Podcast: Play in new window

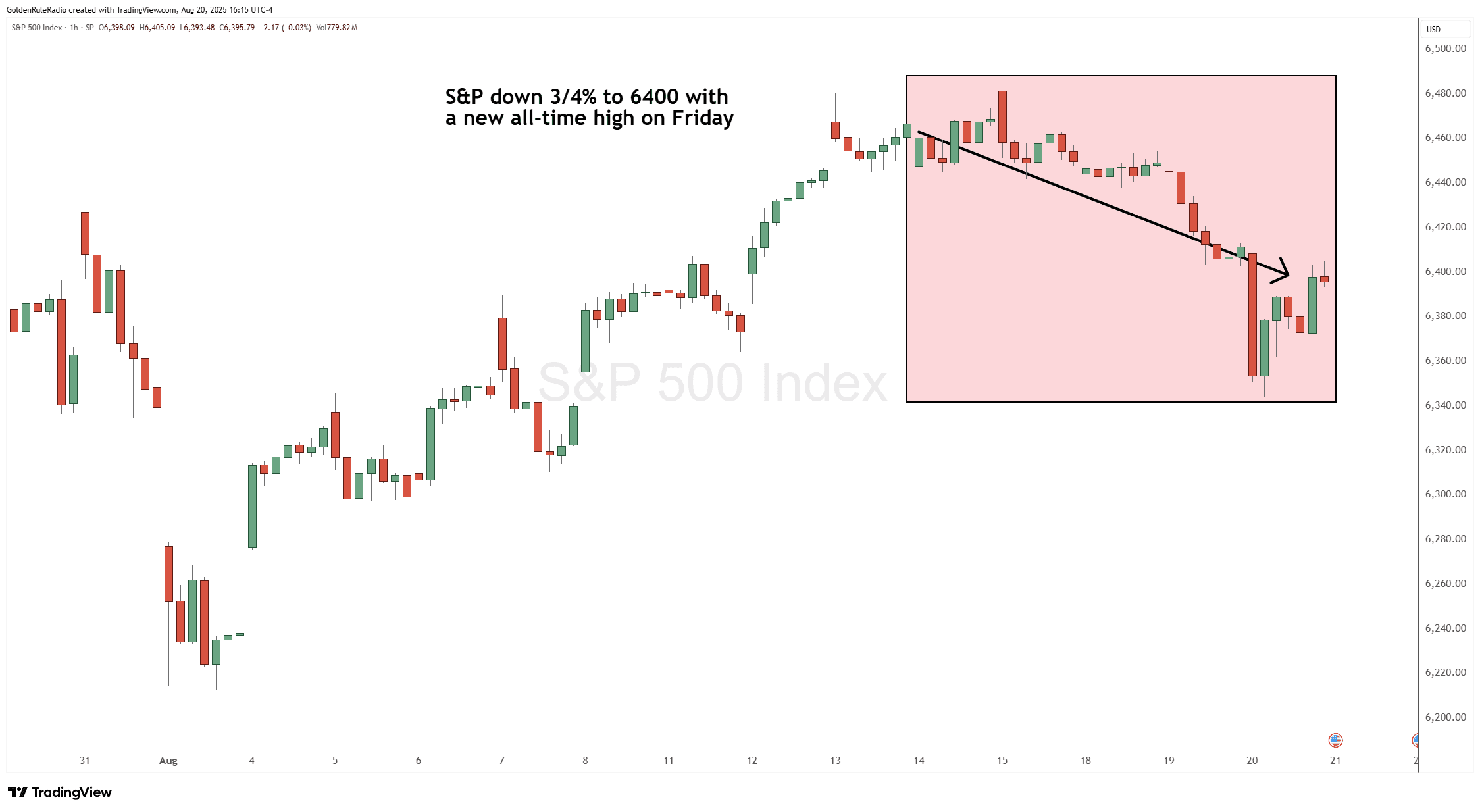

This week gold and silver see some small downwards movement following their recent gains. Platinum held steady, while palladium continued its declining slide. The S&P briefly reached a new all-time high before dropping down to 6,400.

