Podcast: Play in new window

Gold and precious metals were largely flat over the week, as broader markets gyrated on AI news from China and the Fed’s decision to keep rates steady. Let’s take a look at where prices stand as of our recording on January 29:

Gold is flat at $2,755 from a week earlier. Gold did touch up into its all-time high territory for a moment, but it didn’t reach its record.

Silver is sitting at $30.65 — dead even from a week earlier. Silver did have a mid-week dip down 3%, but recovered by the time of recording.

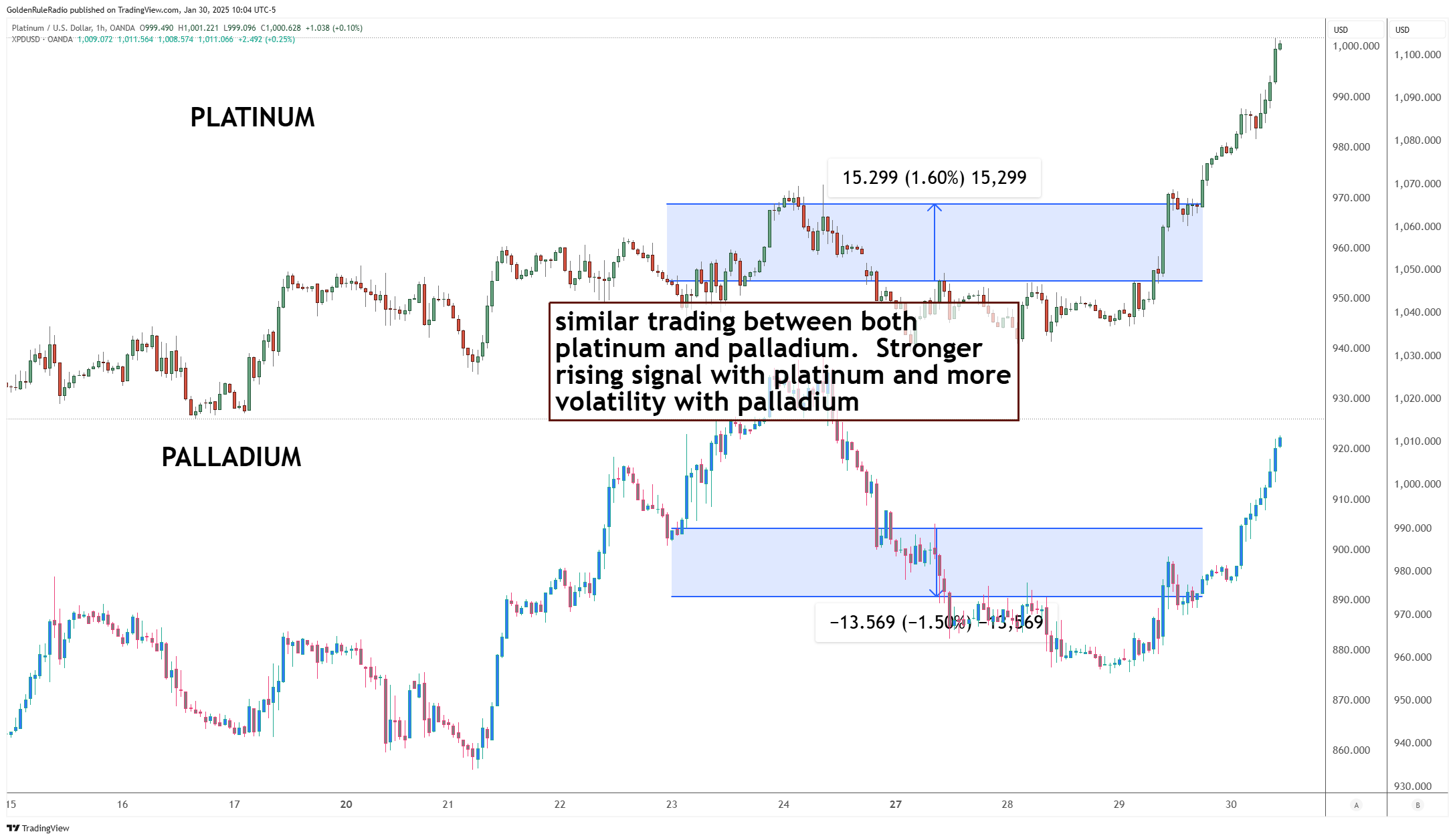

Platinum is up 1.5% to $972 from a week earlier.

Palladium is down 1.5%, also at $972 from a week earlier.

