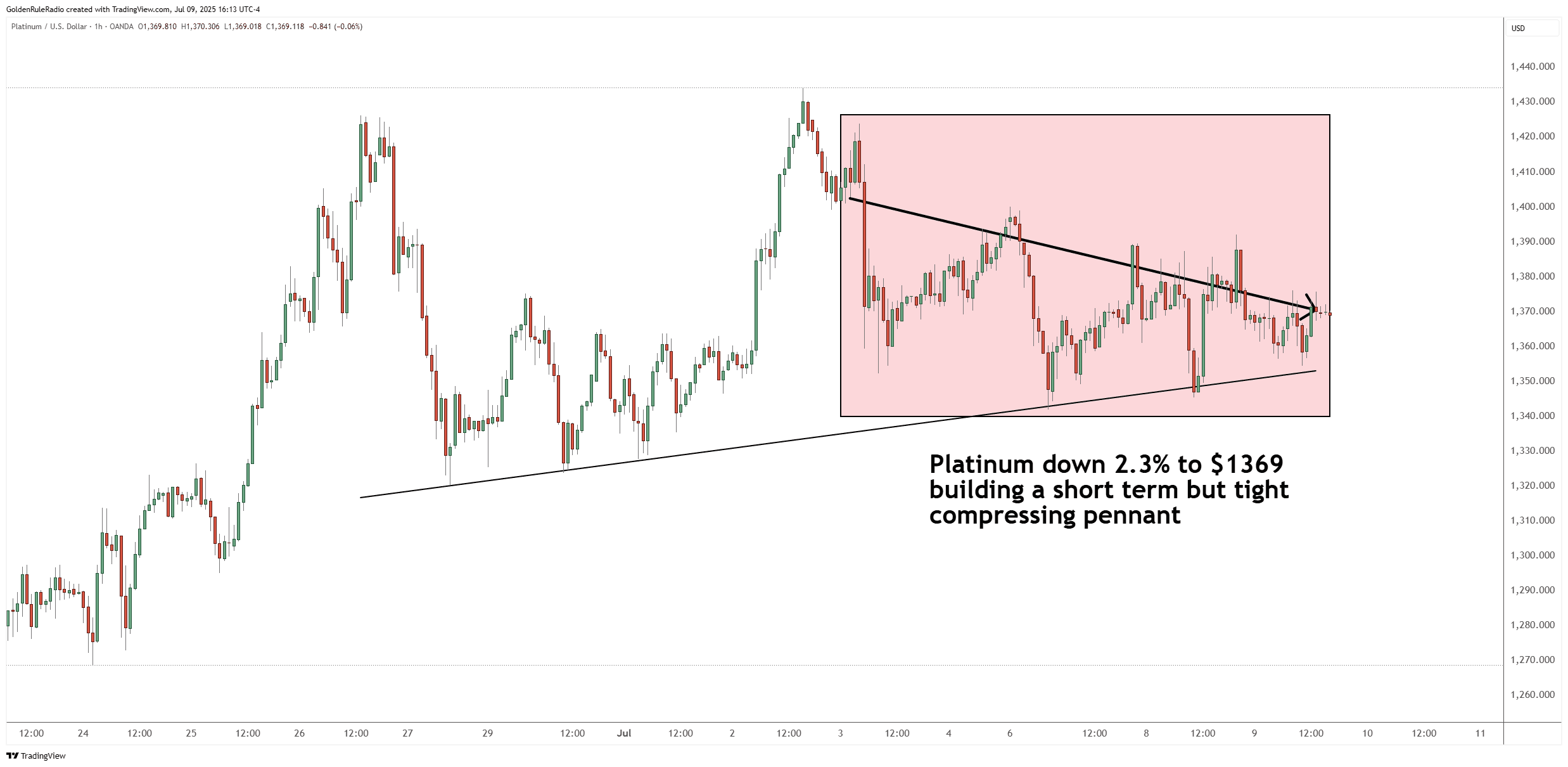

The metals markets have been anything but dull, even if the week’s price action felt subdued. The compressing pennant pattern in gold’s trading often signals an imminent breakout—yet, as history shows, gold can stubbornly trade sideways. For investors, this means patience may be warranted.

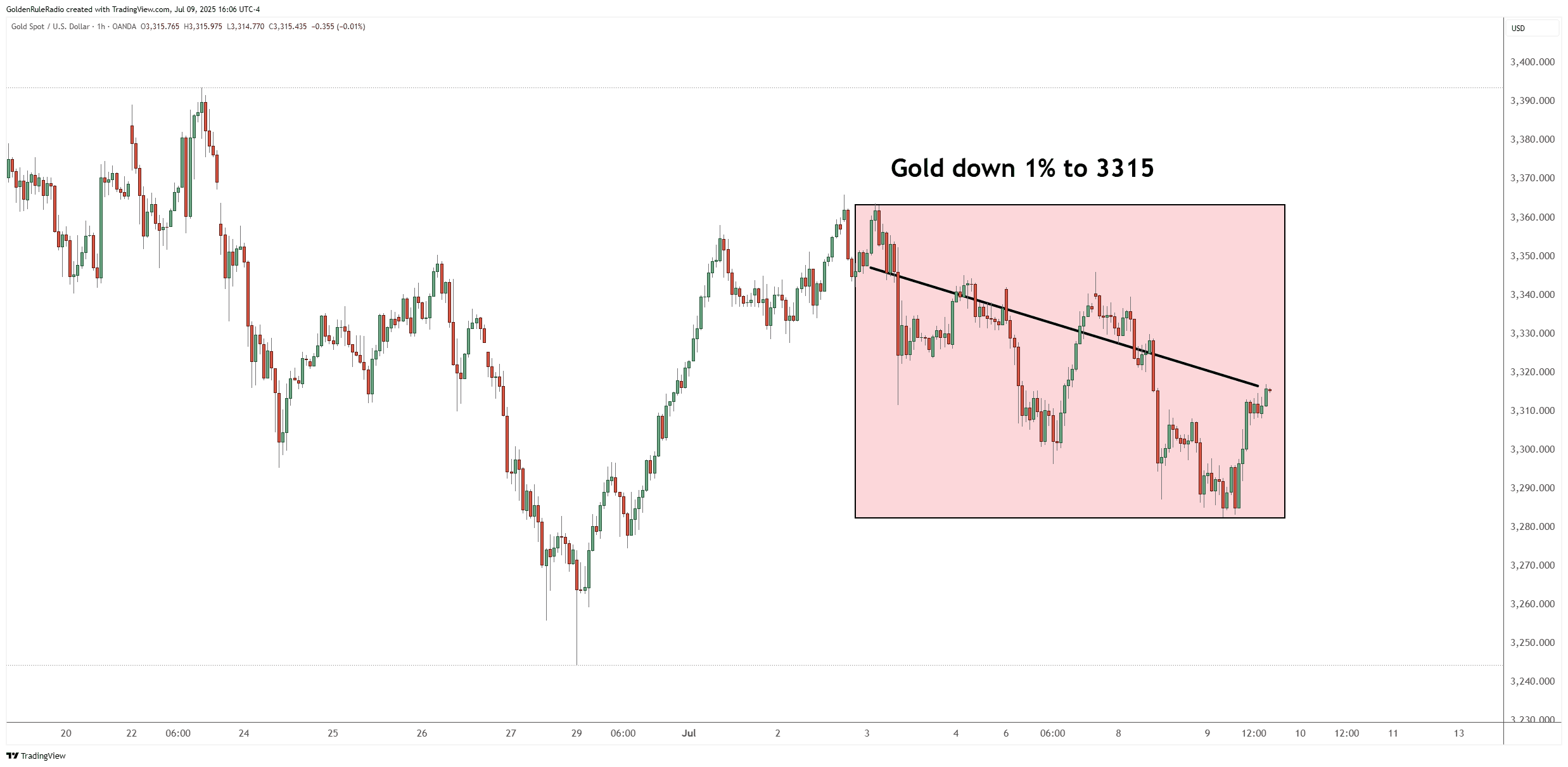

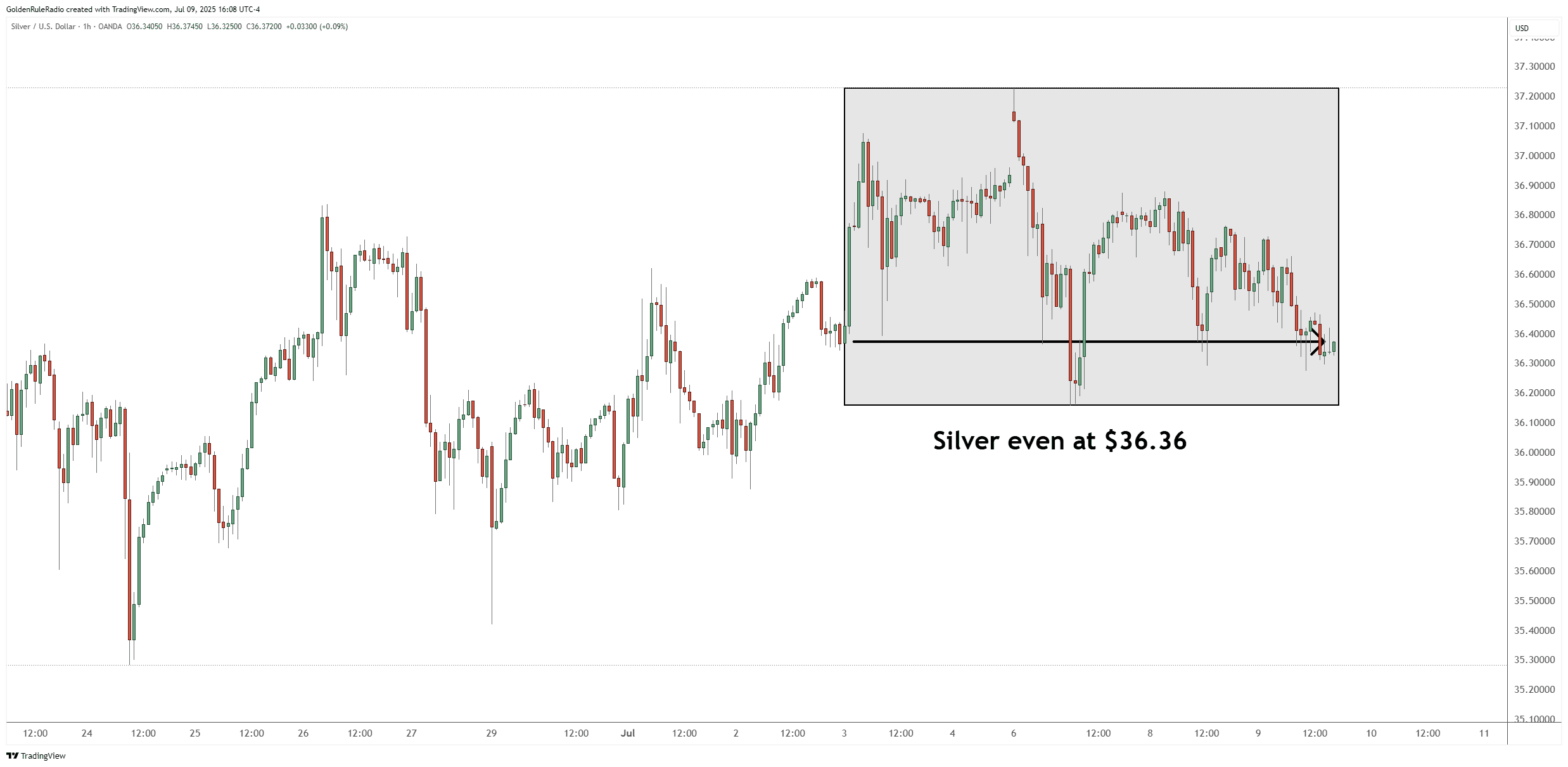

