Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Fed, Retail Sales Prove Obstacles for Stocks

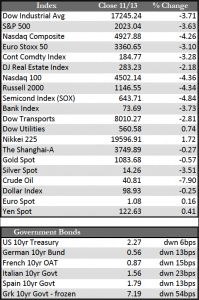

Central bankers refrained from adding to stimulus this week, even as economic growth continued to slow. As if to highlight the decision, global equity markets trekked lower, with European indexes leading to the downside through some minor support levels. Adding further downward pressure, corporations (with some exceptions) are finding it increasingly difficult to finesse their numbers, even given lower revenues in the third quarter from which to make the future look brighter.

Bulls have been looking forward, hoping that the holiday shopping season will keep the momentum going. However, after disappointing guidance from a handful of retailers this week (including JCPenny, Macy’s, Nordstrom’s, Advanced Auto) and rather dull retail sales data for October of 0.1% (September was revised down to 0.0%), sales for the winter months may turn out to be average at best. In any case, it appeared that, for the first time in several weeks, the risks that have been apparent for some time now have started to matter. Speculators were observed discounting the possibility that this correction, now six months old, may have further to go.

Bulls have been looking forward, hoping that the holiday shopping season will keep the momentum going. However, after disappointing guidance from a handful of retailers this week (including JCPenny, Macy’s, Nordstrom’s, Advanced Auto) and rather dull retail sales data for October of 0.1% (September was revised down to 0.0%), sales for the winter months may turn out to be average at best. In any case, it appeared that, for the first time in several weeks, the risks that have been apparent for some time now have started to matter. Speculators were observed discounting the possibility that this correction, now six months old, may have further to go.

Away from stocks, global bond markets popped a bit higher, feeding off of the weakness in stocks and the prospects for slower growth, while currencies and gold ended mixed after a volatile week of trade. Like stocks, it appears that the dollar may be in the process of topping out. The prospect of a December rate hike and weaker GDP figures in Europe failed to push the greenback higher into record territory against the euro. By the same token, gold may also be bottoming out. If that’s the case, a near-term revival in metals prices is in the making. Retail demand for gold in America rose by over 200% in the third quarter of this year, which at the very least suggests an increase in risk aversion among some investors.

That said, much will depend on whether stocks begin to de-leverage in earnest from here or not – when technically and fundamentally they have few reasons not to. This week’s trade was a step in that direction, but, as crazy as these markets have been, anything could happen between now and year-end. Next week we’ll get a look at the FOMC minutes and hear from several Fed heads. If their somewhat hawkish policy holds, as I suspect it will, the bearish attitude that saw gold reach 1,250 and stocks at interim lows in October may develop a bit more staying power.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP