Podcast: Play in new window

The precious metals market is relatively unchanged over the past week. Let’s take a look at our weekly recap of the precious metals markets for August 28. As of this recording, here is where precious metals stand:

The price of gold is flat at around $2,508, after rising and falling about $30 intra-week.

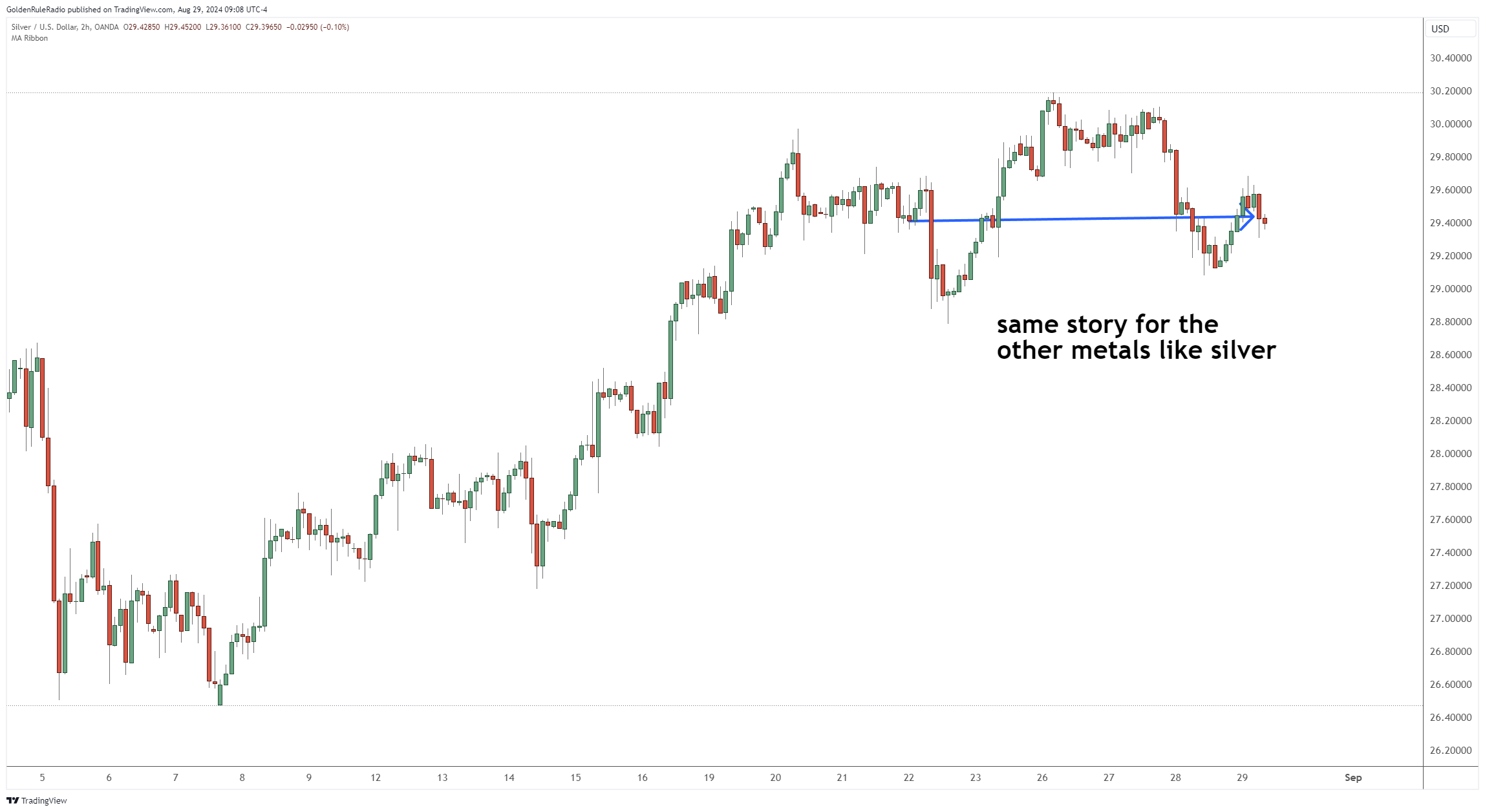

The price of silver is down 11 cents at $29.49 from a week earlier.