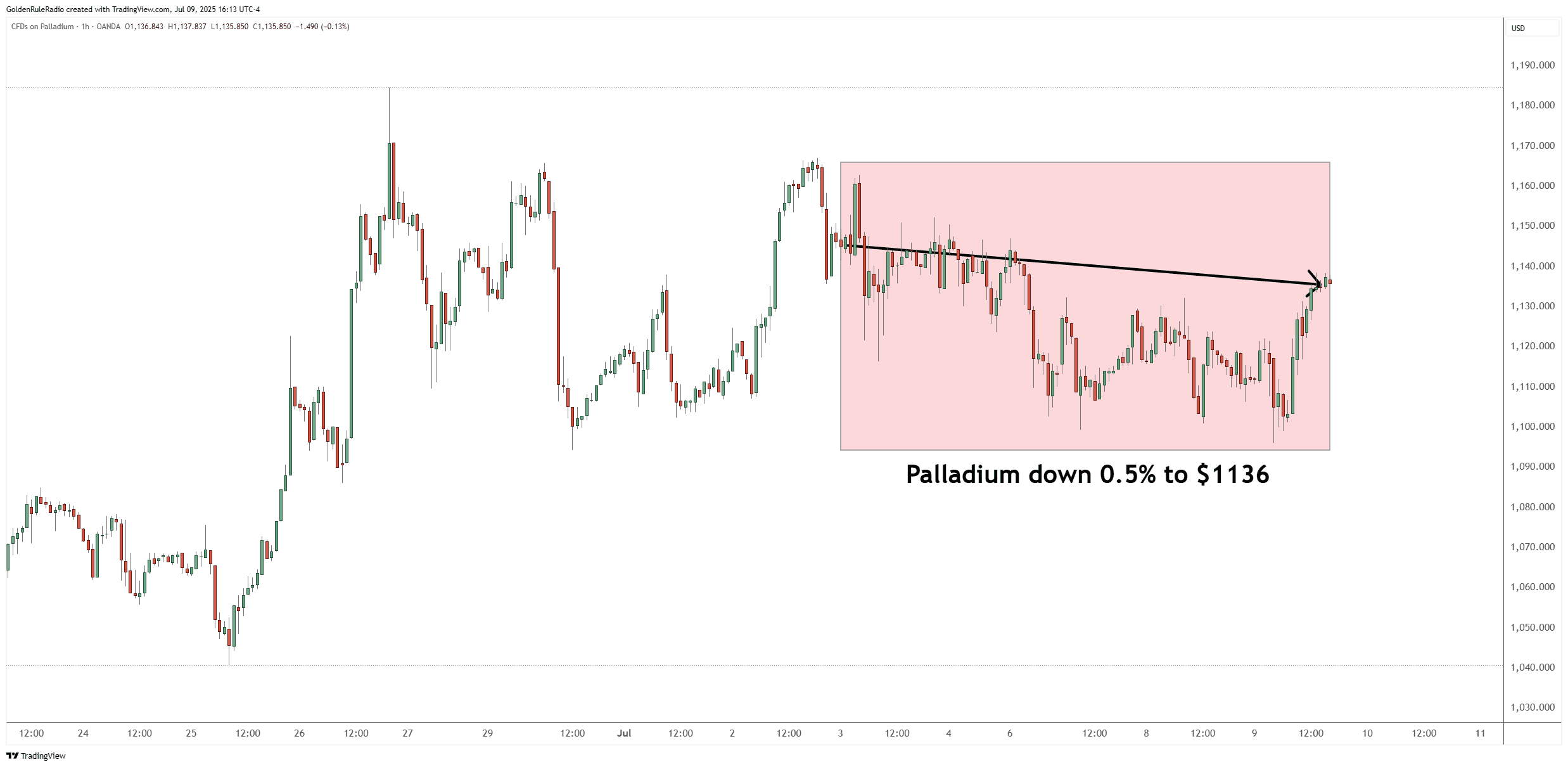

Let’s take a look at where precious metals stand as of Wednesday, July 9:

Gold held steady, down about 1% to $3,315 for the week, remaining in a broad trading range.

