Thank You from McAlvany ICA

Thank you clients, listeners and readers for making 2017 a tremendous year. As the precious metals markets begin their next cyclical bull rise, 2017 became a year to build the infrastructure and information network necessary to provide you with all the tools needed to prepare for the coming years.

This past year, there was no greater need than to spend as much time with clients like you as possible.

David McAlvany was given the honor of speaking at multiple conferences across the country, including Chuck Missler’s Strategic Perspectives Conference, The Lodi Win Symposium, PaleoFX and others. Don McAlvany returned from his work with Asia Pacific Children’s Fund and orphans’ homes in Indonesia and the Phillippines for our own whistle-stop tour. We had the pleasure of sitting down with thousands of you in the 13 cities we visited and building individualized strategic plans for the future.

David McAlvany’s new book The Intentional Legacy has circulated widely over the last year. Drawing from over fifty years experience in a multi-generational wealth management firm, personal failures, and successes, David presents a strategy for “reverse engineering” your life; a redemptive ethic for family prosperity based on love, forgiveness, and non-contingent relationships. If you have not picked up your copy, click the book for more details.

The first year of Golden Rule Radio, a new metals-focused YouTube show, is finished bringing charts and technical market analysis to you in a brief, weekly format. It’s designed to compliment our podcast The McAlvany Weekly Commentary, which is now in its 10th year, and our monthly newsletter, The McAlvany Intelligence Advisor, running for over 30 years.

The first year of Golden Rule Radio, a new metals-focused YouTube show, is finished bringing charts and technical market analysis to you in a brief, weekly format. It’s designed to compliment our podcast The McAlvany Weekly Commentary, which is now in its 10th year, and our monthly newsletter, The McAlvany Intelligence Advisor, running for over 30 years.

Finally, there’s a new, streamlined website, offering you even greater access to market news, events and updates. The plan for 2018 is to continue to be your premier stop for news, education and financial guidance through the economic and geo-political events that shape our markets.

The US Dollar

nowhere to go but down

Following the highs of December 2016, the US Dollar quietly declined over 10%. While public attention was focused on Bitcoin, the purchasing power of your real, hard-earned income has fallen substantially. Food, gas, clothing, education and home ownership costs have and will rise as the US Dollar is likely to continue down in 2018.

Following the highs of December 2016, the US Dollar quietly declined over 10%. While public attention was focused on Bitcoin, the purchasing power of your real, hard-earned income has fallen substantially. Food, gas, clothing, education and home ownership costs have and will rise as the US Dollar is likely to continue down in 2018.

Interest rates rose four times beginning December 2016. Not only has the US Dollar declined in value, but the cost of borrowing for the US citizen and banks alike has risen. The Fed Funds Rate has climbed from near nothing, 0.50% to a paltry 1.5% in the last 13 months. However, should rates continue, investors will look more earnestly towards the bond market, hoping to lock in fixed-rate income. This cyclical shift of assets could cause problems for the US Stock Market, the repository of most Americans’ retirement accounts.

The new tax plan is quite appealing to the average American, and should put extra dollars in most pockets. However, while offering economic stimulus in the private sector, a decrease in taxes does decrease government income. This prompts the question: “Will the government decrease spending to match?” President Trump has made mention of a weaker dollar multiple times, encouraged businesses to bring jobs back to our shores, and make exported goods price-competitive in other countries. But this is a balancing act against government spending, inflation and declining currency value. Will the economic stimulus promised through tax cuts be overpowered by the increasing cost of living expenses through inflation and a declining dollar?

President Trump is also setting his sights on a massive spending plan for infrastructure. With hopes to further stimulate the construction industry and other private sectors, it must be asked; “Where does the money come from?” The likely answer is, “more inflation.”

We have no aversion to decreasing income taxes on the American citizen, increasing economic stimulus in the private sector, or diverting government spending from programs that benefit a few to those like infrastructure spending that benefit many. However, the average American isn’t able to subsequently increase their spending while decreasing their income. The government continues, if not increases this trend. The Fed holds the power of the printing press, and in the immortal words of John Maynard Keynes; “By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

Gold and Precious Metals

the silent stages of the next bull market

The western markets have remained largely indifferent towards metals (for now). Silently, gold and other industrial and precious metals have seen substantial growth over the last two years. Globally, almost 200 tonnes were added to ETF’s, and surprisingly most of this came into the European and US markets. A base is building in the precious metals market in preparation for continued growth through 2018 and beyond.

Since the cyclical bottom was likely formed in December 2015,

Gold is up over 24%

Silver is up over 20%

Platinum is up over 13%

Palladium is up a whopping 125%

Gold is near all-time highs against other currencies like the Japanese Yen, with double-digit returns in Euros and US Dollars in 2017.

