Podcast: Play in new window

While the U.S. demand remains down, global demand for physical gold is surging. Russia and China are challenging the Western pricing dominance as they open their own precious metals exchange to begin swaying control of the metals. Let’s take a look at where precious metals stand as of Wednesday, August 6:

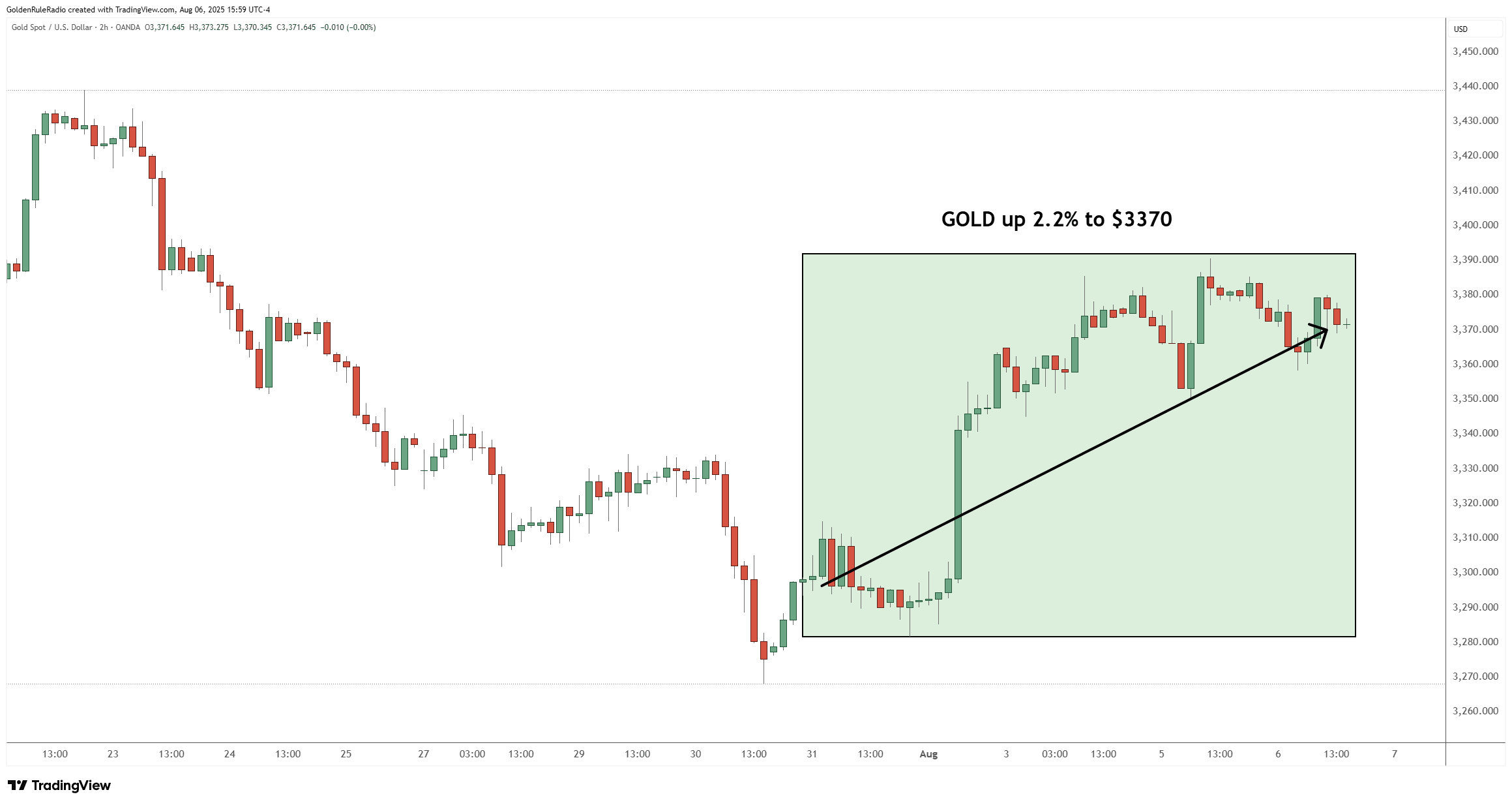

The price of gold is up about 2.2% at $3,370 per ounce.

