Here is a print-ready version of this article: WHAT WILL THE 2020 ELECTION MEAN FOR YOUR FAMILY’S FINANCES?

Going into the 2020 election, America finds itself sharply divided and gripped by immense fear and uncertainty. You could scarcely be blamed if you shared in these emotions. But keep in mind that they’re neither new nor unusual.

Rudyard Kipling wrote his poem to his son for times such as these, urging him to:

“…keep your head when all about you are losing theirs and blaming it on you….”

Doesn’t that just about sum it up for defenders of traditional America and constitutional government at this point in time?

So let’s size things up unemotionally, and see where we need to go and what we need to do. What does the election mean for America? For you?

In brief, both presidential nominees promise to spend a lot of money if they are elected. Biden to provide heavily subsidized health care to everyone, rebuild infrastructure, fight “climate change,” and expand entitlement programs. Trump, at a lower level, to support the military, reduce illegal immigration and offshored manufacturing, and only gradually reduce or phase out such costly expenses as farm subsidies, foreign interventions, maintenance of the bureaucracy, and social programs.

Both candidates would doubtless continue to encourage and demand low interest rates from the Fed, along with the creation of new dollars at a phenomenal rate (not that they would have any opposition from Chairman Powell). Such liquidity is the life support a debt-addicted economy requires, and both candidates would support it.

Here’s the big picture, in brief:

- US Debt is now over $27 trillion.

- Congress has completely ignored any debt ceiling or spending limits, with more money printing to come, borrowing $3 trillion in three months.

