Podcast: Play in new window

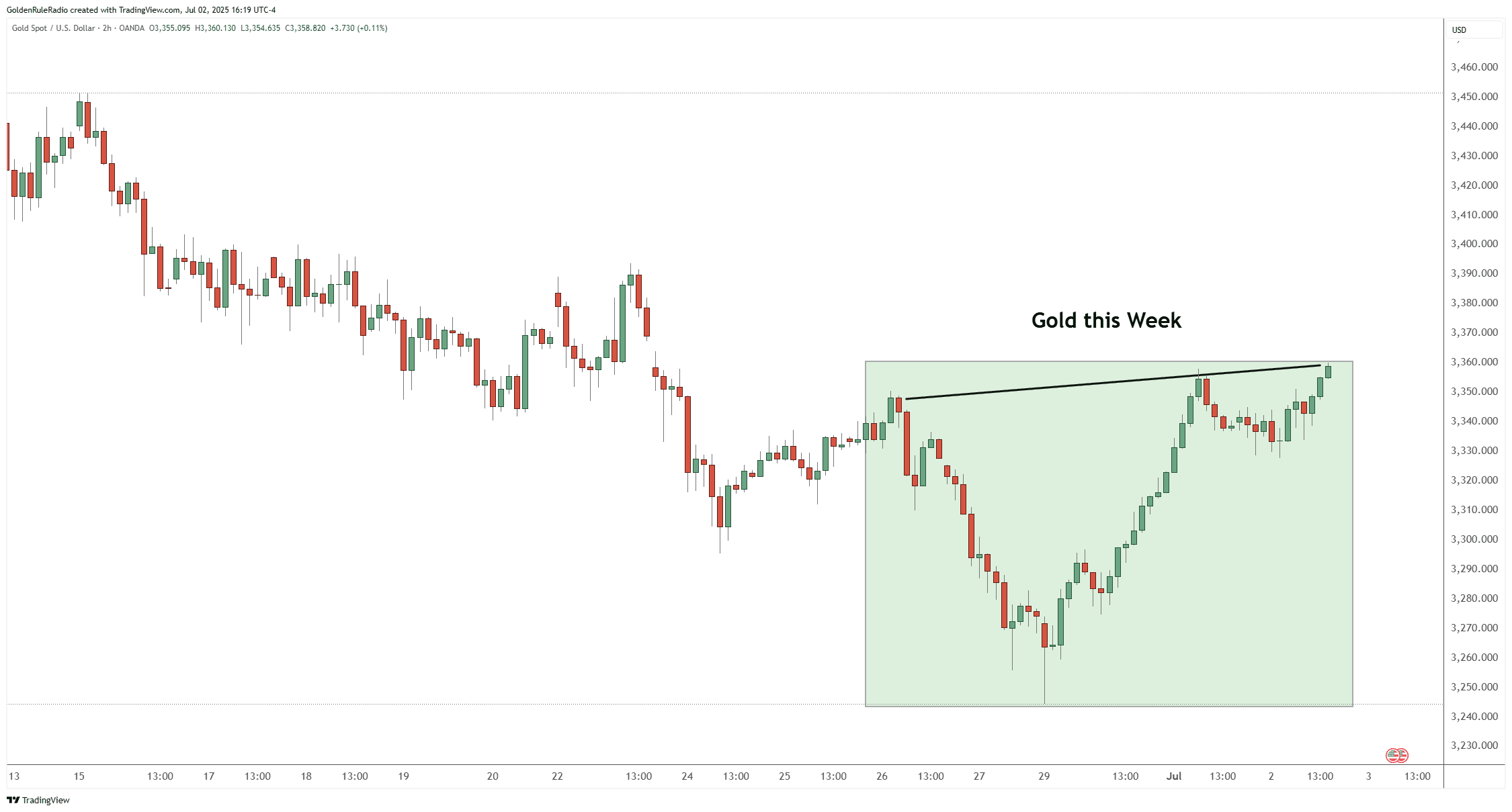

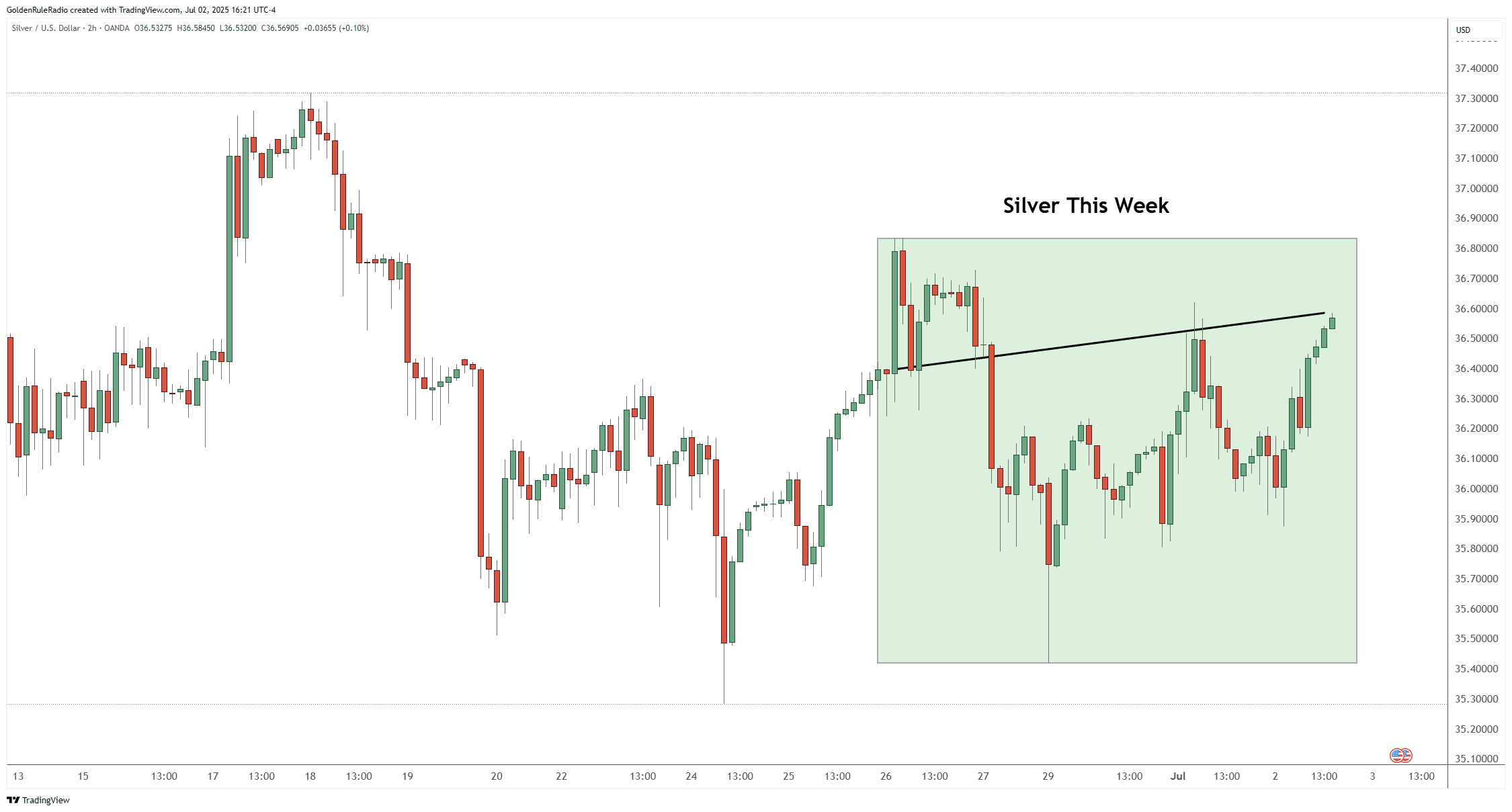

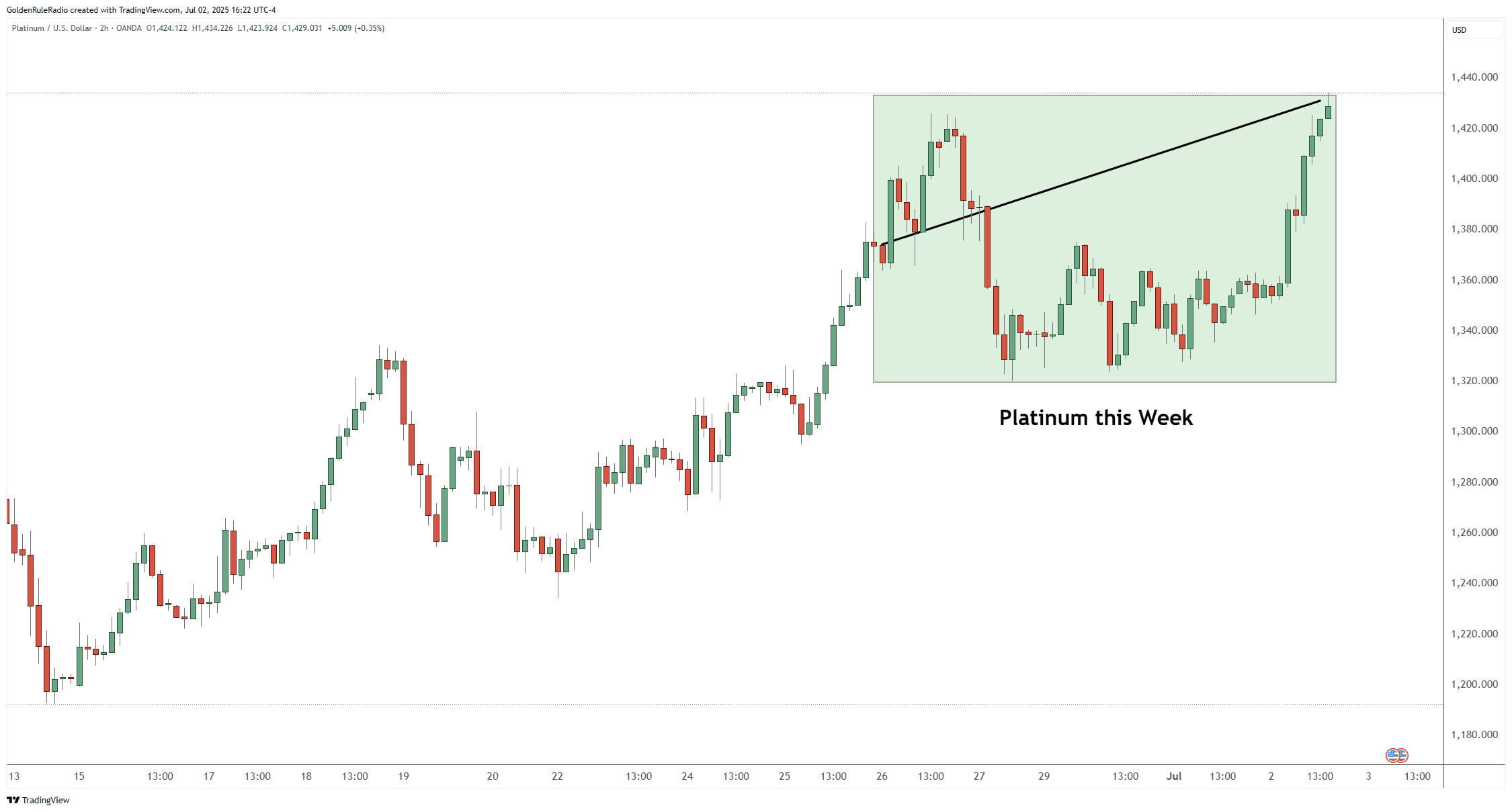

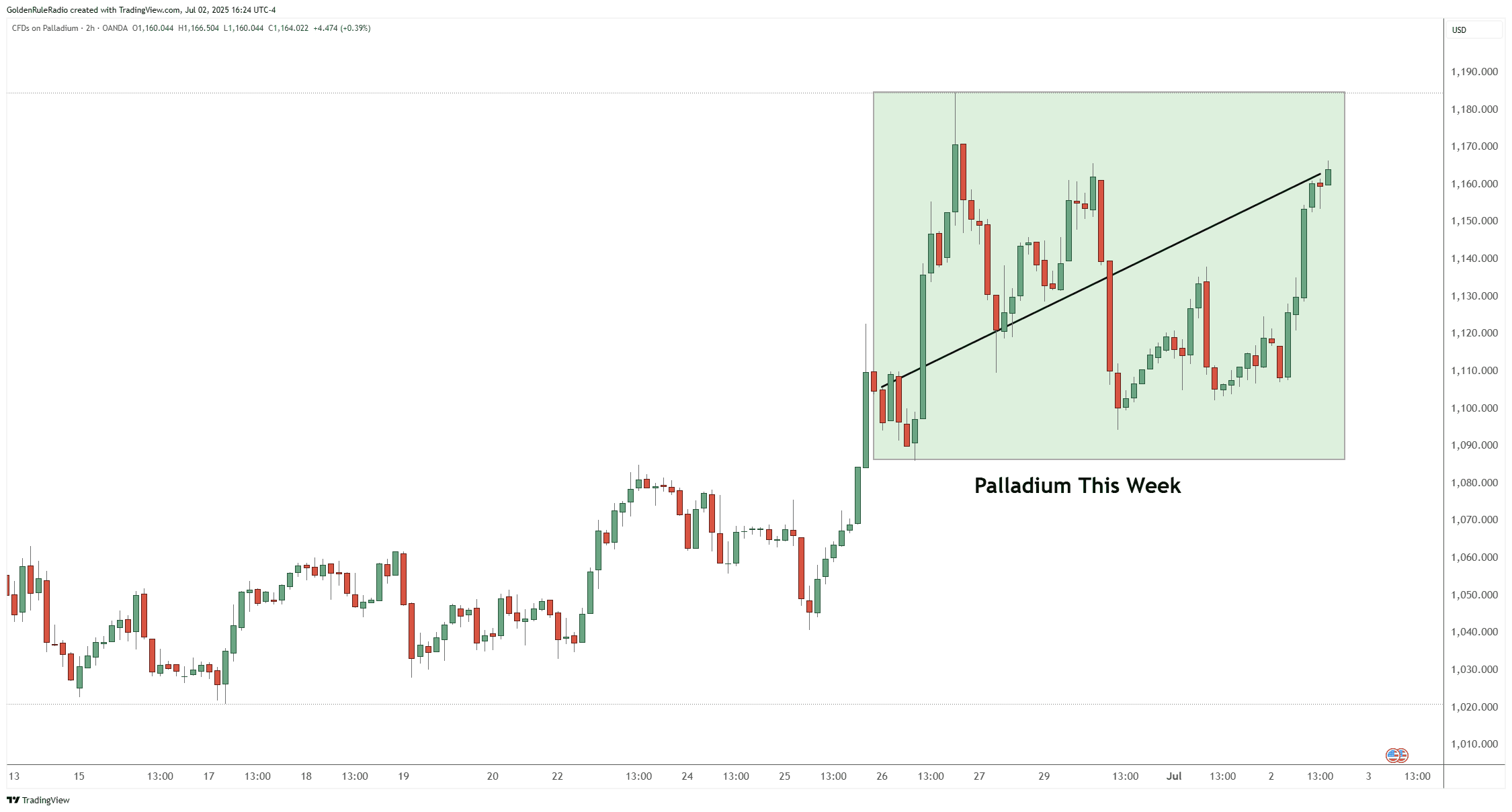

The past week saw significant volatility across precious metals. Gold experienced a sharp drop to $3,240 before rebounding by $120, ultimately ending the week with only a modest gain. Silver followed a similar trajectory, swinging 4% down and back up about half a percent for the week. The white metals—platinum and palladium—were the real standouts.

Let’s take a look at where precious metals stand as of Wednesday, July 2:

The price of gold is up a little from just over 1% to $3,360.

The price of silver is up 0.5% to $36.60.