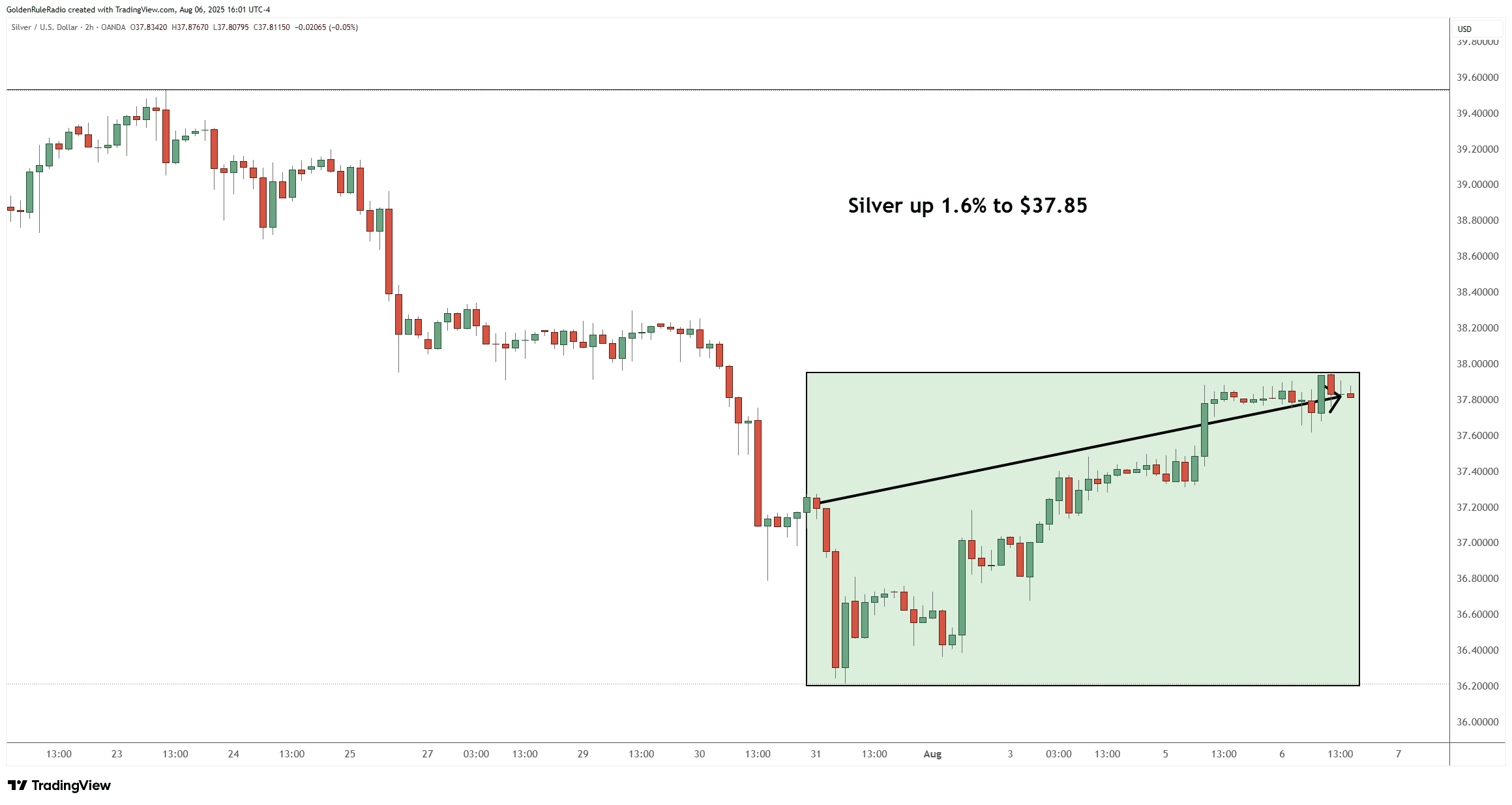

The price of silver is up 1.6% to $37.85 per ounce.

