How To Safeguard Your Portfolio In A Fast Moving Market

What you built is worth protecting. The global economy is still not back to what it was, nor will it be anytime soon. Take these 3 easy steps right now to protect your wealth from mass-market shifts.

Why gold can balance your portfolio right now.

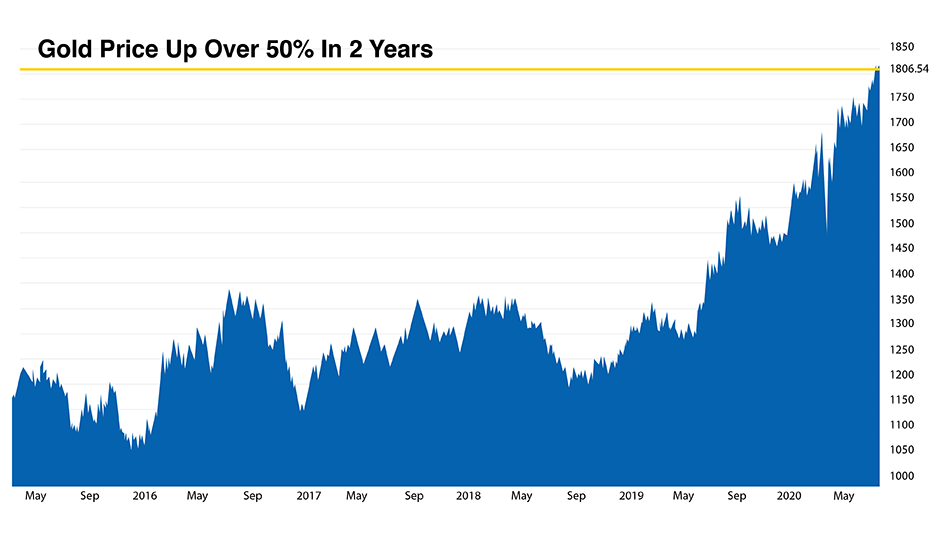

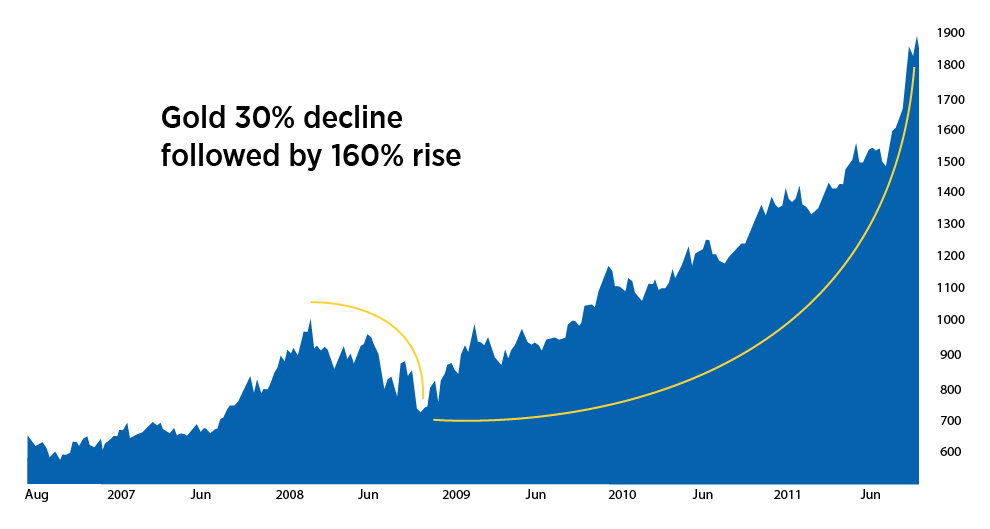

The consequences of shutting down the global economy will be felt for months and years. Gold preserves purchasing power over time, regardless of inflation or deflation which is why the gold price is up 13% so far in 2020. Now is the time to take action with your portfolio, to protect and preserve your assets.

Is your wealth protected?

Here are the 3 key steps to take right now.

