Though gold has been one of the most valuable substances known to man for millennia, its exclusion from the financial system for decades has relegated it to the memory hole for most people—including most investors.

As a result, you get some mistaken beliefs about gold that are often heard by people in a precious metals brokerage company. “Gold is a barbarous relic.” “Gold has no yield.” “Gold doesn’t increase in value like a company can.” “No one cares about gold anymore.” “Gold has no place in a modern investment portfolio.” And so it goes. Day after day. Year after year.

While there are elements of truth to some of these beliefs, they are nonetheless wrong in their essence. At this writing, the US Mint charges $3,200 for a one-ounce gold American Eagle proof coin. One gold Eagle = $3,200. A thoughtful person might consider that to be an item of value. So why all the disrespect?

Well, a partial answer is that it’s harder than it used to be to think broadly or “outside the box.” As schools have focused less on teaching how to think and more on what to think, as politics and media have closed ranks and presented a unified framework for thought (with severe penalties for dissenters), and as most professional organizations have developed commensurate lines of thought and action, true heterogeneity of thinking has fallen on hard times.

In the name of diversity, we have one party line. In the name of toleration, we crush dissent. In the name of independence, we act in accordance with what’s expected. And in the name of diversification, investors buy different kinds of stocks—in different sectors if they’re really savvy. Or perhaps they’ll throw some bonds into the mix.

We’ve written recently in this space of using a wrench when a hammer is needed. It’s a powerful saying, unfortunately robbed of impact by familiarity and simplicity. Anyone who’s had to “make do” without the right tool knows how difficult and even harmful it can be. Pounding nails with a wrench is baaaad juju.

So if you solemnly intone to an MPM broker that gold earns no yield, he will completely resist the urge to respond, “duh.” That would be bad form. Besides, he knows you are intelligent and thoughtful, and have simply fallen in with bad fellows. Instead, he’ll answer you, “It’s true. Gold is not a wrench. But it’s an excellent hammer. You should have a variety of wrenches in your toolbox. But don’t you think a hammer might be nice when you need to slam that 16d home?” Or something like that. Maybe not those exact words.

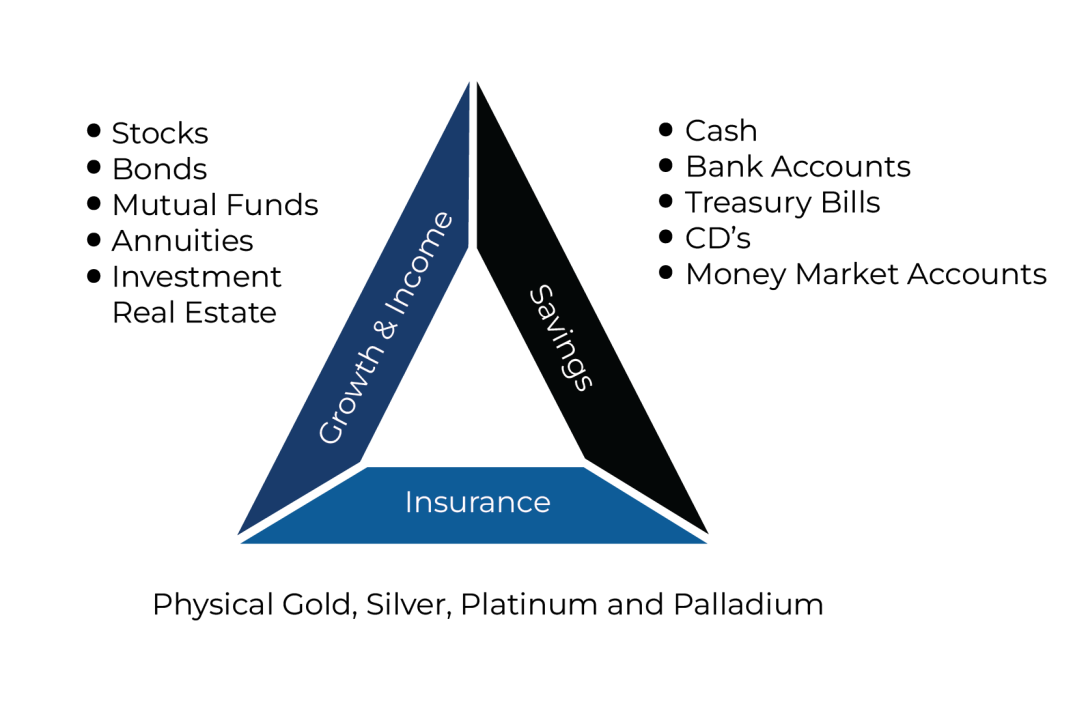

If you haven’t done so, check out MPM’s perspective triangle. It offers perhaps the most optimal “investing toolbox” ever devised. It’s powerful, it’s flexible, it’s versatile, and it’s easy. You’ll notice that personally held gold is used as the “insurance” leg in the triangle. It’s not used as the “growth and income” or “savings” leg, though it can aid with those things at times. It’s fundamentally used as insurance.

Why? For many reasons, but two of the most important are its enduring value (especially in times of crisis) and its lack of counterparty risk. In other words, no one can take its value from you through theft or negligence unless they literally steal it from your house. Stocks, bonds, and cryptocurrencies have massive counterparty exposure in addition to the potential for loss inherent in normal market activity.

David talks about “stupidity insurance” this week. Not your own, of course—our clients are pretty brilliant—rather the folly of those who manage our economy. (And yes, if you happen to have a V8 moment—not that any of us do—it can help with that, too.) As America’s debt becomes too big to manage, and inflation continues to climb, this kind of insurance is a no-brainer.

In short, gold is not just valuable because it’s valuable. It’s valuable because of its role in a fiat currency economy. If you understand that, you’ll be ahead of 99 percent of your peers, and you’ll be able to insure your portfolio against just about any eventuality. And you’ll stop pounding nails with a 7/16ths spanner. Please believe—that’s a good thing.

But there’s more. MPM’s clients enjoy an incredible advantage enjoyed nowhere else. With MPM, gold is not just a bump-on-a-log investment, purchased and stored indefinitely without management. MPM has a unique way to increase its clients’ ounces of gold without additional cost. You’ll want to find out more about this process. No one else offers it. David and Kevin discuss it this week in the Commentary.

Key Takeaways:

- Financial repression on the horizon

- High-schoolers investing during exams

- Debt matters

- “Sell in May and go away” goes away

The McAlvany Weekly Commentary: Gold Is Stupidity Insurance

Continuing the topic addressed above, David discusses MPM’s program for increasing clients’ precious metals ounces without additional cost, “I’m often asked, ‘So who is your competition?’ I have to say we don’t really have any, there’s no one that owns this space in terms of being able to compound ounces.” This is a huge advantage. All it takes is patience, knowledge, action, and patience—and did we mention patience? But good things come to those who wait, and in this case the good things are free ounces of precious metals. They’re especially good when you consider that they’re “stupidity insurance” against monetary policy that, as calculated by Bloomberg, is increasing the national debt by $2 million per minute. David and Kevin also discuss the financial repression that will be an inevitable part of the government’s “solution” to the fiscal emergency now taking shape. They do so partly by hearkening back to David’s interview of Carmen Reinhart, in which she noted (of the government) that, “you can put a cap or a ceiling on interest rates. You can have government ownership or control of domestic banks or financial institutions. You can create or maintain a captive domestic market for government debt. You can direct credit to certain industries. And of course, you can let inflation run a little hot.” For individuals, this is a lose-lose proposition.

Credit Bubble Bulletin: Zhang Zhan

How high is inflation? How high should it be? Are financial conditions loose or tight? What should be done as a result? When every option is costly and major voices in finance and banking disagree, it’s like shooting skeet with a bow and arrow off the back of a small boat in high seas. Everything’s moving, and no one agrees on how the arrow should be held, where the shot should be placed, or even where the clay pigeon should be thrown. Doug updates us on the differing voices involved and the apparent direction the Fed intends to proceed. In the process, he brings some historical definition to the debate, asserting that, “once inflation has taken hold, it becomes quite difficult to return to price stability.” He also perfectly captures the insanity of the times with an anecdote: “One of my son’s high school pals had an especially rewarding trading week. He had purchased GameStop call options ahead of Monday’s price spike. We’re at the stage of the speculative cycle where traders—from high schoolers entering trades between classes (and during examinations, I kid you not) to hedge fund operators trading around the clock—have learned the tricks of the trade. Risk-taking has been rewarded again and again. Traders are emboldened and playing with the house’s money. Disregard economic data, Powell, and geopolitics. It was the splashy return of ‘Roaring Kitty.’”

Hard Asset Insights: The Debt’s Too Darn Big

Morgan again drives home Bob Farrell’s assertion that the rules are changing. According to Morgan, this transformation drives two subordinate developments: “First, financial assets benefited from the old rules; hard assets stand to prosper from the new. Second, on a more micro scale, HAI is of the strong view that while gold mining stocks languished under the old regime, they will thrive under the new.” He then proceeds to quote Adam Rozencwajg from an interview with Macro Voices. The quotation notes with clarity the reason gold stocks haven’t risen appreciably till now, and why they will do so in short order. The short version? Rozencwajg agrees with Farrell. The rules are changing, but most investors are still proceeding by the old rules. So when will investors wake up to the change? Morgan believes they are starting to do so. Taking BlackRock as an effective proxy for the Western investor, he quotes from an interview of the company’s Chief Investment Officer, Rick Rieder. When asked by Real Vision’s Raoul Pal how the government will finance the rollover of the debt if the Fed doesn’t lower rates, Rieder responded that, “They can’t, and I think the biggest risk in the next couple of years is the debt’s too darn big.” Morgan’s conclusion is that, “That response could mark the unofficial changing of the guard from the old rules to the new.” The Western investor might just be waking up and smelling the coffee.

Golden Rule Radio: Bullish Gold

“Where did ‘sell in May and go away’ go?” asks Miles. Gold was up $80 from the week before at recording time. Silver, too, was up $2.35/oz. to $29.70. Platinum and palladium were also up significantly for the week, while the dollar was down. “The metals are responding exactly how you would expect them to on a dollar decline, and the S&P and the Dow are actually doing okay.” Tory points out that though this is entirely as it should be, the story is deeper than that. Copper is also up sharply, which Rob notes is very bullish for silver. And markets are acting as though they expect a rate cut from the Fed in the near term, perhaps this summer. Rob adds confirmation in that, “money is flowing into the bond market in anticipation of a rate cut.” Tory notes that the S&P has closed at record highs 23 times in 2024, while the Dow has done so 18 times and the Nasdaq eight times. Returning to silver, the hosts cite a variety of reasons to be bullish, but all agree that the immediate future looks bright for the white metal. They were not so certain in regard to gold, but Miles stated that if it went above $2,400, he would be cautiously bullish. He follows that with some further chart analysis involving the 50-day and 200-day moving averages, whereupon the hosts conclude that things do look very good for gold.