The Planned Theft of Your Bank Deposits

PREPARE FOR IT, OR FALL VICTIM TO IT

Three sinister Breaking Developments

- New Restrictions on Your Safe Deposit Box

- Negative Interest Rates

- The Ominous Specter of a Coming Wealth Tax

The Fed and the banks would like to make holding cash and gold as difficult and inconvenient as possible. The goal is to have those funds deposited in the banking system where they will be subject to negative returns.

In addition, the government would like for us to convert everything into traceable and trackable deposits or assets, because they are still plotting and planning to implement a wealth tax. They can’t tax you on what they don’t know that you own, therefore, they are intentionally making it difficult (and now dangerous) to hold cash and gold, with no safe deposit boxes available for storage.

New Restrictions on Your Safe Deposit Box

On June 3rd, 2019, KeyBank of Cleveland, Ohio, sent out a letter to all of their customers entitled: “Important Change Of Terms For KeyBank Safe Deposit Box Clients”. In it, they outlined the following four changes:

Important Change of Terms

- The Bank limited the aggregate value of each box, as well as their maximum liability to $25,000. By starting with this point, it would lead one to believe that the letter was primarily addressing an insurance issue, but not so. The second point completely changed directions.

- “You can no longer store gold bullion or non-collectible domestic or foreign currency in your box. ”Why in the world is it their business to tell you that you can’t store perfectly legal cash and gold in your safe deposit box? It clearly is not an insurance issue, since point #1 was to deny liability for any value over $25,000. It’s up to the customer to secure or not secure separate insurance for their valuables. Without question the bank is targeting cash and gold bullion specifically.

- KeyBank has the right to drill and/or enter your box “to ensure your box and everything inside is kept secure.”

- “The Bank has the right to move boxes and/or contents to a new location without any liability…”

These are profoundly intrusive, restrictive, and outrageous changes to the privacy of safe deposit boxes. The question that we must ask ourselves is why? And why now? Keep in mind that KeyBank is a very large bank:

- $138 Billion in Assets

- Over 1100 Branches

- Located in 15 States

- Well over 18,000 Employees

What begins at one major bank is inevitably imitated or even previously planned by other major banks, as evidenced by similar changes at Chase Bank in 2015.

Negative Interest Rates

Another seemingly unrelated event has just occurred. The IMF (International Monetary Fund) released an eighty-eight page “working paper” in April of this year touting the benefits/advantages of negative savings and deposit rates at banks.

In their own words:

“The central message of this paper is that with readily available tools a central bank can enable deep negative rates whenever needed thus maintaining the power of monetary policy to end recessions within a short time.”

“Relying on banks for transmission of a negative rate of return or paper currency reduces the implementation burden and political cost associated with negative rates.”

“The central bank will be concerned about the disruption to the banking system from depositors substituting away from banks to paper currency.” The IMF offers ideas “to counteract this poisonous side effect of people sidestep- ping banks and using cash instead.” They then coach governments suggesting that “large-scale storage outside the home” be “directly prohibited.”

We have been encouraged for years now, in various ways, to abandon cash in favor of debit cards and credit cards. We have been led to believe that we receive “free points” with which we purchase hotel rooms and plane tickets. Actually, retailers are forced to charge more for their products, knowing that the credit card companies will keep a percentage of the sale as a fee. As you know, we pay for our own “free points.”

This is not a prediction of the future. This is happening now!

“The Bank of Switzerland has announced that beginning November 1, they will impose a negative interest rate of .75% on wealthy clients.”

“‘Following similar moves by a number of other banks here in Switzerland, we confirm that we’ve decided to adjust cash deposit fees for Swiss Francs held in Switzerland,’ the bank said, confirming a report by the Financial Times.”

The Ominous Specter of a Coming Wealth Tax

As to the “theory” of a wealth tax: billionaire hedge fund manager Ray Dalio, along with such notables as Berkshire Hathaway’s Warren Buffet and Microsoft co-founder Bill Gates, argue that a wealth tax would help balance things out. REALLY? These three men couldn’t put a dent in their net worth if they spent $1,000,000/day. But what about the average saver/investor?

These developments simply can’t be ignored. They demand our attention.

There is Still Time for the Thoughtful Investor to Formulate a Strategy

First: The KeyBank letter and Roosevelt’s 1933 recall of gold both made exceptions for collectibles. If that is a loophole that has been intentionally created, we would be foolish not to pay attention. We believe it would be prudent to either purchase seminumismatic $20 U.S. Double Eagles or trade a portion of one’s bullion gold for them. Bullion gold includes American Eagle gold coins, Canadian Maple Leaf gold coins, Kruggerands, and a host of other modern bullion coins and bars not minted for actual circulation. U.S. $20 Double Eagles were all dated and minted before 1933 to serve as actual currency.

