Podcast: Play in new window

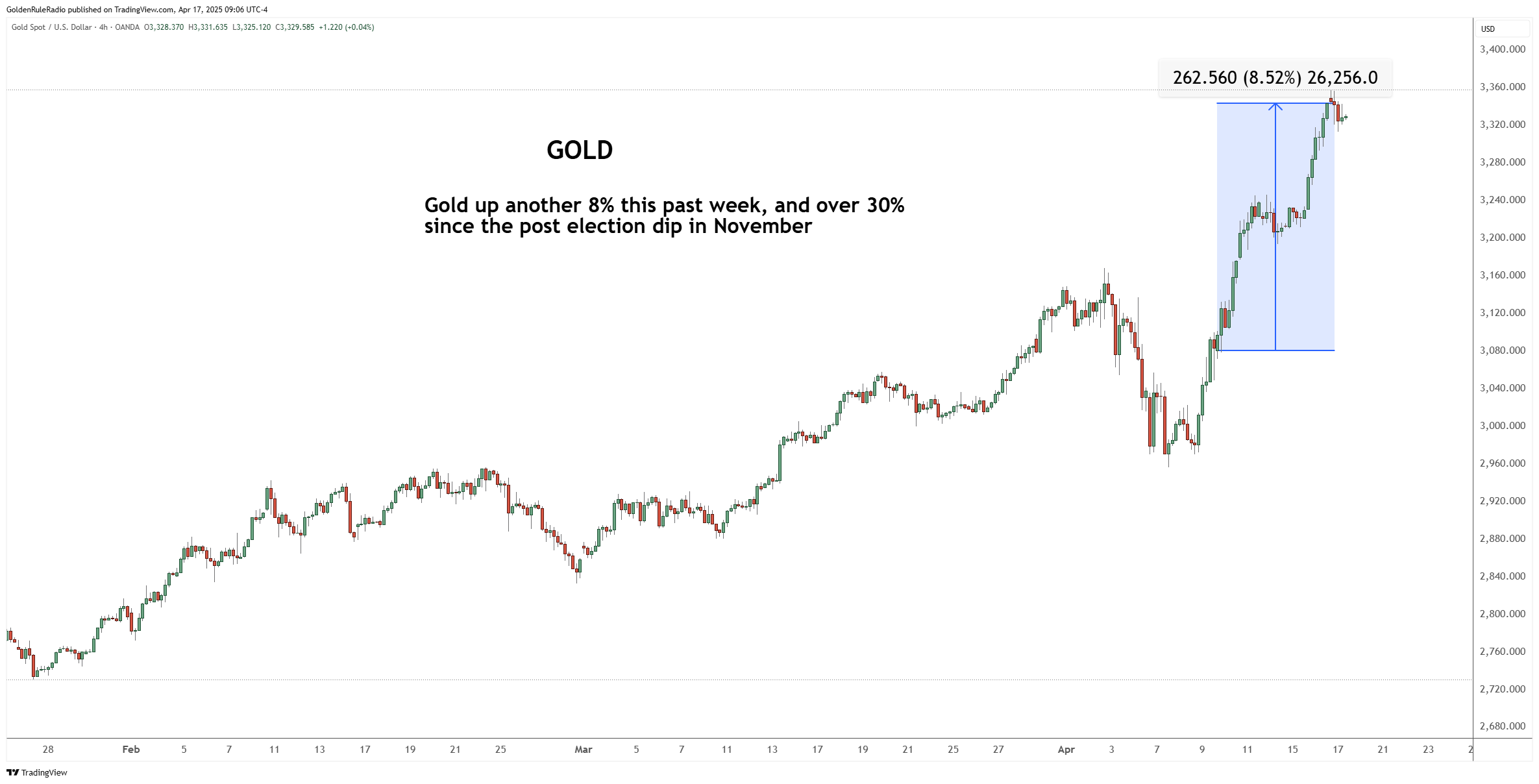

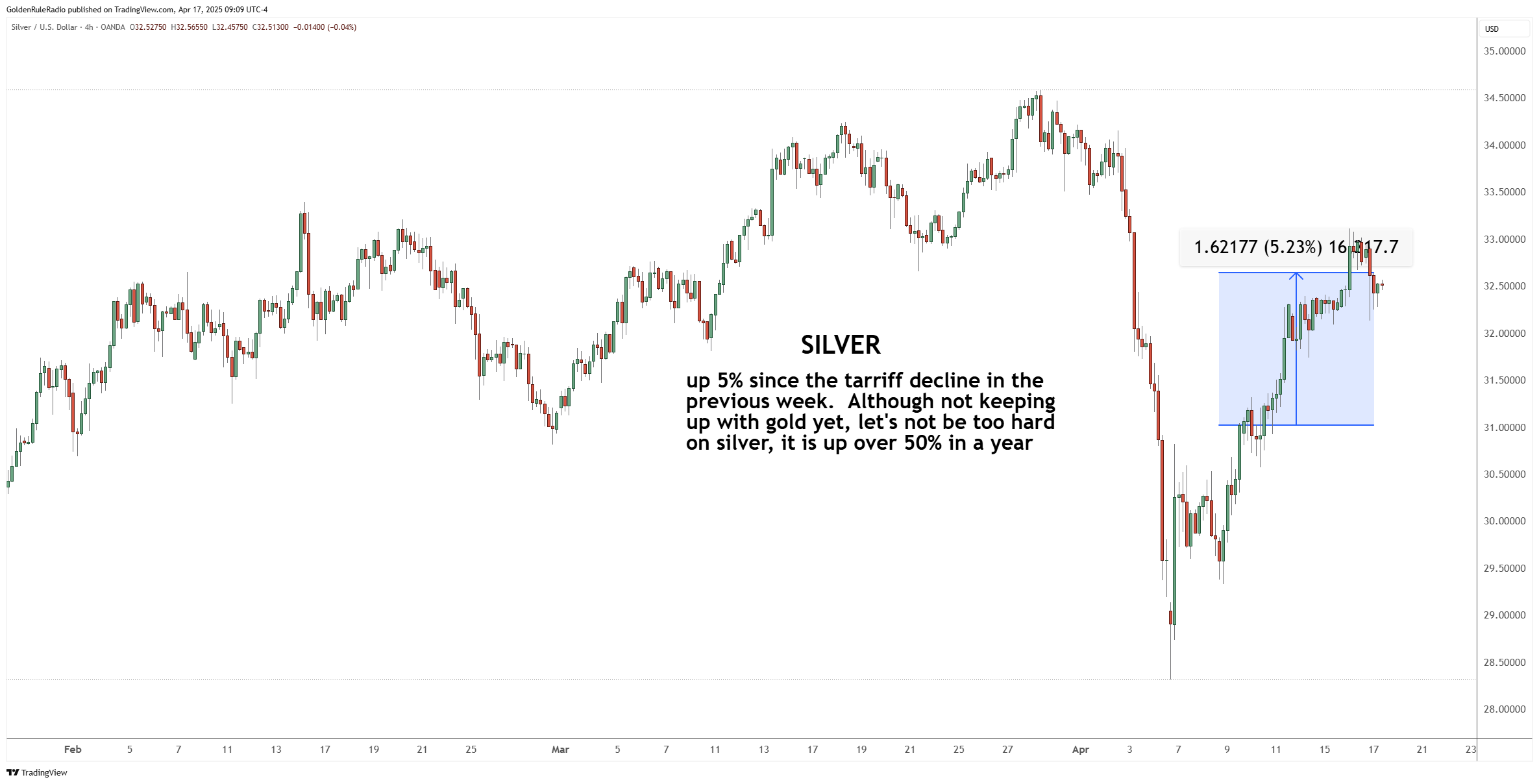

Gold sees a massive surge this week, climbing all the way up to $3,343. Silver also saw a 5% rise to $32.70, while platinum and palladium saw some modest gains.

Alongside the US dollar’s weakened performance and high global demand for gold, the momentum behind gold continues to grow and the likelihood of higher prices increases. Thanks for listening.

Let’s take a look at where prices stand as of our recording on Wednesday, April 16:

The price of gold is up 8% to $3338, after its massive surge over the past week.

The price of silver is up 5.5% to $32.70, starting to look healthier after a big dropoff last week.

