More

Silver is often called “poor man’s gold,” but that nickname doesn’t capture its full potential. More affordable than gold — and historically more volatile — silver offers investors a chance to balance their portfolio while adding meaningful growth opportunities. Contact a Silver IRA Advisor today.

Work with a McAlvany advisor to open a new self-directed IRA or roll over funds from an existing Traditional, Roth, or SEP IRA.

Your advisor guides you through selections of IRS-approved silver coins & bars, including American Silver Eagles & Canadian Maple Leafs.

Your silver is safely held in an IRS approved depository, fully insured and regularly audited under your name.

Silver IRAs allow you to hold physical silver in a tax-advantaged account and to benefit from market cycles that favor precious metals.

A Silver IRA is a self directed individual retirement account that holds physical silver coins and bars as part of your retirement savings. It isn’t a separate account type — it’s part of a broader Precious Metals IRA.

When you open a Precious Metals IRA, you have the ability to hold physical gold, silver, platinum, and palladium — all within one self-directed retirement account.

With a Precious Metals IRA, you can hold gold, silver, platinum, and palladium all within the same account. Your silver is stored in an IRS approved depository under your name, fully insured and audited for your protection.

This is not a silver ETF or mining stock. It’s real, allocated silver that becomes a foundation of your retirement portfolio.

Silver behaves differently than gold — and that difference brings unique benefits to a retirement portfolio.

More Volatile, More Opportunity

Silver prices tend to move faster and swing more sharply than gold. That volatility can create significant upside potential when silver rallies.

An Affordable Entry Point

Silver costs far less per ounce than gold, making it easier to build meaningful holdings quickly and maximize exposure.

The Gold to Silver Ratio Advantage

McAlvany advisors help clients monitor and use the gold to silver ratio, strategically swapping between metals to accumulate more ounces over time.

A Historical Hedge

Like gold, silver has been used as money for centuries and has consistently gained value during periods of inflation and economic uncertainty.

Bottom line: Silver brings energy to a Precious Metals IRA. It complements gold’s steadiness with movement, affordability, and opportunity.

The IRS requires silver in an IRA to be at least 0.999 purity. Eligible products include:

What doesn’t qualify?

Collectible coins, older numismatics, or jewelry. McAlvany advisors ensure every ounce in your IRA is 100 percent IRS approved.

Silver offers a rare mix of growth potential and protection. Unlike paper assets, it is a tangible store of value with centuries of proven use.

Diversification

Silver moves differently than stocks and bonds, helping reduce portfolio risk.

Inflation Hedge

Silver has historically gained value during inflation and dollar weakness, protecting purchasing power.