The price of silver is unchanged at $36.36, hovering near the upper end of its sideways channel.

Platinum is down 2.3% at $1,369. However, it is still up over 45% year-to-date. It currently sits 42% above its 200-day moving average—a sign of significant upward momentum.

Palladium saw slight dip, moving in tandem with platinum.

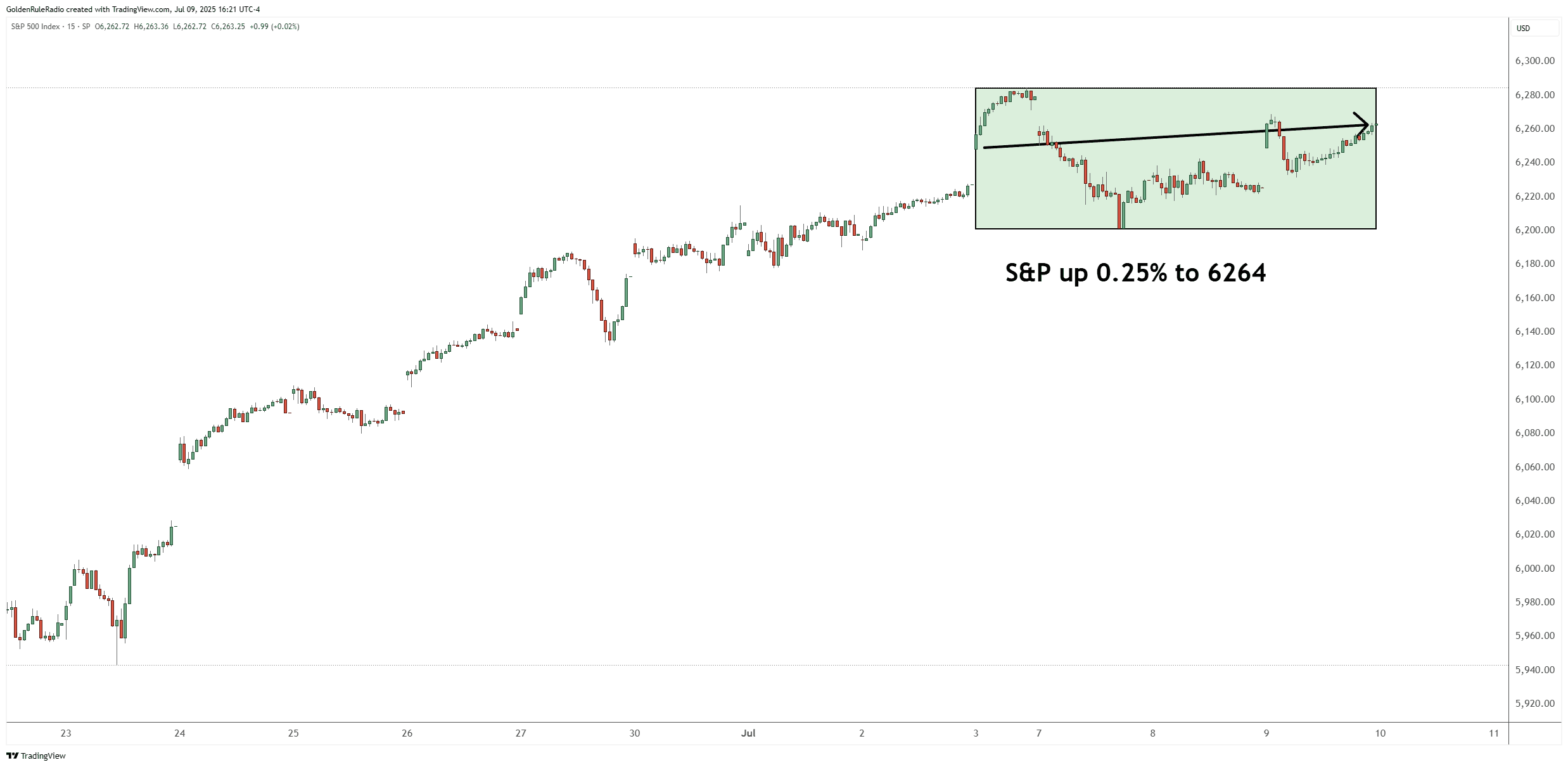

Moving over to the paper markets…

The S&P 500 is up 0.25% at 6,264 from the week prior.