Platinum is up about 4% to $1,433. This is after it had a dramatic 9% swing in a single day.

Palladium also managed a 5.5% gain, reaching $1,070. Similar to its sister metal, it had a 9% single-day move.

And taking a look at the paper markets…

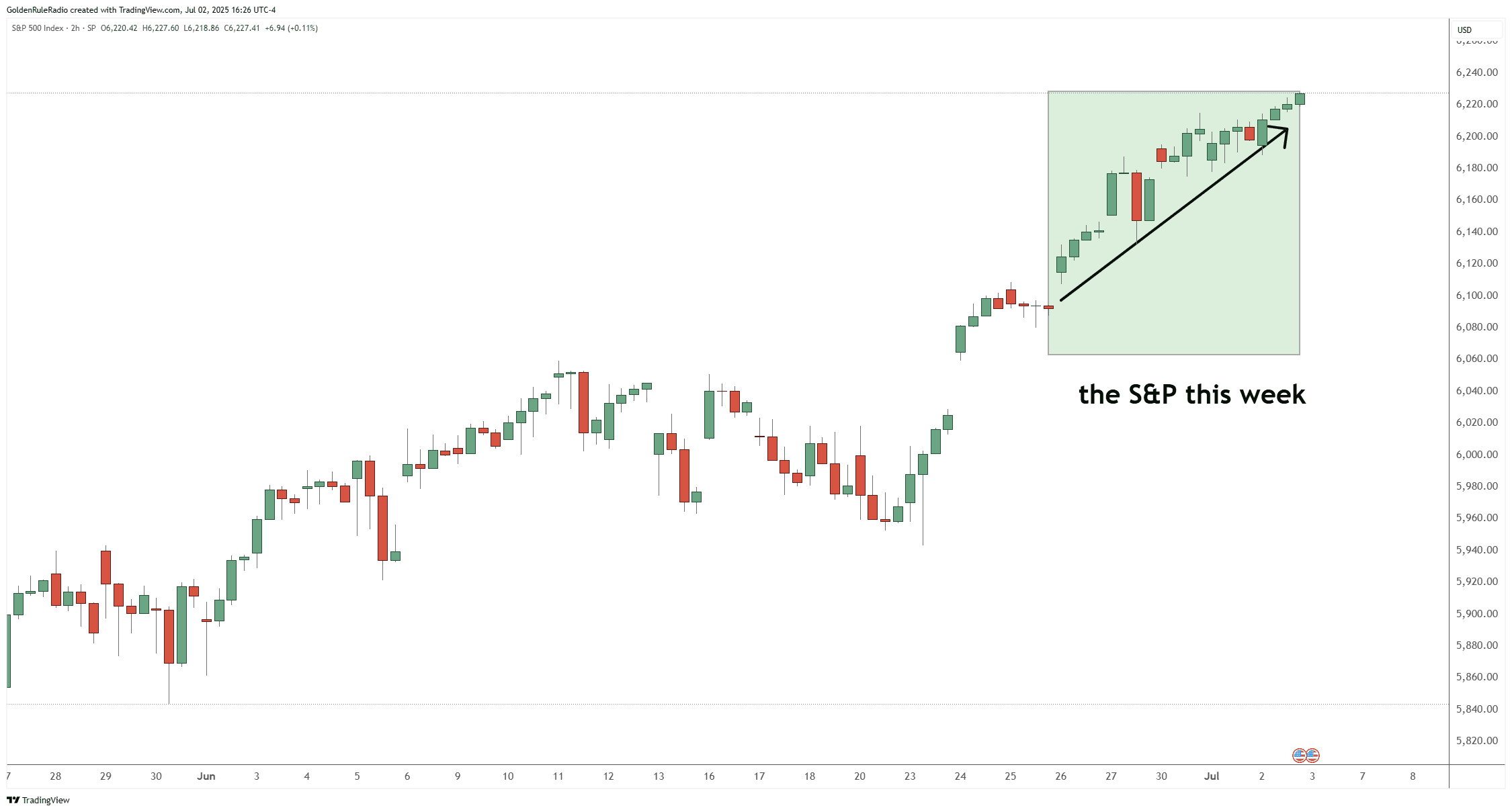

The S&P 500 is up 1.8% to 6,225 — and it also reached a new all-time high.