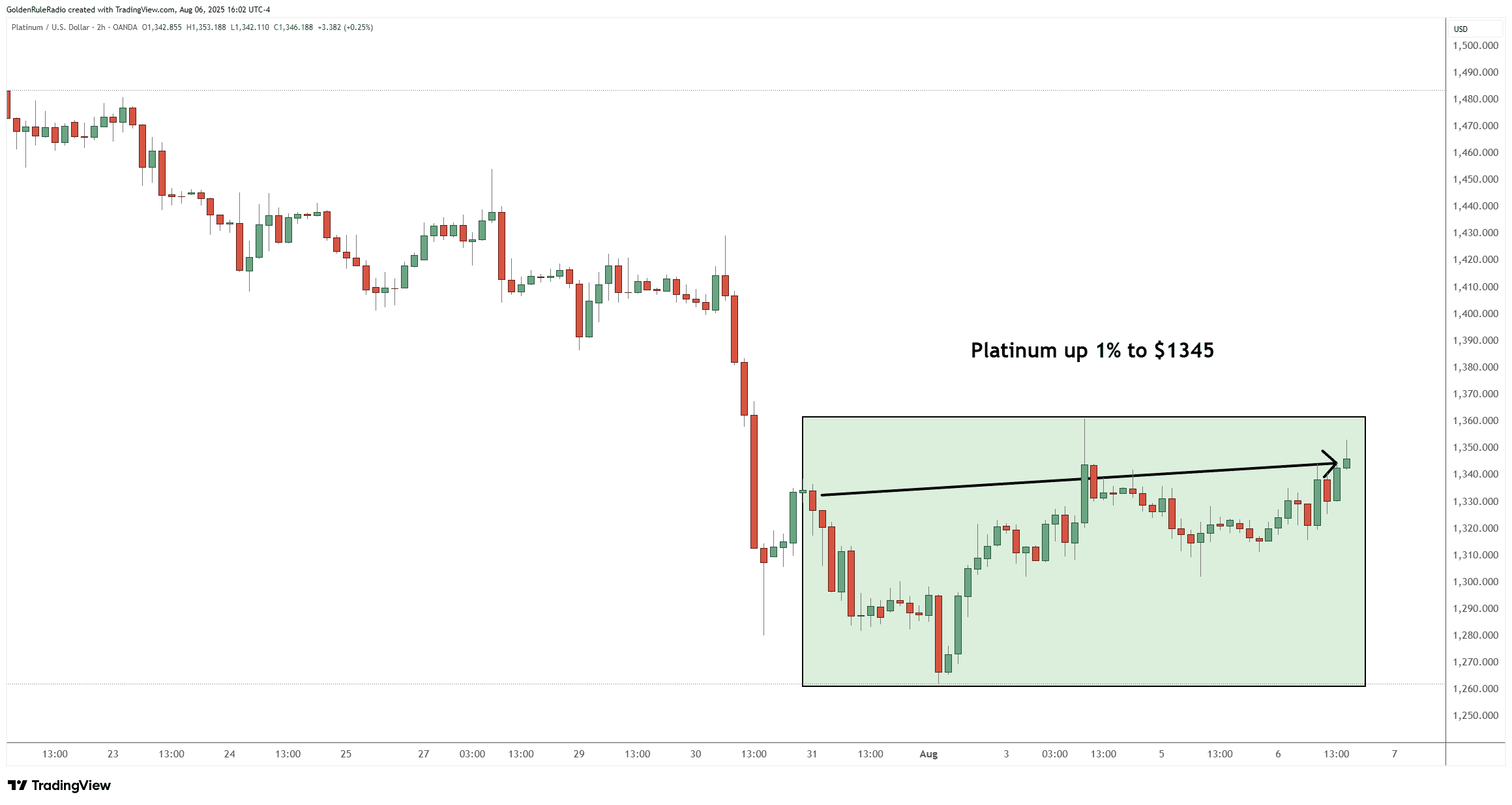

Platinum is also up about 1% at $1,345 per ounce.

