Diversify your Precious Metals Portfolio now with Platinum!

You’ve heard the wise old saying, “Don’t put all your eggs in one basket.”That principle is especially true when it comes to building a strong investment portfolio. Unfortunately, many investors who have purchased precious metals have concentrated only in gold or perhaps silver, and have ignored the rarest of the precious metals group, platinum.

If you don’t currently own any platinum and are heavy only in gold or silver, we recommend you begin now to reposition your metals portfolio. The best part is, you can do it successfully without spending a dime!

When adjacent things move at different rates, powerful things can happen. When tectonic plates move, earthquakes occur. When glaciers move, landscapes are shaped. When pistons move, heavy vehicles are propelled. When precious metals prices move in relation to one another – well, when that happens, fortunes are made. You just have to know-how.

*Ratio Changes with the Markets

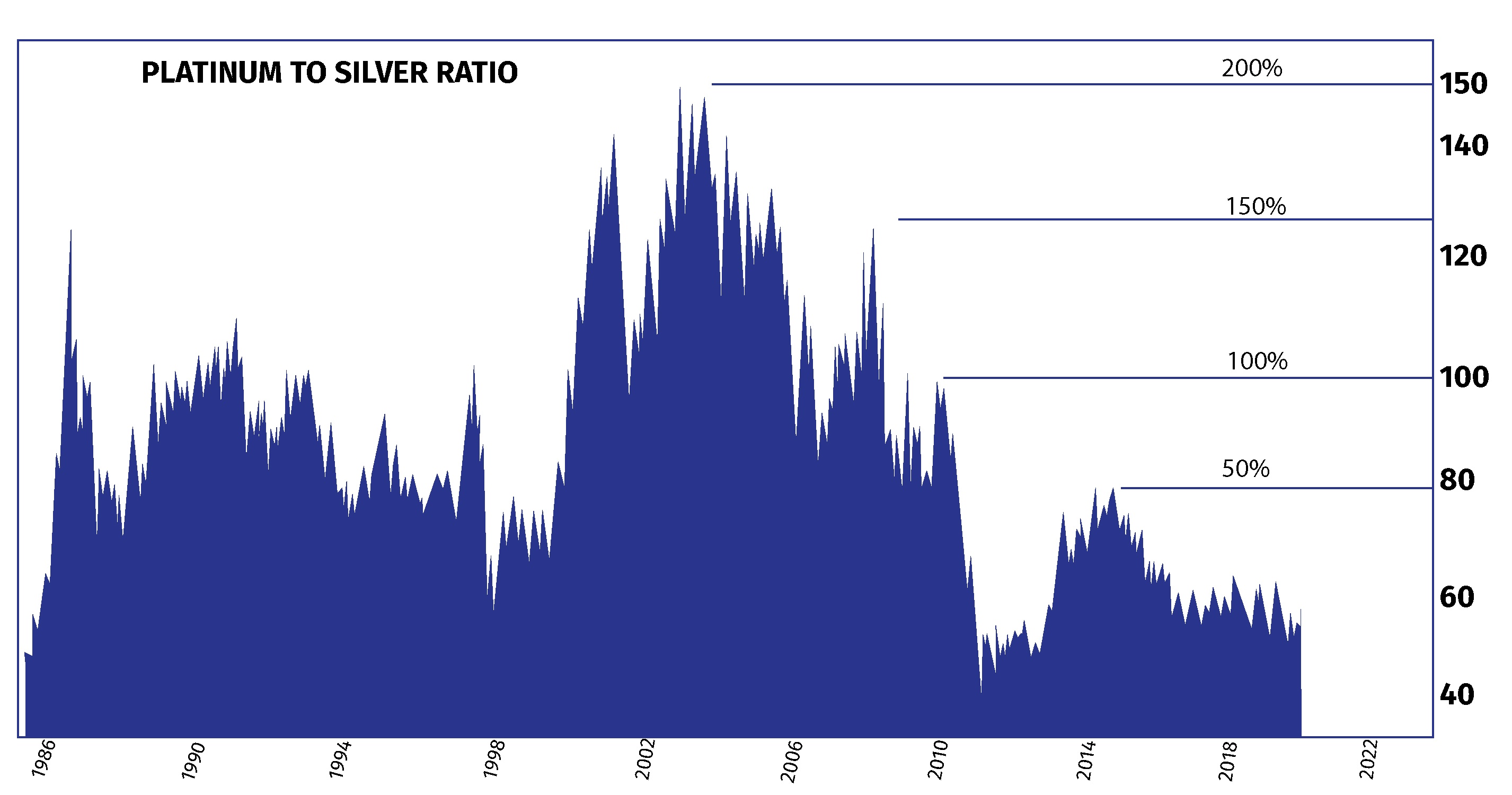

As careful students of markets, experts at ICA observed this phenomenon decades ago, and have employed it for their clients’ benefit ever since. Called the Ratio Trading Strategy, it entails repetitive trading into undervalued metals from overvalued ones. This method is so effective and so powerful that it recently netted most of its users a hefty 300 percent increase in the number of platinum ounces in hand. All this was done by trading ounces already possessed – no new purchases were necessary.

Many clients have discovered that by ratio trading within a well-diversified precious metals portfolio, they can add a substantial quantity of ounces to their holdings, even in falling markets. All markets, including gold, silver, platinum and investment coins move through cycles. The key is understanding when to trade and which metal or combination of metals will best take advantage of cycle movements. ICA can assist you with this timing. If you are a conservative, long-term investor, we recommend you contact us and begin to realize the benefits of strategic trading.

In 2003 we purchased 40 ounces of Platinum from my ICA advisor. We traded those for 140 ounces of Palladium in 2009. Recently, we sent back the Palladium and switched to Platinum again, receiving 95 ounces. We now have more than double the ounces of Platinum that we started with and triple the dollar value that we originally invested.

R.R. – Minnesota

We can help you determine how to build a proper combination of gold, silver and platinum coins and bars that will be best suited to achieve your investment requirements and goals.

Why You Should Acquire Platinum Now

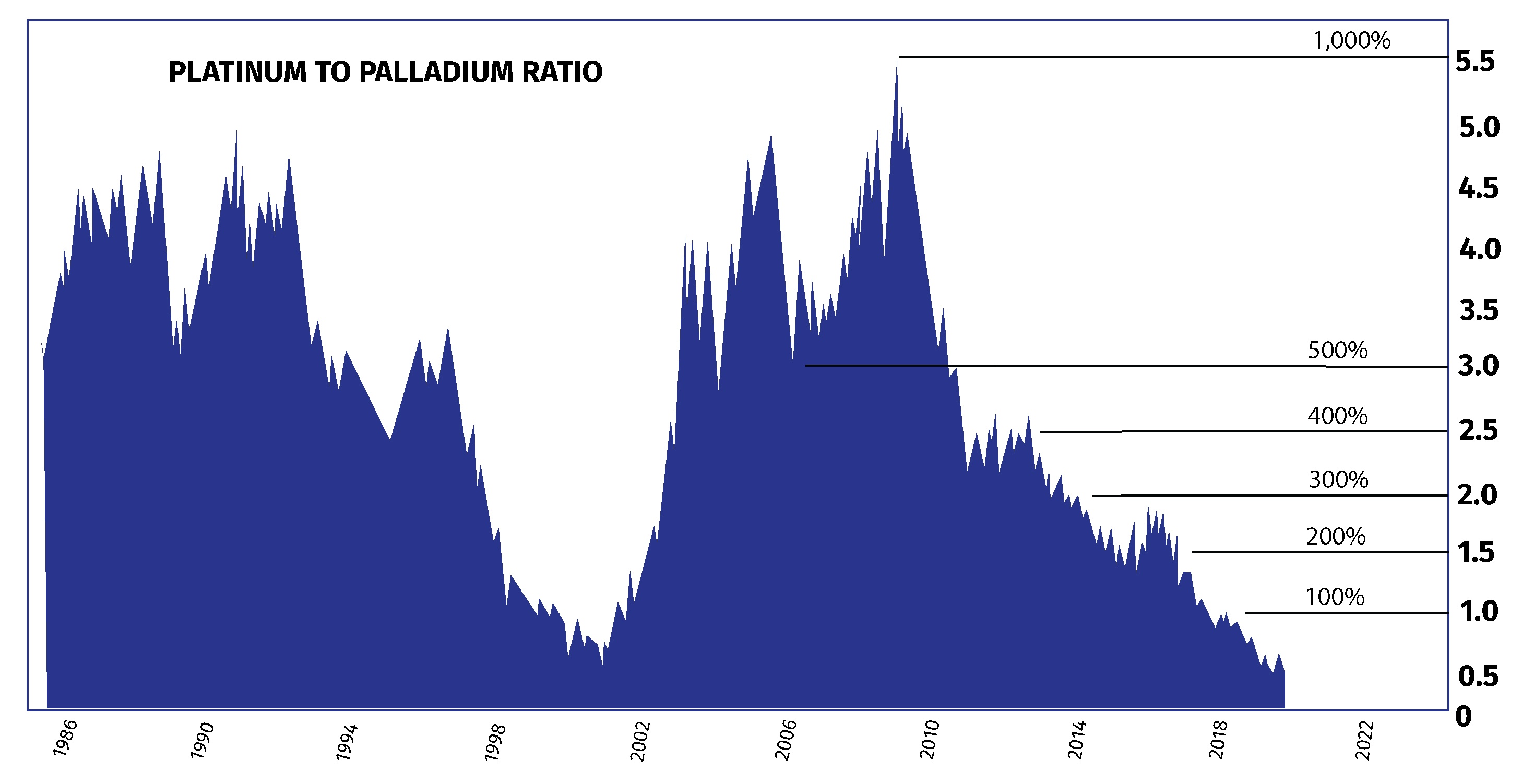

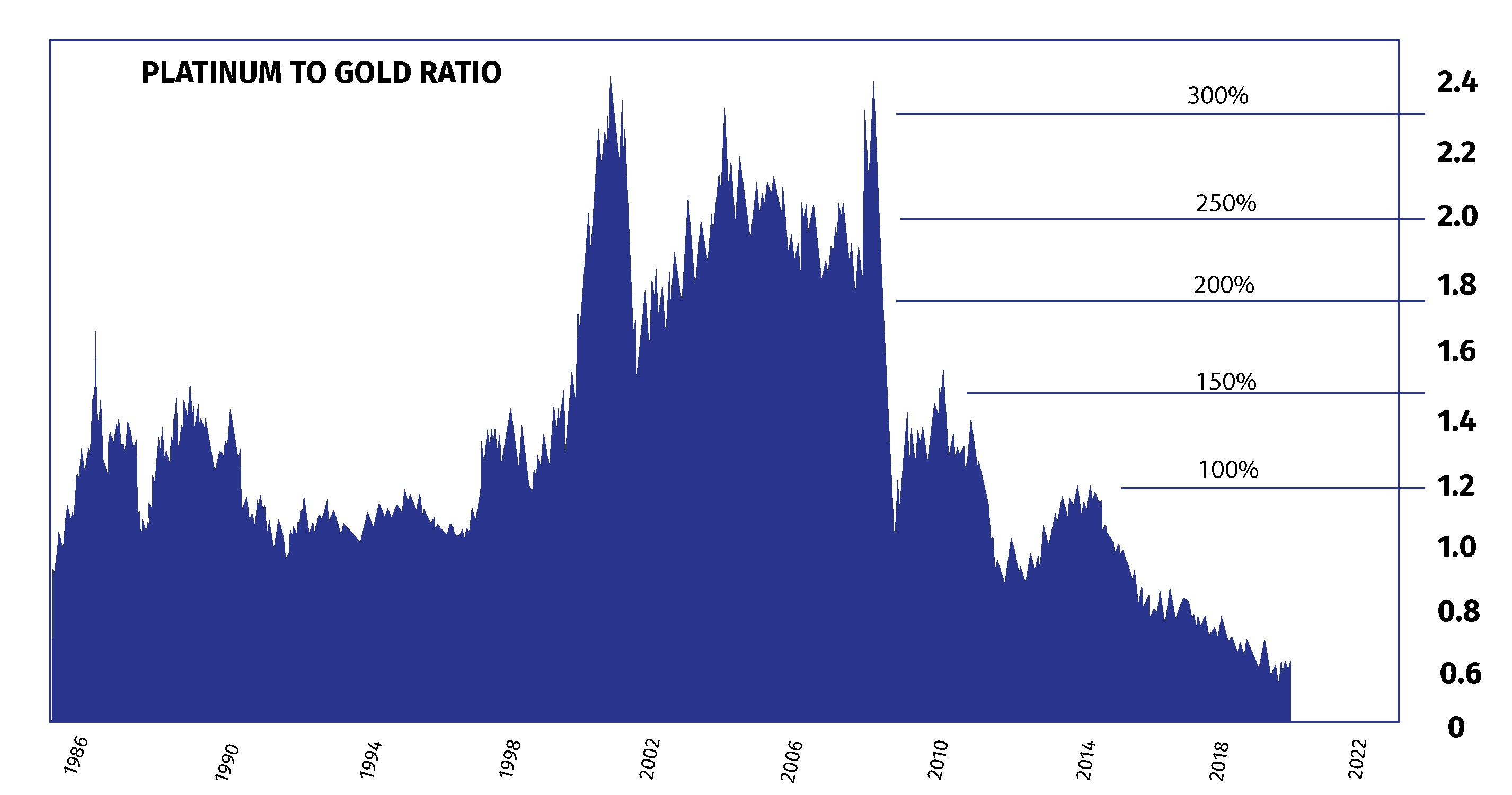

- Platinum is rarely at a discount to either gold or palladium

- Platinum’s current discount to both gold and palladium is the greatest in 40 years

- Platinum’s undervalued nature is confirmed by other precious metals; gold, silver, and palladium

- The ratio serves as a way to multiply ounces within a metals portfolio

- There are multiple exit strategies through gold, silver, and palladium

A return to the average ratio would net a 200% return in ounces,

A return to the average ratio would net a 200% return in ounces,

with a 300% return at the old high

A return to the average ratio would net a 100% return in ounces,

A return to the average ratio would net a 100% return in ounces,

with a 200% return at the old high

A return to the average ratio would net a 300-400% return in ounces,

with a 1,000% return at the old high

Your investment requirements and goals can easily be employed as a strategy in IRA’s. Please call 800-525-9556 for more details concerning placing precious metals in your IRA.