Meanwhile, the focus shifts to Jackson Hole and what the next Fed meeting will unveil. Let’s take a look at where precious metals stand as of Wednesday, August 20:

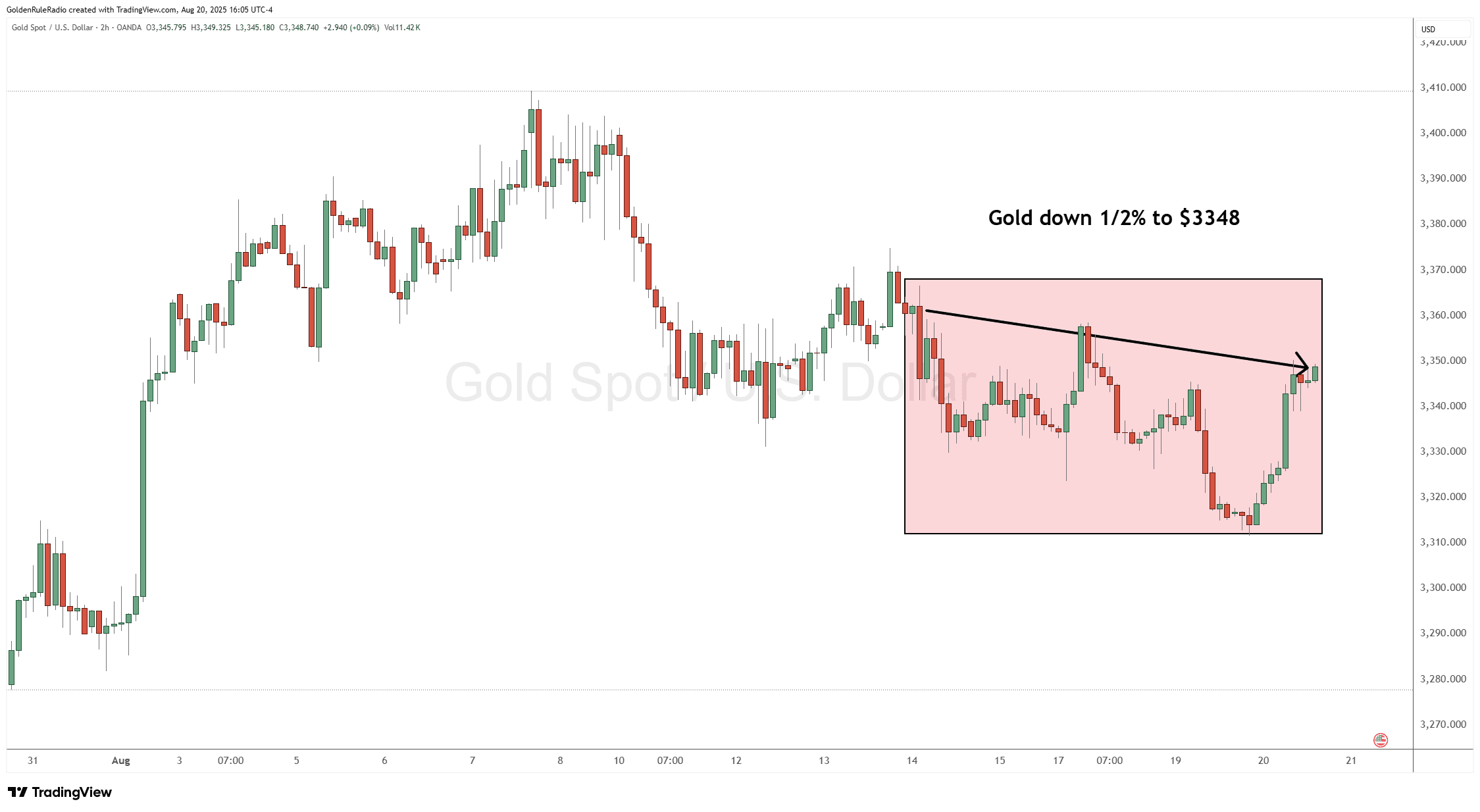

The price of gold is down 0.5% to $3,348, but it remains in its trading range.