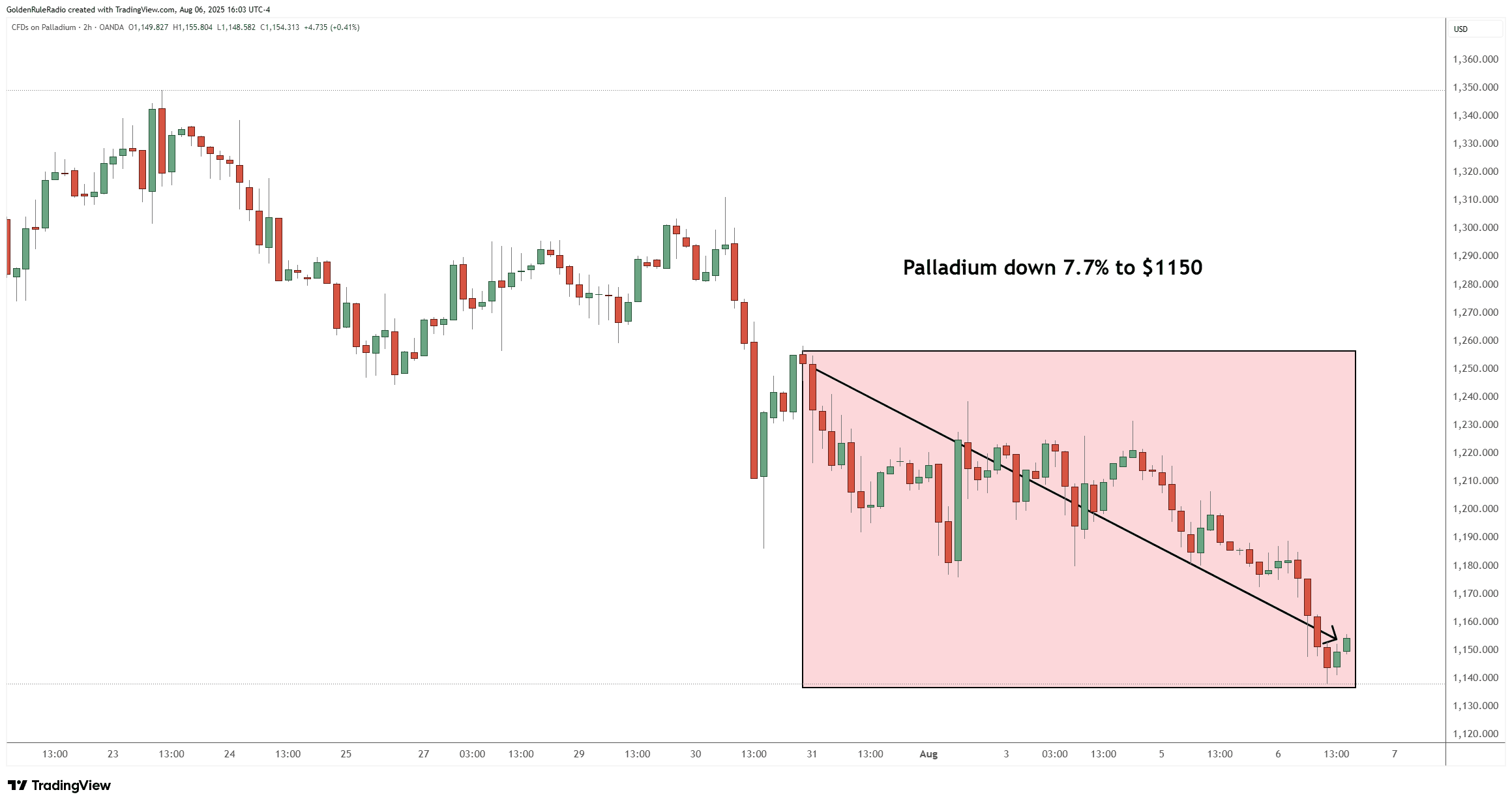

Meanwhile, Palladium is down 7.7% at $1,150.