- Download the worksheet to assess your current portfolio

- Get a better understanding of your portfolio’s risk & build your plan

- Schedule a call with a McAlvany Advisor to review your risk level to market disruption then make the smart moves to ensure your investments stay balanced

The consequences of shutting down the global economy will be felt for months and years. Gold preserves purchasing power over time, regardless of inflation or deflation which is why the gold price is up 13% so far in 2020. Now is the time to take action with your portfolio, to protect and preserve your assets.

Oops! We could not locate your form.

There is a smarter way to add gold to your portfolio

Don’t get stuck with dead-end products from the mass-market players. There’s a better way to add gold coins to your portfolio. Knowing clearly your investment goals in tandem with a strategic plan from an ICA advisor can help you tackle a long term intentional portfolio vision.

- According to the National Bureau of Economic Research, we are officially in a recession, likely headed for a depression.

- The national debt has skyrocketed to $26 trillion! That equates to $384 billion in interest payments alone each year.

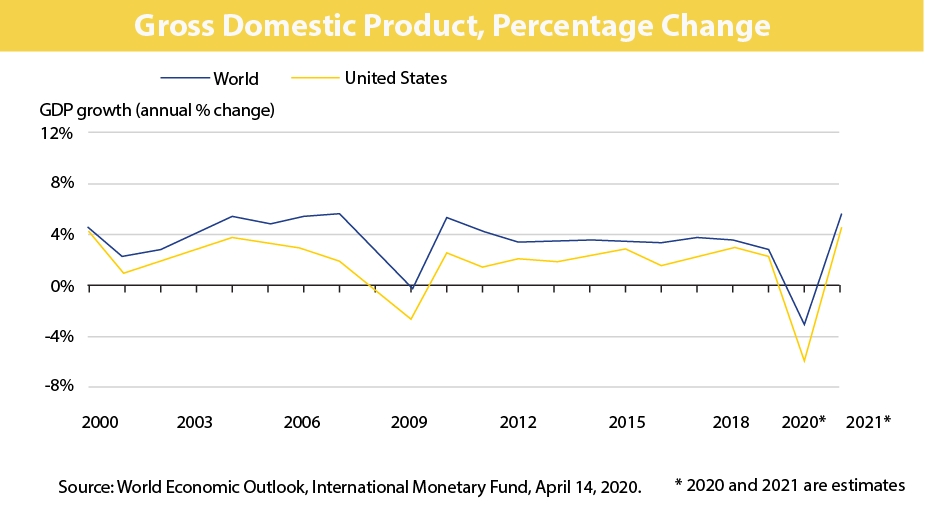

- The US GDP is set to decline by 5.9% which is twice the decline we saw in 2009 after the onset of the financial crisis.

- The US debt:GDP ratio has increased from 57% in 2000 to 130% now. That is up from 113% three months ago.

- The US Dollar Index has decreased from a 17 year high three months ago at 102 to 96 now, a trend that is expected to continue as faith in the currency fades.

- Congress has completely ignored any debt ceiling or spending limits with more money printing to come, borrowing $3 trillion in three months.

- Central banks have printed more than $10 trillion in response to the pandemic.

- The stock market ‘recovery’ after its 34% decline has been driven solely by the stimulus from central banks and sovereign governments. It has provided a false sense of security.

- The current deflation will turn to inflation, causing a likely inflationary depression.

GDP has already slipped below the last recession’s level and is set to decrease to historic lows before even a partial recovery

Will we see a global economic crisis?

The World Trade Organization has projected that global trade volumes are set to decline as much as 32% in 2020.

That may not seem like much but even a 1 – 2 % imbalance in the economy can lead to massive changes in our day to day life. These changes aren’t solved quickly either, it will take a long time before the world is back on track, or at least back to a more normal state.

The post-COVID-19 world will look much different in the coming months and years than it did prior to the pandemic. The resulting economic shutdown has changed the rules, changed the realities, and changed the projections for the US and global economies. That being said, it is imperative to respond with prudence and pragmatism.