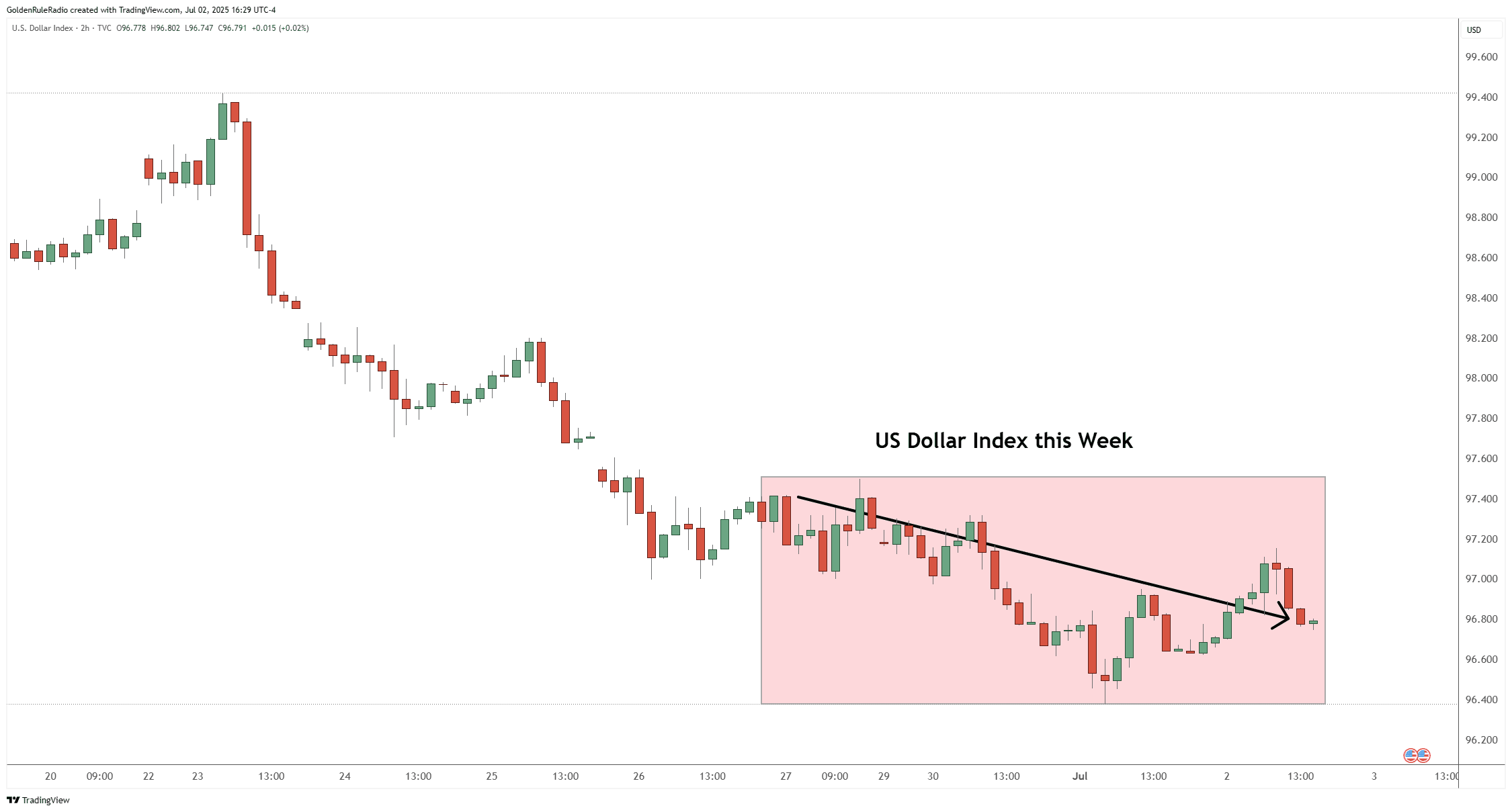

And the US dollar is down about 0.5% to 96.75.