Looking over at the paper markets…

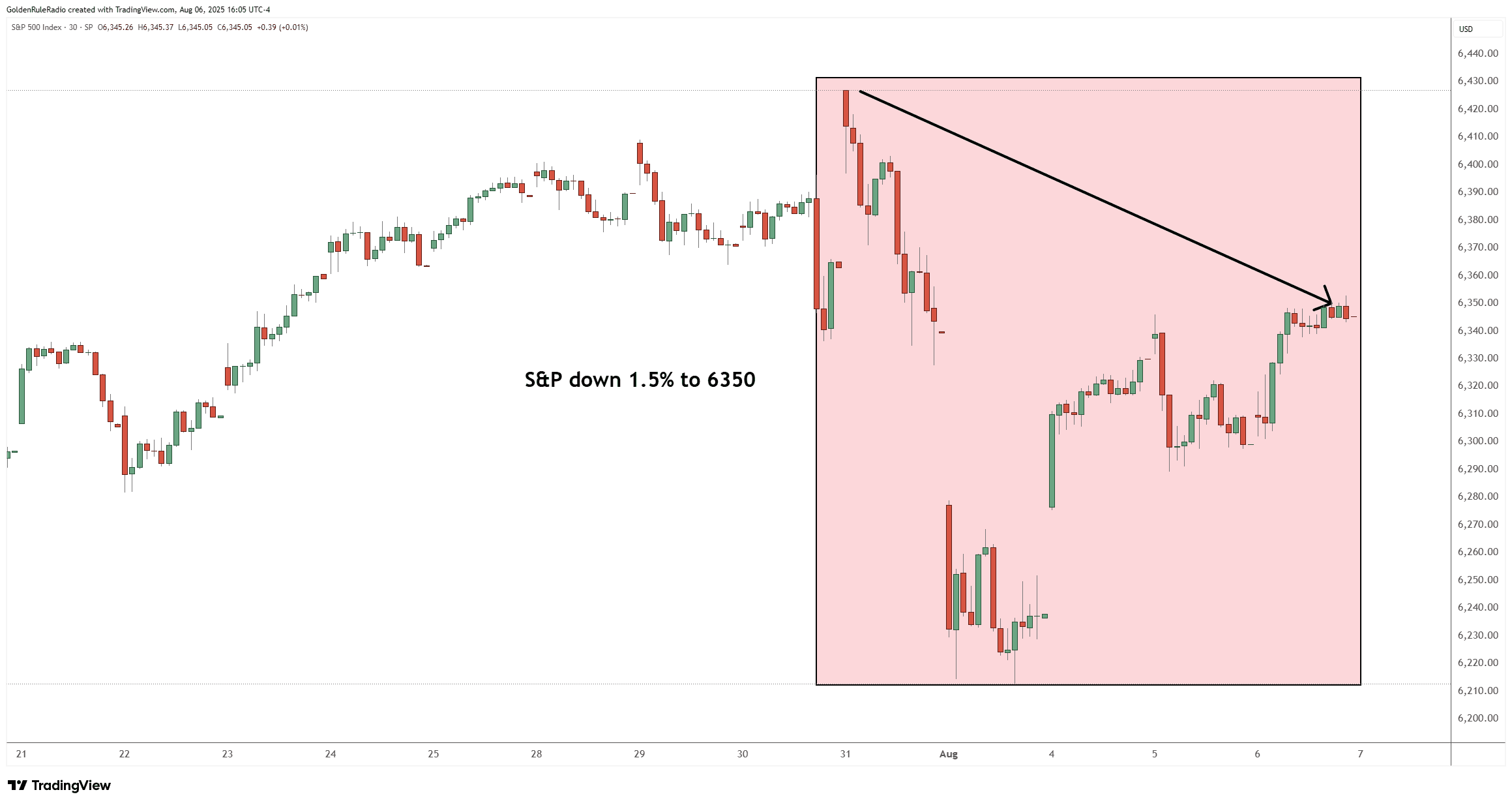

The S&P 500 is down 1.5% to 6,350. The index had a pretty wild swing, down at one point as much as 3.5% during the week, after putting in a relatively new higher high.