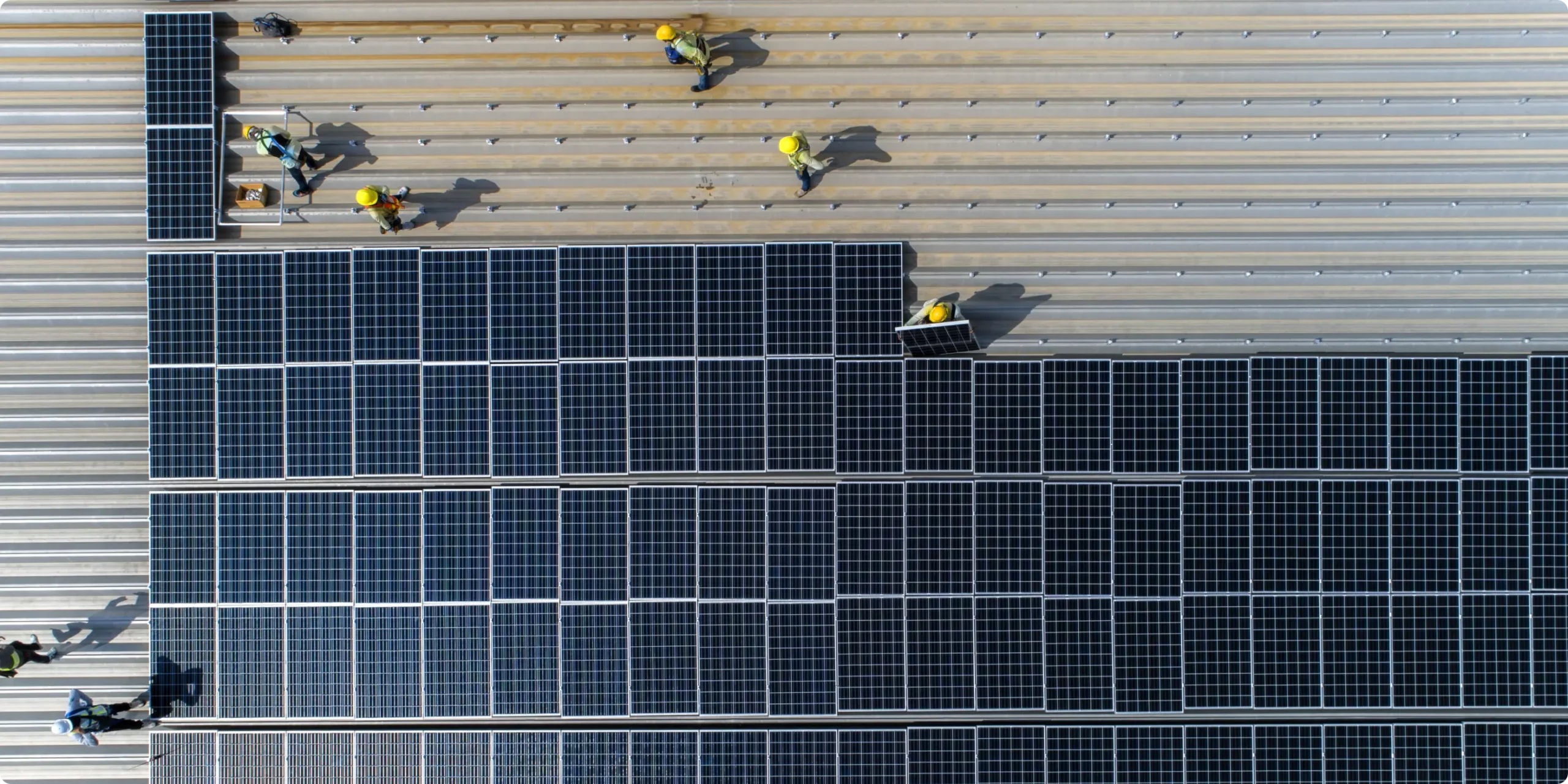

Industrial Strength

Nearly 60 percent of demand comes from solar, EVs, electronics, and healthcare — industries driving future growth.

Affordable Access

Silver trades well below gold, making it easier to build meaningful holdings and benefit from price rallies.

Undervalued Opportunity

With the gold to silver ratio near 90 to 1, silver remains deeply undervalued compared to gold, offering strong upside potential.

7 Consecutive Years of Supply Deficits — Nearly 800 million ounces shortfall from 2021 through 2025.

60 Percent Industrial Demand — Driven by solar panels, electric vehicles, 5G, and medical technology.

Affordable Entry Point — Silver trades far below gold, making larger allocations accessible.

Gold to Silver Ratio Near 90 to 1 — Well above the historical average of 50 to 1, suggesting silver is undervalued.

Up Nearly 30 Percent in 2025 — With forecasts projecting silver could climb to 40–50 dollars per ounce in the near term.

Silver’s demand is being reshaped by technology and industry innovations. From clean energy to AI and advanced electronics, silver’s role in modern life is expanding — and supply deficits highlight its long-term potential as part of your IRA.

Silver is vital for solar cells, enabling efficient energy capture. With solar capacity set to nearly triple by 2030, demand for silver in photovoltaics is climbing steadily.

Semiconductors and 5G infrastructure depend on silver’s unmatched conductivity. As the digital economy grows, silver’s role in electronics will only deepen.

Silver’s antimicrobial qualities make it essential in medical devices, wound care, and water purification. Healthcare demand continues to expand worldwide.

Industrial uses now account for about 60 percent of silver demand, creating persistent market deficits and supporting its case as a long-term IRA asset.

Silver’s potential is powerful — but you want the right guidance to use it effectively. McAlvany has built its name on integrity, education, and service. When it comes to your retirement, you deserve nothing less.

One of America’s original precious metals firms, with decades of earned client trust and a reputation for integrity.

Among the first to help investors hold physical silver inside retirement accounts — setting the standard for Precious Metals IRAs.

Our advisors specialize in helping clients use the gold to silver ratio to grow holdings strategically and make the most of market cycles.

You work with a real advisor, not a call center. No hidden markups, no gimmicks — just honest, prudent, experience-driven guidance.