Looking at movement in the broader markets…

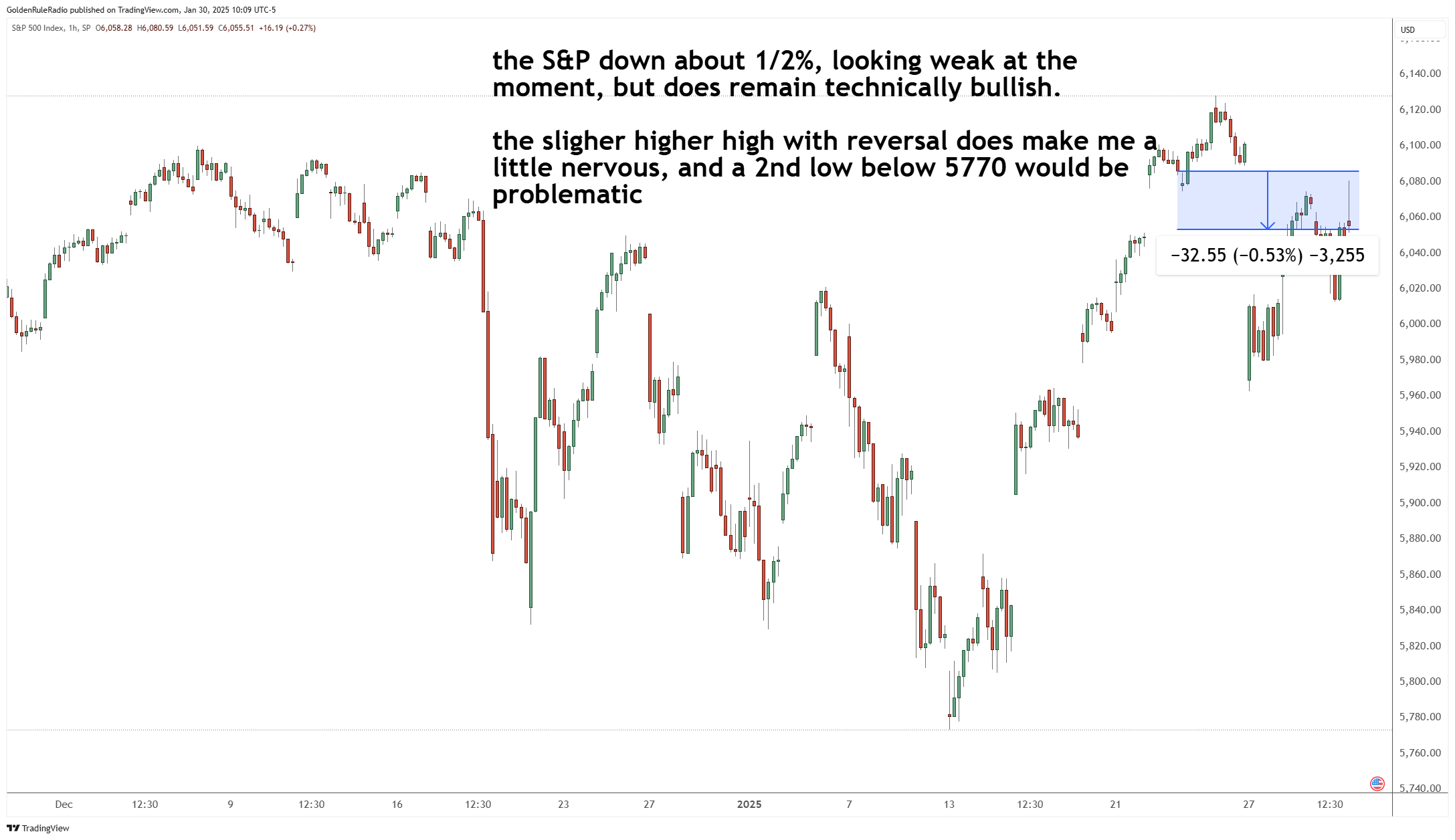

The S&P 500 is down about 0.5% to 6,040 this week. It did put in a new high as well as about a 2% decline at one point in the immediate reaction of the AI news coming out of China.

The US dollar is also dead even at $108. For the first time in quite a while, the dollar did go below $107 for a short period.

Dr. Copper Shows Strength in Economy

Looking at a chart of copper prices over the past year, the metal has shown a strong pendant formation. And when we look back over the last four years, copper shows its in a rising trend line.

The shiny metal is nicknamed "Dr. Copper" because it is an indicator that reflects the health of the economy. With copper’s price rising steadily, the economy is growing stronger.

Trump Picks a Fed Fight

Trump is blaming Powell and the Fed for high inflation, and he wants the Fed to reduce the target for interest rates. On Wednesday, the Federal Reserve indicated that they would keep interest rates steady and noted the lack of progress toward their 2% inflation rate goal.

Cutting rates would further stimulate the economy, increasing the inflation rate and making it harder for people to afford staples like groceries and gas. As we’ve discussed in past episodes, the way to attack inflation is to curb overspending by Congress — an unpopular solution that can kill a political career.

One thing that will preserve your purchasing power no matter what move the Fed makes? Turning your dollar bills into gold ounces.

Invest in Gold Today

Our team of advisors have decades of experience investing in gold and other precious metals, and they can help you find the best strategy to meet your unique needs. They are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556.