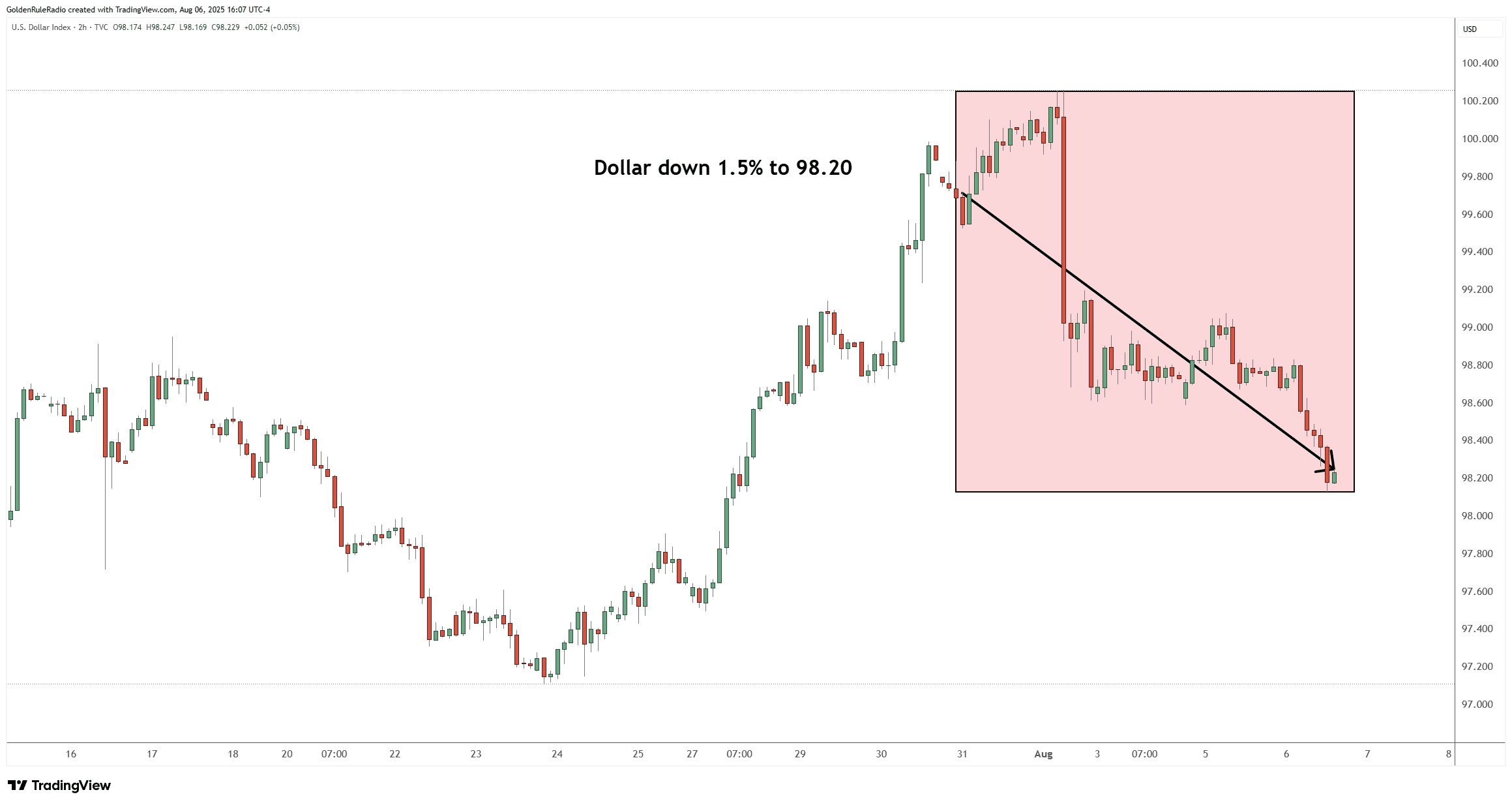

And the US dollar index is down 1.5% at 98.2.

