Financial Control With One Goal… Destroy Capitalism

You know US government spending is completely out of control. It was unsustainable before the pandemic; now it’s far worse.

With Fed interest rates near zero and pressure to take them negative, you know inflation is not likely; it’s certain. And dollar depreciation isn’t a possibility; it’s inevitable.

You know the party that just took over the US government is not known for pinching pennies. What has been an ocean of spending is likely to turn into a worldwide flood.

You know stock prices have been buoyed by central bank spending for years now. Stocks are priced far more than they’re worth by any objective measure.

You’ve likely read how bonds have been in a long bull market since 1982, but they don’t do well in a high-inflation environment.

You may have even heard about the “Great Reset.” If not, it’s something proposed last May by the World Economic Forum (WEF).

The WEF, whose website modestly offers some advice under the title, “How to Save the Planet,” describes the Reset this way: “There is an urgent need for global stakeholders [meaning billionaires, heads of state, and central bank heads] to cooperate in simultaneously managing the direct consequences of the COVID-19 crisis. To improve the state of the world, the World Economic Forum is starting “The Great Reset Initiative.”

The WEF hopes to influence

The WEF hopes to influence “all those determining the future state of global relations, the direction of national economies, the priorities of societies, the nature of business models and the management of a global commons.”

Its solution involves GLOBAL tax reform, wealth taxes, withdrawal of fossil-fuel subsidies, and new regulations on intellectual property, trade, and competition.

In short, the Great Reset represents a strong push by the world’s financial leaders to globally impose coordinated controls and monetary restrictions that will limit financial and individual freedom. The war on cash will be accelerated as world financial leaders work in tandem to push forward their agenda.

What Should You Do?

Well, you likely also know that while gold has always been a crucial component for dealing with problems like these, gold buyers were disillusioned in the 2010s. In 2011 they learned governments can manipulate the price of gold. The extent to which that was done was disturbing.

So is gold now a bad bet? Even if you value gold only for its convertibility to US dollars, that’s not likely the case. But dollar conversion has never been the best reason for having the metal.

Gold is exceptional in many ways, but its most important traits in bad times are its simplicity and intrinsic value. Modern economic systems are largely manmade. Currencies, rules of exchange, and things like stocks, bonds, banks, and credit systems are all made by people and depend for their success on human ingenuity and oversight. So when the human hand on the economic tiller is unreliable, incompetent, or misled (as by Marxism or Keynesianism), the economy can capsize or run aground.

In contrast, gold has at times been picked up from the ground, panned from a stream, or mined with picks and shovels. Even as a nugget on the ground it is extremely valuable, but it can be melted, coined, and then used to obtain almost any other product or service on the face of the earth.

But here’s what you might not know. Even in competition with all of today’s currencies and assets, gold has held its own. It has outperformed stocks over the past 50 years, and even over the past 20. It has done far better than any national currency anywhere on earth.

It depends on no person, thing, or event to maintain its value, and it has a 6,000-year-old record of seamlessly facilitating commerce and living – and of getting people through times of trouble. No other commodity, asset, or currency even comes close to that record.

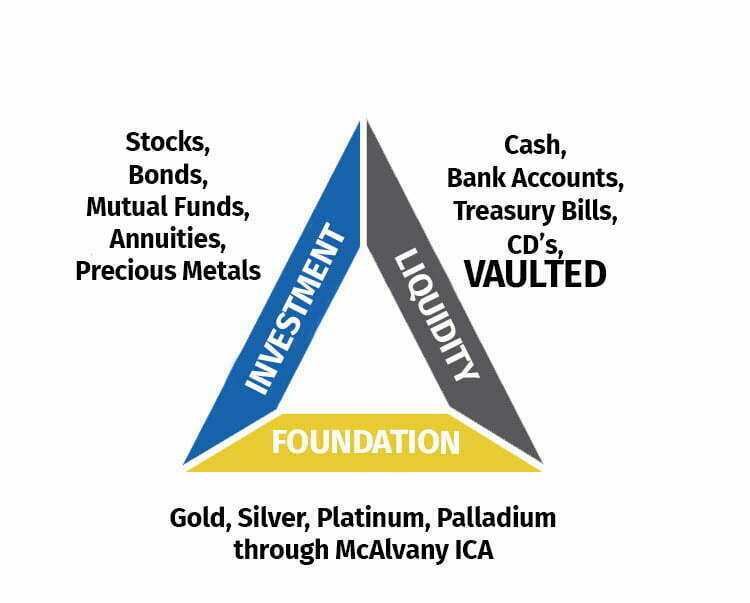

ICA created the Investment Triangle in the 1970s, and has educated generations of investors with it. It’s equal sides flex with personal and external circumstances.

And while perceived risk in the market today is low, actual risk is high. Insurance is the order of the day in risky times, and precious metals are insurance. They’re much more, of course, but they are insurance. You should have at least one-third of your assets in precious metals in this environment.

If you think you’ve missed the boat, that metals prices are too high, understand we’re still early in the downturn of the American economy. The price of almost everything is going up sharply for one simple reason: the dollar is losing its value. Faster and faster.

What do you do when what you hold in your hand is losing its value? Simple. Exchange it for something that’s not losing its value while you still can.

Don’t worry about the deal you could have had yesterday. Act on the deal you have today. All indicators agree it’s likely much better than the deal you’ll have tomorrow.