Podcast: Play in new window

Here’s our weekly recap of the precious metals markets for August 14. As of this recording, here is where precious metals stand:

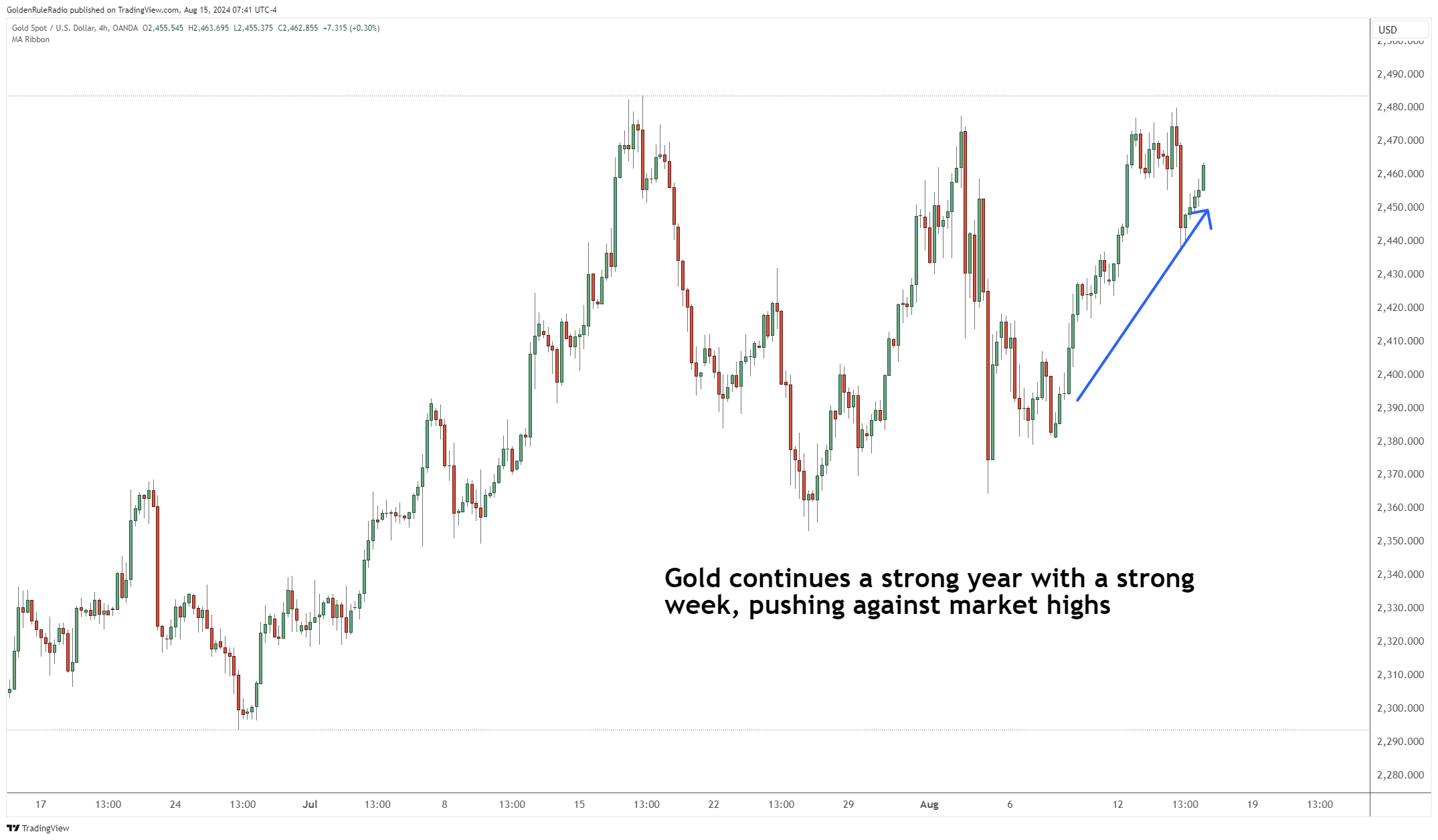

The price of gold is up 2.8% to $2,450, from $2410 a week ago.

The price of silver is up 4% to $27.54 since last week.

Platinum is gaining ground, up 1% to $922.

Palladium had a good week, up 6% to $916 from $880 a week earlier.

The S&P 500 is up 3% to 5454.

The dollar is flat from a week earlier.

Buy Sign for Silver

Gold has been steadily rising within its trading range, and it is testing the top. The last time it rose near the top was mid-July, and it didn’t fall anywhere near the bottom. It looks like there will be a strong gold price going into the fall season.

Meanwhile, silver has been trading at lower prices recently, well below $30. The gold to silver ratio has shifted from 75 to one back to 90 to one. For those who are looking to eventually do ratio trades, this is a strong buy signal for silver. Since the white metal is well undervalued, we expect its price to rise, which will provide a gold-to-silver ratio trade and an opportunity to potentially double your gold ounces down the road.

Avoid Gold Scams

Clients come to McAlvany all the time asking about what they should be paying for gold. Because there are a number of bad actors that will sell gold to unsuspecting customers for exorbitant premiums.

For example, some gold brokers will try to sell clients non-standard products — such as ¼ ounce gold products. The standard measure for gold products is by the ounce.

No matter where you purchase gold, you will have to pay some sort of premium. However, you can find out if you are getting ripped off by understanding what you’re paying per ounce.

You can find the true price by taking the price per ounce of gold divided by the spot price — and use the NYMEX spot price for consistency. Then you will understand what premium you’re paying over the spot price.

So for example, if you are considering a ¼ ounce product, you need to multiply that price times four to equal an ounce. Then you divide that figure by the spot price — and you will arrive at a percentage over spot that will give you the premium.

A reasonable premium should be around 20% or less. If you are quoted a price that includes a much higher premium — say 70% or more — you should run.

Get in Touch

If you’re considering purchasing gold, reach out to a trusted McAlvany advisor. They are happy to speak with you on the phone and give you a clear price with transparent premiums. Reach us at 800-525-9556, Monday through Friday from 8am to 5pm Mountain Time.