Podcast: Play in new window

Gold kicked the week off dropping just below the $3,300 level, while silver dropped down about 2%. Platinum held onto its strong gain following last week staying near $1,060, though palladium took a sharp drop by over 7%. Copper remained flat overall at $4.60 but is up over 10% from 2020’s high.

The S&P 500 inched up 1%, reaching the break point seen in March.

Amid economic uncertainty, long-term buyers are turning to gold more and more as confidence in currencies and market stability continues to wane. Let’s take a look at where prices stand as of Wednesday, May 28:

The price of gold is down 1.5%, from our recording at $3,290.

The price of silver declined 2% from a week earlier, sitting at $32.97.

Platinum is even on the week, sitting at around $1065. That’s following a significant jump up 11% from the previous week.

Palladium is down this week, sinking about 7.5% on the week, at around $957.

Copper is sitting at $4.60, down 0.8%. But that’s after a massive trading range over the week.

Moving over to the paper markets…

The S&P 500 is up about 1% from a week earlier, sitting at around 5,900.

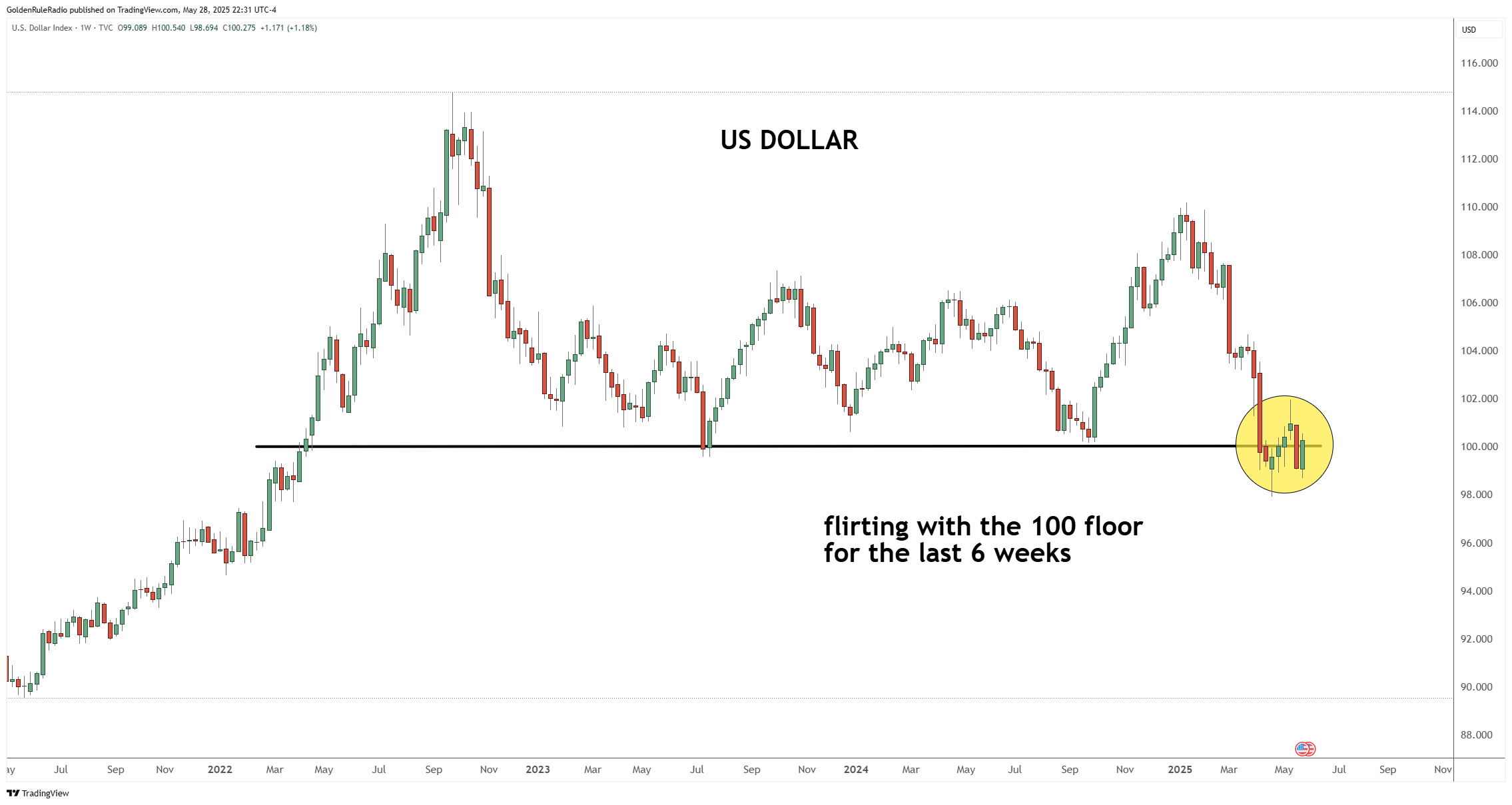

The dollar index is hovering just below the 100-level mark, currently sitting at 99.85. There was a nice small run on the dollar, but it’s now pushed back below 100.

Gold’s Technical Outlook: Declining Channel and Seasonal Weakness

Gold is currently trading in a well-defined declining channel after its recent spike near $3,500. At the time of recording, gold pulled back to around $3,290, showing a classic pattern of lower highs and lower lows. The technical setup suggests that gold may be heading toward the $3,000 level, where the 200-day moving average and the key 61.8% Fibonacci retracement converge.

Seasonal trends also point to potential further weakness in June and July, historically softer months for precious metals. For patient investors, this could present a strategic opportunity to add ounces at lower prices before the next leg higher. When multiple technical indicators align, it often marks an attractive entry point for long-term accumulation.

Platinum and Palladium Divergence

Platinum has broken decisively above palladium, now trading over $100 higher per ounce—a reversal years in the making. This divergence reflects shifting industrial demand and supply dynamics. Meanwhile, copper remains volatile within a broad trading range, highlighting ongoing uncertainty in the broader commodity complex.

While gold and silver remain the core of most precious metals portfolios, the action in platinum, palladium, and copper underscores the value of diversification and the need to monitor all corners of the metals markets.

Central Bank vs. U.S. Retail Demand