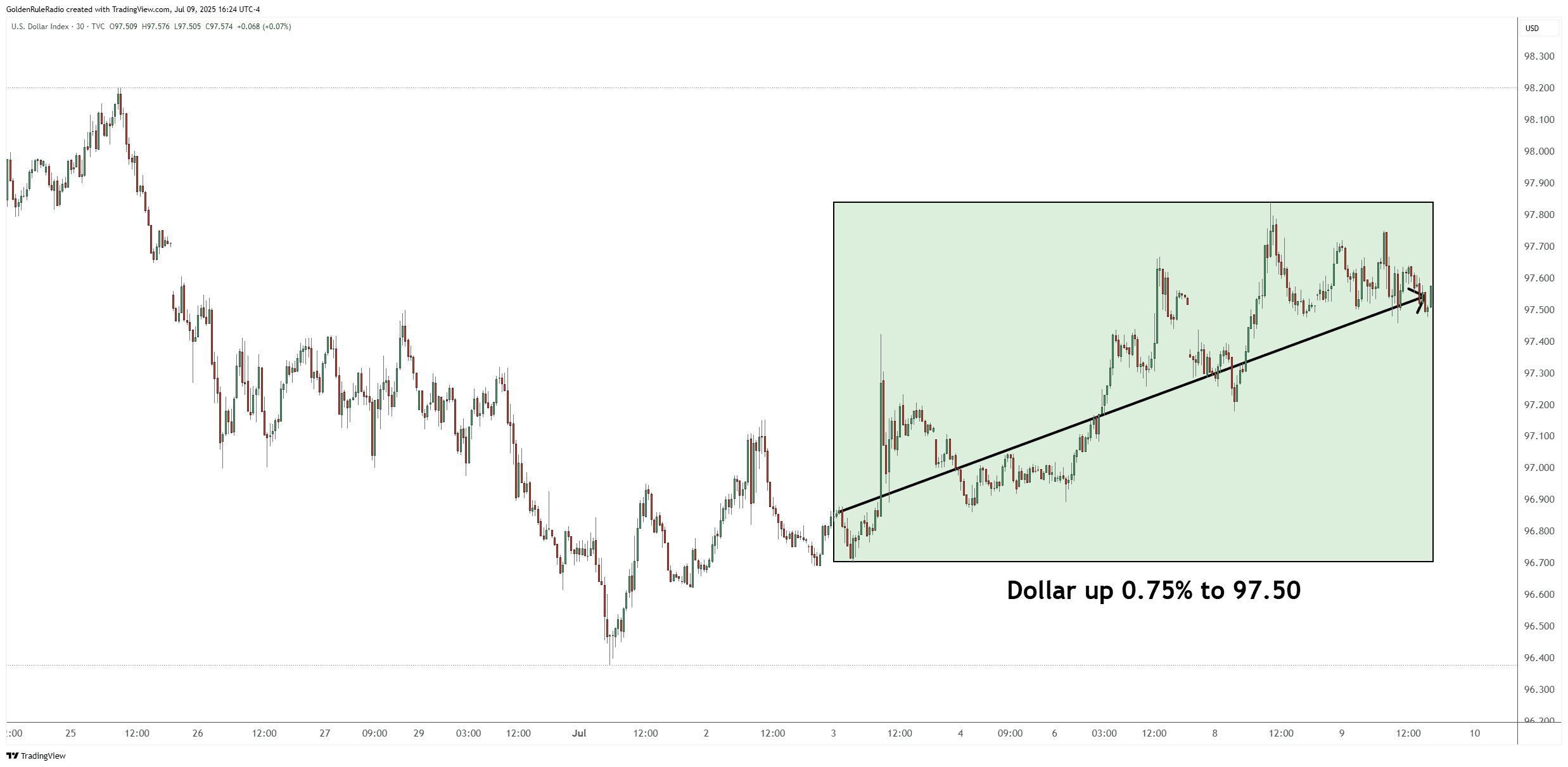

And the US dollar index is up 0.75% to 97.55. The dollar’s strength continues to show its classic inverse relationship with gold.

Dollar Trends and The Tariff Ripple Effect

The dollar’s story is a tale of two cycles. In the short-to-medium term, the dollar has been in a growth channel since 2011–2012. But zoom out to the 30–40 year “super cycle,” and the greenback is still in a broader downtrend. Technical indicators hint at a possible bounce, even as policymakers talk up the benefits of a weaker dollar for exports and employment.

Recent tariff chatter—specifically, a proposed 50% tariff on copper—sent copper prices soaring above $5.80 before settling back. For metals investors, these kinds of policy moves are worth watching. Not only do they create volatility in industrial metals like copper, but they can also serve as early signals for moves in silver and platinum. Still, these reactions may be short-lived, especially given the U.S.’s reliance on copper imports from key trade partners.

Metals Ratios: Opportunity in Volatility

The gold-silver ratio recently spiked above 100, a rare event that’s only happened three times in history. This mirrors the post-COVID surge to 120:1. We could see a potential move back to the low-to-mid 60s in the coming months, offering savvy investors a strong opportunity for ratio trades—swapping silver for gold to increase total gold ounces without new capital.

Platinum’s relative value also remains compelling, even after its significant run-up. Keeping a close eye on these ratios can be a powerful tool for maximizing portfolio growth, especially in markets where outright price appreciation is hard to come by.

Beware of Industry Scams