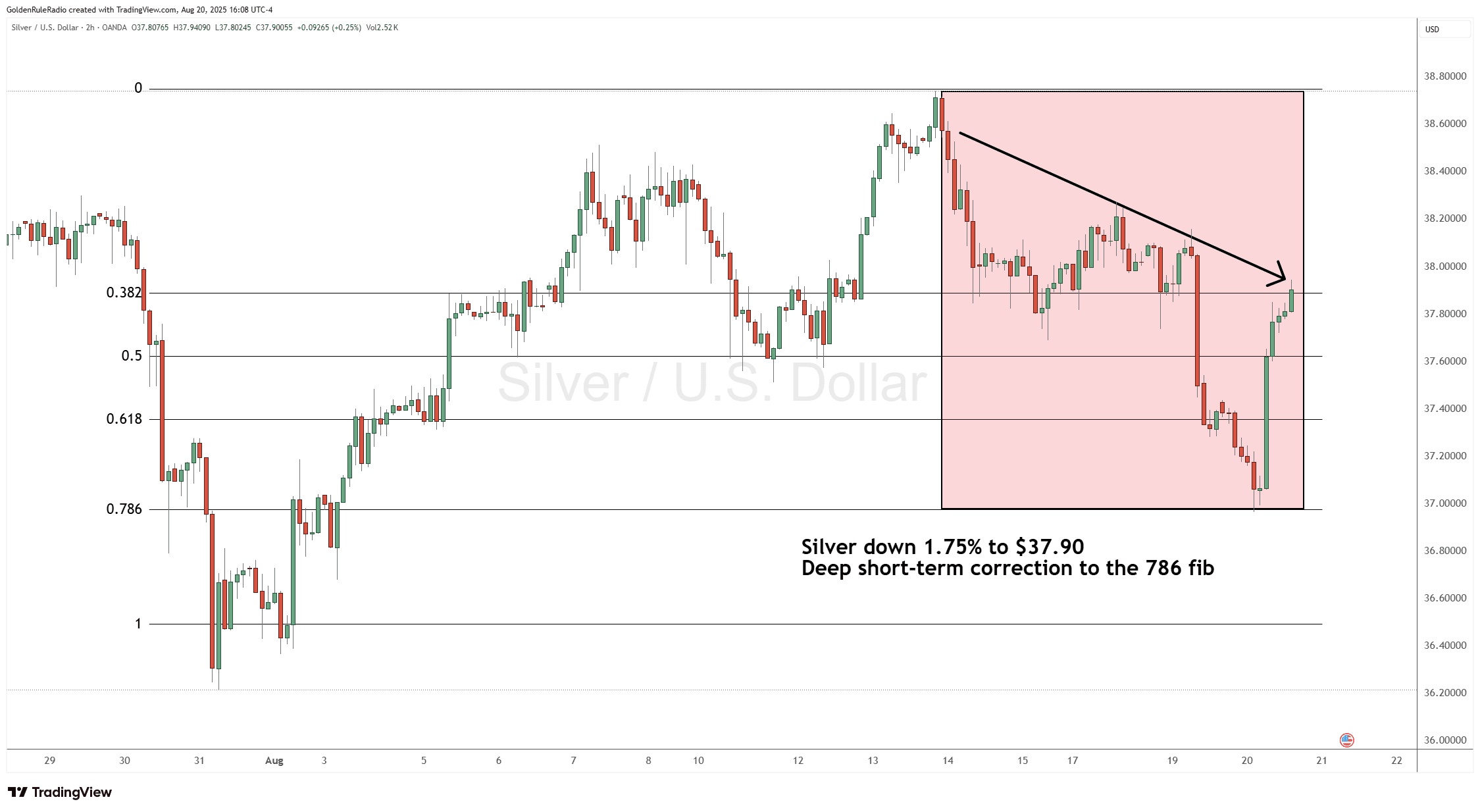

The price of silver is down 1.75% at $37.90. Silver started the week up higher, but it was still shy of $40.

