Podcast: Play in new window

Despite the recent pullback, our team explains why this may simply be a pause in a long-term bull market, not a breakdown. We discuss how the Fed’s mixed messaging is impacting precious metals, why ETFs in both the East and West are adding gold exposure, and what the broader economic and geopolitical backdrop means for gold’s next move.

Let’s take a look at where prices stand as of Wednesday, October 29:

The price of gold is down 3.5% to $3,930 as of this recording.

The price of silver is down 1.7% sitting at $47.70.

Platinum is dead even currently sitting around $1,567 from a week earlier. The white metal was volatile intraweek but ended up near where we left it last Wednesday.

Palladium is down 4% sitting at $1,409 over the last week. This was the big loser over the week.

Meanwhile, looking at the paper markets…

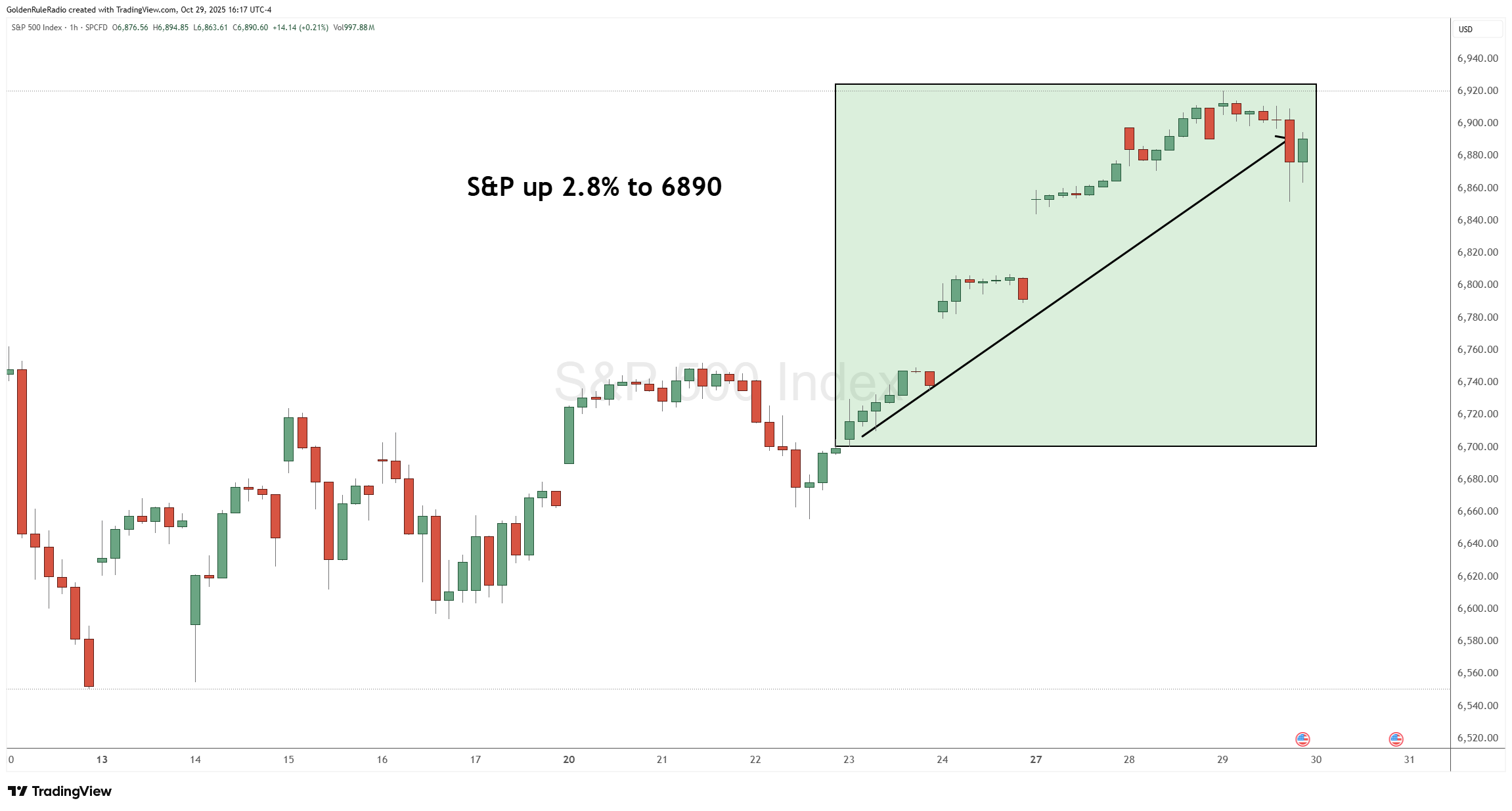

The S&P 500 is up 2.8% to 6,890. Intraweek, the index rose up to a new high.

And the US Dollar index is up 0.4% at 99.50. The dollar rose up on the news of the Fed rate cut.

What Spot Prices are Telling Us

Gold recently experienced a notable pullback to $3,930 after peaking above $4,400 in the last two weeks. Silver, slightly less volatile but also correcting, dropped to $47.70, down from a high over $54. These corrections brought gold and silver back by 11-16% from their recent peaks, which may indicate potential oversold conditions in the short term.

Market technicals such as moving averages, Fibonacci retracements, and momentum indicators like RSI suggest gold and silver are in a typical pause or base-building phase after a strong run-up rather than a full correction. This implies that a bottom may be forming soon—rather than being on the edge of a crash.

If you’re watching the technicals, you’ll see gold is trading just below some key levels—moving averages and Fibonacci retracements—that often act as support. Silver’s bouncing between similar important markers too.

The Fed’s Mixed Messages

The Federal Reserve recently gave the markets a 25 basis point rate cut but tempered expectations for more ease next year. The message? Inflation’s still lurking around 3%, above the Fed’s comfort zone, so don’t count on easy money just yet.

This tug-of-war inside the Fed, along with ongoing inflation and government debt concerns, means precious metals still have a strong reason to shine. These dynamics create uncertainty in the broader economy, making gold and silver attractive safe havens and inflation hedges.

Geopolitical Factors Impacting Gold

Tensions abroad continue to underline the value of precious metals. Whether it’s troop movements in the Middle East, the strategic game between the U.S. and China, or trade war uncertainties, these factors keep markets on edge.

Meanwhile, big money from Chinese and Western ETFs is still piling into metals, signaling confidence from serious players who aren’t just chasing momentum but are investing for the long haul. This shift hints at a foundational strength under the market, giving us all more confidence.

Navigating Choppy Markets

The smart play? Stick with a steady, disciplined approach. Dollar-cost averaging — buying a little bit regularly rather than chasing tops or bottoms — remains king.

Whether you add gold to an IRA or hold it yourself, patience through these ups and downs pays off. Some investors can also strategically use parts of their holding to generate income without selling everything, a smart way to let your metals work for you. Precious metals are about preserving and growing your purchasing power over the long haul, especially when inflation and uncertainty persist.

While it feels like the market is bouncing around, the correction in gold and silver is a normal part of a healthy uptrend. Between what the charts show, the Fed’s cautious moves, rising geopolitical risks, and steady institutional buying, metals are positioned strongly for the future.

How to Invest Now

Whether you’re already invested or thinking about getting in, this pause is not a signal to sell but a time to consider steady accumulation and focus on your longer-term goals.

The team at McAlvany Precious Metals is happy to discuss your personal objectives on a no-obligation, complimentary portfolio review. We can help you find opportunities for growing your portfolio as well as adding ounces through strategic ratio trades. Reach out to us at 800-525-9556.