Own physical precious metals in a strategic and dynamic fashion

For generations, productive Americans have taught their children to save a portion of what they earn, put it in a savings account, and let compound interest grow its value over time. It was great advice for its time, but its time is past. Interest payments on bank savings are so small they can’t even overcome inflation and fees – Which means savings will shrink in value over time rather than grow. When you couple this fact with major bank failures in recent years, the inadequacy of the FDIC to adequately insure more than pennies on the dollar of all deposits at risk today, and the groundwork that has been laid for “bail-ins” (using depositors’ money to meet banks’ need for emergency funds), savings accounts can no longer be considered safe. It’s no wonder savers feel like they can’t win. Both living and investing in America today is like going up the down escalator. Rest for a moment, and you might not be able to gain back the position you’ve lost. Stocks are in the riskiest territory they’ve ever been in (including 1929, 1987, 2001, and 2008). What’s a saver to do? Well, what if there was a way to save without risk of loss caused by government or financial emergency, but which also offered the opportunity for gain?

What if you could save your money and grow it too?

To do this, you’d have to accomplish two goals.

- Avoid riding the escalator down. Keep your money from buying less over time as inflation increases your cost of living. This is called “maintaining your purchasing power.”

- Rather than just maintaining your position, start moving up the escalator. (ie, increase the amount of your money)

Gold maintains your purchasing power over time. That’s not something that has proved to be true for paper currencies just since the founding of the Fed or even the Bank of England. For over 5,000 years, there have been two universal truths in the financial world:

- Real assets maintain real value.

- Gold is real money.

No asset accomplishes the first goal better than gold.

But What If You Want To Do More?

A lot of investors come to us out of frustration. They’ve taken some misdirected approach to their finances and are either unhappy with the results or fearful that they’ve squandered what they’ve worked so hard to build. Some even come to us with dead-end precious metals portfolios due to bad advice on the initial acquisition. These investors seek us out because they’ve come to understand that gold and other precious metals offer incredible financial protection. You want more than just protection. You want potential.

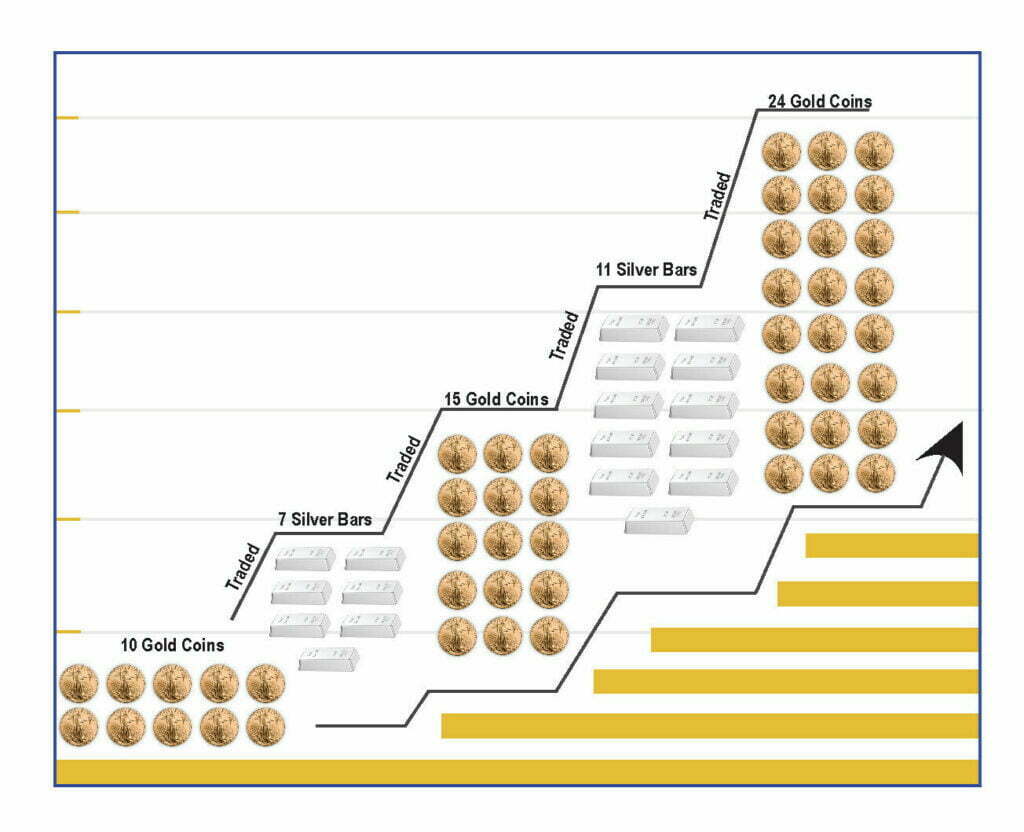

You want to put your trust (and your money) in a proven system that will compound your investment AND ensure the money is there when you need it. We’re happy to report this system exists. At McAlvany Precious Metals, it’s affectionately known as the “Compounding Ounce Strategy” and begins by asking one simple question: How many ounces of silver does it cost to buy an ounce of gold?