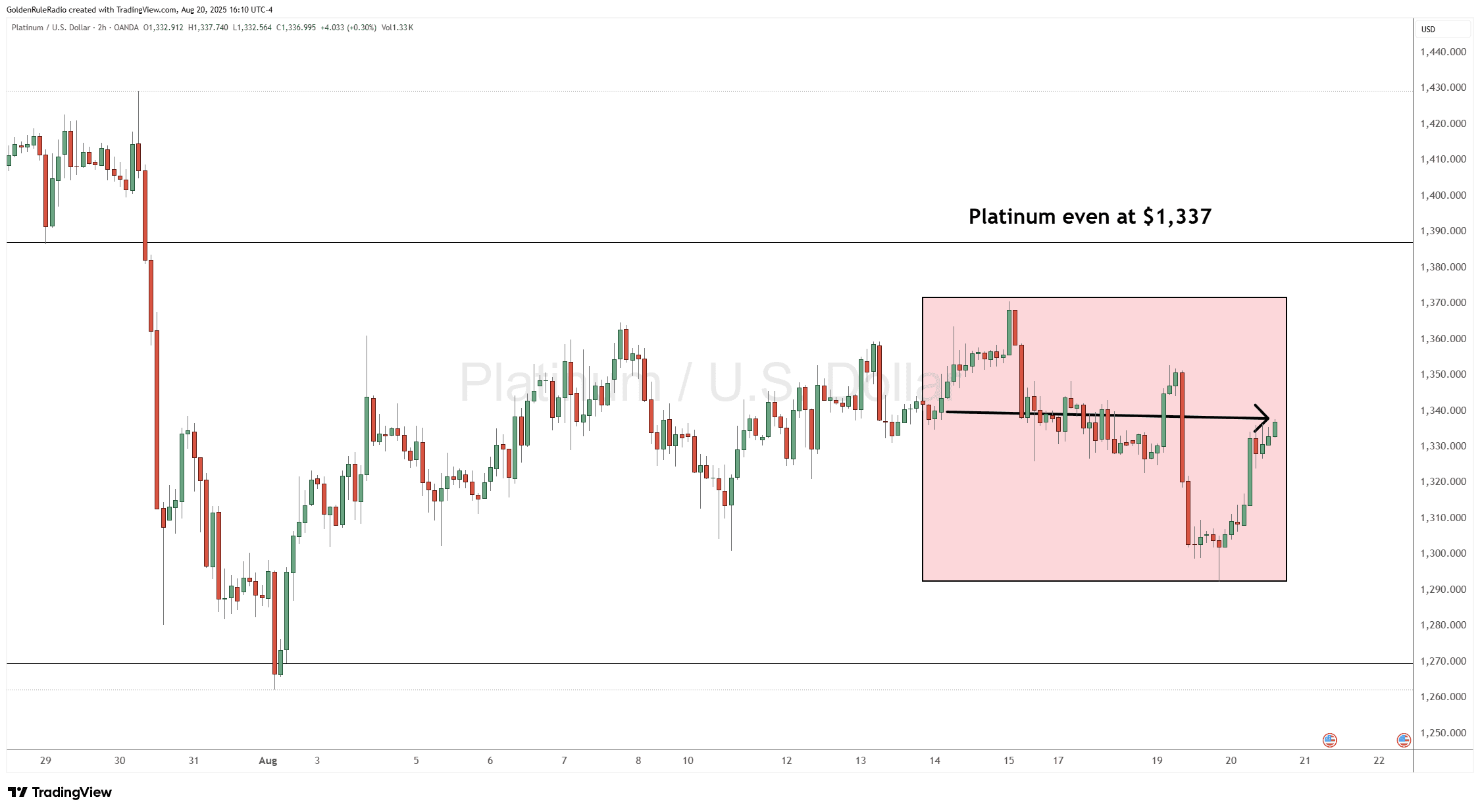

Platinum is flat at $1,337. It remains flat since it took that big decline right at the end of July.