Second: Market timing couldn’t be better. The bull market in gold was confirmed again recently when it broke above $1,385. Remember, in a renewed bull market, the past high is eventually taken out. The past high in gold was $1,930.00.

Third: Premiums on semi-numismatic gold coins are at historic lows. This means that the price of a $20 gold piece compared to its gold content is much, much lower than its historical average.

Solution to Protecting Your Wealth

For almost half a century, McAlvany Financial has been a forerunner in warning investors and savers about future government regulations that will negatively affect both their privacy and net worth. If you understand the times, and can read the handwriting on the wall, investors simply need to connect the dots to formulate a solid plan that will steer them out of harm’s way.

Negative rates, now firmly entrenched in most of Europe and Japan, are coming to America. The next economic crisis will likely be a time for radical new government restrictions and regulations to be imposed on Americans, in the name of “restoring financial peace and safety.”

As Americans are witnessing a new wave to the political left, it is becoming very obvious that our rights to privacy and personal wealth are being threatened. A “day of reckoning” may indeed be rapidly approaching for America, as our government continues to create trillions of dollars of additional debt, ultimately decimating the purchasing power of our paper “money.”

These new bank and IMF policies are reminiscent of FDR’s executive orders which he passed shortly after taking office in 1933. He closed every U.S. bank and subsequently ordered the recall of privately held gold bullion bars and coins in exchange for paper dollars. The next government gold bullion confiscation will most likely catch the majority of Americans completely unaware.

ICA Has Been Reliably Assisting Investors for Nearly 50 Years

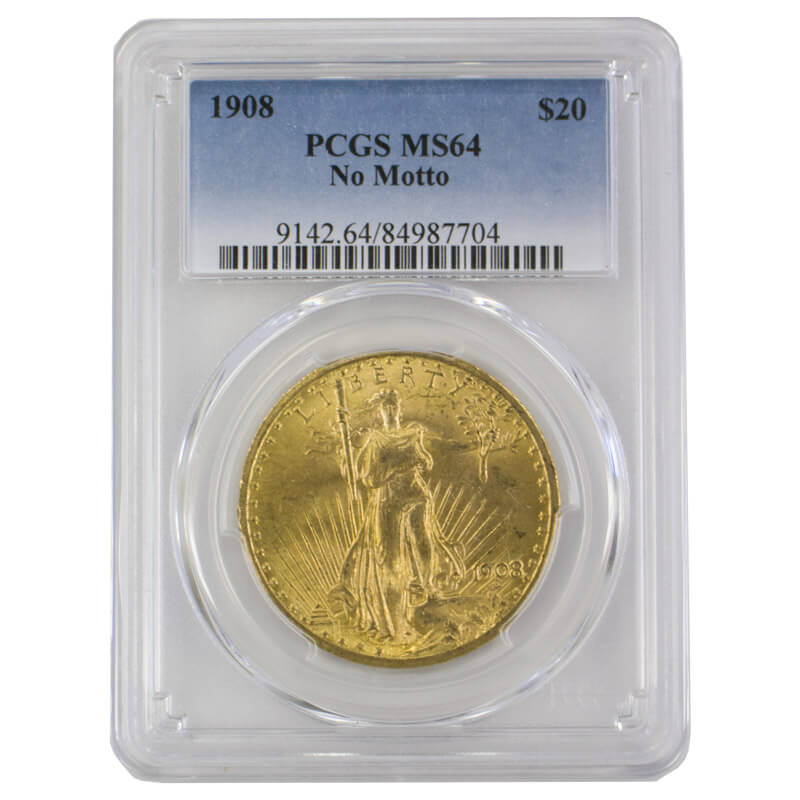

ICA specializes in helping investors and savers reposition assets that are “out of the system.” The ultimate anonymous hard asset, which offers protection, privacy and profit-potential, are the pre-1933 U.S. $20 St. Gaudens and Liberty gold coins.

It is a bit ironic that as a result of American investors largely ignoring the gold market over the past few years, in favor of an over-inflated stock market, investment quality double eagles can now be purchased at their lowest premiums in almost 30 years.

In anticipation of negative government and economic changes, ICA recently started acquiring gold coins originating from one of the finest quality U.S. Double Eagle gold coin caches to surface in over 50 years. Every coin we purchase is hand-selected, certified and graded by the “pickiest grader in America,” as well as by either PCGS or NGC. ICA is proud to offer this outstanding group of gold coins to our clients at historically low premiums.

When the majority of American investors finally become aware of these new draconian banking regulations, negative savings rates, safe deposit restrictions and wealth taxes, there will be a surge in demand for the privacy and security that only gold can provide. We urge you to take action now to protect your financial assets. We believe that we are entering the most dynamic gold bull market of our generation.

Do you have additional questions or want to get started?

Simply click below to receive more information and schedule a free consultation or call