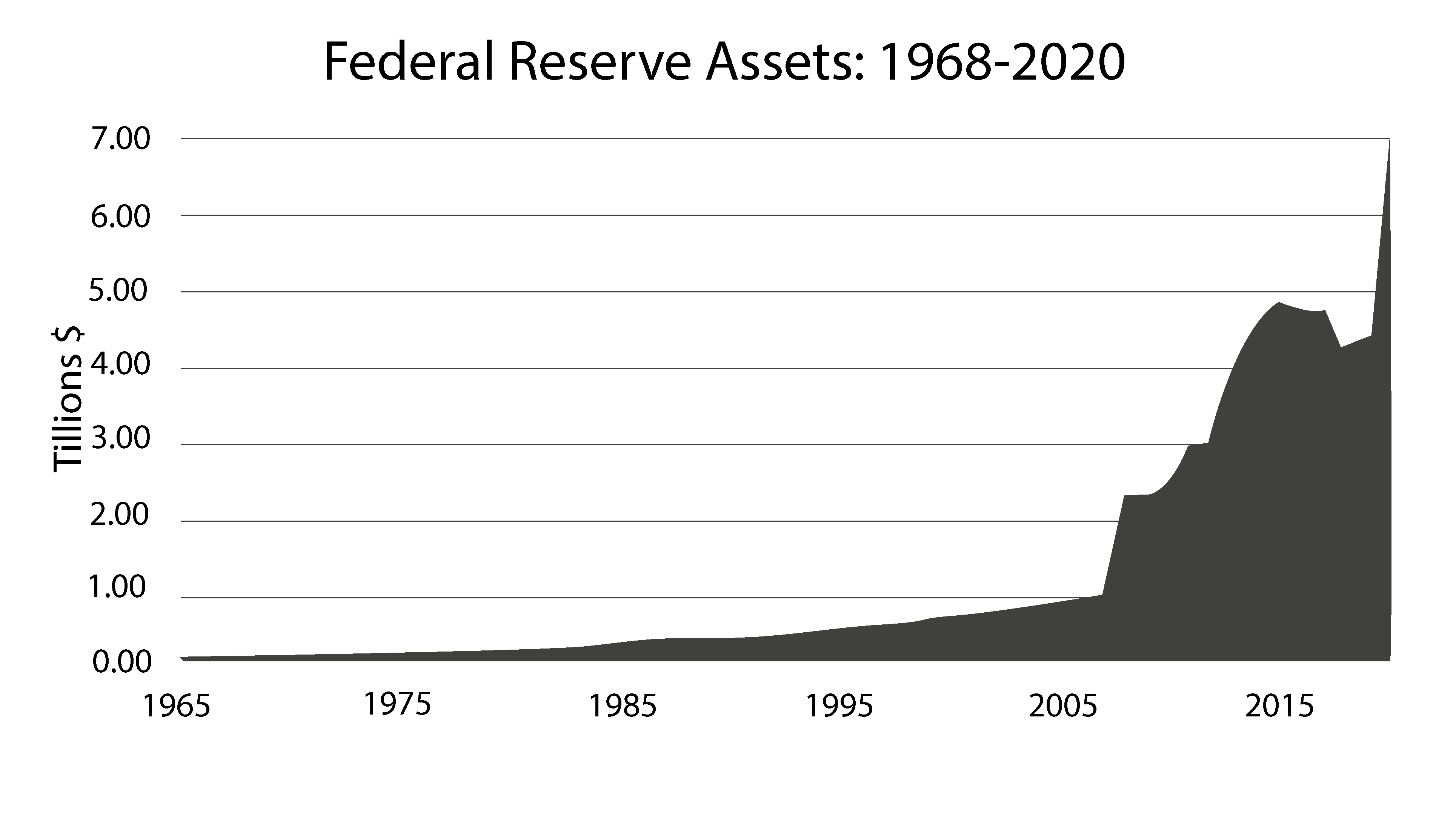

- Central banks have printed more than $10 trillion in response to the pandemic.

- The Federal Reserve as of Wednesday September 16, 2020 has indicated that interest rates are to remain near zero through 2023 and is continuing to flood liquidity into the system at a rate of $120 billion per month.

This rate of money creation creates an inflationary environment that will define the economic landscape for the foreseeable future. Such extreme inflation will greatly impact savers and investors as they watch their dollars shrink before their eyes.

And it’s not going away. Inflation helps deal with debt, and America’s debt is astronomical. Ironically, the quantity of debt keeps growing in order to keep rates from rising. It’s a vicious circle!

The US has never seen a lead-up to an election with such inflationary pressures. Even in the best of times elections tend to bring uncertainty into the investing markets. Pair that fact with the consequences of shutting down the global economy for most of the year, and it’s clear that this could be a watershed election. Now is the time to take action with your portfolio, to protect and preserve your assets.

As you do so, keep these key points in mind:

- According to the National Bureau of Economic Research, we are officially in a recession and likely headed for a depression.

- The national debt has skyrocketed to $27 trillion! That equates to $384 billion in interest payments alone each year.

- The US GDP is set to decline by 5.9%, which is twice the decline we saw in 2009 after the onset of the financial crisis.

- The US debt/GDP ratio has increased from 57% in 2000 to 130% now. That is up from 113% three months ago.

- The stock market ‘recovery’ after its 34% decline has been driven solely by the stimulus from central banks and sovereign governments. It has provided a false sense of security.

- The current deflation will turn to inflation, causing a likely inflationary depression.

These facts define our current trajectory. They pertain no matter which presidential nominee wins the election, or what the composition of Congress is. If the Democrats sweep the election, the facts represent a best-case scenario. If the Republicans sweep, the above will be the expected outcome. Either way, there are likely hard economic times ahead.

So how can you prepare? How can you make the right choices now to support your portfolio in the best ways possible? We can help.

We’ve put together a simple, print-ready Market Readiness Worksheet for you. It’s quick, it’s easy, and it helps you review your portfolio’s current footprint to assess whether you’re at risk or not – in complete privacy. It’s helpful, too, in identifying and setting your investment goals.

Get the Worksheet Today

This step-by-step worksheet will help you with the three moves you need to make right now to protect your portfolio from these uncertain times. It’s 100% secure and 100% confidential.

What Steps To Take Right Now?

Don’t Let Fear Rule. In volatile times like these, fear can easily drive investors. Fortunately, history provides us with abundant advice on what to do in the face of danger and uncertainty. The wise road in this case is not a goat path. It is leveled, paved, and marked.

Take that road! Don’t take chances with your investments. With historic highs in the gold/silver ratio, the global economy set for a contraction, gold prices nearing all-time highs, and events lining up as they did before the last financial crisis, NOW is the time to take action!

Print the Market Readiness Worksheet