Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Trump Fiscal Euphoria on the Downshift?

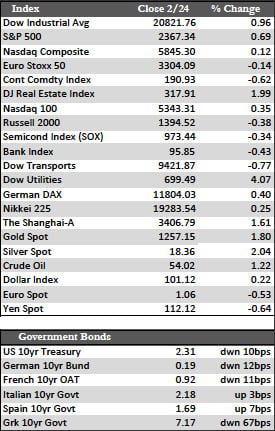

Although US stocks closed another record week, the gains were a little less impressive than in the weeks preceding. The Dow and the S&P500 added about a half a percent (amid lower volume), while the NASDAQ finished essentially unchanged. As to what held the broader indices to modest gains, I can only guess. Much of the post-election rally has been emotional rather than fundamental, but it appears that traders have become more skeptical about the implementation of some of the Trump administration’s fiscal plans, particularly tax cuts and infrastructure spending. The former seems difficult to manage in light of our massive deficit ($587 billion), while the latter – surprise, surprise – will be pushed into 2018 because Congress’s to-do list has become overcrowded with matters more important (?). In any case, the Trump stocks that led in the post-election rally, most notably banks and construction-related firms (i.e., Caterpillar and US Steel), rolled over and weighed on the broader market. However, from a technical standpoint I would not describe the action as significantly bearish just yet.

That ratcheting down of over-confidence in fiscal plans and perhaps the dovish interpretation traders applied to the latest FOMC minutes put a firm bid into Treasuries and EGBs. The higher quality German, Austrian, and British 10-year yields appeared to be more popular than the others. Treasuries and JGBs were stronger, yet rangebound – for the moment. Oil climbed higher, nearer the technical goal of $55/bbl., for no apparent reason other than that oil has trailed the performance in stocks, and therefore may be considered relatively undervalued. The dollar and the metals both moved higher in sympathy together. Gold has improved about 9.0% and silver 15.3% year-to-date.

That ratcheting down of over-confidence in fiscal plans and perhaps the dovish interpretation traders applied to the latest FOMC minutes put a firm bid into Treasuries and EGBs. The higher quality German, Austrian, and British 10-year yields appeared to be more popular than the others. Treasuries and JGBs were stronger, yet rangebound – for the moment. Oil climbed higher, nearer the technical goal of $55/bbl., for no apparent reason other than that oil has trailed the performance in stocks, and therefore may be considered relatively undervalued. The dollar and the metals both moved higher in sympathy together. Gold has improved about 9.0% and silver 15.3% year-to-date.

At some point in the not-to-distant future, we should see the stock market take a giant step back from its blind optimism regarding Trump’s ability to cure the ills we have imposed upon ourselves financially over the past two-plus decades. Low volume trade, fading rallies, strength in bonds (and utilities), doctored earnings (in most cases), and a diverging Transport index are all signs that we could be getting close to a turning point. We’ll just have to wait and see, as up to now many of these things have not mattered to the bulls. Also, while there are few negatives facing the metals at the moment, I still advise caution over the nearer-term – unless the 200-day on gold of $1,261 is broken decisively. Gold could see some short-term profit taking if perceptions about inflation shift from “demand-pull” (or consumerism) – which is something I do not believe we are getting along with the higher rates we’ve seen at both the short and long end of the curve.

Best Regards,

David Burgess

VP Investment Management

MWM LLC