Podcast: Play in new window

There has been extraordinary momentum in the precious metals markets this week, with silver breaking historic barriers and gold continuing its record-setting run.

Gold’s climb continues this week as it surged to another new high just above $4,200. Not to be out done, silver locks in nine straight weeks of gains and soars past the $50 threshold. While not keeping up with the staggering performance of gold and silver, platinum and palladium still see steady upwards movement.

Let’s take a look at where prices stand as of Wednesday, October 15:

The price of gold is up 4.3% to $4,212 since our recording the prior week.

The price of silver is up 8.4% sitting at $53.29 — firmly moving above the old $49 high. Silver is starting to look extended from a spot price standpoint.

Platinum is up just $10 to $1670 from a week earlier. However, the white metal had a lot of volatility intraweek, with three 4% moves up and down on either side.

Palladium is up 6% sitting at $1,590 over the last week. Still about $1000 below platinum.

Looking over at the paper markets…

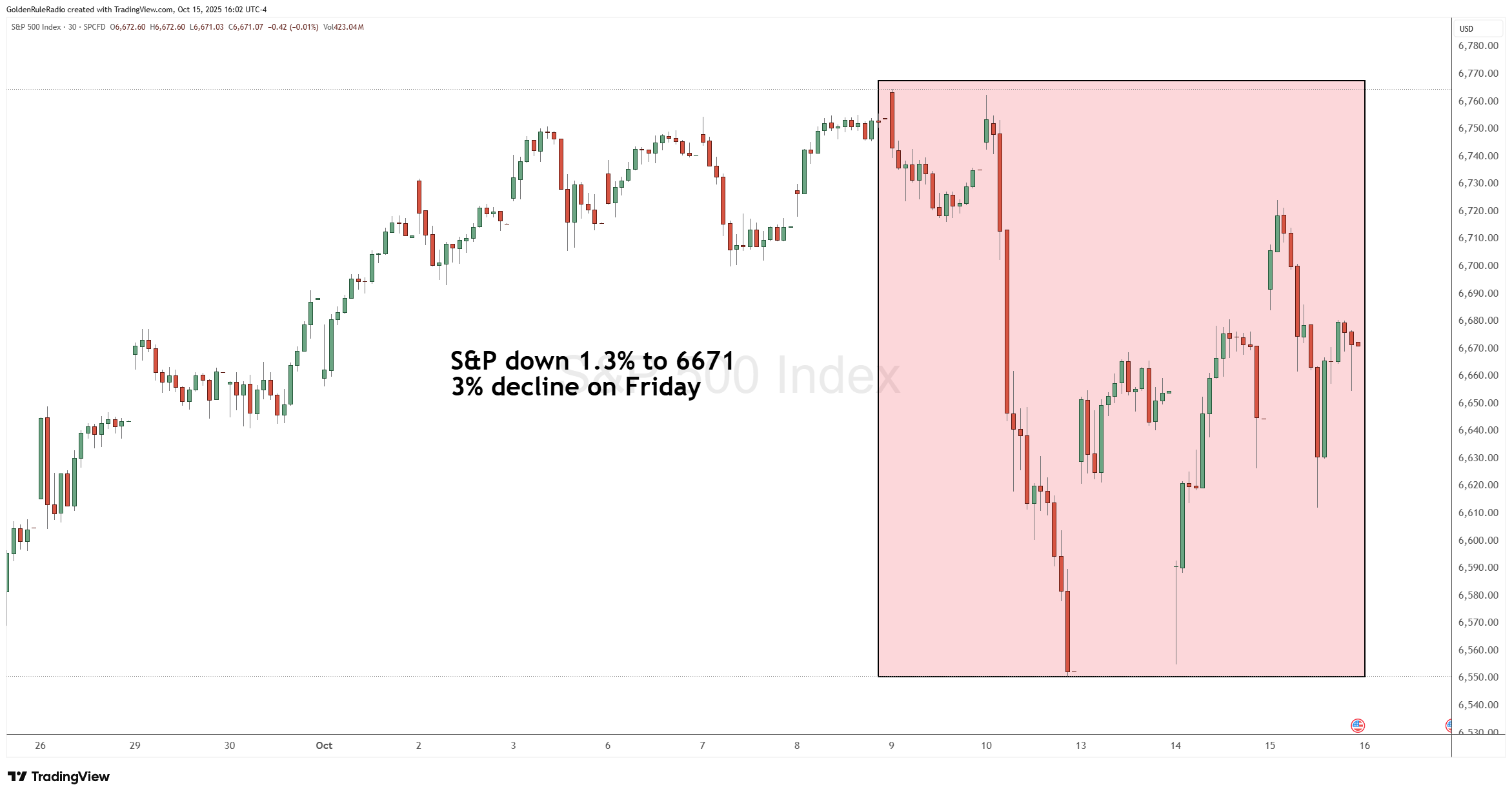

The S&P 500 is down 1.3% as of our recording last week. The previous Friday afternoon before Columbus Day weekend, the index fell as much as 3% in a single day.

Gold Surges Above $4,200

Gold climbed 4.3% for the week, reaching around $4,212. The move reflects ongoing global uncertainty — from tariff conflicts between the U.S. and China to volatility in the equity markets. This combination of geopolitical tension and market instability underscores gold’s continued role as a defensive anchor in diversified portfolios.

And while the rising price of gold has been making headlines, it was not the shining star in the precious metals markets this week.

Silver Smashes Through $50 Resistance

Silver stole the spotlight, launching 8.4% higher on the week and surging past $53 per ounce — a level not only surpassing both the 1980 and 2011 highs near $50 but doing so with almost no resistance. What’s remarkable is that the price didn’t stall at this historically symbolic ceiling; it moved “as if someone opened a door,” signaling broad underlying demand and speculative momentum.

Buyers are behaving differently than in past bull cycles. Despite technically overbought indicators — RSI readings not seen since 2011 and 2020 — there’s been limited profit-taking, especially on the global scale.

Physical silver demand has outpaced mining production for five straight years, with industrial usage from solar energy, advanced electronics, and military technology only accelerating. This mix of supply strain and renewed investor confidence hints that silver’s current rally may reflect more than a speculative blow-off — it may represent a long-awaited repricing event, where years of suppressed value begin to normalize toward inflation-adjusted equivalence.