There are a number of troubling trends in the precious metals industry, especially around gold IRAs. Some clients have paid premiums north of 80% over spot, only to see their account values decimated. Bait-and-switch tactics abound: dealers may lure clients with standard products for a fraction of their trade, then steer the bulk of funds into high-premium, off-ounce, or so-called “semi-numismatic” coins.

Celebrity endorsements and “free” offers are another minefield. These often mask inflated pricing and poor value, preying on the unwary. Transparency remains a major issue, with many investors unclear about the true per-ounce cost or even the specifics of their holdings.

Always demand a written quote detailing product type, quantity, and per-ounce cost before committing.

Best Practices for Precious Metals Investors

You can protect yourself from precious metals scams by following the guiding principles that we share with our clients:

- Stick to U.S. Mint products for better liquidity and fairer pricing.

- Keep premiums reasonable—anything above 10–12% over spot should raise alarms.

- Avoid “semi-numismatic” and odd-ounce products, which often lack a robust secondary market.

- Work with trusted advisors who focus on maximizing ounces at the lowest cost, not just making a sale.

- Be skeptical of aggressive marketing, celebrity spokespeople, and “exclusive” offers—these are often signs of overpriced or illiquid products.

Book a Complimentary Consultation

Staying informed, asking the right questions, and maintaining discipline in your buying decisions are essential for success in the precious metals space. The market may not always move as quickly as we’d like, but with a thoughtful approach, you can navigate both the opportunities and the risks.

The McAlvany precious metals advisors are here to help you review your portfolio strategy and take advantage of market opportunities. Give us a call for your complimentary, no obligation consultation at 800-525-9556.