A “stealth bull market” is underway as supply is sucked into Asian countries, and the early stages of the next cycle are being repeated from previous years.

- 2001 – 2002 following the Tech Stock crash, gold silently increased 25%. Soon following, the general public shifted focus as the housing market boom began to bust, and gold rose over 300% between 2003 and 2006.

- 2007 – 2008 gold increased over 20%, including an interim high of $1,050, a 70% rise in one year. As the stock market fell, gold subsequently rose over 350%, peaking in 2011 at over $1,900 an ounce

As the US Dollar continues its decline, interest rates rise, the stock market runs out of new investor income and the cryptocurrency experiment shows its faults, gold will retain the title of the de-facto safety, liquidity and growth option in uncertain times.

Silver is most likely the sleeping giant of the precious metals.

Silver is most likely the sleeping giant of the precious metals.

While its returns have lagged behind other metals like gold and palladium, silver investors should enjoy the catch up as metals continue to rise. Follow the simple rule; acquire assets when they are undervalued and sell them when there are overvalued. This is most apparent in the silver market today. If you have not spoken with your advisor at McAlvany ICA recently about the discrepancy in the price ratio between gold and silver, and how best to position yourself to take advantage when the ratio realigns, we encourage you to give us a call today.

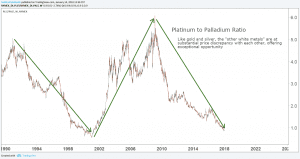

Platinum and Palladium, the “other white metals,” are also offering substantial opportunity regarding their relative price ratios.

Platinum and Palladium, the “other white metals,” are also offering substantial opportunity regarding their relative price ratios.

Between 2009 and 2011, many clients like you were positioned into palladium due to this discrepancy. During the latter months of 2017, palladium neared all-time highs with price increases double that which the stock market had seen, you were encouraged to move those positions along with new investments into platinum.

Many clients who were positioned in palladium six or seven years ago are now able to swap their product into platinum at three, four, or five times the ounce increase.

Click the Image to learn more about precious metals investing and our ratio trading strategies

Bitcoin

a product of its own popularity

Bitcoin and other cryptocurrencies were created with the best intentions: privacy, decentralization from government currencies, and public availability. All are mandates that any gold investor supports. However, bitcoin has become anything but what is was meant to be. Cryptocurrencies have become highly volatile, with substantial gains and losses taking place over just a few days. This rampant speculation in bitcoin and its kin has vastly overpowered the initial intention of the digital currency. Cryptocurrencies had proven illiquid, reflected by both online wallets incapable of processing transactions as well as limited retailer interest in accepting them as payment. Ownership is anything but private, requiring photo ID and personal information to open accounts.

The creation of a digital currency in which everyone has access but no one has control is a feat unto itself. This accomplishment, coupled with the manic investor attention makes Bitcoin something truly to be remembered in 2017. However, the first attempt at a digital, decentralized currency was not without major flaws. Prudent investors should continue to watch with caution for what this technology may grow in to. At this point, there is no certainty as to whether cryptocurrencies today will continue to increase in price due to true value, or pure speculation.

While the technology will likely be refined as it continues forward in some form, fears now arise that the mechanism will be co-opted into existing government currencies, centralizing ownership in the hands of the Federal Reserve and other global banks.

The US Equity Market

where will new investment money come from?

Up approximately 25% through 2017, investor sentiment indicators are at extremes; this is indicative of greed dominating investor behavior. The markets are broadly characterized by herding and uniform decision making. In our view, the majority is often wrong.

Among other indicators, price to earnings (P/E) ratios have reached levels only witnessed just prior to significant crashes. Previously in 2008, when near identical conditions occurred, many investors lost between 50% and 60% of their portfolios. During this time, gold increased from $700 to over $1,900 and silver from $9 to almost $50.

As mentioned above, with expectations of increasing interest rates and government spending, we question the Fed’s ability to prop up the equity markets. Perhaps President Trump’s plans to put money back in the pockets of the American taxpayer and return jobs from overseas will provide the boost needed to replace government intervention and Wall Street manipulation. Or perhaps it will all come down on the shoulders of the US dollar as inflationary spending to keep the stock market afloat drives purchasing power down.

Final Thoughts

We are deeply grateful for each of you and your continued patronage through the years. We will continue to bring you thoughtful planning and strategic actions as we push forward into 2018 and beyond. If last year was one of preparation, then this year is one of action. Whether it be precious metals, retirement accounts, asset planning and management, our advisors at McAlvany ICA want to help you design your individually tailored financial plan, offering both a protective hedge and strategic growth opportunities.

CLICK HERE to schedule your free portfolio review with one of our advisors today.

Thank you and may God bless you and your family this year.