Physical Market Tightens — Junk Silver and Bars in Focus

Refineries and wholesalers are selectively halting purchases of junk and scrap silver due to capacity limits, as they attempt to catch up on international orders. This is creating short-term tightness in physical markets — not panic-level disruption, but enough to widen spreads between bid and ask prices. Investors holding physical silver should recognize that temporary liquidity squeezes can distort premiums even when spot prices rise.

Profit-Taking Meets Rising Demand

Some investors who bought years ago are realizing profits, especially those whose metals positions have swollen to a larger percentage of their total portfolio. However, global silver demand continues to outstrip mining supply for the fifth consecutive year, with industrial consumption — from electronics to weapons systems — reinforcing long-term support.

Simply adjusting for the dollar’s purchasing power loss since 1980 and 2011, silver’s “fair value” would be closer to $75 today. That makes the recent breakout potentially just the beginning of a broader, secular move rather than the end of a short-term rally.

Ratio Trading Opportunities

The gold-to-silver ratio narrowing from over 100:1 earlier this year to around 78:1 underscores that silver is once again catching up to gold after years of lagging performance. Historically, these moments present prime opportunities for ratio-based trading — the disciplined process of swapping between metals, not selling out of them.

Here’s how the strategy works in this environment:

- When silver dramatically outperforms gold, we trim a portion of silver holdings and convert them into additional ounces of gold.

- When gold later regains leadership, we perform the reverse — swapping some gold back into silver.

- Each rotation increases the total ounces held of both metals over time, without committing additional capital or leaving the safety of the precious metals market.

The beauty of this approach lies in removing timing guesswork. Whether silver hits $75 in six weeks or takes six months to consolidate, disciplined ratio trading allows investors to systematically multiply ounces by letting the market’s natural ebb and flow work in their favor. With the current volatility and ratio divergence, this environment could offer one of the best ratio trading windows since the post-2011 retracement.

Get In Touch

With the current market conditions, could your portfolio benefit from ratio trading in the near future? The best way to know is to consult with one of our precious metals investing experts. Our team is happy to discuss your personal objectives and help you create a precious metals investment strategy on a complimentary, no-obligation consultation. Please reach out to us at 800-525-9556.