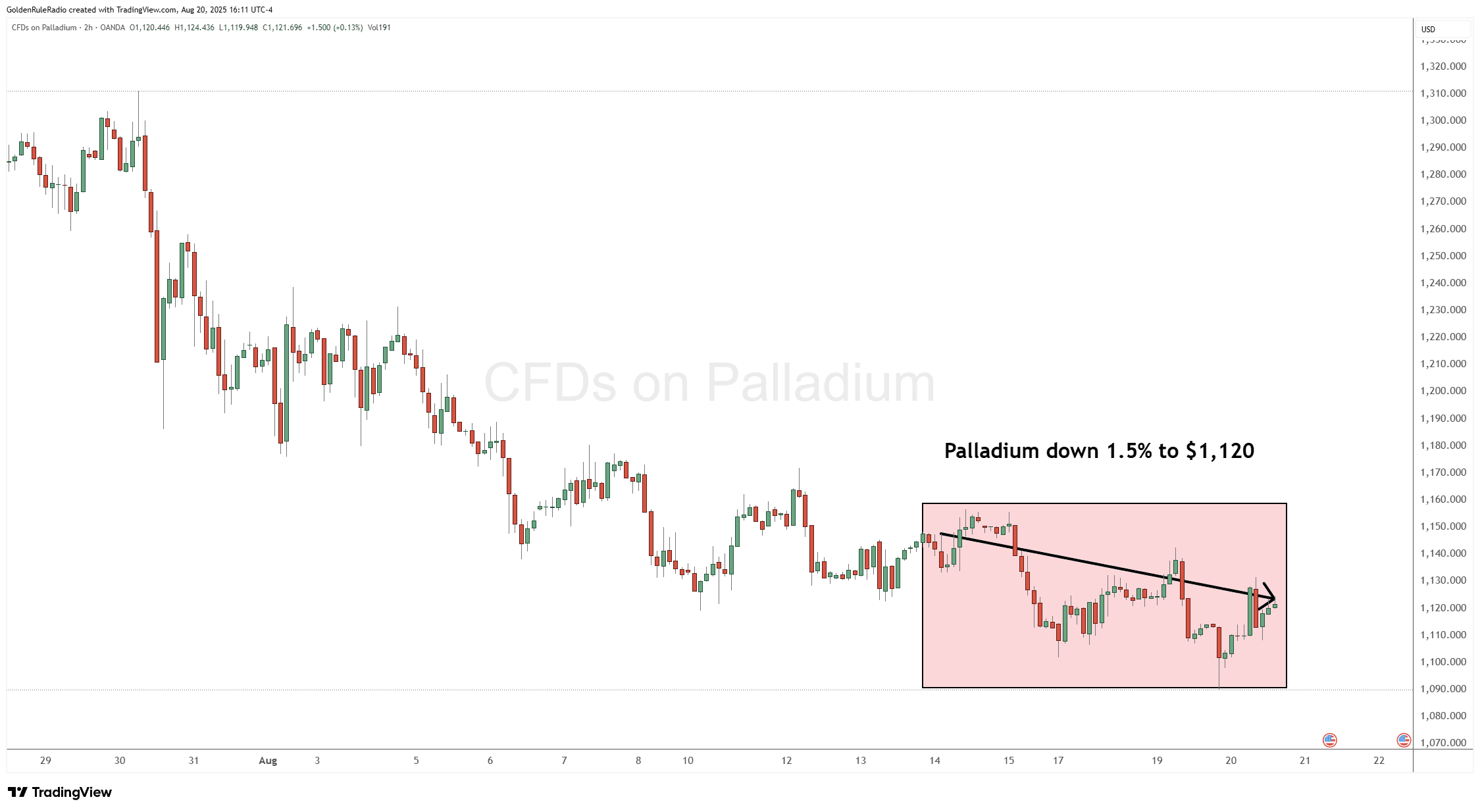

Palladium is down 1.5% at $1,120, declining slowly after a runup last month.

Looking at the paper markets…

The S&P 500 is down about 0.75% at 6,400. But on Friday, the index reached a new all-time high as it continues to climb to the top of its ladder.

