Here’s our weekly recap of the precious metals markets for August 7. As of this recording, here is where precious metals stand:

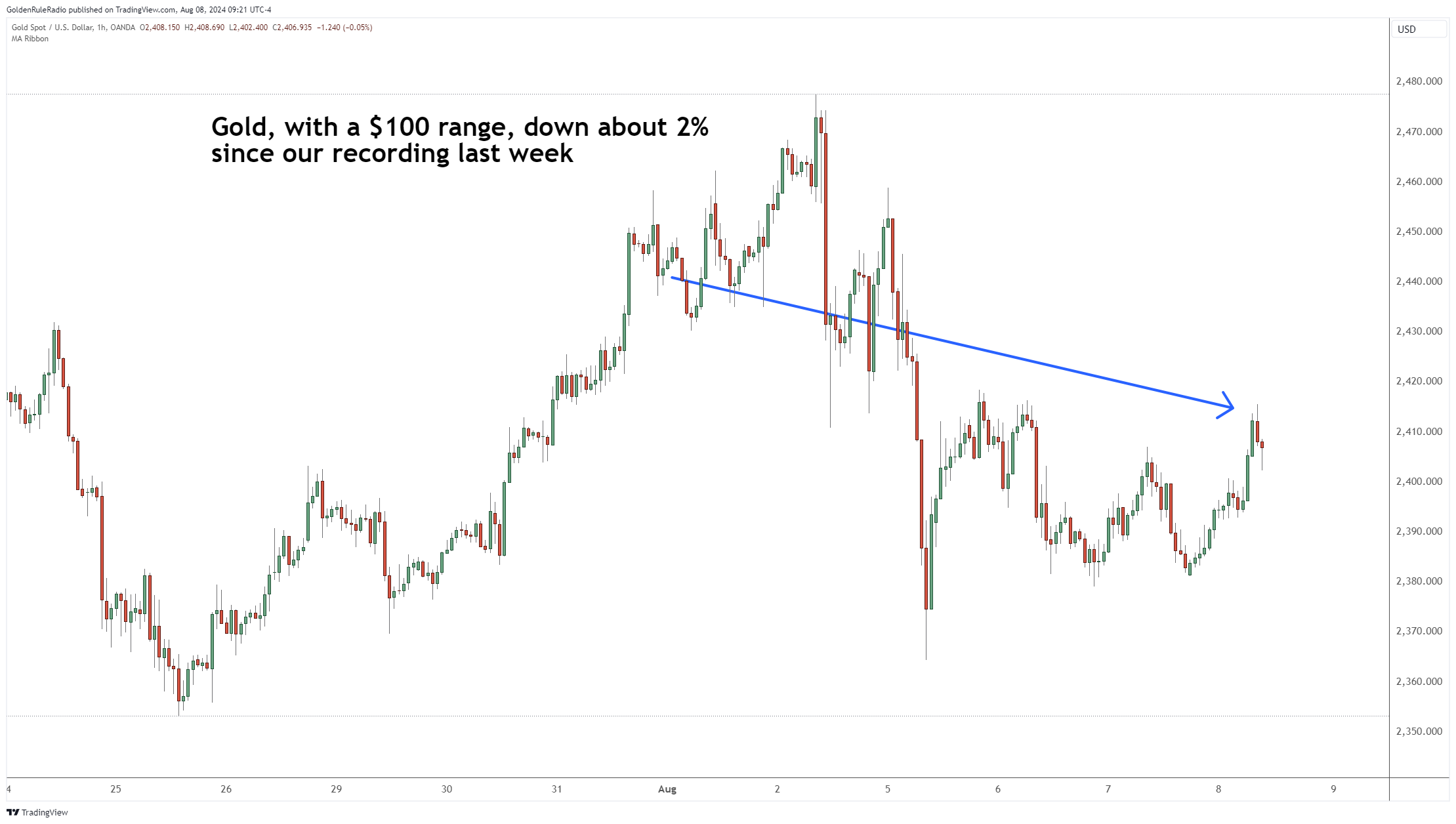

It’s been a surprisingly volatile week for precious metals — including gold, with a high and a low difference of about $100. However, gold is the most steady of the metals right now.

The price of gold is down about 2% to $2410 as of this recording.

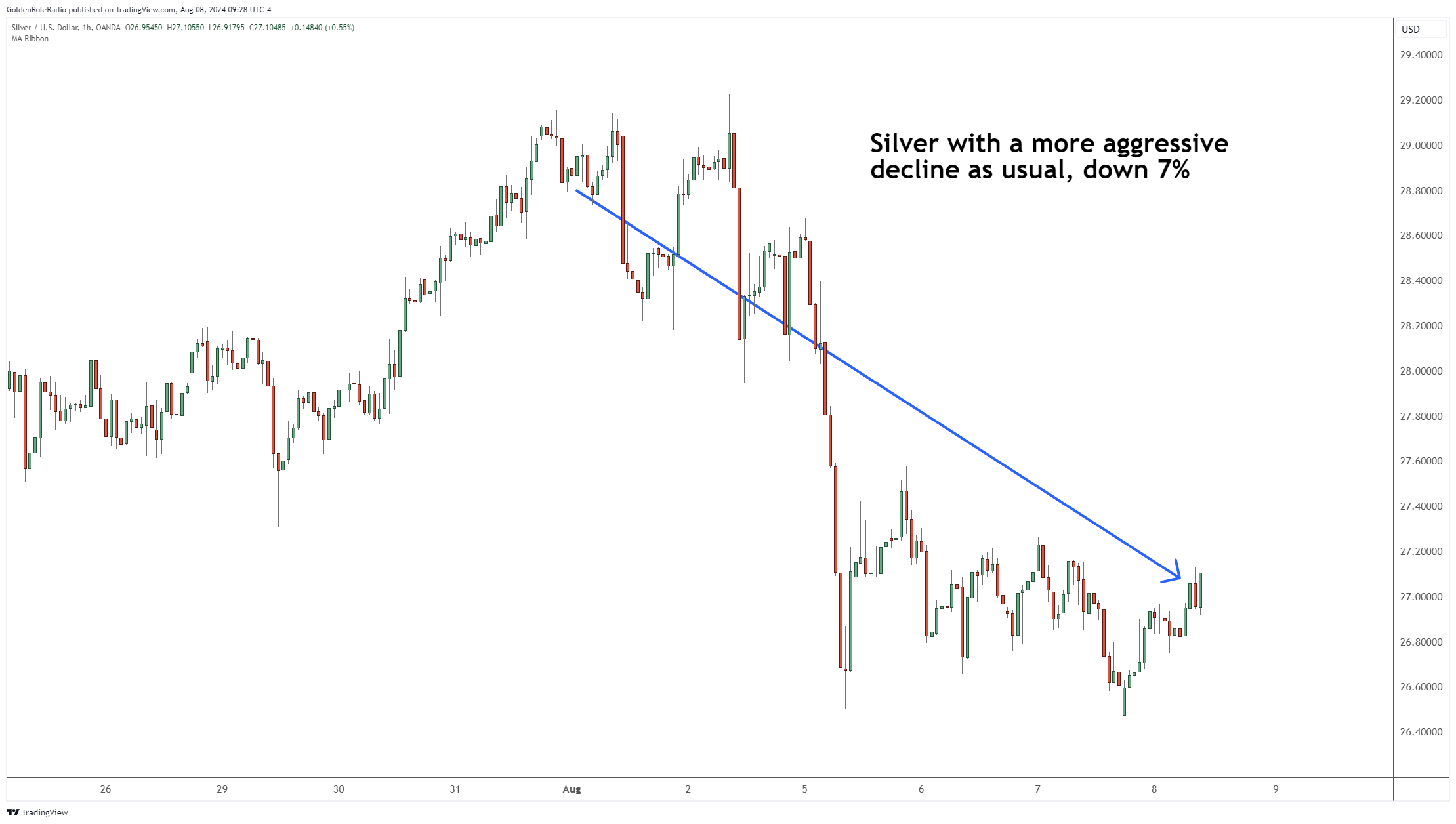

Silver is down about 7% or about $27 since our recording last week.

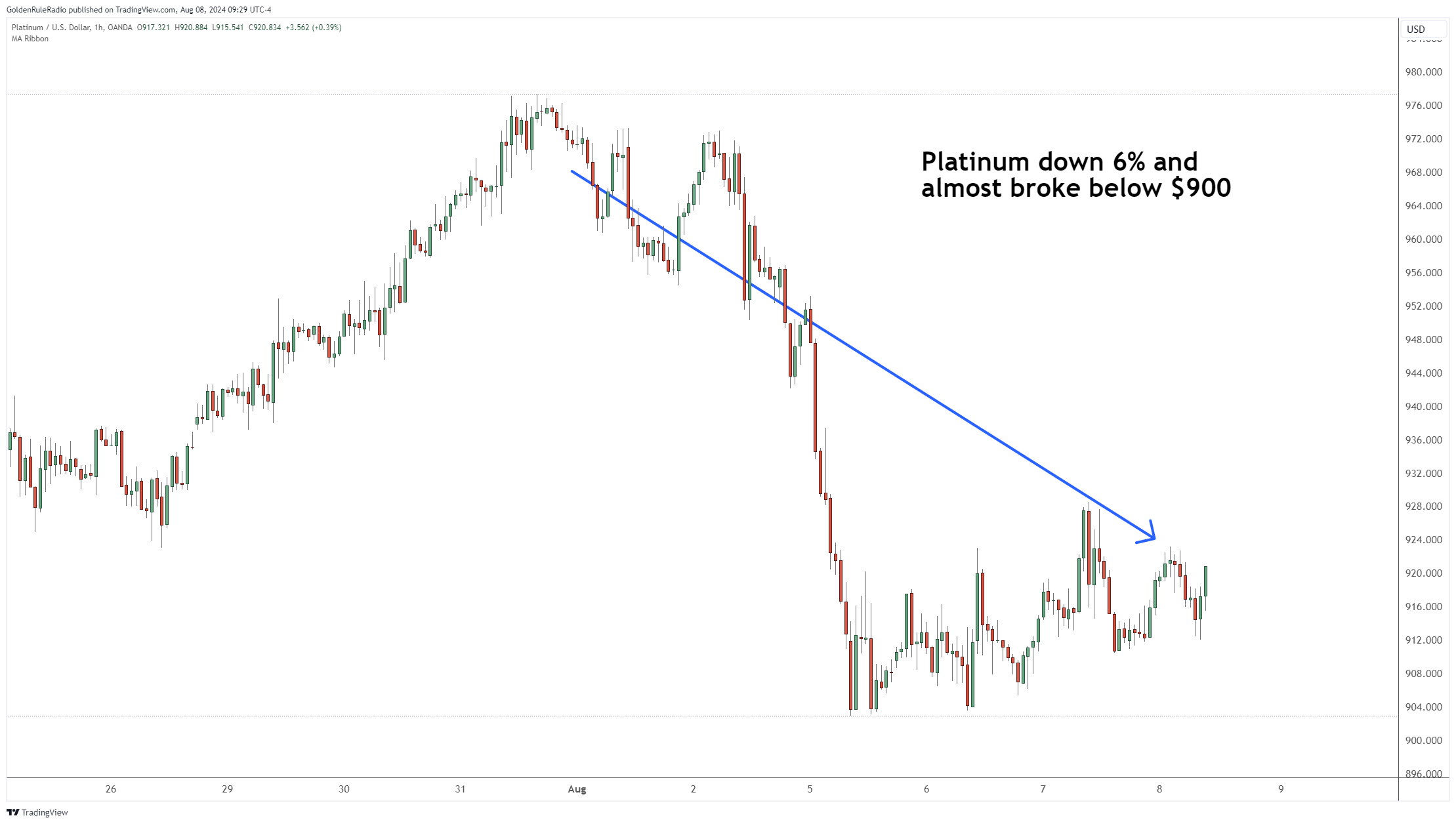

Platinum is down 6% to around $920, almost breaking below $900 during the week.

Palladium has declined 5% to around $880 from a week earlier.

Looking at the broader equities market…

The DJIA has declined about 4% this week.

The Dow Transports have lost about 6% in the past week.

The S&P 500 has also declined about 6% this week.

The NASDAQ 100 is down 8% week over week.

The dollar is up 1% over the week — it had a technical bounce, losing 1% during the week but now upas of this recording.

Japan Selloff

On Monday, the Japanese markets had a big selloff after Japan’s Central Bank increased its interest rate by 0.15%. The Nikkei 225 lost 20% after the move. This decline rocked the global markets early this week, causing a broad selloff.

Gold > Bitcoin

Some investors believe that Bitcoin is the new gold. If that were the case, Bitcoin should have increased — but instead, it is down 10% this week. Bitcoin is more likely to move in tandem with the broader markets.

Unlike Bitcoin, gold can be used for stability in a portfolio amid market turmoil and geopolitical tension. It is also a hedge against inflation and the dollar.

Secure Your Future

With all of the huge declines seen in the markets between 5% – 8%, gold is the only asset that declined marginally — just 2% week over week. This illustrates the balance gold brings to a portfolio in minimizing the drawdown on a portfolio.

If you’re ready to protect your portfolio with the power of gold, McAlvany is here to help. Get in touch with one of our trusted precious metals advisors for a free, no-obligation portfolio review. We can be reached at 800-525-9556.