Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Fed Says “All is Well” – Again

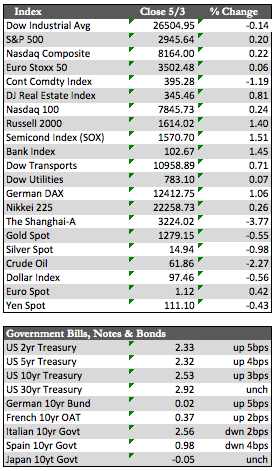

Stocks stumbled their way to small gains this week, as the FOMC meeting turned out to be a bit less dovish than speculators expected. Somewhere in the mix, investors had hopes – desperate ones, in my opinion – that the Fed would hint at a rate cut in order to aid the ongoing party in stocks. But the Fed kept an optimistic view of things, and drew from past successes – such as the 3.2% first-quarter GDP and subsequent job growth – to justify a pause on any rate decision. Hindsight is always 20/20, of course, and when asked about the on-balance deterioration in the US economic data for April (i.e., ISM data collapse), the Fed dismissed it as if it were a fluke and conveniently blamed any weakness on overseas growth issues. In any case, the indices (ex the Transports) ended the week with minor losses, led by Telecom and Energy, while Financial and Healthcare sectors rounded out the week’s winners. US Small Cap stocks and many overseas indices still lag the performance in broader US markets.

Treasuries, like stocks, were weaker across the board following the Fed’s less-than-dovish leanings. Thirty-year Treasury yields are 12bps above the more stimulating low set at the end of March. The dollar fell from its nose-bleed highs, as European currencies – e.g., the pound – rebounded from recent lows thanks to BoE rate hike expectations. The metals, however, didn’t start to rally until Friday’s jobs report showed lackluster growth in wages, which reignited belief that the Fed would be more dovish in the future. Incidentally, the market has priced in a 100% chance of a rate cut in 2020. Oil fell on sharp increases in US crude and gas inventories, and finished the week just above $60/bbl.

Treasuries, like stocks, were weaker across the board following the Fed’s less-than-dovish leanings. Thirty-year Treasury yields are 12bps above the more stimulating low set at the end of March. The dollar fell from its nose-bleed highs, as European currencies – e.g., the pound – rebounded from recent lows thanks to BoE rate hike expectations. The metals, however, didn’t start to rally until Friday’s jobs report showed lackluster growth in wages, which reignited belief that the Fed would be more dovish in the future. Incidentally, the market has priced in a 100% chance of a rate cut in 2020. Oil fell on sharp increases in US crude and gas inventories, and finished the week just above $60/bbl.

As we head further into this year, I expect US economic data to reflect the impact of marginally higher interest rates, the decline in catastrophe spending, and relatively tight central bank policies around the globe. The larger question is how markets here will react to the prospect of a trade deal and more speculation with respect to Fed rate cuts. Many of these things have already been priced into stocks because of extensive media coverage, so a sell-the-news proposition has considerable merit from the vantage point of an extremely overbought condition. Selling into the rallies, as has been common lately, may highlight the initial action before a more serious correction can take place.

Best Regards,

David Burgess

VP Investment Management

MWM LLC