Podcast: Play in new window

Gold reached a new all-time high, finally hitting $3,500 as predicted. Silver gained ground, recovering from recent losses, while other metals remained flat. Let’s take a look at where the prices of precious metals stand as of Wednesday, April 23:

The price of gold is up around 2% as of this recording. Intraweek, gold rose up 8% to touch $3,500, and had a 17% total increase since April 8.

The price of silver is up 4.09% to $33.60, recovering most of what it lost following the post-tariff dropoff.

The price of platinum is up 1% to $964 as of recording — that’s mostly flat week over week.

The price of palladium is down 3% to $934, a little bit of a switch from the one-to-one race that it has been in with platinum.

Moving over to the paper markets…

The S&P 500 is up only 0.7% to 5,371, moving sideways week over week.

The dollar index is flat around $100 as of recording this week. This is after it was down about 2% intraweek, which is a significant drop.

Seasonal Moves in Gold

It is well known among precious metals experts that gold is more popular in certain seasons — and spring is one of them. So it’s no surprise that the price of gold is on the rise this month.

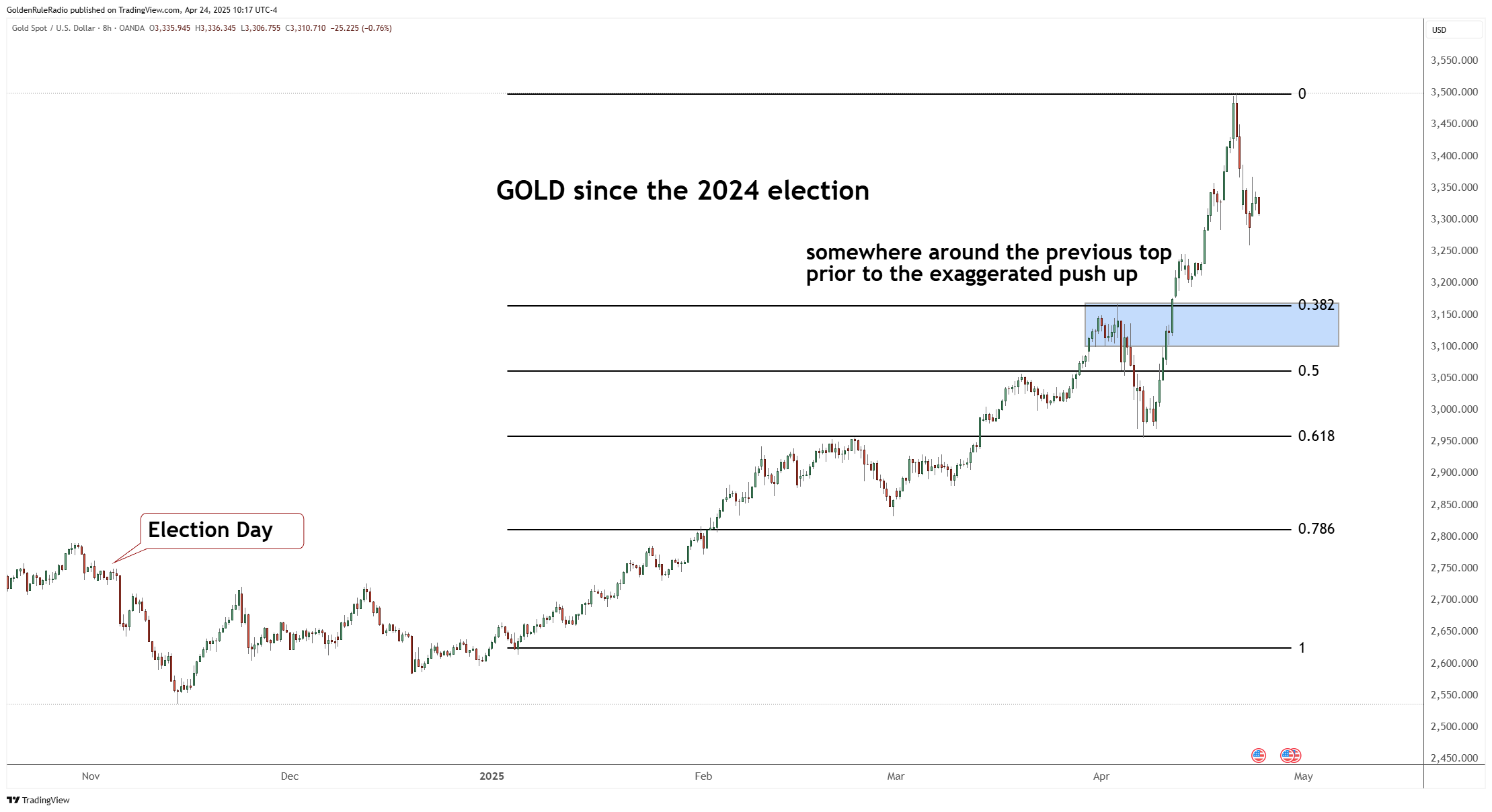

But what’s unusual is the rapid, short-term rise that we’ve seen in the price of gold. Since the 2024 election, the price of gold has shot up $1,000. And since it hit a bottom at $1,625 in November 2022, it has more than doubled its price in just 2.5 years.

Looking forward, summer is usually a time when gold will pull back a bit. Since gold had such a strong run up this spring, we suspect that there will be a small retracement in the near future.

The first pullback we might see would be somewhere around the previous top of $3,150 prior to the exaggerated push up.

And then the secondary pull back could be more along the 6 18 short term fib that lines up with other levels as well as being resistance and support — which is right around $2,940. Those are two really good stair steps.

Ratio Trade Opportunity

Because gold had that brief melt up, it drove up the gold to silver ratio to 105 to one. This is just one of three times in our lifetimes that we’ve seen the ratio pop over 100. The first one was in the early 1990s and the second time was during the 2020 pandemic.

This brief pop up was a great opportunity to move some gold into silver if you were able to take advantage of it in time.

But don’t feel like you missed out on trading some gold for silver on this brief high. Any gold to silver ratio number that’s in the high nineties is still favoring silver, and there’s a good chance that could happen again in the near term.

Get Started Today

Now is a great time to discover how precious metals can support your investment goals. One of our McAlvany financial advisors will happily speak with you about your personal objectives and show you how to start adding ounces to your portfolio. Just give the team a call at (800) 525-9556 to get a complimentary portfolio review.