Metals’ Strong Performance in Q2

The second quarter of 2025 has been especially strong for precious metals. Platinum led the pack with a 34% gain for the quarter, and it is up 47% year-to-date. Silver is up 6% for Q2 and 24.7% for the year, while gold has gained 5.7% for the quarter and 25.6% year-to-date. Palladium, meanwhile, is up 10.8% for Q2 and nearly 20% for the year.

Year-over-year, gold is up 41%, silver 22%, platinum 35%, and palladium 12.5%, with much of these gains concentrated in the first half of 2025.

Moving Averages Outlook

The recent surge in prices has left many metals, especially the white metals, trading well above their 20-day and 50-day moving averages.

Gold, however, has recently dipped below these short-term averages. It appears to be forming a “wedge” pattern, which typically indicates a pause in a bull market. This allows moving averages and technical indicators like the Relative Strength Index (RSI) to catch up to current prices.

This technical setup often signals that a correction or pause is likely, either through a sharp pullback or a period of sideways consolidation.

Silver and platinum may also be entering similar consolidation phases, which could help stabilize the market and set the stage for the next move.

Strategic Ratio Trades

One of the most effective strategies in the current environment is ratio trading—using the relative value of different metals to maximize long-term gains.

The gold-to-silver ratio remains elevated at 92:1, suggesting that silver is undervalued relative to gold. This presents an opportunity to allocate more heavily to silver, with the intention of eventually trading into gold when the ratio normalizes, thereby increasing total gold holdings without additional investment.

The platinum-to-gold ratio is less straightforward. Platinum’s recent spike makes it a tougher call on when to convert to gold. Historically, a 1:1 ratio has been the target, but patience may be required until a more favorable exchange rate returns.

Meanwhile, the Dow-to-gold ratio stands at 13:1, still above the single-digit levels that have historically signaled gold is overvalued versus equities. This indicates that gold is not yet in a bubble and may have further room to run.

US Dollar Weakness, Inflation Concerns

The US dollar has been under significant pressure. The Dollar Index fell another 0.5% this week to 96.75, erasing all gains made since the Federal Reserve began raising interest rates.

In 2025 alone, the dollar has lost 10% of its value—the worst first-half performance in nearly 40 years. Over the past decade, the cost of living has doubled, pointing to real inflation rates closer to 10% annually.

Monetary expansion continues unabated, with the US M2 money supply hitting a record $21.94 trillion and marking the 19th consecutive monthly increase. This ongoing devaluation is not accidental; it’s a deliberate policy choice. In response, global central banks are increasing their gold reserves as a hedge against currency debasement and systemic risk.

Debt, Policy, and the Case for Gold

The macroeconomic backdrop remains a key driver for precious metals. The US national debt has reached $37 trillion, with projections of $59–$62 trillion by 2035. Annual deficits now exceed $2 trillion, and interest payments on the debt are over $1 trillion per year. This unsustainable fiscal trajectory, combined with ongoing global de-dollarization and central bank gold buying, underpins the long-term bullish case for gold.

The current move in gold is being driven by institutional money, not retail speculation. This suggests that the rally is built on a solid foundation and is likely to continue as more investors seek safe havens in an increasingly uncertain world. Regular, disciplined accumulation of gold—and ratio trading from white metals to gold—remains a prudent strategy for long-term wealth preservation.

Positioning for the Next Phase

Gold’s multi-year bull run continues amid mounting US debt, persistent inflation, and a weakening dollar. While technical indicators suggest a pause or correction may be due, the fundamental case for gold as a hedge against systemic risk remains as strong as ever.

Here to Help

The McAlvany precious metals advisors are here to help you review your portfolio strategy and ensure you are positioned to benefit from the ongoing paradigm shift in global finance. The window of opportunity for building a robust position in precious metals may be wide open, but as history shows, these windows can close quickly. Give us a call for your complimentary, no obligation consultation at 800-525-9556.