A defining feature of the current gold market is that it’s being driven by “top-down” buyers—central banks, sovereign wealth funds, and institutional investors—rather than U.S. retail investors. The Commitment of Traders data and IMF statistics show that central banks are increasing their gold reserves, with gold now backing over 20% of global currency reserves, up from just 9% a decade ago.

Meanwhile, U.S. retail investors remain largely on the sidelines, buoyed by strong consumer confidence and distracted by equity market performance. This divergence suggests that the “smart money” is positioning for long-term currency and debt risks, while retail participation could provide additional fuel for gold prices once sentiment shifts.

U.S. Debt, Deficits, and Global De-Dollarization

Recent headlines have been dominated by Moody’s downgrade of the U.S. credit rating and a notably weak bond auction, both of which underscore growing global concerns about U.S. debt and deficits. The administration’s stated focus on economic stimulus over fiscal tightening, combined with resistance to meaningful spending cuts, points to persistent structural deficits.

The conversation is shifting from just the deficit to the much larger issue of total debt—a problem that’s not unique to the U.S., but shared by most major fiat currencies. This is fueling a global rotation out of government debt and fiat currencies and into physical gold, especially among central banks who are making decade-long commitments to gold as a reserve asset.

Rotation Out of Bonds and Fiat Currencies into Gold

We are witnessing a new cycle in the bond market, with yields rising after decades of decline. This has led to a loss of confidence in government debt and fiat currencies, prompting central banks and institutional investors to increase their allocation to gold. This is not a short-term trade, but a long-term strategic shift that reflects deep-seated concerns about the sustainability of current monetary and fiscal policies.

For investors, this trend reinforces the importance of holding tangible assets—gold, silver, platinum, and palladium—as a hedge against currency debasement and financial system risk.

Strategic Patience and Long-Term Positioning

The current environment is defined by technical consolidation in gold, institutional accumulation, and mounting macroeconomic risks. For investors, this is a time for strategic patience—using seasonal and technical weakness to build positions, and staying focused on the long-term drivers of precious metals demand.

Here to Help

As always, the McAlvany team is here to help you navigate these markets, execute ratio trades between metals, and structure your portfolio for resilience in the face of ongoing monetary and fiscal challenges. If you’d like to discuss how to add precious metals to your portfolio, or how to convert your retirement accounts into a precious metals IRA, reach out to your trusted McAlvany advisor today. Reach us at 800-525-9556.