Podcast: Play in new window

The markets are sitting with bated breath ahead of the inauguration of President Trump. However, precious metals continue to show strength. Let’s take a look at where prices stand as of this recording, January 15:

The price of gold is up 1.3%, sitting at around $2,695.

The price of silver is up 1.8% at $30.66. It is now comfortably above the $30 mark.

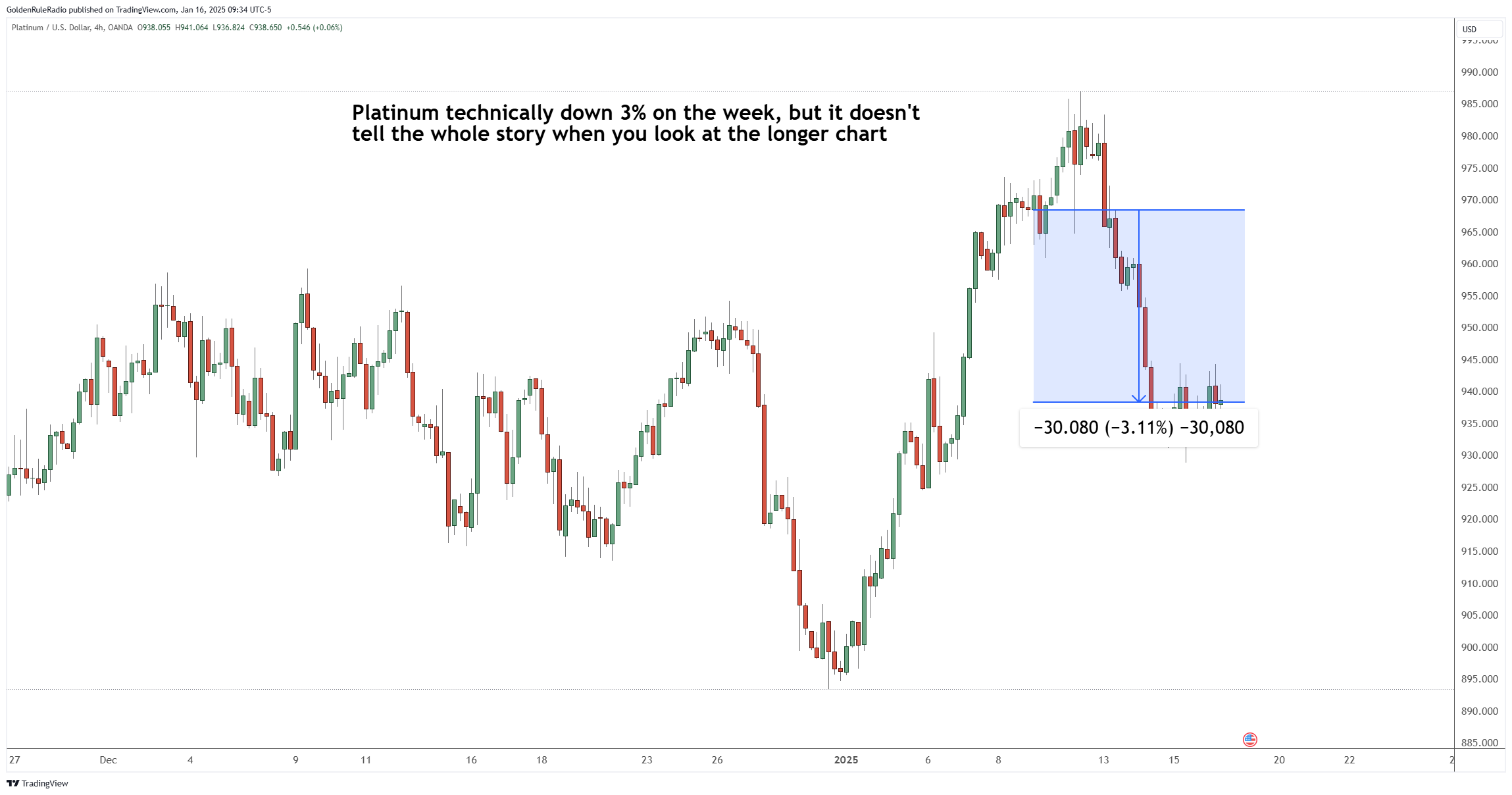

Platinum is down 3.3%, to $934. But in the middle of the week, it did hit a high that it hadn’t reached since November 2024. Platinum is stair-stepping up.

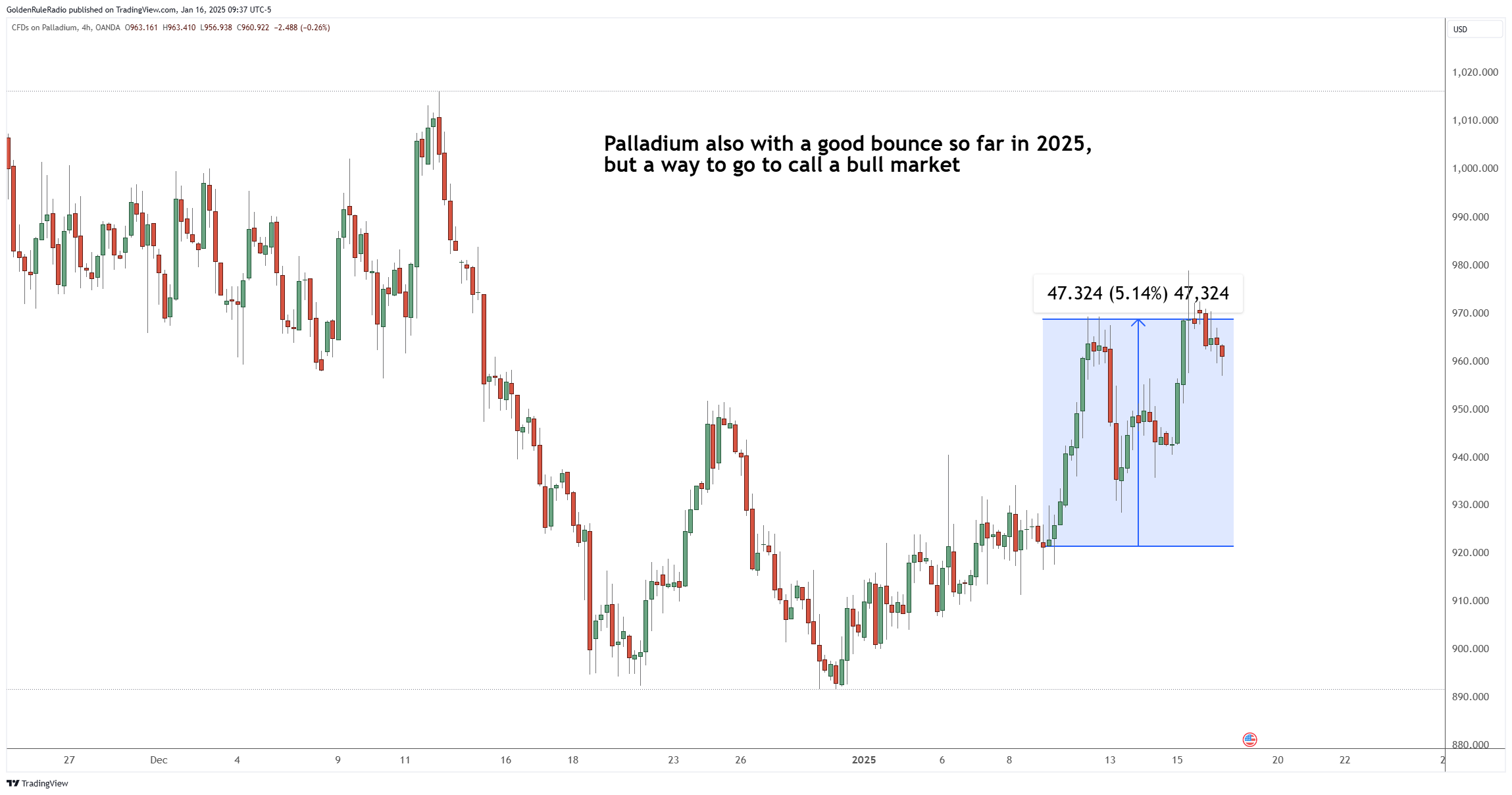

Palladium is up 5.2%, a big move up the day of recording. at $924, just slightly below platinum.

Looking at the broader market…

The S&P 500 is up about 1.1% this week to 5,954. It is on an upswing of a downward movement, as it has been stair-stepping down.

The US dollar is even this week, hovering around $109.20. But the dollar did have an intraweek high as it broke above $110.

If we could look into a crystal ball and predict the future, the outlook right now is one of great optimism

There’s a consistent pattern that we’re following according to our election market expectation show. The honeymoon is over, and the markets are settling back into reality — that is, back into the trends that they were in before the election.

Economic Watch

The CPI report for December indicated that inflation is still hot, rising up 2.9% over the year. The core CPI figure, tracking food and energy prices, rose 0.2%. The markets reacted with enthusiasm, hoping for an additional rate cut by the Fed. The DJIA, S&P 500, and NASDAQ rose up around 2% on the news.

Over the last few days, bond yields have been declining while prices continue to rise. Even though yields have declined, bonds appear to be in a holding pattern ahead of the inaugration.

Gold to $3,000?

For people holding gold, the fundamentals look good. We predict that we’ll be seeing gold peeking above $3,000 per ounce this spring.

Gold rising up to $3,000 per ounce in 2025 is a conservative estimate, because that would be a 10% gain at its current price. If you look back over the last 50 years, you will see that gold has been gaining an average of 8.5% – 10% per year.

Gold: Silver Ratio Trades

As for an upcoming ratio trade between gold and silver, it will depend on whether the ratio widens or narrows to a favorable ratio. The price of silver dipped below $30 a bit earlier in the week. However, silver has bounced back strongly above $30.

Silver still has a lot of upside potential, and it is undervalued right now. Industrial demand for silver continues to grow, especially with the development of new EV batteries that rely heavily on the white metal for their manufacturing.

There’s also the potential for internal ratio trades — such as trading silver bars for junk silver or silver American eagles. Sometimes, the premiums on one product are significantly lower than for another product, and a trade will give you more ounces without paying for them.

Get Started With Expert Advice

Will there be a new ratio-trading opportunity coming up this year for you? The best way to know what your ideal next trade would look like is to speak with your McAlvany financial advisor.

Our advisors have decades of experience investing in gold and other precious metals, and they can help you find the best strategy to meet your unique needs. They are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556.