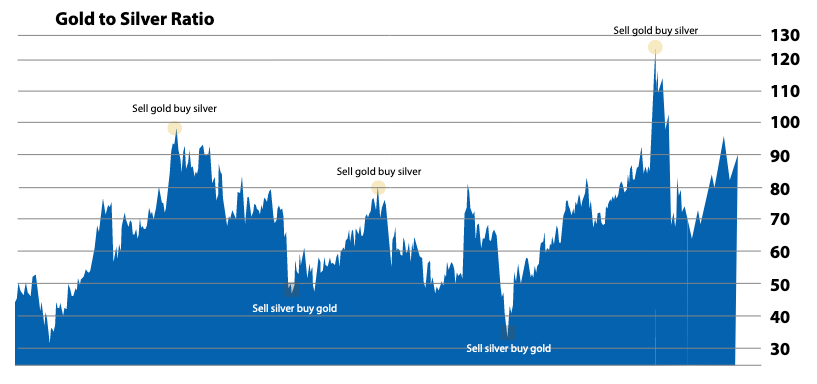

For over 50 years, McAlvany Precious Metals has tracked the price of silver relative to that of gold, and regularly looked for opportunities for clients to make strategic shifts between the two metals. By buying whichever of the two is weaker, watching it grow stronger, and then continually repeating the process, you can increase the amount and value of your holdings over time with very low risk. As you may already know, the price of precious metals responds to various influences. Industrial supply and demand issues, central bank demand, investor demand, and geopolitical events all impact the metals at different times to differing degrees. We can’t control these events, but we don’t need to. Instead, we can use them to our financial advantage. The McAlvany Ratio Trading Strategy operates under the following immutable law: The value of gold and silver relative to each other fluctuates over time (as is the case with platinum and palladium). Said another way, although the prices of the precious metals usually move in the same direction (up or down), they move at different speeds. Over time, one of the metals will be trading at a significant discount to the others. By trading one for another, an investor can move out of an overvalued metal and into an undervalued one with ease and safety.

The strategy is perfect for the conservative, long-term precious metals investor. While most trading “tricks” involve jumping in and out of markets and trying to hit every top and bottom, this strategy is quite different. You are never out of physical precious metals when you correctly employ our compounding ounce strategy. For example, if the strategy calls for selling gold, you will be simultaneously buying silver. If it calls for selling silver, you will be simultaneously buying gold. Many of the best trades are executed during drops in price rather than increases. And you’ll never purchase an investment whose value can become completely worthless like stocks or other investment vehicles can.

You Have Constant Protection Against Inflation And Financial Upheaval.

Our strategy doesn’t focus on the increase in the price of the metals but rather on the increase in the ounces of metals. Over the years, you’ll watch your number of ounces of precious metals increase just as you watched your savings grow in the past. Those who simply buy and hold precious metals during bull markets do well. However, clients empowering us to employ the strategy not only ride the price of the metals up, but also greatly increase the number of their ounces.

The Ounce Gains Produce A Staggering Return When The Prices Climb.

Many clients who participated in this strategy in previous bull and bear markets in the metals more than doubled their ounces of metals, and most tripled their ounces recently in the platinum / palladium swaps. As spot prices climb in uncertain times, the portfolio value far exceeds what it would have been had it been held as originally structured.

Who Can Participate?

We can employ the strategy with metals either in your possession or that you’ve stored. Many of our clients currently participating in the strategy use storage accounts. Tax-free and tax-deferred accounts like IRAs are ideal vehicles for this compounding strategy.

What Do I Need?

- A physical precious metals position with the proper strategic initial positioning.

- A long-term mindset. These strategies are best suited for those committed to the precious metals for the longer term.

- Patience.

- A precious metals advisor to assist you in timing your trades. Our advisors have been helping investors for decades.

How To Get Started

About McAlvany Precious Metals

At McAlvany Precious Metals, we understand that when it comes to growing profits and safeguarding your wealth, the journey is just as important as the destination. Your worldview must be the guiding force in setting your ultimate goals and determining your strategy for achieving them. The good news is, you don’t have to go it alone. To build a strong financial base and position yourself for maximum profits, its imperative you partner with a trusted expert and advisor who not only enjoys a documented track record of success, but more importantly, understands your goals and shares your worldview. No one understands the big picture like McAlvany Precious Metals. And we’ve got the history to prove it.