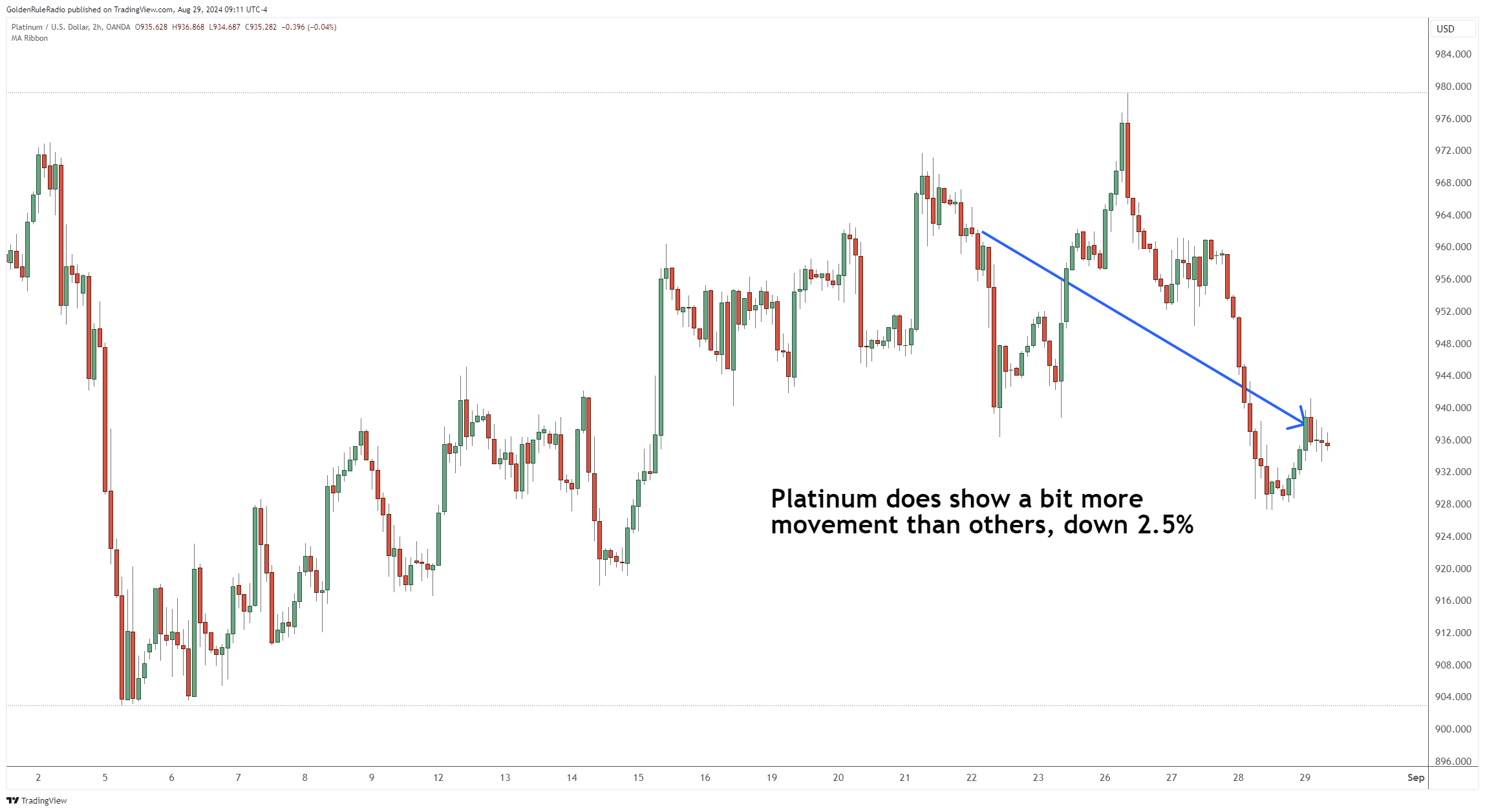

Platinum is about 2% lower to around $938 from the previous week.

