Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Earning Keep Stock Gains in Check

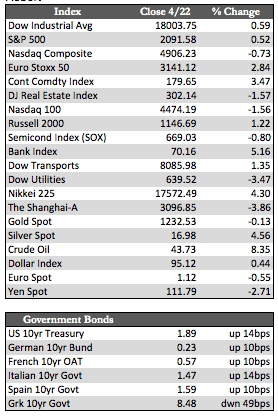

Early on in the week, stock averages were quite firm worldwide. Markets responded to events that were construed as bullish, including China’s record weekly stimulus of 680 billion yuan ($105 billion), a drop in US oil production of 24,000 barrels/day, and comments made by Mario Draghi in defense of criticisms regarding the ECB’s monetary policy. But as the week wore on, stocks began to lose the high ground to news of US earnings, which has been a mixed bag of results thus far. It has favored the more interest rate-sensitive companies such as autos (as long-term rates fell in Q1) rather than firms that deal in less durable products (e.g., the tech sector). But common among firms in the game of “beat the number” has been the use of share buybacks as a means to boost earnings, which I believe totaled a little over $160 billion for the quarter.

IBM’s revenues hit a 14-year low when its shares traded in the 40s today. Goldman Sachs’ revenue hit a 12-year low, while Caterpillar’s revenues sank, albeit less slowly this quarter, to a six-year low. The surprising thing was that none of these stocks were hammered as one would expect at the close of this week. In fact, in the case of Goldman Sachs, the shares gained 5%. But, as I said above, it has been the tech sector leaders, aka the FANGs, along with Microsoft, a few chip companies connected to Apple, and Apple itself that provided the undertow for stocks later in the week. Google in particular saw its closely watched “cost per click” fall by 9% year-over-year overall (with the decline even sharper at 12% on Google’s own websites). Google’s shares lost about 5.4% and had a hard time finishing on a positive note Friday. I’m singling out Google here for two reasons. First is that this announcement came as a complete surprise to the bulls in the “worst is over” camp, and second, based on how Alphabet’s shares reacted, it’s fairly clear to me that stocks are grossly unprepared for any news to get worse, as I believe it will after having rallied to such extremes.

IBM’s revenues hit a 14-year low when its shares traded in the 40s today. Goldman Sachs’ revenue hit a 12-year low, while Caterpillar’s revenues sank, albeit less slowly this quarter, to a six-year low. The surprising thing was that none of these stocks were hammered as one would expect at the close of this week. In fact, in the case of Goldman Sachs, the shares gained 5%. But, as I said above, it has been the tech sector leaders, aka the FANGs, along with Microsoft, a few chip companies connected to Apple, and Apple itself that provided the undertow for stocks later in the week. Google in particular saw its closely watched “cost per click” fall by 9% year-over-year overall (with the decline even sharper at 12% on Google’s own websites). Google’s shares lost about 5.4% and had a hard time finishing on a positive note Friday. I’m singling out Google here for two reasons. First is that this announcement came as a complete surprise to the bulls in the “worst is over” camp, and second, based on how Alphabet’s shares reacted, it’s fairly clear to me that stocks are grossly unprepared for any news to get worse, as I believe it will after having rallied to such extremes.

Away from stocks, Treasuries lost some ground to the notion that equities were officially on the mend. The metals were mixed, with gold down a smidge and silver up 5.4%. The dollar strengthened against the euro and the yen, as expectations for additional easing in these regions (mimicking China) is again on the increase – right after, I might add, Draghi declared that all would be well last month. However, I do not expect the Fed to jump with similar ease onto the QE bandwagon at the next FOMC meeting on Wednesday. There are no apparent reasons to do so. This leads me to believe that, in tune with with further earnings disappointments, as Apple’s may be next Tuesday, stocks could be in for some rough sledding ahead. Of course, based on that thesis, I could see the metals trade either way, but we’ll know more along those lines as we see things play out in the coming week.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP