Here’s our weekly report on the price moves of precious metals for April 26. Let’s take a look at where precious metals stand:

The gold price is at $2,320. It’s down about 1.6% off the end of the day.

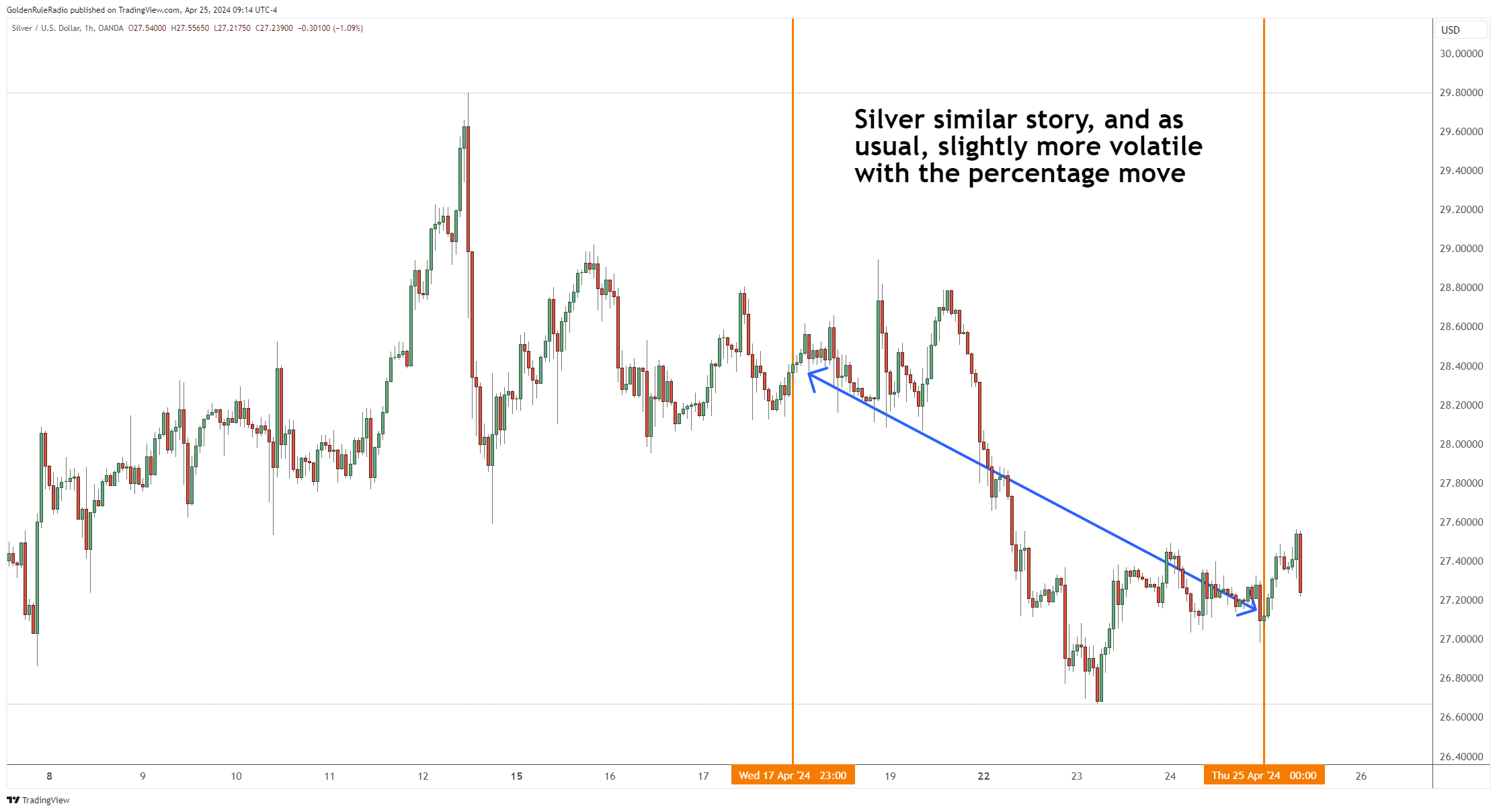

The silver price is at $27.25, down about 3.4% from a week ago.

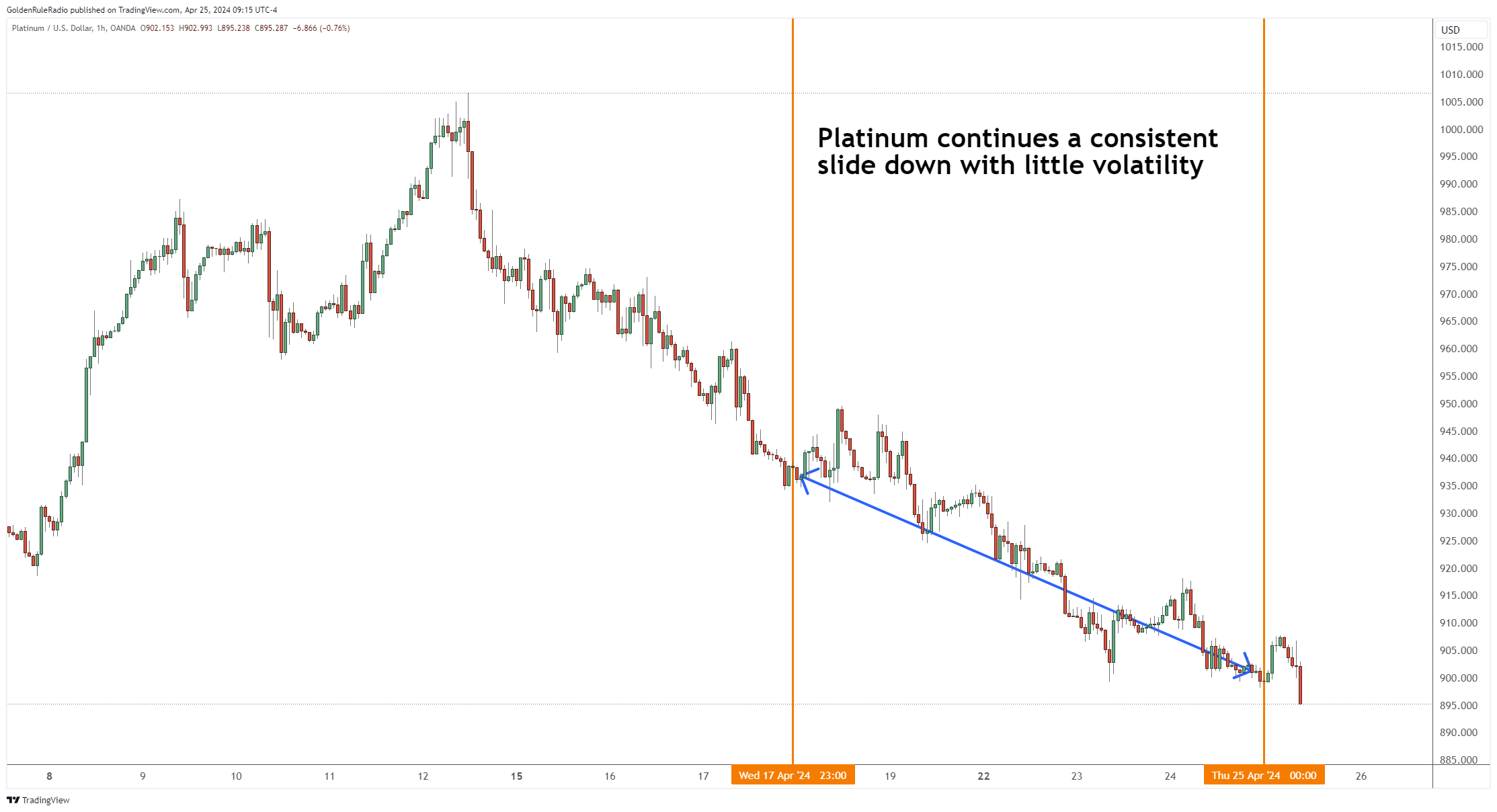

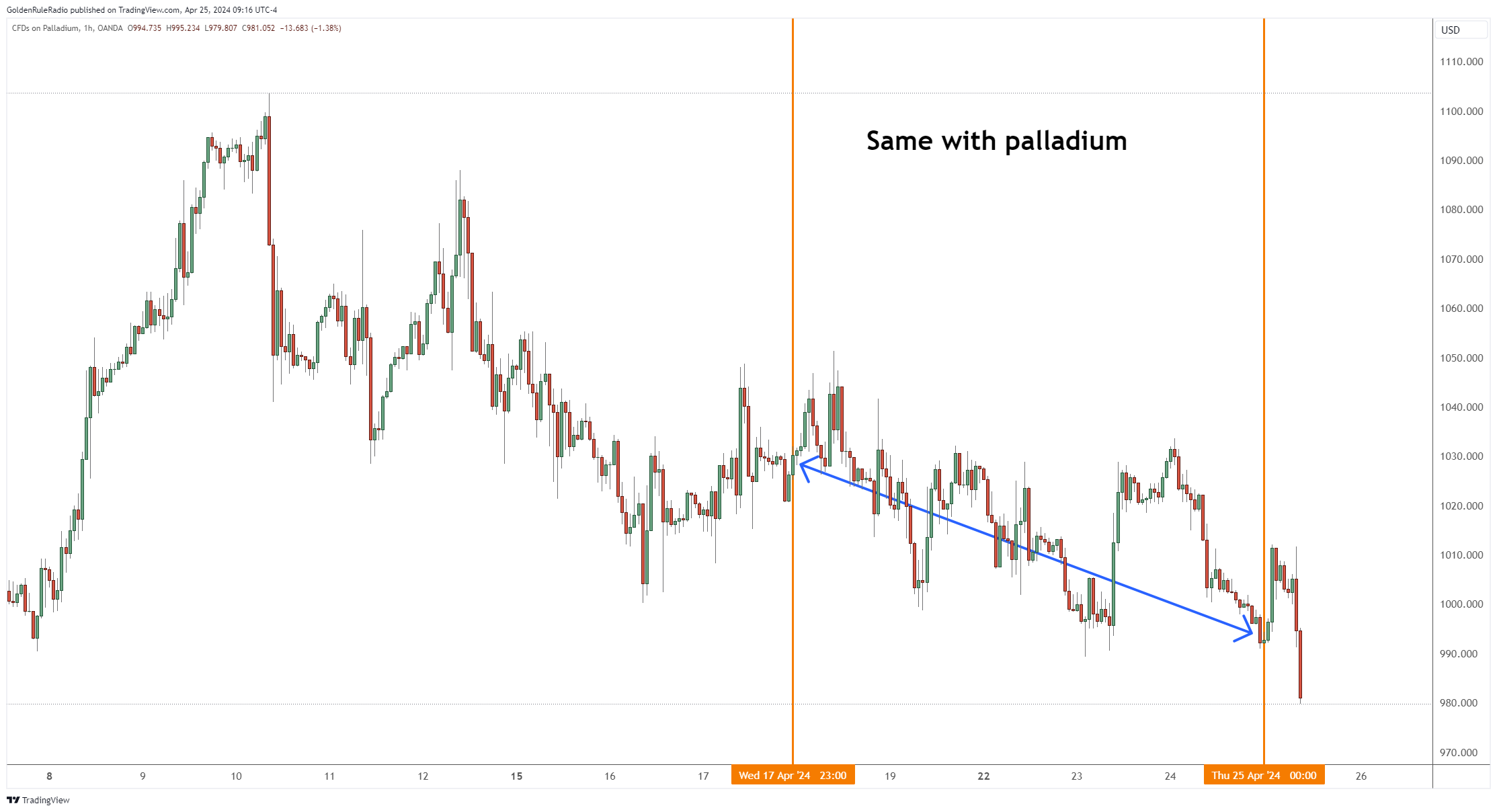

The other two white metals are also lower this week.

The platinum price is at $902, down 6.3% since last week.

And the price of palladium is at $1,004, down about 2.4% for this week.

The S&P 500 is at 5,084, up about 1.2% over the last week. It took a little bit of a bounce after declining about 6% over the last couple of weeks.

The dollar is pretty much flat, sitting at $105.08, down about 1/10 of a percent.

So the gold to silver ratio is back up to 85 to 1 this week, up slightly from the week before.

What’s driving the price of gold this week?

Most of the movement in precious metals is on current events. This is likely short-term movements based on unrest in the Middle East, Russia and Ukraine, as well as other market uncertainty in real estate and oil.

Watching the longer term gold bull market

The gold bull market started back in 2016, and the price of gold has since risen up 130% from that time. In the post-pandemic era, around October 2022, the price of gold stopped at around $2100. But since then, gold prices have risen 50% in the last 18 months.

Longer term, gold looks like the safe-haven investment that will preserve purchasing power. With the real inflation rate hovering around 8%, keeping money in fiat dollars in the bank is a losing proposition.

Should you buy gold or silver now?

As the price of gold rises, it’s easy to freeze into analysis paralysis. Some investors don’t want to buy gold while the price is rising, so they start to overanalyze and they get stuck.

Instead of not buying, you can buy silver in this case, because the ratio of gold to silver is like buying gold at $1,900 an ounce. Let the silver work for you in the short term. You can move it into gold later and you will have saved $400 an ounce on your gold by purchasing silver today and doing a ratio trade later.

An easy way to get started is to buy silver through our Vaulted app.

Will gold offer a summer buying opportunity?

Tune into this episode to get all the details of our team’s analysis.

With low US demand, now is the time to buy gold. Get in touch with your McAlvany advisor to get personalized strategies for your precious metals investing plan.