Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Trade War Babble Dominates

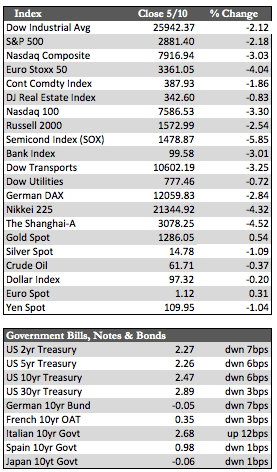

A breakdown in US/China trade talks forced an already vulnerable stock market into a bit of a tailspin this week. The indices fell between 3% and 4%, led by the tech and materials sectors, as the Trump administration increased tariffs from 10% to 25% on $200 billion worth of Chinese goods. It is also said that Trump is starting “paperwork” on a 25% tariff that would be applied to a completely separate $325 billion in Chinese imports. I assume that would go into effect if President Xi’s ongoing visit to Washington results in another stalemate. China is naturally reluctant to change its laws pertaining to, in this case, forced technology transfers and protecting intellectual property rights.

If the punitive tariffs are applied, China has vowed to retaliate in like form, which is expected to reduce corporate profits by an estimated 5%. Traders remain skeptical of that happening, asserting that tariffs of such magnitude won’t last long – so stock bulls bought on the dips all week, both here and abroad.

If the punitive tariffs are applied, China has vowed to retaliate in like form, which is expected to reduce corporate profits by an estimated 5%. Traders remain skeptical of that happening, asserting that tariffs of such magnitude won’t last long – so stock bulls bought on the dips all week, both here and abroad.

Away from stocks, Treasuries rallied as a safe haven even as the bid-to-cover ratios in the latest bond auctions fell to the lowest levels in 10 years. And for the first time since March, the yield curve began to invert again between the 3-month bill and the 10-year note. The dollar fell back from its recent highs (for a number of reasons), but managed to remain within its bullish trend. Still, a break below 96.60 – a stone’s throw away on the charts – would be bearish territory for the dollar, and perhaps bullish for the metals. The metals’ advances have been thwarted by the dollar’s strength and perhaps restrictions on trade. They finished the week in mixed fashion, as gold gained 0.62% to silver’s loss of 1.07%. Oil received a small boost on a 3.96 million barrel reduction in US inventories, and perhaps the contamination that hit Russian pipelines, but still closed out the week relatively unchanged.

As for the economic data, it’s still showing that things are getting weaker rather than stronger – this while tariffs remained static and pretty much inconsequential since last September. US PPI (0.2%) and CPI (0.3%) for April both came in much lower than last month, and lower than expectations. PPI was actually 0.6 in March. In any case, these are just a few of many data points suggesting that the US is headed for the same quagmire, economically speaking, as many overseas markets. It’s doing so because of interest rates, storm spending, etc., not necessarily tariffs. Next week, stocks may continue to be soft unless a much-better-than-expected trade deal emerges (which I doubt). We’ll also get a look at China manufacturing, US retail sales, and housing data for April.

Best Regards,

David Burgess

VP Investment Management

MWM LLC