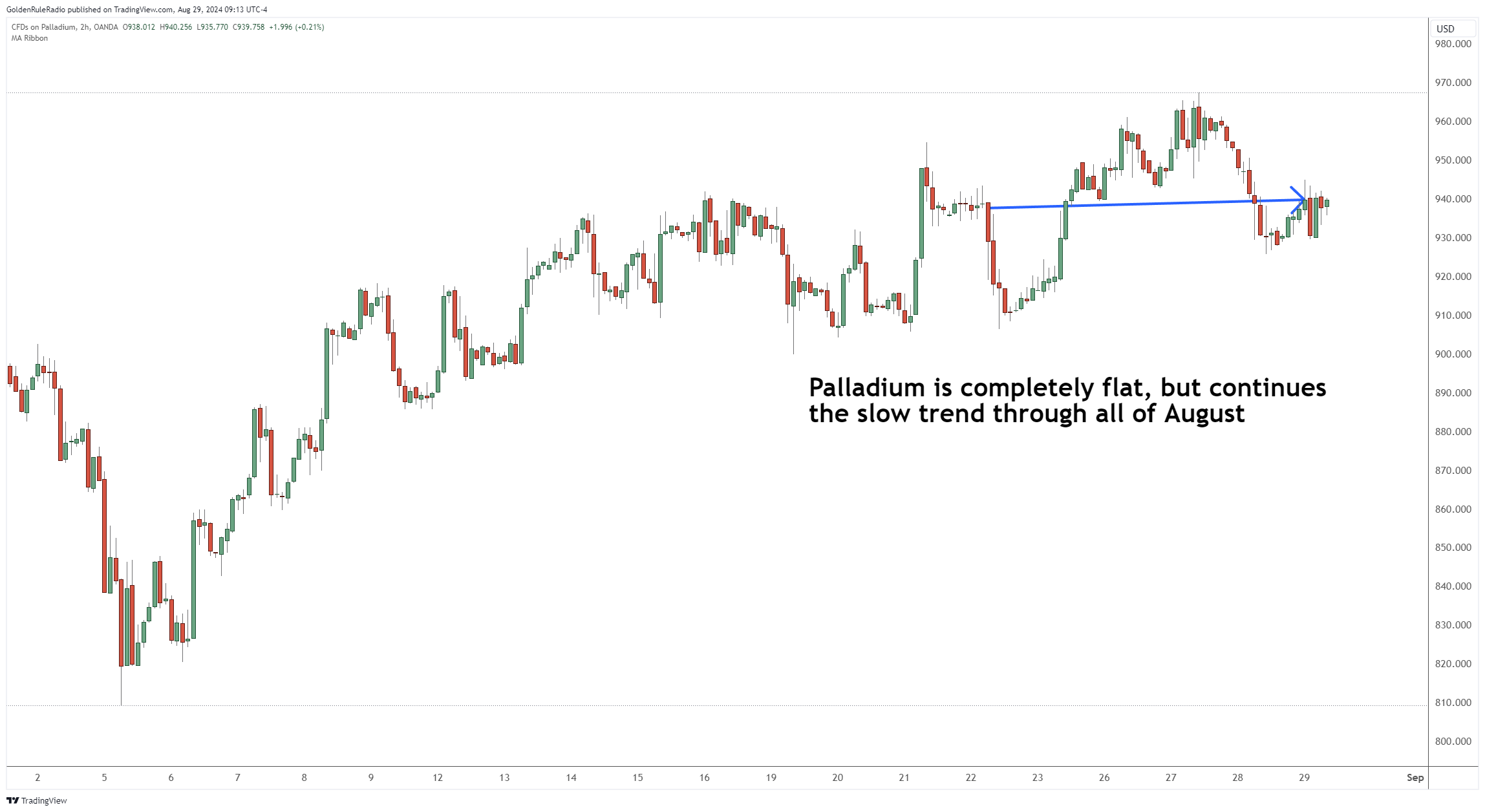

Palladium is completely flat at $936 from a week earlier, but it continues its slow trend through August.

The S&P 500 is also flat, down around 21 points to around 5,600, looking like it’s waiting for something to happen.

The US Dollar is also flat at around $101.20, but it had some good trading indicators intra-week.

The SAHM Rule of Recession

In macroeconomics, the SAHM rule of recession states that when the three-month moving average of the national unemployment rate is up by 0.5% or more compared to its low over the prior 12 months, the economy is in the early stages of a recession.

Looking at the revised employment numbers and Fed Chairman Jerome Powell’s dovish comments at the recent Jackson Hole conference, the recession is indeed here.

The Bureau of Labor Statistics tends to “cook” the labor numbers. If you want to understand the implications of the true statistics, the US debt clock reveals more in-depth data of how the US economy is actually performing.

Weak Dollar Policy

Expectations of a September rate cut could prop up the US economy. However, it also means that the US will have a weak dollar policy.

What will it mean for gold? It’s possible that the price of gold will drop while the US dollar will rise higher right after an interest rate cut.

Even if the price of gold goes temporarily lower, it would mean a buying opportunity to add more ounces of gold to your portfolio. With the uncertainty around the elections and other geopolitical forces, we expect the gold price to continue its climb and break through to new highs.

Plan Your Next Gold Buy

If the gold price does indeed dip lower, it may only be for a matter of days. With the ongoing weak dollar policy and global market uncertainty, it is best to plan ahead for your next purchase of gold ounces. One of our trusted McAlvany advisors can help determine your strategy for purchasing gold. You can schedule a no-obligation consultation with one of them by calling our office: 800-525-9556.