“Working with McAlvany Precious Metals has been one of the best financial decisions I’ve made. I was looking for a way to protect my retirement savings from market volatility and rising inflation, and their team guided”

“McAlvany made the entire process of opening a Silver IRA simple and stress free. Their advisors explained every step and gave me confidence in my retirement plan.”

“I had considered adding precious metals for years, but I didn’t know where to start. The McAlvany team gave me clear guidance and no pressure. Today I have a diversified IRA that feels protected.”

Get a personally tailored plan specific to your financial goals and needs. Connect with an advisor today.

Straightforward answers to the most common questions about how Silver IRAs work, what qualifies, and the benefits they can bring to your retirement.

A Silver IRA is a type of self directed individual retirement account that allows you to hold physical silver coins and bars as part of your retirement savings. Instead of relying solely on paper assets such as stocks, bonds, or mutual funds, a Silver IRA gives you direct ownership of IRS approved silver bullion.

When you open a Precious Metals IRA, you can hold not just silver but also gold, platinum, and palladium. Your silver is stored in an IRS approved depository under your name, fully insured and audited for your protection. This is not a silver ETF or mining stock. It is real, tangible silver that becomes a cornerstone of your retirement portfolio.

Investors add silver to their retirement accounts because it combines affordability with long term potential. Silver trades at a much lower price per ounce than gold, making it easier to build meaningful holdings quickly. At the same time, silver has been in global supply deficit for seven consecutive years, highlighting its strong fundamentals.

Silver is also widely recognized as an inflation hedge. During periods of rising inflation, heavy government debt, or a weakening dollar, silver has historically held or increased its value. By adding silver to your IRA, you are introducing diversification, protection, and growth potential into your retirement plan.

The IRS sets strict rules for silver in an IRA. All silver must be at least 0.999 fine purity, and only certain products qualify. The most common IRA eligible silver includes American Silver Eagles, Canadian Silver Maple Leafs, Austrian Philharmonics, and bars from accredited refiners such as PAMP or Perth Mint.

Popular IRA eligible choices include:

American Silver Eagles

— one of the most recognized and liquid silver coins in the world.

Canadian Silver Maple Leafs — highly trusted bullion coins known for their purity and security features.

Peace Silver Dollar — initially issued from 1921 to 1928—soon after the end of hostilities in World War I, celebrated peace and liberty. It was briefly minted again in 1934-5.

Collectible coins, older numismatics, and jewelry are not eligible for an IRA. McAlvany advisors ensure every ounce in your account is 100 percent IRS approved and guide you in selecting the best silver products for your retirement.

What does not qualify? Collectible coins, older numismatics, jewelry, or silver that does not meet purity standards. McAlvany advisors guide you through the selection process, ensuring every ounce in your account is IRS approved and properly stored.

Opening a Silver IRA is a straightforward process with the right guidance. McAlvany helps you choose a self directed IRA custodian, complete the paperwork, and either fund your account with new contributions or roll over funds from an existing IRA or 401(k).

Once funded, you can purchase IRS approved silver bullion. Your custodian then arranges secure storage in an IRS approved depository. With our advisors walking you through each step, the process is simple, transparent, and tailored to your goals.

Yes. One of the biggest advantages of a Silver IRA is that you have the option to take possession of your silver when you reach retirement age. You can either sell the metal inside your IRA for cash or take delivery of the actual coins and bars you purchased.

Distributions from a Silver IRA are treated like any other IRA withdrawal for tax purposes. Many investors value the peace of mind that comes with knowing they can one day hold their silver in hand as part of their retirement wealth.

A Silver IRA involves some standard costs, which typically include a one time account setup fee, annual custodian charges, and secure storage costs at an IRS approved depository. These fees cover account administration and the safekeeping of your metals.

At McAlvany, transparency is key. There are no hidden markups or gimmicks — only straightforward pricing and honest guidance. Knowing exactly what you are paying allows you to focus on growing and protecting your retirement.

The right allocation depends on your personal goals, risk tolerance, and overall retirement strategy. Many investors dedicate 5 to 20 percent of their portfolios to precious metals. Silver often complements gold in this mix, providing affordability and growth potential.

Silver’s lower price per ounce allows investors to accumulate more ounces, giving greater leverage when prices rise. Combined with its undervaluation compared to gold and strong industrial demand, silver can be a strategic piece of a well balanced Precious Metals IRA.