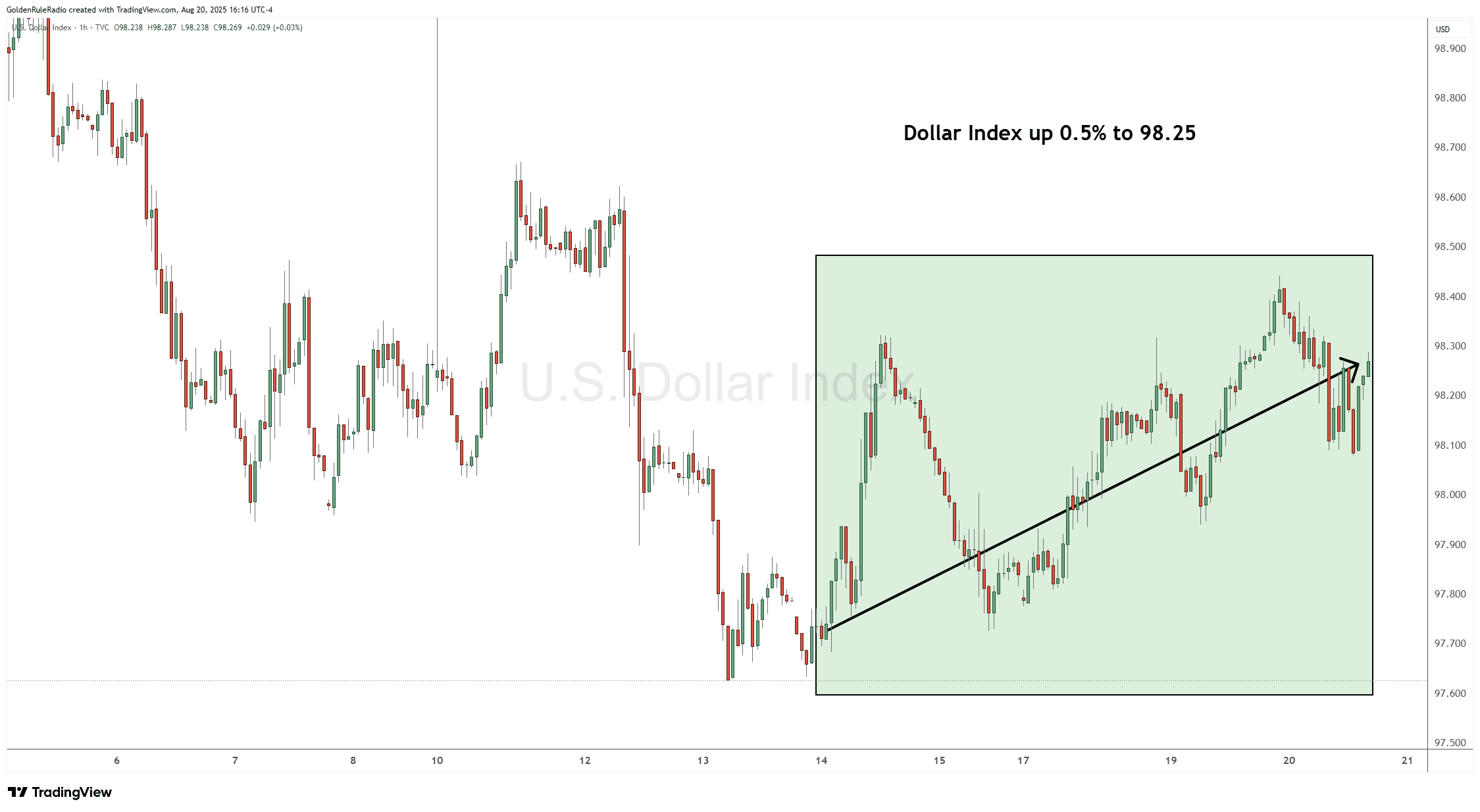

The US dollar index is up 0.5% at 98.25, inching its way back towards the fabled 100 number.

FOMC and the Interest Rate Debate

All eyes are on the Federal Reserve’s upcoming meetings, particularly the anticipated September 17th FOMC decision.

Chairman Powell is scheduled to speak Friday. Markets will be closely watching to see if he’s hawkish and thinks that the rates need to stay high, or if he’s dovish and thinks the rates could afford to come down. Market expectations are pricing in over a 90% chance of a 0.25% rate cut, though the Jackson Hole meeting this week will mostly serve as a signaling event, not a policy action.

The arguments for a cut include stimulating a weakening labor market, reducing government debt service (which is crucial as $37 trillion in US debt requires refinancing soon), and supporting the robust but possibly overheated stock market.

However, resurgent inflation is the counterargument—producer prices (PPI) surprised to the upside at 3.3% for July (vs. 2.5% expected), and monthly CPI inflation at 0.9% far exceeded the 0.2% forecast. These figures argue for holding off on cuts until inflation is surely subdued, reserving rate reductions as a response to an actual recession.

Expanding the Money Supply and the Dollar’s Dilemma

Government efforts to stimulate the economy—through lower rates, encouraging credit, and deficit spending—risk further debasing the dollar.

Looking at charts, the M2 money supply has been on a consistent upward trajectory along with gold, equities, and general inflation since the early 1970s. The more the government stimulates, the more it depreciates the dollar.

Inflation is fundamentally tied to money supply growth, not just rising prices. Increasing velocity of money (how quickly it circulates) is a key goal for policymakers but raises inflation risks further.

U.S. Debt Strategy: From Safe Haven to “Debt for Equity” Swap

A major structural shift is underway: the U.S. is moving from simply attracting foreign capital to its Treasury market to actively encouraging foreign direct investment (FDI) into factories, infrastructure, and manufacturing.

Recent measures mirror “state capitalism”—using incentives, government-backed loans, and even “debt for equity” deals (letting investors buy into productive assets instead of holding Treasuries), all in an effort to retain capital and spur re-industrialization.

The freezing of Russian assets after the Ukraine invasion catalyzed global mistrust in the absolute safety of U.S. Treasuries, driving diversification efforts by countries like the BRICS nations away from the dollar.

Preserve Purchasing Power with Gold

Gold is the only tried and true that you can count on to continue to offset the loss of purchasing power. Gold and precious metals investors know that accumulating gold over decades gives them a way to preserve their hard earned wealth.

Investors can sustain their lifestyle in retirement by converting just a few gold coins into dollars when they need them. Regardless of what happens to the dollar, gold is not affected by inflation.

Get In Touch

The team of advisors at McAlvany precious metals is here to help you review your portfolio strategy and take advantage of market opportunities. Give us a call for your complimentary, no obligation consultation at 800-525-9556.