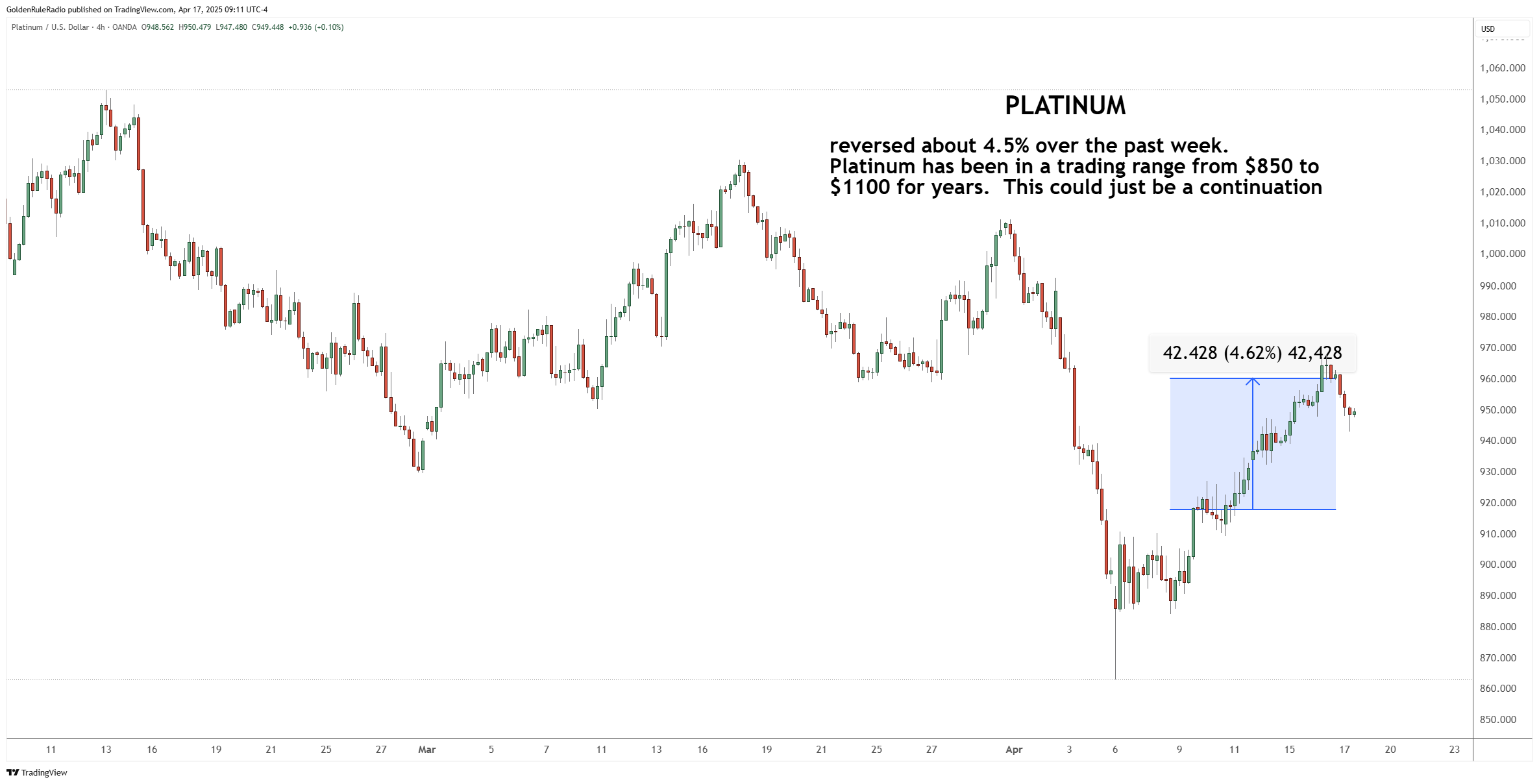

The price of platinum is up 4.6% to $960 as of recording. Platinum seems hard stuck between about $950 and $1,000 and continues to remain there.

The price of palladium is up 7% to $972, surpassing platinum by a small amount in their neck-and-neck race.

Metals Momentum

On Tuesday, India announced that they want to use a trade surplus to buy gold, silver, and oil from the United States, and that caused a moonshot for gold in the early morning hours.

President Trump is trying to initiate an industrial revolution, and that’s when we expect to see platinum finally break north of $1,000 per ounce. So keep an eye on these industrial metals. It is still early in the game.