Gold Remains Bullish Amid Mixed Signals

Despite recent technical weakness—such as a short-term break below a key flag pattern—gold continues to show resilience, climbing 2.2% last week alone and staying near historical highs.

This strength is particularly notable given the drop in US physical demand, which is down 37% year-to-date. Yet the US softness is more than offset by explosive international interest: gold demand has jumped 250% in Germany, 128% across Europe, 55% in the Middle East, and a staggering 91% in China.

The underlying message? Gold’s role as a global store of value is more robust than ever, and U.S. market softness should not distract from the strong international bid.

Miners Take the Lead—A Bullish Omen

Traditionally, gold equities follow the bullion price, but this year we’re seeing mining stocks and sector ETFs move ahead of the metal itself.

Mining giants such as Newmont, Kinross, Barrick Gold, and Agnico have notched record or multi-year highs. Excitement isn’t limited to the majors—mid-tier and junior miners like El Dorado have posted multi-hundred-percent gains from their 2022 lows.

When miners take the lead, it’s often a preview of renewed strength in spot gold, making this leadership a bullish indicator for the metal and the sector at large.

Commitment of Traders (COT) Data: Bulls Well in Control

A quick glance at the COT reports tells the story: speculative long positions on gold are outpacing shorts by about five to one (330,000 contracts long vs. 78,000 short). Silver’s ratio stands at three to one.

While these ratios aren’t as fevered as earlier this year, they remain decisively bullish—indicating broad market consensus for higher prices. When paired with strong mining equities, this firmly tilts the odds toward further gains in both gold and silver.

Macro Tailwinds: Interest Rates, Employment, and Dollar Risks

Recent labor market weakness and substantial negative revisions to employment data have revived hopes for a Federal Reserve rate cut as soon as September—a factor that juiced both precious metals and stock prices last week.

With gold rising $120/oz in just seven days, it’s clear that falling rates remain a powerful driver for safe-haven assets. As central banks weigh inflation against economic weakness, the runway for metals remains open.

Geopolitics and “De-Dollarization”

Russia’s impending launch of a domestic precious metals exchange (poised to challenge the traditional London-New York duopoly) and joint action with China’s Shanghai Exchange are ushering in a new era. These initiatives reflect an accelerating move away from dollar-based financial systems and a deliberate recycling of foreign reserves into tangible bullion—especially gold and now increasingly silver.

With Russia and South Africa controlling most of the world’s platinum and palladium, fresh international exchanges could further roil the metals markets and support higher prices.

Positioning Your Portfolio: Actionable Insights

- Look Beyond Price, Focus on Market Structure: The synchronized strength among mining shares and bullish COT positioning suggest the rally is on solid footing. Don’t let short-term volatility derail your accumulation plan.

- Think Globally: Record demand in Europe, Asia, and the Middle East point to enduring support, even if US buyers remain cautious. This international strength should provide US investors with added conviction.

- Prioritize Physical Metals: Building a core portfolio allocation in physical gold and silver remains the most reliable way to harness precious metals’ hedging power against inflation, currency risk, and market volatility.

- Diversify with White Metals: Platinum and palladium are volatile but may offer high-reward potential, especially as supply disruptions and new exchanges affect pricing.

- Gold’s Enduring Value: As it now takes only 129–130 ounces of gold to buy the average US home—a dramatic drop from the 200–300 ounces required decades ago—gold continues to hold its own against the rising cost of living.

Get In Touch

The team of advisors at McAlvany precious metals is here to help you review your portfolio strategy and take advantage of market opportunities. Give us a call for your complimentary, no obligation consultation at 800-525-9556.