Dollar vs Gold

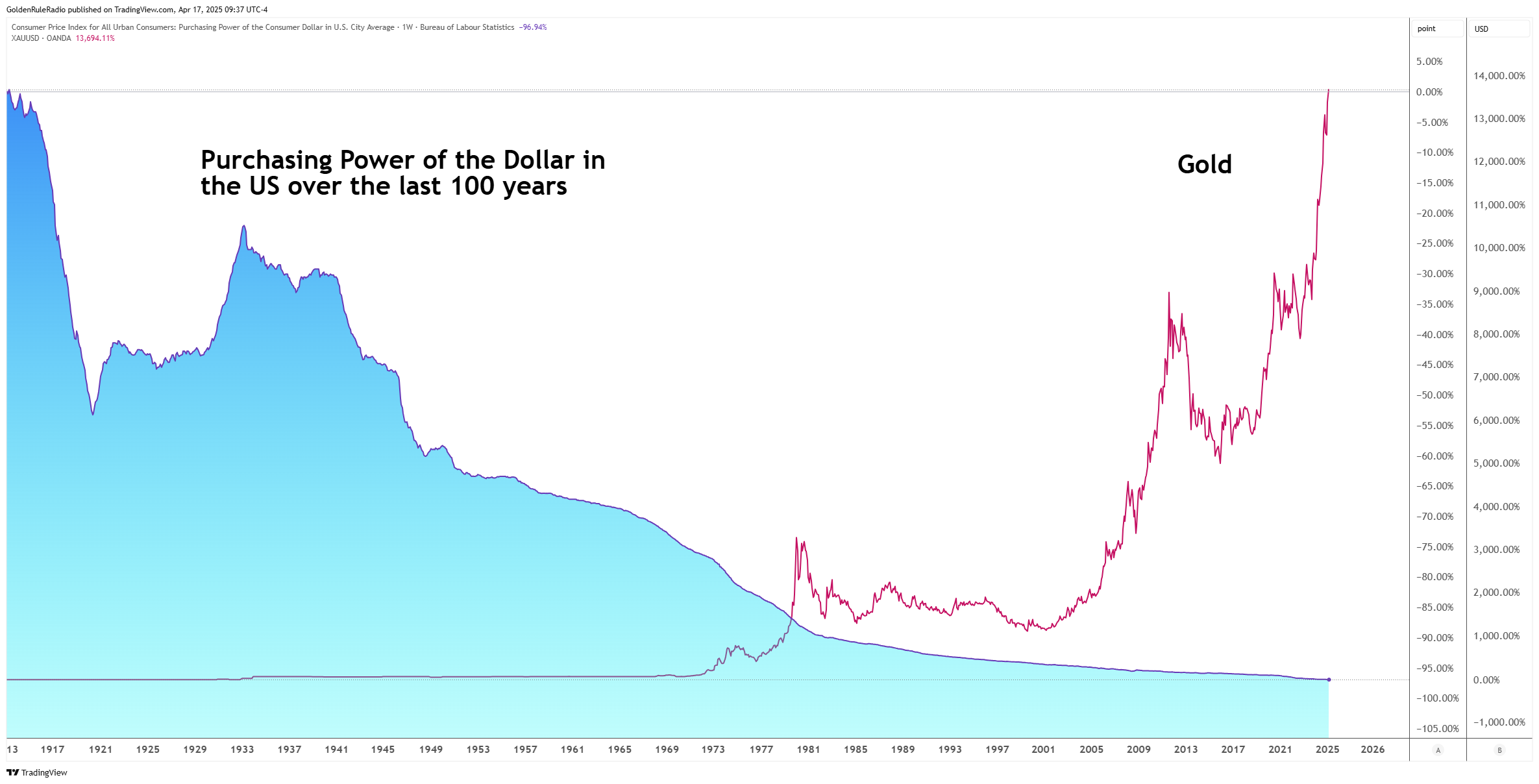

When you’re a gold investor, it’s hard to remember how you used to think about investing before you purchased precious metals. But many investors find an asset like gold to be out of their comfort zone. They’re used to looking at how the stock market performs and how many dollars they have in the bank.

Gold is an allocation. It can be seen as insurance for the rest of your money or an allocation as capital to preserve your purchasing power as the dollar gets eroded by inflation.

And there’s no better illustration of gold’s power than looking at this chart showing the purchasing power of the dollar over the last 100 years:

As you can see, the price of gold is the mirror image or the inverse relationship of this US dollar purchasing power.

Ratio Trade Opportunity

The gold-to-silver ratio hit a rare high of 101, indicating a rare chance for silver investors to take advantage of. The gold to silver ratio has fluctuated between 99 and 101 for weeks. This week, the ratio is back to 101 today. The last time we saw a significant shift in the gold to silver ratio was at the beginning of the pandemic in March 2020.

And because there is still little western demand for gold and silver right now, premiums are very low. So if you’ve been thinking about making a ratio trade, now is the time to get in touch with your McAlvany Precious Metals advisor.

Add Gold Ounces Today

Call us at (800) 525-9556 so we can speak with you individually and walk through your own portfolio. Our team of experts can help you understand the whys and the hows with acquiring gold.